Press release

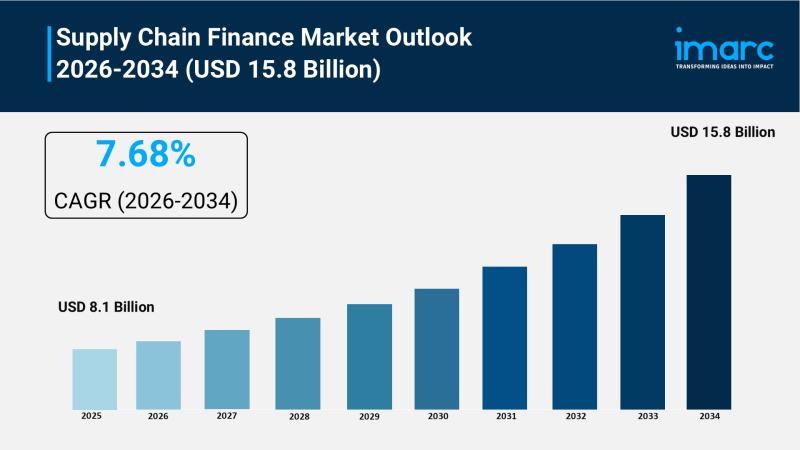

Supply Chain Finance Market Predicted to Exceed USD 15.8 Billion by 2034, Rising at a CAGR of 7.68%

Market Overview:According to IMARC Group's latest research publication, "Supply Chain Finance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global supply chain finance market size reached USD 8.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 15.8 Billion by 2034, exhibiting a growth rate (CAGR) of 7.68% during 2026-2034.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Supply Chain Finance Market

● AI transforms supply chain finance by enhancing credit risk assessment, with 64% of supply chain leaders considering AI capabilities essential when evaluating new technology solutions.

● Blockchain technology integrated with AI reduces operational costs by up to 33% in supply chain finance, with the blockchain SCF market projected to reach USD 34.6 billion by 2034.

● Financial institutions deploy AI-powered platforms for real-time transaction monitoring and fraud detection, with accounts receivable financing market estimated at $1.2 trillion in 2024, forecast to double by 2033.

● Machine learning algorithms optimize invoice processing and supplier onboarding, reducing administrative costs by up to 42% while improving accuracy and eliminating manual errors.

● AI-driven predictive analytics enable 94% of companies to use AI for decision support in supply chain operations, with 91% planning to leverage AI for demand forecasting over the next 2 years.

● Smart contract automation on blockchain platforms cuts processing time by 30% while ensuring transparency, with digital ledgers saving an estimated $3.8 billion annually by reducing fraud and double financing.

Download a sample PDF of this report: https://www.imarcgroup.com/supply-chain-finance-market/requestsample

Key Trends in the Supply Chain Finance Market

● Digital Transformation and Technology Integration: Supply chain finance is experiencing rapid digitalization, with automation, AI, and blockchain driving mainstream adoption. Digital platforms enable real-time, scalable funding solutions accessible to mid-market firms through embedded AR/AP systems. Companies are integrating AI for invoice processing, reducing manual intervention and errors while achieving processing times cut by 30% at facilities implementing AI check-in systems.

● Blockchain-Based Solutions Gaining Traction: Blockchain in supply chain finance market reached USD 1.8 billion in 2024, projected to grow at 39.4% CAGR through 2034. Smart contracts lower administrative costs by up to 42%, while 46% of North American supply chain firms plan to adopt blockchain solutions. The technology provides tamper-proof record-keeping and instant verification, with 63% of companies seeking blockchain verification systems to enhance transparency.

● Sustainability-Linked Financing Programs: ESG-linked financing is reshaping SCF, with 8% of programs offering lower rates for sustainable suppliers in 2025. Lenders provide preferential rates for eco-friendly practices like carbon footprint reduction and ethical sourcing, aligning with corporate sustainability mandates. This trend attracts ESG-conscious investors, as regulators push for greener supply chains and companies integrate ESG metrics into financing strategies.

● Multi-Tier Financing for Supply Chain Resilience: Technology enables tracing transactions deeper into supply chains, allowing smaller sub-suppliers to access working capital. Multi-tier financing leverages platforms to provide visibility beyond first-tier suppliers, fostering greater resilience across entire supply networks. This approach is particularly beneficial for SMEs, which make up 65-70% of suppliers worldwide but face a financing gap of USD 5.7 trillion.

● Cross-Border Trade Finance Expansion: International trade complexity drives demand for specialized SCF solutions managing currency exchange, customs compliance, and payment settlement. Export and import bills represent 40.6% of the market share, providing crucial short-term financing for businesses engaged in global trade. Asia Pacific dominates with 42.2% market share, driven by strong trade environment and regulatory support.

Growth Factors in the Supply Chain Finance Market

● Working Capital Optimization Demand: Businesses increasingly turn to supply chain finance to manage cash flow effectively amid economic uncertainties and tightening credit markets. SCF enables suppliers to access early payments while buyers extend payment terms, improving liquidity across supply chains. Companies with 90% of global businesses being SMEs often struggle with liquidity, with platforms like C2FO facilitating billions in early payments to thousands of suppliers.

● Government Support and Regulatory Initiatives: Governments implement schemes like India's Electronic Vendor Financing Scheme (e-VFS) offering paperless, real-time fund transfers. The EU's Farm to Fork Strategy funds organic farming approaches, while initiatives support SME growth through accessible financing programs. India's PKVY offers incentives, and regulatory bodies consistently encourage SCF to strengthen economic ecosystems through collaborative public-private initiatives.

● Rise of E-Commerce and Digital Platforms: Online platforms make supply chain finance more accessible, with e-commerce retail reaching 21% of Asia Pacific's total retail sales as of 2023, up from 10.2% in 2019. Subscription-based models gain traction, particularly in emerging markets, driving demand for flexible financing solutions. Smartphones and express delivery enable convenience, making SCF solutions available to businesses of varying sizes.

● Advanced Risk Management Capabilities: AI enhances supply chain finance effectiveness through predictive analytics for identifying potential disruption events and credit risk management. Technology supports cash flow forecasting and fraud detection, with AI algorithms combining multiple data types for rapid, objective, and accurate credit assessments. Financial institutions achieve better risk assessment while maintaining scalability for evolving market needs.

● SME Access to Capital: Small and medium-sized enterprises comprising over 50% of workforce in regions like Latin America require enhanced liquidity solutions. SCF addresses the critical financing gap, with SMEs showing 38% CAGR adoption potential through 2034. Digital transformation makes financing more accessible to underserved markets, with fintech platforms expanding reach to remote areas through mobile banking integration.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=19065&flag=E

Leading Companies Operating in the Global Supply Chain Finance Industry:

● Asian Development Bank

● Bank of America Corporation

● BNP Paribas

● DBS Bank India Limited

● HSBC

● JPMorgan Chase & Co.

● Mitsubishi UFJ Financial Group Inc.

● Orbian Corporation

● Royal Bank of Scotland plc (NatWest Group plc)

Supply Chain Finance Market Report Segmentation:

Breakup By Provider:

● Banks

● Trade Finance House

● Others

Banks account for the majority of shares (88.6%) on account of their established trust, extensive financial networks, and access to capital essential for large-scale supply chain finance solutions.

Breakup By Offering:

● Letter of Credit

● Export and Import Bills

● Performance Bonds

● Shipping Guarantees

● Others

Export and import bills dominate the market (40.6%) due to their crucial role in providing short-term financing for international trade, enabling exporters to receive immediate cash and importers to manage payment obligations.

Breakup By Application:

● Domestic

● International

Domestic holds the largest market share (60.0%) as companies prioritize managing cash flow and reducing risk within local supply chains through enhanced technological solutions and efficient processing.

Breakup By End User:

● Large Enterprises

● Small and Medium-sized Enterprises

Large enterprises comprise the majority of shares (63.0%) as they have more financial resources, diverse supplier bases, easier access to capital markets, and established procurement processes.

Breakup By Region:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

Asia Pacific enjoys the leading position (42.2% market share) owing to diverse industries, vast pool of investors, advanced technology adoption, and strong governmental support driving expansion.

Recent News and Developments in Supply Chain Finance Market

● January 2025: The Reserve Bank of India (RBI) granted KredX permission to develop a Trade Receivables Discounting System (TReDS) platform, authorizing auction of trade receivables to facilitate easy financing for MSMEs and improve liquidity for small business expansion.

● January 2025: NEC Thailand collaborated with AIRA Factoring to launch a Digital Supply Chain financing platform supporting SMEs in Thailand. The platform leverages NEC's digital capabilities and TASConnect to enhance supply chain finance programs, improve cash flow, and increase credit disbursement aligned with Thailand's 4.0 strategy.

● November 2024: The Reserve Bank of India (RBI) instructed non-banking financial companies (NBFCs) to submit comprehensive information about supply chain financing activities as part of efforts to monitor risks in the financial ecosystem and improve transparency for better financial stability.

● September 2024: Veefin acquired digital lending platform EpikIndifi for Rs 125 crore, marking its third acquisition of 2024. This supports Veefin's strategy to expand from digital supply chain finance provider to end-to-end working capital finance platform, adding new revenue streams through digital retail lending.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Supply Chain Finance Market Predicted to Exceed USD 15.8 Billion by 2034, Rising at a CAGR of 7.68% here

News-ID: 4361007 • Views: …

More Releases from IMARC Group

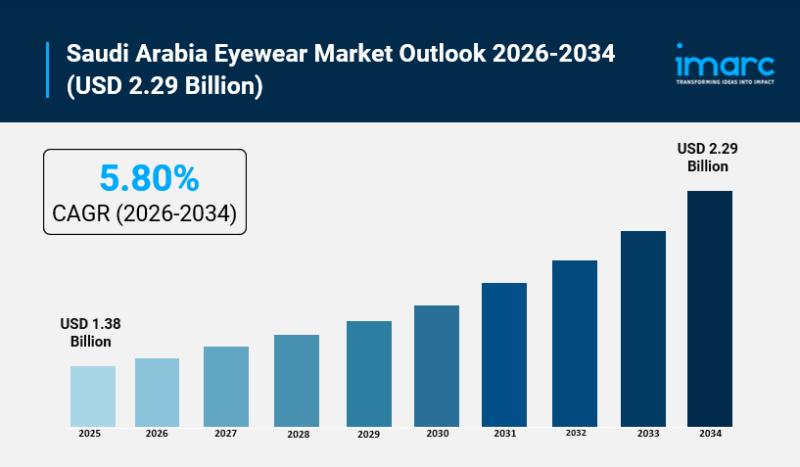

Saudi Arabia Eyewear Market Eyes USD 2.29 Billion by 2034 Already Hits USD 1.38 …

Saudi Arabia Eyewear Market Overview

Market Size in 2025: USD 1.38 Billion

Market Forecast in 2034: USD 2.29 Billion

Market Growth Rate 2026-2034: 5.80%

According to IMARC Group's latest research publication, "Saudi Arabia Eyewear Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2026-2034", The Saudi Arabia eyewear market size was valued at USD 1.38 Billion in 2025 and is projected to reach USD 2.29 Billion by 2034, growing at…

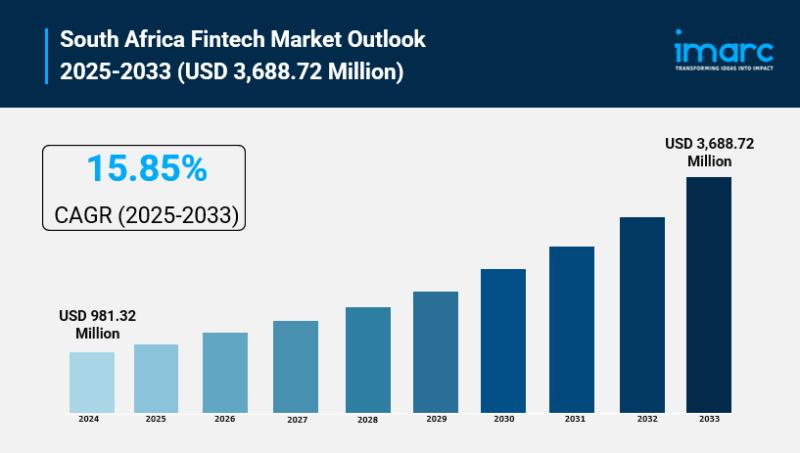

South Africa Fintech Market Size to Surpass USD 3,688.72 Million by 2033 | With …

South Africa Fintech Market Overview

Market Size in 2024: USD 981.32 Million

Market Size in 2033: USD 3,688.72 Million

Market Growth Rate 2025-2033: 15.85%

According to IMARC Group's latest research publication, "South Africa Fintech Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the South Africa fintech market size reached USD 981.32 Million in 2024. The market is projected to reach USD 3,688.72 Million by 2033, exhibiting a growth rate (CAGR) of 15.85%…

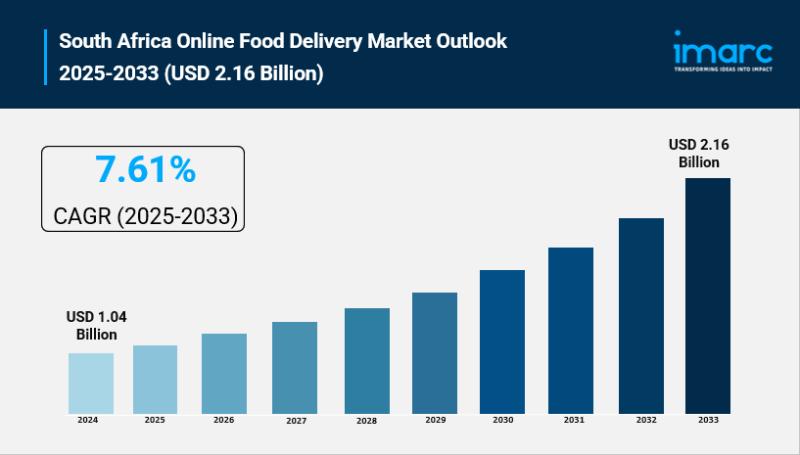

South Africa Online Food Delivery Market Size to Hit USD 2.16 Billion by 2033 | …

South Africa Online Food Delivery Market Overview

Market Size in 2024: USD 1.04 Billion

Market Size in 2033: USD 2.16 Billion

Market Growth Rate 2025-2033: 7.61%

According to IMARC Group's latest research publication, "South Africa Online Food Delivery Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the South Africa online food delivery market size reached USD 1.04 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.16 Billion…

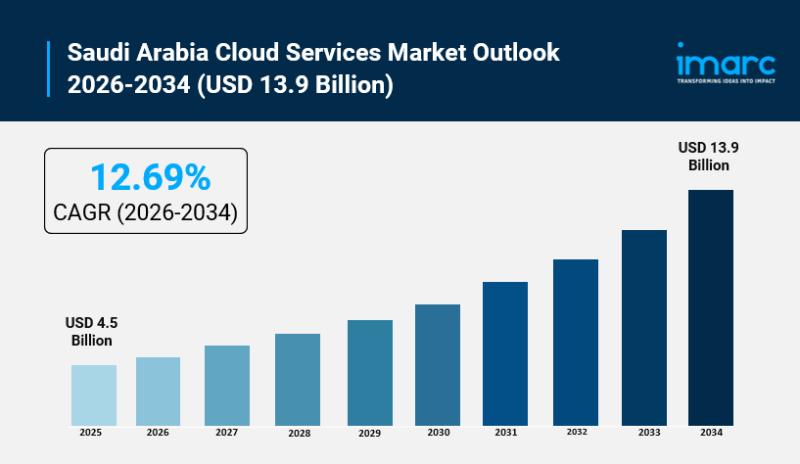

Saudi Arabia Cloud Services Market Poised for Explosive Growth to USD 13.9 Billi …

Saudi Arabia Cloud Services Market Overview

Market Size in 2025: USD 4.5 Billion

Market Forecast in 2034: USD 13.9 Billion

Market Growth Rate 2026-2034: 12.69%

According to IMARC Group's latest research publication, "Saudi Arabia Cloud Services Market Report by Deployment (Public Cloud, Private Cloud), End Use Industry (Oil, Gas, and Utilities, Government and Defense, Healthcare, Financial Services, Manufacturing and Construction, and Others), and Region 2026-2034", The Saudi Arabia cloud services market size reached USD…

More Releases for Supply

Driving Agility in Retail Supply Chains with Signavio Supply Chain Modeling

Retail supply chains were developed for stability but are now asked to contend with disruption, variable demand, and the complexity of omnichannel retailing.

Retailers require networks that are fast, transparent, and efficient on all fronts, as long as they do not give away margin. YRC is addressing this through SAP Signavio, transforming these traditional supply chains into adaptable, cost-saving ecosystems that maximize real-time response capabilities.

The core of YRC's initiative is Signavio…

Blockchain Supply Chain Market: Securing and Streamlining Supply Chains

Blockchain Supply Chain Market report 2024-2031 covers the whole scenario of the global including key players, their future promotions, preferred vendors, and shares along with historical data and price analysis. It continues to offer key details on changing dynamics to generate -improving factors. The best thing about the Tax Management report is the provision of guidelines and strategies followed by major players. The investment opportunities in the highlighted here will…

Industrial equipment supply

We stock and sell Compressor, Servo Motor and Drive, HMI, Encoder, Light Curtain, Sensor, VFD, Soft Starter, Thyristor, Solenoid Valve and Coil, Air Cylinder, Gearbox, Linear Guideway, Actuator, Transmitter, Flowmeter, Power Supply, Transformer, Expansion Valve, Circuit Breaker and other necessities all catering to your needs.

Visit out site at okmarts.com for more info.

Address : No. 469, Xinsheng Road, Gaoxin District, Chengdu, China

Email : support@okmarts.com

Email : service@okmarts.com

Tel : +86-28-84166335

Since 2008, we are…

Top players profiled in the Tattoo Market report are WorldWide Tattoo Supply,ELE …

The global Tattoo Market report contains market revenue, market share, and production of the service providers is also mentioned with accurate data. Moreover, the global Tattoo Market report majorly focuses on the current developments, new possibilities, advancements, as well as dormant traps. Furthermore, the market report offers a complete analysis of the current situation and the advancement possibilities of the market across the globe. Tattoo Market size is forecasted to reach…

LED Supply Chain

This report covers market size and forecasts of LED Supply Chain, including the following market information:

Global LED Supply Chain Market Size, 2019-2021, and 2020 (quarterly data), (US$ Million)

Global LED Supply Chain Market Size by Type and by Application, 2019-2021, and 2020 (quarterly data), (US$ Million)

Global LED Supply Chain Market Size by Region (and Key Countries), 2019-2021, and 2020 (quarterly data), (US$ Million)

Global LED Supply Chain Market Size by Company, 2019-…

Advanced Marine Power Supply Market Report 2018: Segmentation by Device (Battery …

Global Advanced Marine Power Supply market research report provides company profile for Emerson Electric Company, Schneider Electric SE, ABB Ltd, Exide Industries Ltd, EnerSys, HBL Power Systems Ltd, Systems Sunlight S.A., Eaton Corporation Plc, Powerbox International AB and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue,…