Press release

Top 30 Indonesian Battery Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)PT Aneka Tambang Tbk (ANTM) diversified metals (nickel & battery feedstock)

Bayan Resources Tbk (BYAN) large mining & metal revenue

AlamTri Resources / Adaro Energy Tbk (ADRO) diversified mining & metals

Indo Tambangraya Megah Tbk (ITMG) mining including metals exposure

PT Bukit Asam Tbk (PTBA) minerals/coal & metals linkage

Vale Indonesia Tbk (INCO) nickel & concentrates

PT Timah Tbk (TINS) tin & metals

Harum Energy Tbk (HRUM) diversified mining

Merdeka Copper Gold Tbk (MDKA) metals portfolio, including nickel linkage

Amman Mineral Internasional Tbk (AMMN) smelting & metal operations

Golden Energy & Resources (GEMS) energy & mining group

Bumi Resources Tbk (BUMI) integrated mining & metals

PT Merdeka Gold Resources / EMAS precious metals miner

Borneo Olah Sarana Sukses (BOSS) metals & mining services

Baramulti Suksessarana (BSSR) coal/minerals operations

Indika Energy Tbk (INDY) diversified energy & mining

Mitrabara Adiperdana Tbk (MBAP) mining & logistics

Sumber Mineral Global smaller listed metals/minerals entity

J Resources (PSAB) gold & metal mining

Wilton Resources (SQMI) nickel / metals exposure

Bumi Resources Minerals (BRMS) minerals division of Bumi

Transcoal Pacific Tbk mining & related services

Petrosea Tbk mining infrastructure & services

Elnusa Tbk oil & mining services

TBS Energi Utama Tbk energy/mining sector linkage

Trimegah Bangun Persada (Harita Group) nickel mining exposure

Merdeka Battery Materials (MBMA) battery materials & nickel feedstock (unit under MDKA)

PT Timah Smelting (subsidiary activities) metal processing support

IDX Metals/Mining Small Caps (collective) cluster of smaller metal/mining listings

Other Junior Metal/Resources Stocks (emerging names) emerging IDX resource plays

2) Revenue results of major public companies in Indonesia summarized (per company)

PT Aneka Tambang Tbk (ANTM) - Q3 2025 Net Profit: approx. Rp 5.97 trillion ≈ USD 357.7m. Strong downstream margins from nickel/gold business and higher processing volumes.

PT Merdeka Battery Materials Tbk (MBMA) - 9M2025 Revenue: USD 935 million (approx) to Q3 2025. Operational highlights: saprolite ore production up +89% YoY and limonite up +51% YoY. Focus on higher efficiency and downstream expansions (HPAL, AIM).

Vale Indonesia Tbk (INCO) - Q3 2025 Profit: ~Rp 874.8 billion ≈ USD 52.4m. Improved profitability via operational efficiencies in nickel concentrate.

PT Timah Tbk (TINS) - Q3 2025 Profit: ~Rp 602.4 billion ≈ USD 36.1m. Performance influenced by tin pricing & product mix.

Harum Energy Tbk (HRUM) - Q3 2025 Profit: ~Rp 622.3 billion ≈ USD 37.3m. Solid cash flows despite tighter margins.

Merdeka Copper Gold Tbk (MDKA) - 9M 2025 Revenue: ~USD 1.298 billion. Large metals portfolio including nickel influence.

Bayan Resources Tbk - Q3 2025 Net Profit: ~USD 523.6m.

Adaro Energy/Alamtri Resources - Q3 2025 Profit: ~USD 302.5m. Mineral/energy with mining exposure.

Indo Tambangraya Megah - Q3 2025 Profit: ~USD 130.6m. Coal/mining performance influencing capital flows to metal sectors.

PT Bukit Asam Tbk - Q3 2025 Profit: ~USD 83.3m. Coal & mineral

3) Key trends & insights from Q3 2025

Nickel Production & Downstream Focus: Companies like MBMA are expanding nickel ore output significantly, boosting supply for EV battery precursors.

Commodity Price Volatility: Lower benchmark prices for nickel & related metals compressed margins across multiple producers despite production gains.

Diversification & Value-Added Metals: Firms like ANTM benefitted from end-product diversification (gold + nickel) with solid downstream margins.

Strategic Infrastructure Advancements: Integration of HPAL, AIM, and smelter expansions indicate strategic shifts toward higher value in battery material chains.

Export & Regulatory Environment: Battery material export policies and processing incentives influenced profitability and investment planning throughout 2025.

4) Outlook for Q4 2025 and beyond

Capacity Expansion: Downstream projects (HPAL & precursor facilities) expected to start operational phases in late 20252026, supporting long-term value creation.

EV Supply Chain Growth: With expected lithium battery plants in Indonesia by end of 2026 (e.g., CATL partnerships), local materials producers like ANTM & MBMA will play key roles in the global battery ecosystem.

Policy Support: Government incentives and mineral processing mandates continue encouraging domestic value-addition, boosting longer-term battery sector prospects.

Price & Demand Risks: Continued commodity pricing volatility and EV market demand swings could affect short-term margins and capital investment.

5) Conclusion

The Q3 2025 snapshot of Indonesian public companies tied to the battery industry highlights a dynamic supply chain pivot where nickel miners and battery materials producers are increasingly critical. Companies such as ANTM, MBMA, and Vale Indonesia stood out with real earnings growth tied to downstream battery relevance. Commodity price shifts and global EV demand dynamics shape near-term earnings, while strategic investments in capacity expansion position Indonesia as a regional battery supply hub going into 2026.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Battery Public Companies Q3 2025 Revenue & Performance here

News-ID: 4360360 • Views: …

More Releases from QY Research

The Future of Contactless Experiences: RFID Wristband Systems Market Forecast, C …

The RFID (Radio-Frequency Identification) Wristband System industry has emerged as a critical segment within the broader RFID ecosystem, enabling automated identification, access control, contactless payments, and data analytics across event management, healthcare, transportation, and entertainment sectors. RFID wristbands consist of embedded electronic tags that communicate with readers to transmit unique IDs and other encoded information, eliminating manual scanning and streamlining user interactions across environments such as theme parks, festivals, hospitals,…

From Food to Pharma: The Expanding Role of Multi Piston Viscous Filling Systems

The global Multi Piston Viscous Filler Machine market plays a critical role in modern automated packaging lines, particularly for products that require high filling accuracy, consistency, and repeatability when handling viscous, semi-viscous, and high-density liquids. These machines have become a core asset across food, beverage, pharmaceutical, cosmetic, chemical, and specialty industrial manufacturing, where production efficiency and hygiene standards are increasingly non-negotiable. As manufacturers worldwide continue shifting toward higher throughput and…

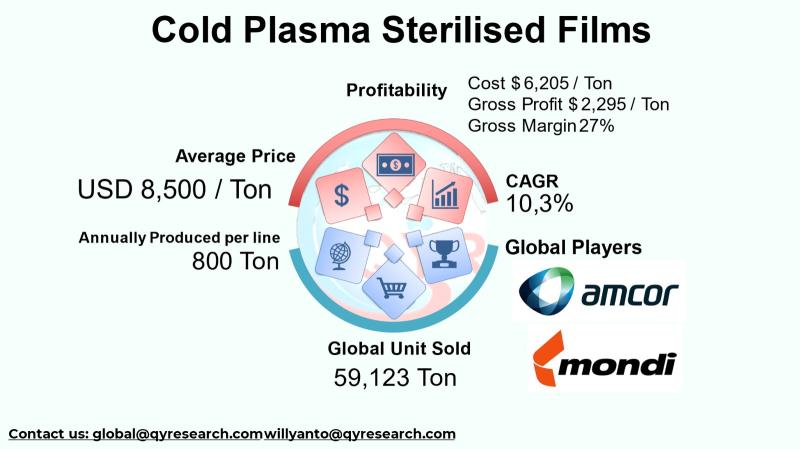

Sterile by Design: The Global Rise of Cold Plasma Sterilised Films and Asia-Paci …

The global Cold Plasma Sterilised Films industry is an emergent segment of advanced packaging and sterilisation technologies, integrating cold plasma treatment with polymer film substrates to achieve microbial-free surfaces without thermal or chemical degradation. These films are essential in sectors requiring rigorous sterility especially medical and pharmaceutical packaging as well as aseptic food packaging due to their ability to maintain integrity under sterilised conditions and provide enhanced shelf life and…

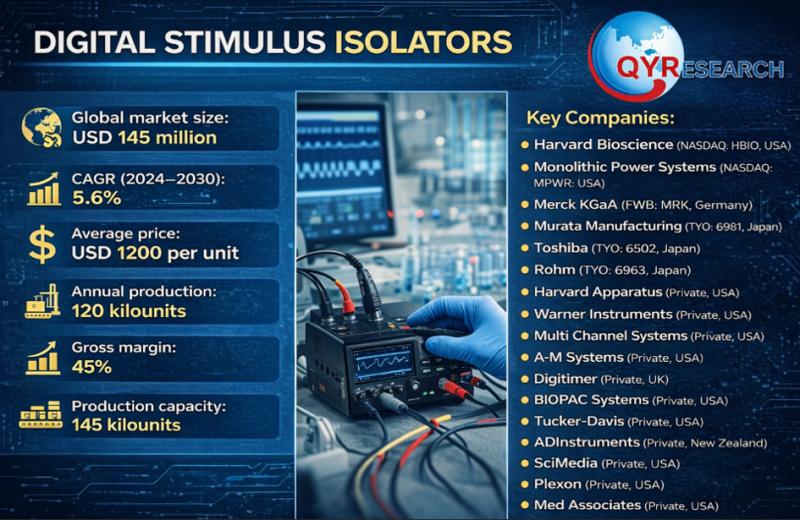

Global and U.S. Digital Stimulus Isolators Market Report, Published by QY Resear …

QY Research has released a comprehensive new market report on Digital Stimulus Isolators, precision electronic instruments designed to deliver electrically isolated, digitally controlled stimulation signals to biological tissues, neural circuits, and excitable cells. By providing accurate pulse timing, amplitude control, and complete galvanic isolation between stimulation and control electronics, digital stimulus isolators are essential in neuroscience research, electrophysiology, cardiac studies, and biomedical engineering. As experimental protocols become more complex and…

More Releases for Tbk

Indonesia Textile Industry Market Valuation Expected to Hit USD 28.57 billion by …

USA, New Jersey: According to Verified Market Research analysis, the global Indonesia Textile Industry Market size was valued at USD 21.7 Billion in 2023 and is projected to reach USD 28.57 Billion by 2031, growing at a CAGR of 3.50% from 2024 to 2031

How AI and Machine Learning Are Redefining the future of Indonesia Textile Industry Market?

AI-powered production planning systems optimize yarn selection, fabric blends, and loom utilization, improving output…

Infrastructure Market 2021 Strategic Assessments - PT. Acset Indonusa Tbk.., Pt. …

The Infrastructure Market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The Infrastructure sector in Indonesia is…

Indonesia Telecom Tower Market Demand, Size, Share, Scope & Forecast To 2025 |To …

The Indonesia telecom tower market accounted to US$ 557.9 Mn in 2017 and is expected to grow at a CAGR of 27.1% during the forecast period 2018 – 2025, to account to US$ 3,695.5 Mn by 2025.

Get Sample Copy of this Indonesia Telecom Tower Market research report at - https://www.businessmarketinsights.com/sample/TIPRE00004113

The Business Market Insights provides you regional research analysis on “Indonesia Telecom Tower Market” and forecast to 2025. The research report…

Coal Mining in Indonesia Market 2022| PT Bumi Resources Tbk, PT Adaro Energy Tbk …

Researchmoz added Most up-to-date research on "Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption" to its huge collection of research reports.

Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption

Summary

GlobalData's "Coal Mining in Indonesia to 2022", provides a comprehensive coverage on Indonesias coal industry. It provides historical and forecast data on coal production by grade, reserves, consumption and exports by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes

Summary

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by type; exports, exports by type and exports by country. Detailed analysis of the…