Press release

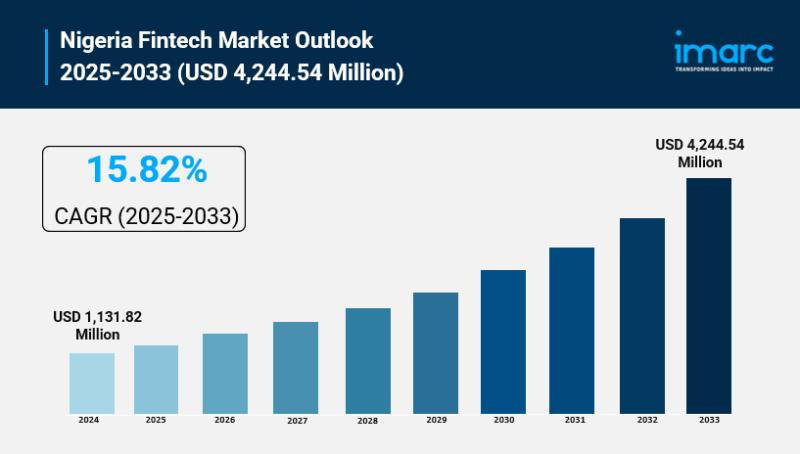

Nigeria Fintech Market Size is Expected to Reach USD 4,244.54 Million By 2033 | CAGR: 15.82%

Nigeria Fintech Market OverviewMarket Size in 2024: USD 1,131.82 Million

Market Size in 2033: USD 4,244.54 Million

Market Growth Rate 2025-2033: 15.82%

According to IMARC Group's latest research publication, "Nigeria Fintech Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Nigeria fintech market size reached USD 1,131.82 Million in 2024. The market is projected to reach USD 4,244.54 Million by 2033, exhibiting a growth rate (CAGR) of 15.82% during 2025-2033.

How AI is Reshaping the Future of Nigeria Fintech Market

● AI-powered advisory tools are driving innovations in personalized financial services, streamlining user experience and accuracy in loan and wealth management platforms.

● The Central Bank of Nigeria's initiatives, including blockchain and AI applications, are fostering trust and driving adoption of digital currencies and smart contracts.

● Digital lending platforms leverage AI for credit risk evaluation, enabling faster, customized loan offerings to underserved citizens and micro-enterprises.

● AI enhances fraud detection and security across fintech platforms, bolstering consumer confidence and facilitating increased transaction volumes.

● AI integration in mobile payment solutions supports wider financial inclusion by enabling secure, convenient transactions even in rural areas.

● Nigerian fintech startups and established companies are increasingly combining AI with digital wallets and embedded banking to expand financial accessibility and operational efficiency.

Grab a sample PDF of this report: https://www.imarcgroup.com/nigeria-fintech-market/requestsample

Market Growth Factors

The rise of digital payments and mobile money has transformed the financial services market in Nigeria due to a fast uptake of smartphones and a cashless policy by the national government. Mobile wallets, instant money transfers and point-of-sale systems represent the most common payment methods of day-to-day transactions in Nigeria. It helps close the divide concerning banking services for unserved and under-served segments, mainly in urban and semi-urban markets. Regulatory bodies further strengthen this trend as they push for interoperability and open banking, and fintech companies and banks collaborate to build mobile payment systems for a unified ecosystem.

Machine learning and analytic tools fundamentally let players in the lending and credit market use alternative sources of consumer data like mobile usage or transaction history. This helps them tailor loans and financial products to consumers. These consumers may be unbanked or underbanked. This has broad implications in regards to expanding access to capital for individuals and small businesses, as well as promoting entrepreneurship. AI can help to detect fraudulent activities and allow systems to automate when dealing with customer service issues, which builds consumer confidence within digital technology and enables fintech firms to thrive inside a competitive market.

There is rapidly increasing interest in blockchain and decentralized finance solutions to meet the demand for secure and transparent payment solutions, and cross-border remittances. While regulators are investigating, innovators see opportunities to improve the efficiency of domestic and cross-border payment systems for customary currencies. Regulatory developments for digital assets and virtual service providers are creating conditions for responsible growth, new investment in and experimentation with new technologies that can support greater security and less intermediation, placing the business and financial services sector in a strong position for the future.

Buy the Latest 2026 Edition: https://www.imarcgroup.com/checkout?id=41870&method=4210

Market Segmentation

Deployment Mode Insights:

● On-Premises

● Cloud-Based

Technology Insights:

● Application Programming Interface

● Artificial Intelligence

● Blockchain

● Robotic Process Automation

● Data Analytics

● Others

Application Insights:

● Payment and Fund Transfer

● Loans

● Insurance and Personal Finance

● Wealth Management

● Others

End User Insights:

● Banking

● Insurance

● Securities

● Others

Regional Insights:

● North West

● North East

● North Central

● South

Recent Developement & News

● October 2024: OmniRetail, a Nigerian startup focused on digitizing traditional e-commerce, acquired Traction Apps to enhance its SME payment solutions. This move strengthens its offerings for retailers, distributors, and manufacturers through OmniPay, supporting broader embedded finance adoption in Africa.

● May 2024: Paystack, a Nigerian fintech under Stripe, led a consortium including Piggy Vest, Ventures Platform, and P1 Ventures to acquire Lagos-based Brass. The acquisition supports continuous customer service and reflects consolidation trends in the market.

● January 2025: Government data revealed a sharp rise in digital loans extended, indicating significant growth in fintech-driven credit access, which boosts entrepreneurial and consumer financing essential for economic activities.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Nigeria Fintech Market Size is Expected to Reach USD 4,244.54 Million By 2033 | CAGR: 15.82% here

News-ID: 4361189 • Views: …

More Releases from imarcgroup

Tofu Powder Manufacturing Plant: Setup Guide, Production Cost & Industrial Uses

Setting up a tofu powder manufacturing facility necessitates a detailed market analysis alongside granular insights into various operational aspects, including unit processes, raw material procurement, utility provisions, infrastructure setup, machinery and technology specifications, workforce planning, logistics, and financial considerations.

IMARC Group's report titled "Tofu Powder Manufacturing Plant Project Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" offers a comprehensive guide for establishing a tofu…

How To Setup An Electric Bus Manufacturing Plant

Setting up an electric bus manufacturing facility necessitates a detailed market analysis alongside granular insights into various operational aspects, including unit processes, raw material procurement, utility provisions, infrastructure setup, machinery and technology specifications, workforce planning, logistics, and financial considerations.

IMARC Group's report titled "Electric Bus Manufacturing Plant Project Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" offers a comprehensive guide for establishing an electric…

Copper Carbonate Manufacturing Plant 2024: Machinery and Raw Materials

IMARC Group's report, "Copper Carbonate Manufacturing Plant Project Report 2024: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a manufacturing plant. The Copper Carbonate Manufacturing plant report offers insights into the manufacturing process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Copper Carbonate Manufacturing Plant Project Report Summary: -

• Comprehensive guide for setting up a copper carbonate Manufacturing…

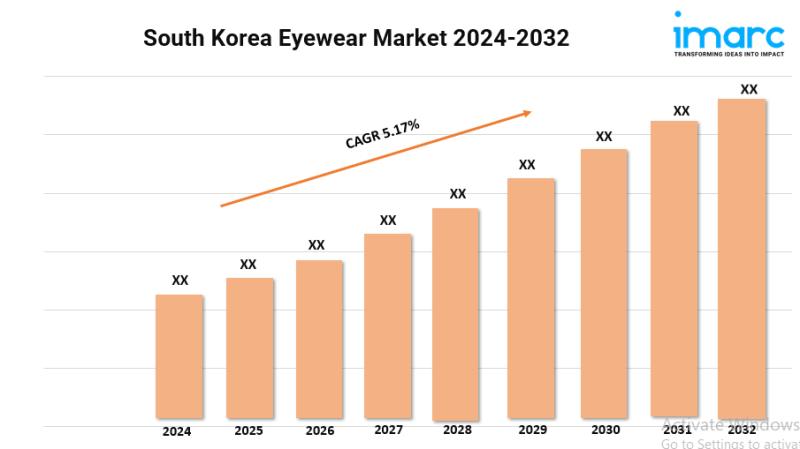

South Korea Eyewear Market Size to Expand at a CAGR of 5.17% during 2024-2032

𝐒𝐨𝐮𝐭𝐡 𝐊𝐨𝐫𝐞𝐚 𝐄𝐲𝐞𝐰𝐞𝐚𝐫 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰

𝐁𝐚𝐬𝐞 𝐘𝐞𝐚𝐫: 2023

𝐇𝐢𝐬𝐭𝐨𝐫𝐢𝐜𝐚𝐥 𝐘𝐞𝐚𝐫𝐬: 2018-2023

𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐘𝐞𝐚𝐫𝐬: 2024-2032

𝐌𝐚𝐫𝐤𝐞𝐭 𝐆𝐫𝐨𝐰𝐭𝐡 𝐑𝐚𝐭𝐞: 𝟓.𝟏𝟕% (𝟐𝟎𝟐𝟒-𝟐𝟎𝟑𝟐)

The rising prevalence of visual impairments and eye-related issues represents one of the key factors propelling the growth of the market in South Korea. According to the latest report by IMARC Group, The South Korea eyewear market size is projected to exhibit a growth rate (𝐂𝐀𝐆𝐑) 𝐨𝐟 𝟓.𝟏𝟕% during 2024-2032.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐬𝐚𝐦𝐩𝐥𝐞 𝐜𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.imarcgroup.com/south-korea-eyewear-market/requestsample

𝐒𝐨𝐮𝐭𝐡…

More Releases for Nigeria

Nigeria Food and Drink Market Rewriting Long Term Growth Story: Cadbury Nigeria, …

According to HTF Market Intelligence, the Nigeria Food and Drink market to witness a CAGR of 11.41% during the forecast period (2024-2030).The Latest published a market study on Global Nigeria Food and Drink Market provides an overview of the current market dynamics in the Global Nigeria Food and Drink space, as well as what our survey respondents- all outsourcing decision-makers- predict the market will look like in 2030. The study…

HLKS Cargo Nigeria is The Best Cargo Service from Nigeria to London

HLKS Cargo Nigeria is committed to providing you with the most reliable, secure, and cost-effective delivery of your goods. Our highly trained and experienced staff will ensure that your Cargo to Nigeria is shipped safely and securely. From the moment your Cargo leaves our warehouse in Lagos, we will take care of all aspects of the journey until it reaches its destination in London or any other country.

HLKS Cargo Nigeria…

Nigeria Diesel Genset Market

Nigeria Diesel Genset market is expected to witness modest growth owing to the expansion of telecom infrastructure, the establishment of new industries, and poor grid infrastructure of the country. Growing investment in the non-oil sector of the country is anticipated to support the economic growth in the region over the coming years which would foster the demand for diesel gensets during 2018-24. Additionally, the growing number of manufacturing units in…

Nigeria Agriculture Market, Nigeria Agriculture Industry, Nigeria Agriculture Li …

Nigeria Agriculture could be a branch of the economy in Nigeria, providing employment for approximately 35% of the population. It’s the most supply of livelihood for many Nigerians. The Agricultural sector is formed from four sub-sectors: Crop Production, Livestock, Forestry and Fishing. The country could be a leader in varied forms of agricultural production, like palm oil, cocoa beans, pineapple, and sorghum. It’s the biggest producer of sorghum within the world…

Promotion - Webcore Nigeria

Webcore Nigeria is passionate about using the power of the Internet to grow any business.

Webcore Nigeria can assist you by doing all the social media promotion on your behalf. Choose and order the service you need.

Webcore Nigeria provide fast delivery time, so with just a few clicks you will be able to start receiving online promotions.

Facts about Webcore Nigeria:

Nigerian owned and operated

…

SOCIAL MEDIA MARKETING IN NIGERIA BY WEBCORE NIGERIA

Webcore Nigeria social media marketing.

Webcore Nigeria is a leading digital marketing agency in Nigeria that operates using e-commerce.

Webcore Nigeria supports brands with different aspects of their social media marketing strategy by organizing paid social advertising, influencer marketing, publish press releases, social media page verification and more.

Webcore Nigeria is a full-service digital marketing organization. Webcore has been providing a wide variety of services to clients of all industries since 2016. Webcore…