Press release

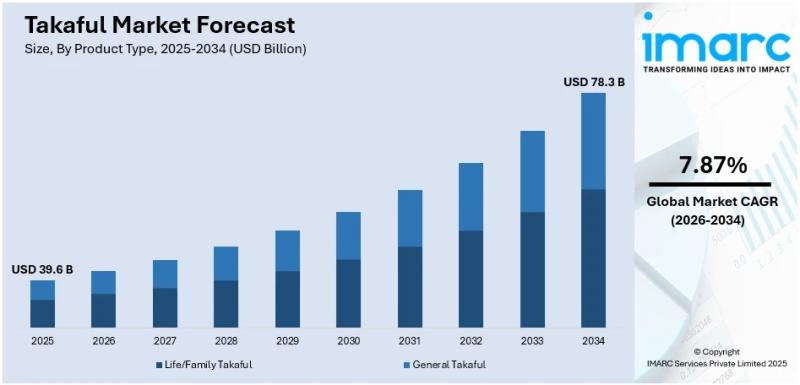

Takaful Market Size is Estimated to Exceed USD 78.3 Billion by 2034

Driven by the rising global Muslim population and increasing awareness about Islamic finance among individuals.

Growing Awareness of Ethical and Sharia-Compliant Insurance

The Takaful market is growing rapidly and is partly a result of increased awareness of socially responsible and Sharia-compliant financial products. Takaful, based on mutual cooperation and shared responsibility, attracts customers looking for an alternative to conventional insurance, which is viewed as problematic because it involves riba (interest) and gharar (uncertainty). With the huge growth of the Muslim population in 2025, and the growth of Sharia compliant financial products, Takaful schemes are increasing in popularity. Governments of Islamic countries such as Malaysia, Saudi Arabia and United Arab Emirates have set about a task of formulating Takaful friendly legislation and spreading public awareness through public relations campaigns. Islamic ethical finance has become popular among non-Muslim countries, who prefer fair and transparent risk-sharing arrangements. Digital finance has allowed people to smoothly access and better understand (Takaful) products during an era when ethical finance is gaining traction among people of all backgrounds. With increasing awareness and financial literacy at the global level, Takaful is now looked at as an alternative.

Government Regulations and Supportive Legal Frameworks

The expansion of Takaful markets is due to assistance from governments and the introduction of regulatory frameworks from many Islamic nations that have developed guidelines to ensure the Takaful industry's success. These plans have offered a framework for the promotion and development of Takaful to be conducted in accordance with Sharia. The closer co-operation between Islamic finance bodies and the insurance regulator expected in 2025 should lead to better licensing, governance and risk management of Takaful companies, but new approaches from financial institutions appear likely only if they can show Sharia transparency and accountability. The Governments are also working to encourage international cooperative ventures to expand the reach of the Takaful solutions. International cooperative ventures are working on the development of standards, easing cooperation amongst Takaful operators, reinsurers and financial service providers, and setting the stage to allowing Takaful products to be offered through conventional banks and the windows of insurers, thus opening up markets. These changes and institutional supports have contributed towards creating a conducive environment for the Takaful industry and protecting its operations in line with the ethical and religious principles.

Technological Integration and Product Innovation

The Takaful business is undergoing a transformation as information and communication technology is being adopted to ease its operations, claims handling, outreach, and brand building. Simplicity and customer-friendliness in mobile and other personal technologies, artificial intelligence, and blockchain technology for security and transparency make it possible for the entire Takaful assistance to be availed of through a simple and transparent claim process. The need for digital Takaful is expected to grow in 2025 as consumers increasingly seek financial products that are available through digital channels and are customized according to lifestyle. AI-based underwriting testing, use of predictive analytics, and digital advisory platforms are constantly increasing the attractiveness of Takaful products in terms of meeting individual needs and competitively pricing the same. With the use of blockchain to ensure full transparency in fund management and claim settlement, and with there being no mistrust in the way funds are handled due to Sharia compliance, the product portfolio has expanded to include health, life, micro and family Takaful schemes for individuals and SMEs. Furthermore, digitalization can be leveraged as a means of financial inclusion and a means of increasing the attractiveness of Takaful to a larger segment of younger, tech-savvy consumers in developing and developed markets.

Takaful Market Trends 2025

The Takaful market is no exception and is currently subject to rapid change due to the prevalence of technological innovation, the success of regulatory reform, and the implementation of globally accepted standards and best practices throughout the region. The current partnership between conventionally insured and providers of Islamic finances would have grown by this time and would impact product diversification and cost effectiveness. New developments in mobile technology, blockchain and artificial intelligence analytics would also impact the customers' experiences and levels of transparency in the market at this time. The growth in the population of middle classes in Southeast Asia, the Middle East and Africa are driving the demand for family and health Takaful plans. Micro-Takaful and inclusive insurance plans, catering to the low-income segments as well as to those not serviced by financial institutions, are garnering attention as a pathway for financial inclusion. With the growing importance of ESG issues, such as sustainability and ethical investing, Takaful is aligning itself with global ESG trends. The Takaful industry will provide a resilient and socially responsible alternative to conventional insurance systems as awareness among consumers increases and digital ecosystems develop.

Get your Sample of Takaful Market Insights for Free: https://www.imarcgroup.com/takaful-market/requestsample

Industry Segmentation:

Segmentation by Product Type:

• Life/Family Takaful

• General Takaful

Regional Insights:

• Gulf Cooperation Council (GCC)

• Southeast Asia

• Africa

• Others

Who are the key players operating in the industry?

The report covers the major market players, including:

• Abu Dhabi National Takaful Co. PSC

• Amana Takaful (Maldives) PLC

• Etiqa (Malayan Banking Berhad)

• Great Eastern Takaful Berhad

• HSBC Amanah Malaysia Berhad

• Prudential BSN Takaful Berhad

• Qatar Islamic Insurance Company

• Salama Islamic Arab Insurance Company

• Standard Chartered Bank

• Syarikat Takaful Brunei Darussalam Sdn Bhd

• Syarikat Takaful Malaysia

• Takaful Emarat

• The Islamic Insurance Co

• Zurich Malaysia

Ask Our Expert & Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=1027&flag=E

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Takaful Market Size is Estimated to Exceed USD 78.3 Billion by 2034 here

News-ID: 4363928 • Views: …

More Releases from IMARC Group

Hydrogen Fluoride Manufacturing Plant DPR 2026: Investment Cost, Market Growth & …

Setting up a hydrogen fluoride manufacturing plant positions investors within a strategically important segment of the global specialty chemicals and fluorochemicals industry, driven by increasing demand for semiconductor manufacturing, refrigerant production, and pharmaceutical intermediates. As modern industrial processes advance, electronics manufacturing expands, and the need for high-purity fluorine compounds grows, hydrogen fluoride continues to gain traction across semiconductor fabrication, aluminum production, and petroleum refining worldwide. Rising demand from high-tech industries,…

Vinyl Acetate Ethylene Production Plant Cost 2026: Industry Overview and Profita …

Setting up a Vinyl Acetate Ethylene Production Plant positions investors in one of the most stable and essential segments of the specialty chemicals and polymer value chain, backed by sustained global growth driven by growing construction activity, rising demand for high-performance dry-mix mortars, increasing use in paints and coatings, and the dual-benefit advantages of delivering flexible, low-VOC polymer binder solutions that meet both industrial performance standards and evolving environmental compliance…

Fluff Pulp Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/Op …

Setting up a fluff pulp manufacturing plant positions investors within a strategically important segment of the global hygiene products and absorbent materials industry, driven by increasing demand for disposable hygiene products, absorbent personal care items, and medical applications. As consumer hygiene standards advance, disposable product adoption expands, and the need for high-quality absorbent materials grows, fluff pulp continues to gain traction across baby diapers, adult incontinence products, feminine hygiene items,…

Fire Alarms Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Pro …

Setting up a fire alarms manufacturing plant positions investors within a strategically important segment of the global safety and security equipment industry, driven by increasing demand for fire detection and safety systems, stringent building safety regulations, and growing awareness of fire protection measures. As modern construction practices advance, smart building integration expands, and the need for advanced fire safety infrastructure grows, fire alarms continue to gain traction across commercial buildings,…

More Releases for Takaful

Islamic Insurance (Takaful) Market Hits New High | Major Giants Takaful Malaysia …

HTF MI recently introduced Global Islamic Insurance (Takaful) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Takaful Malaysia, Syarikat Takaful Malaysia, Abu Dhabi Islamic Insurance.

Download Sample Report PDF…

Takaful Market Is Going To Boom | Etiqa, SALAMA, Takaful Emarat

According to HTF Market Intelligence, the Global Takaful market is expected to grow from USD 35 Billion in 2023 to USD 65 Billion by 2032, with a CAGR of 9.10% from 2025 to 2032.

HTF MI recently introduced Global Takaful Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2025-2032). The market Study is segmented by key regions which…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024-2032, Product Type (Life/Family Takaful, General Taka …

According to latest research report by IMARC Group, titled "Takaful Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032," The global takaful market size reached US$ 33.6 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 74.0 Billion by 2032, exhibiting a growth rate (CAGR) of 8.9% during 2024-2032.

Sample Copy of Report at - https://www.imarcgroup.com/takaful-market/requestsample

Takaful Market Trends:

The global takaful market is experiencing significant growth…