Press release

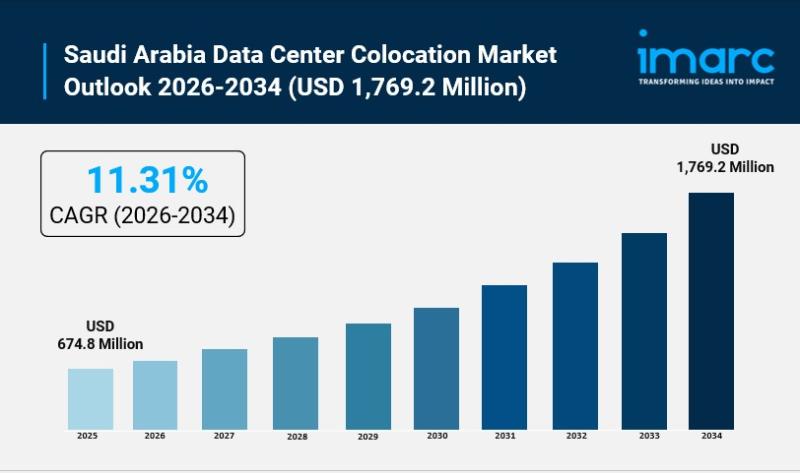

Saudi Arabia Data Center Colocation Market Size to Surpass USD 1,769.2 Million by 2034, at a CAGR of 11.31%

Saudi Arabia Data Center Colocation Market OverviewMarket Size in 2025: USD 674.8 Million

Market Size in 2034: USD 1,769.2 Million

Market Growth Rate 2026-2034: 11.31%

According to IMARC Group's latest research publication, "Saudi Arabia Data Center Colocation Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia data center colocation market size was valued at USD 674.8 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,769.2 Million by 2034, exhibiting a CAGR of 11.31% during 2026-2034.

How AI is Reshaping the Future of Saudi Arabia Data Center Colocation Market

● AI-powered predictive analytics enable colocation providers to forecast capacity demands and optimize resource allocation across facilities, ensuring efficient utilization of power, cooling, and space while reducing operational costs and improving service delivery to enterprise clients.

● Machine learning algorithms analyze real-time data center performance metrics including temperature, humidity, and power consumption, enabling automated adjustments that maintain optimal operating conditions and prevent equipment failures before they occur, significantly enhancing facility reliability and uptime.

● Intelligent workload management systems leverage AI to dynamically distribute computing tasks across colocation infrastructure, balancing loads to maximize efficiency while meeting service level agreements and supporting the growing demand for high-density GPU clusters required for AI model training and inference.

● AI-driven energy optimization platforms continuously monitor and adjust power distribution and cooling systems based on workload patterns and environmental conditions, achieving significant reductions in power usage effectiveness and supporting Saudi Arabia's sustainability goals while lowering operational expenses for colocation operators.

● Advanced AI security systems employ behavioral analytics and anomaly detection to identify potential cybersecurity threats in real-time, providing colocation facilities with enhanced protection against sophisticated attacks while ensuring compliance with stringent data sovereignty and regulatory requirements across the Kingdom.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-data-center-colocation-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Data Center Colocation Industry

Saudi Arabia's Vision 2030 is fundamentally transforming the data center colocation industry by establishing the Kingdom as a strategic digital hub connecting Europe, Asia, and Africa. The initiative drives unprecedented investment in digital infrastructure, with government-backed programs creating favorable regulatory environments and economic incentives that attract global hyperscalers and enterprise clients. The Cloud-First policy mandates government entities to prioritize cloud services, generating sustained demand for secure, compliant colocation facilities that meet strict data localization requirements. Major giga-projects including NEOM, The Red Sea Project, and smart city developments create massive data processing requirements, positioning colocation providers as critical enablers of these transformative initiatives. Strategic investments in submarine cable infrastructure and fiber-optic networks enhance Saudi Arabia's connectivity advantage, making the Kingdom an attractive location for regional data center operations. The establishment of specialized economic zones with streamlined regulations and tax incentives further accelerates foreign direct investment in colocation facilities. Public Investment Fund initiatives support domestic capability development while attracting international expertise and best practices. Ultimately, Vision 2030 positions the data center colocation sector as a cornerstone of economic diversification, creating thousands of high-skilled jobs and establishing Saudi Arabia as the Middle East's premier destination for mission-critical digital infrastructure.

Saudi Arabia Data Center Colocation Market Trends & Drivers:

Saudi Arabia's data center colocation market is experiencing explosive growth driven by rapid digital transformation across government and enterprise sectors under Vision 2030 initiatives. The government's Cloud-First policy, introduced in 2019, requires public sector organizations to prioritize cloud solutions, creating substantial and sustained demand for colocation services that provide secure, compliant infrastructure. The establishment of the Cloud Computing Special Economic Zone in 2023 offers regulatory flexibility and economic incentives that attract major global cloud service providers and hyperscalers to establish regional operations. These strategic initiatives are complemented by massive investments from the Public Investment Fund in digital infrastructure, with programs targeting establishment of the Kingdom as a global AI hub capable of handling significant portions of worldwide artificial intelligence workloads. The data localization regulations enforced by the Saudi Data and Artificial Intelligence Authority require financial institutions, healthcare providers, and government agencies to store sensitive data within the Kingdom, driving enterprises toward third-party colocation services rather than building costly proprietary facilities. Hyperscale cloud providers including major global technology companies are launching Saudi cloud regions to serve regional markets, creating anchor demand for wholesale colocation capacity. The surge in internet penetration, with over thirty-six million users generating massive daily data consumption through streaming, social media, e-commerce, and digital banking, necessitates robust local data processing infrastructure that colocation facilities uniquely provide.

The expanding deployment of emerging technologies and smart infrastructure projects is significantly amplifying market demand. The development of futuristic smart cities including NEOM, The Red Sea Project, and urban transformation initiatives generates unprecedented requirements for edge computing and low-latency data processing capabilities that colocation facilities are specifically designed to deliver. Internet of Things ecosystems deployed across smart city infrastructure, industrial automation, and connected vehicle networks produce continuous streams of data requiring real-time processing at strategically located facilities. The healthcare sector's rapid digitalization, with telemedicine platforms serving significant portions of medical consultations and artificial intelligence applications enhancing diagnostic procedures, demands secure colocation infrastructure meeting strict regulatory compliance standards. The financial technology sector's explosive growth, supported by regulatory frameworks encouraging digital banking and payment innovation, creates sustained demand for high-availability colocation services. E-commerce expansion, with internet users increasingly engaging in online shopping activities, requires scalable infrastructure supporting transaction processing and customer data management. Energy sector digitalization initiatives, particularly Saudi Aramco's smart construction programs and renewable energy monitoring systems, generate substantial data processing requirements. The government's strategic investments in artificial intelligence, including establishment of specialized AI development companies and multi-billion dollar commitments to GPU infrastructure, position Saudi Arabia as a regional AI powerhouse requiring advanced colocation facilities with high-density computing capabilities, liquid cooling technologies, and renewable energy integration.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=21115&flag=E

Saudi Arabia Data Center Colocation Market Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

● Retail Colocation

● Wholesale Colocation

Organization Size Insights:

● Small and Medium Enterprises

● Large Enterprises

End Use Industry Insights:

● BFSI

● Manufacturing

● IT and Telecom

● Energy

● Healthcare

● Government

● Retail

● Education

● Entertainment and Media

● Others

Breakup by Region:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Recent News and Developments in Saudi Arabia Data Center Colocation Market

● January 2025: Gulf Data Hub and KKR announced a strategic partnership through which affiliated funds will acquire a stake in the colocation provider, committing to support investment in building data center capacity across Saudi Arabia and the broader region, positioning the collaboration to address accelerating hyperscale demand driven by cloud migration and artificial intelligence workloads.

● January 2025: NEOM and DataVolt signed a landmark agreement to develop a large-scale sustainable data center campus in Oxagon, northwestern Saudi Arabia, featuring advanced cooling technologies and renewable energy integration designed to support hyperscale cloud operations while minimizing environmental impact and establishing a foundation for the smart city's digital infrastructure requirements.

● February 2025: Etihad Etisalat Company announced substantial investment in digital infrastructure across the Middle East during the LEAP technology conference in Riyadh, allocating resources to expand data center facilities, submarine cable networks, and fiber-optic connectivity to support growing demand for colocation services, cloud computing, and artificial intelligence applications throughout the Kingdom.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Data Center Colocation Market Size to Surpass USD 1,769.2 Million by 2034, at a CAGR of 11.31% here

News-ID: 4361091 • Views: …

More Releases from IMARC Group

India Bottled Water Market 2026: Explosive Growth, Key Players & Future Opportun …

Introduction:

According to the latest research report titled "India Bottled Water Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Bottled Water Market Overview:

The India bottled water market size was valued at USD 10.71 Billion in 2025 and is projected to reach USD 29.70 Billion by 2034, growing at…

India E-Bike Market 2026: Explosive Growth, Top Brands & Investment Opportunitie …

Introduction:

According to the recent data, the report titled "India E-Bike Market Size, Share, Trends and Forecast by Propulsion Type, Battery Type, Power, Application, and Region, 2026-2034" offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India E-bike Market Overview:

The India E-bike market attained a valuation of USD 1,420.78 Million in 2025 and is forecasted to reach USD 3,007.19 Million by 2034, demonstrating a robust compound…

United States AI Governance Market Size, Growth, Latest Insights and Forecast 20 …

IMARC Group's Latest Research Reveals a CAGR of 28.10% from 2026-2034, Supported by Expanding Certification, Auditing, and Impact Assessment Processes

NEW YORK, USA - The United States artificial intelligence (AI) governance industry is witnessing rapid expansion as organizations intensify efforts to implement responsible AI practices. According to the latest market intelligence report by IMARC Group, the United States AI Governance Market, valued at USD 81.6 Million in 2025, is projected to…

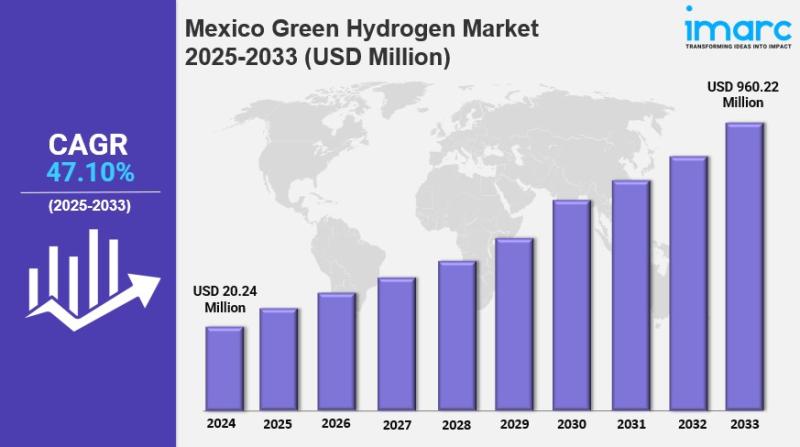

Mexico Green Hydrogen Market Size, Share, Demand, Trends & Forecast to 2033

IMARC Group's Latest Research Reveals a CAGR of 47.10% from 2025-2033, with Renewable-Powered Electrolysis and Export-Oriented Projects Accelerating Market Expansion

NEW YORK, USA - The Mexico green hydrogen industry is entering a high-growth phase, supported by national decarbonization initiatives and rising global demand for clean fuels. According to the latest report by IMARC Group, the Mexico Green Hydrogen Market reached a value of USD 20.24 Million in 2024 and is projected…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…