Press release

Top 30 Indonesian Glass Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)PT Asahimas Flat Glass Tbk (AMFG)

PT Mulia Industrindo Tbk (MLIA)

PT Arwana Citramulia Tbk (ARNA) related building materials

PT Cahayaputra Asa Keramik Tbk (CAKK) tile & partial glass products

PT Intikeramik Alamasri Industri Tbk (IKAI) ceramics & glass adjacencies

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Surya Toto Indonesia Tbk (TOTO)

PT Mark Dynamics Indonesia Tbk (MARK)

PT Indopoly Swakarsa Industry Tbk (IPOL) polymers for coatings

PT Sumi Indo Kabel Tbk (IKBI) industrial cable, plant supplier

PT Brilliance China Automotive Lighting Tbk (BCL) parts including glass components

PT Multistrada Arah Sarana Tbk (MASA) rubber/auto components (glass segments)

PT Astra International Tbk (ASII) heavy equipment distributor with construction tie-ins

PT United Tractors Tbk (UNTR) heavy equipment (infrastructure demand)

PT Barito Pacific Tbk (BRPT) industrial conglomerate

PT AKR Corporindo Tbk (AKRA) logistics/industrial distribution

PT Indocement Tunggal Prakarsa Tbk (INTP) building materials

PT Semen Indonesia (SMGR)

PT Cemindo Gemilang Tbk (CMNT)

PT Wijaya Karya Beton Tbk (WTON)

PT Waskita Beton Precast Tbk (WSBP)

PT Lionmesh Prima Tbk steel components

PT Gunung Raja Paksi Tbk (GGRP)

PT Timah Tbk (TINS) tin/metal supply to glass coating markets

PT Vale Indonesia Tbk (INCO) nickel/metal side streams

PT Aneka Tambang Tbk (ANTM) diversified metals

PT Indosolar Tbk (ISLO) solar glass/solar panel related materials (if listed)

PT Trimitra Plastindo Tbk industrial plastics (packaging & glass ancillary)

PT Nipress Tbk metal components for engineered glass segments

PT Delta Dunia Makmur Tbk (DOID) diversified industrials

2) Revenue results of major public companies in Indonesia summarized (per company)

1. PT Asahimas Flat Glass Tbk (AMFG) - Q3 2025 Net Profit: Rp 71.0 billion (~USD 4.3 million) reported for Q3 2025. Earnings were down significantly YoY (from ~Rp 170.9 billion prior year quarter), reflecting margin contraction amid higher energy and input costs in glass production. AMFGs profitability weakened due to rising industrial gas prices and softer demand. Despite stable revenue levels domestically, net margins compressed.

2. PT Mulia Industrindo Tbk (MLIA) - a major float glass producer and exporter positions it among Indonesias largest glass manufacturers. MLIA operates both domestic and export segments; earnings impact mostly tied to global prices and supply chain costs. Broader fiscal data suggests flattening revenue patterns.

3. PT Arwana Citramulia Tbk (ARNA) - Ceramic and building materials producer with partial exposure to glass façades and related products; does not publish standalone glass segment results.

4. PT Cahayaputra Asa Keramik Tbk (CAKK) - Revenue up but continued net losses in adjacent building materials segments; glass exposure limited but included as building materials affiliate.

5. PT Intikeramik Alamasri Industri Tbk (IKAI) - Strong Q4 base building set for 2025, but Q3 numbers largely focus on ceramics; glass exposure through tiles and building goods.

6. PT Keramika Indonesia Assosiasi Tbk (KIAS) - Modest sales with net losses for Q3 2025; not directly reporting glass revenues.

7. PT Indopoly Swakarsa Industry Tbk (IPOL) - Polymer supplier used in coatings and industrial segments; quasi glass adjacencies.

8. PT AKR Corporindo Tbk (AKRA) - Q3 profits in industrial & logistics segment contribute to glass value chains; reported steady net profit ~USD 28 million in Q3 2025.

9. PT Astra International Tbk (ASII) - Industrial/vehicle conglomerate with indirect impact on construction demand; ultra-large net profit of ~USD 1.47 billion due to diversified portfolio.

10. PT United Tractors Tbk (UNTR) - Strong equipment sales supporting infrastructure demand; significant earnings ~USD 689 million for Q3 2025.

3) Key trends & insights from Q3 2025

Margin Pressure from Energy Costs: Glass producers especially like AMFG reported sharply lower profits due to rising industrial gas and energy costs essential to float glass furnaces.

Demand Moderation Linked to Construction Cycles: Domestic construction activity experienced softening, impacting key glass demand in residential/commercial projects. Industry surveys indicate surplus inventories and slower pick-ups in Q3.

Export Dynamics & Global Supply Chains: Exports remain a potential growth lever for large producers like MLIA, which operates in Australia, Europe, and Asia cushioning local market softness.

Spillover Effects from Adjacent Sectors: Companies in building materials (tiles, ceramics, cement) influence glass demand indirectly; ceramic producers have mixed earnings due to similar margin impacts.

4) Outlook for Q4 2025 and beyond

Stabilization of Input Costs: Energy price forecasts suggest potential moderation late 2025, which may ease cost inflation for glass producers and improve profitability early 2026.

Infrastructure & Housing Policy Support: Indonesian government incentives for infrastructure and housing could lift glass demand if translated into concrete projects particularly in growing manufacturing hubs.

Export Expansion: Strategic export growth, especially to ASEAN and Oceania markets, is expected to offset weaker domestic demand for Indonesian glass manufacturers.

Technological Upgrades: Investment into higher value-added glass types (low-E, laminated, automotive glass) could enhance margins versus commodity flat glass.

5) Conclusion

The Q3 2025 earnings season for Indonesian glass industry players painted a picture of mixed performance, with rising energy costs and demand moderation weighing on profitability especially for smaller pure-play producers like AMFG. Diversified industrial players with exposure to infrastructure and broader building materials chains helped buoy sector performance. With potential easing of input cost pressures and supportive infrastructure policy on the horizon, the industrys outlook for Q4 2025 into 2026 remains cautiously optimistic.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Glass Public Companies Q3 2025 Revenue & Performance here

News-ID: 4362306 • Views: …

More Releases from QY Research

Pea Starch Industry Outlook to 2031: Pricing Dynamics, Regional Demand and Inves …

The global pea starch industry is built around the extraction and processing of starch from yellow peas, serving food, feed, industrial, pharmaceutical, and emerging biodegradable materials applications. Pea starch is prized for its neutral flavor, strong gelling and binding properties, gluten-free status, and alignment with clean-label and plant-based trends that are reshaping global food systems. Pea starch is derived primarily from Pisum sativum or yellow field peas using wet-milling technologies…

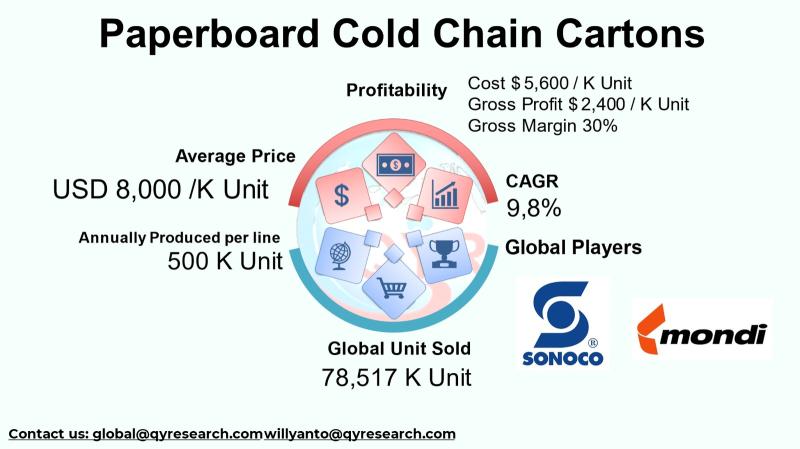

Investing in Temperature Control: A Deep Dive into Paperboard Cold Chain Packagi …

The global Paperboard Cold Chain Cartons industry plays a strategic role in the temperature-controlled logistics landscape, providing insulated paperboard solutions that protect sensitive products during transit. These cartons designed to maintain thermal integrity for perishables such as fresh foods, pharmaceuticals, and biologics are increasingly preferred over traditional foam or plastic packaging due to their recyclability, lightweight structure, and improving insulation performance. The industry has matured alongside the rise of global…

Sustainable Packaging Breakthrough: Breathable Paper Wraps Path to USD 1.2B Indu …

The Breathable Paper Wrap industry encompasses the production and use of specialized paper-based wrapping materials designed to allow controlled air and moisture exchange, which helps extend the shelf-life of perishable goods such as fresh produce, bakery items, cheeses, and other oxygen-sensitive products. This segment has emerged as a sustainable alternative to conventional plastic films, aligning with global regulatory pressures and consumer demand for eco-friendly packaging that minimizes waste and environmental…

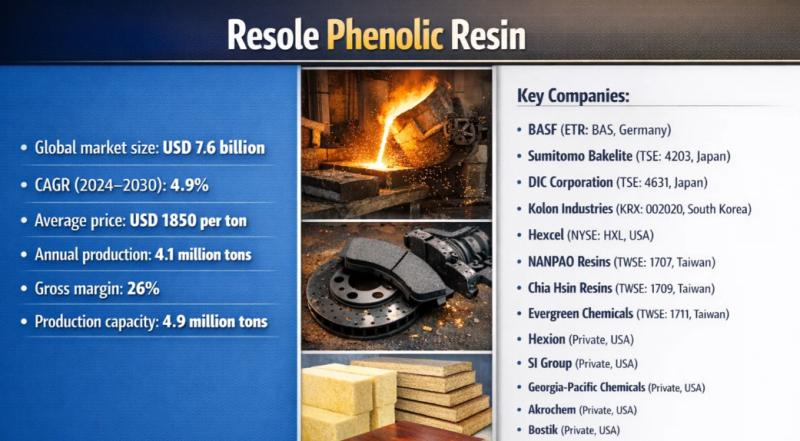

From Slow Cure to High Performance: Weyerhaeuser's Shift to Resole Phenolic Resi …

Problem

Weyerhaeuser Company using conventional thermoplastic binders or novolac-type phenolic systems faced limited heat resistance, slower curing, and additional curing-agent requirements. In applications such as wood panels, insulation, abrasives, refractories, and molded components, these limitations led to longer press cycles, insufficient thermal stability, and inconsistent mechanical performance under high-temperature or fire-exposed conditions.

Solution

Hexion adopted Resole Phenolic Resin, a thermosetting phenolic resin synthesized under alkaline conditions with a formaldehyde-to-phenol ratio greater than 1.…

More Releases for Tbk

Indonesia Textile Industry Market Valuation Expected to Hit USD 28.57 billion by …

USA, New Jersey: According to Verified Market Research analysis, the global Indonesia Textile Industry Market size was valued at USD 21.7 Billion in 2023 and is projected to reach USD 28.57 Billion by 2031, growing at a CAGR of 3.50% from 2024 to 2031

How AI and Machine Learning Are Redefining the future of Indonesia Textile Industry Market?

AI-powered production planning systems optimize yarn selection, fabric blends, and loom utilization, improving output…

Infrastructure Market 2021 Strategic Assessments - PT. Acset Indonusa Tbk.., Pt. …

The Infrastructure Market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The Infrastructure sector in Indonesia is…

Indonesia Telecom Tower Market Demand, Size, Share, Scope & Forecast To 2025 |To …

The Indonesia telecom tower market accounted to US$ 557.9 Mn in 2017 and is expected to grow at a CAGR of 27.1% during the forecast period 2018 – 2025, to account to US$ 3,695.5 Mn by 2025.

Get Sample Copy of this Indonesia Telecom Tower Market research report at - https://www.businessmarketinsights.com/sample/TIPRE00004113

The Business Market Insights provides you regional research analysis on “Indonesia Telecom Tower Market” and forecast to 2025. The research report…

Coal Mining in Indonesia Market 2022| PT Bumi Resources Tbk, PT Adaro Energy Tbk …

Researchmoz added Most up-to-date research on "Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption" to its huge collection of research reports.

Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption

Summary

GlobalData's "Coal Mining in Indonesia to 2022", provides a comprehensive coverage on Indonesias coal industry. It provides historical and forecast data on coal production by grade, reserves, consumption and exports by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes

Summary

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by type; exports, exports by type and exports by country. Detailed analysis of the…