Press release

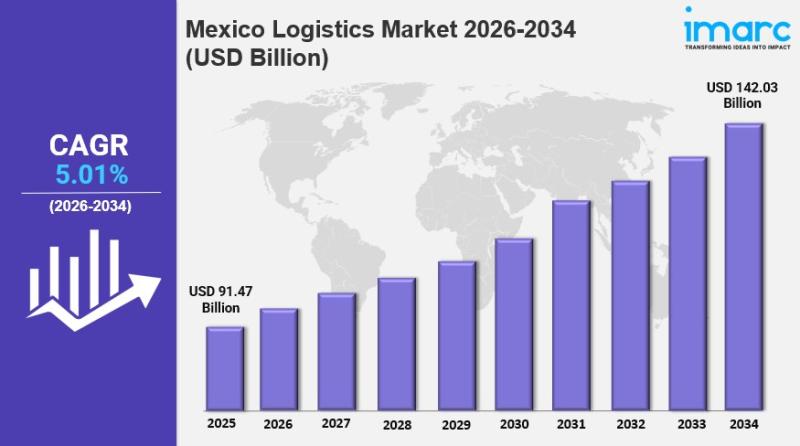

Mexico Logistics Market Size to Hit USD 142.03 Billion by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.Market Overview

The Mexico logistics market size was valued at USD 91.47 Billion in 2025 and is forecasted to reach USD 142.03 Billion by 2034, growing at a CAGR of 5.01% during 2026 to 2034. The market growth is driven by Mexico's strategic geographical position as a North American trade gateway, increasing nearshoring activities, and e-commerce growth requiring efficient delivery solutions. The use of third-party logistics providers and multimodal transport further bolsters operational efficiency.

Study Assumption Years

● Base Year: 2025

● Historical Years: 2020-2025

● Forecast Period: 2026-2034

Mexico Logistics Market Key Takeaways

● Current Market Size: USD 91.47 Billion in 2025

● CAGR: 5.01% from 2026 to 2034

● Forecast Period: 2026-2034

● By Model Type, 3 PL dominates with 46% market share in 2025.

● Roadways lead transportation mode with a 59% share in 2025.

● Manufacturing is the largest end-use segment with 18% market share in 2025.

● Northern Mexico holds the leading regional share of 46% in 2025.

● Market is fragmented with global logistics corporations and domestic providers competing through technology and partnerships.

Sample Request Link: https://www.imarcgroup.com/mexico-logistics-market/requestsample

Mexico Logistics Market Growth Factors

The Mexico logistics market is driven in large part by nearshoring, in which multinational companies move production to Mexico because of proximity to North American consumers and to reduce supply chain risk. Companies have invested in warehouses, freight transport, and third-party logistics in industrial corridors from the border to central manufacturing hubs in states such as Guanajuato and San Luis Potosi. An example of this is Canada's MARKDOM, which opened a $25 Million manufacturing plant in Irapuato, Guanajuato, Mexico in November 2025. This action nearshored manufacturing and logistics operations into Mexico to serve North American markets; this has broad logistical implications in terms of the supply and distribution of inbound raw materials and outbound goods. A positive trade environment enables more straightforward customs processes and cross-border transportation of freight, both of which benefit the manufacturing environment and logistics infrastructure.

The rapid growth of e-commerce in Mexico is driven by an increase in the demand for speed of delivery, choice of fulfillment options and ease of returns, and has created a large market for logistics providers to deliver last mile to the urban and suburban consumer for a great variety of goods and services. In 2025 the eCommerce logistics provider DHL invested US$60 Million to add 300 ground transport vehicles to the fleet to ensure eCommerce deliveries could be fulfilled quickly on peak days such as El Buen Fin. Investment has also been made in infrastructure including additional fulfillment centers, sortation technology and tracking systems. The rise of omnichannel retailing creates additional demand in logistics capacity and capabilities to allow retailers to integrate physical store networks with their digital order fulfillment capabilities in a cost-effective way.

Mexico invested a lot in transportation infrastructure. New freeways, ports, and rail links connect production areas to domestic and international markets. Transit times decrease and capacity increases. Logistics parks and inter-modal terminals efficiently transship and move goods from one mode of transport to another within a coordinated system. Value-added services of warehousing, customs clearance, consolidation and aggregation services are also offered. The government has also began policies to upgrade planned trade corridors and improve border crossings that recognize the role of logistics in improving manufacturing investments and export competitiveness. These infrastructure improvements considerably ease multimodal transport and benefit the overall supply chain.

Buy Report Now: https://www.imarcgroup.com/checkout?id=16217&method=3682

Mexico Logistics Market Segmentation

Breakup by Model Type

● 2 PL

● 3 PL

● 4 PL

3 PL dominates due to outsourcing advantages, scalability, and service integration, supporting manufacturing, retail, and e-commerce sectors.

Breakup by Transportation Mode

● Roadways

● Seaways

● Railways

● Airways

Roadways lead with extensive highway networks, last-mile flexibility, and cost-efficiency supporting domestic freight between manufacturing and consumption centers.

Breakup by End Use

● Manufacturing

● Consumer Goods

● Retail

● Food and Beverages

● IT Hardware

● Healthcare

● Chemicals

● Construction

● Automotive

● Telecom

● Oil and Gas

● Others

Manufacturing sector logistics requires integrated solutions for automotive, aerospace, electronics, and consumer goods, focusing on just-in-time delivery and complex supply chains.

Breakup by Region

● Northern Mexico

● Central Mexico

● Southern Mexico

● Others

Northern Mexico dominates the market due to proximity to U.S. borders, dense industrial clusters, maquiladoras, and trade corridors facilitating cross-border freight.

Regional Insights

Northern Mexico leads the Mexico logistics market with a 46% share in 2025. The region's proximity to U.S. border crossings, concentration of maquiladoras, and robust industrial parks drive efficient cross-border logistics services. Key hubs like Monterrey, Tijuana, and Ciudad Juárez offer warehousing, customs brokerage, and multimodal transport, cementing northern Mexico's strong position amid rising nearshoring and industrial investment.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=16217&flag=C

Recent Developments & News

In June 2025, Amazon Mexico collaborated with Rappi to launch Amazon Now, enabling ultrafast delivery of over 5,000 essential products within 15 minutes across Mexico's 10 largest cities including Mexico City, Guadalajara, and Monterrey. This service integrates restaurant orders and elevates digital retail convenience, enhancing last-mile e-commerce fulfillment significantly.

Key Players

● Amazon

● Mercado Libre

● GEODIS

● Salesforce

● DP World

● DHL

● MARKDOM

● Volvo

● Prologis

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mexico Logistics Market Size to Hit USD 142.03 Billion by 2034: Trends & Forecast here

News-ID: 4359703 • Views: …

More Releases from IMARC Group

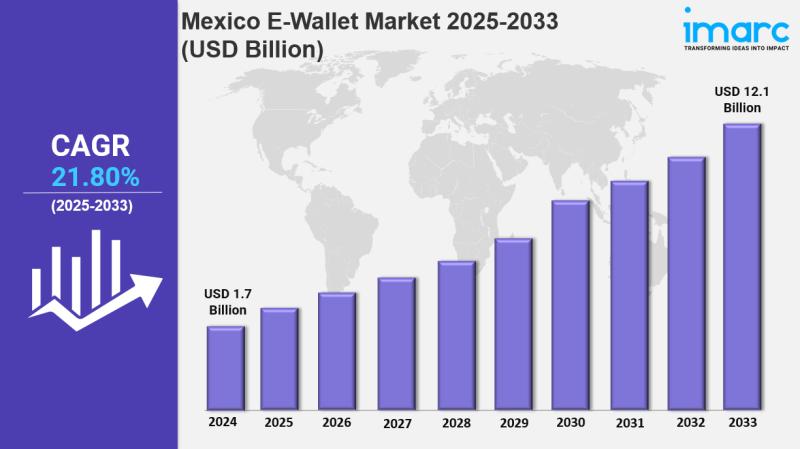

Mexico E-Wallet Market Size, Share, Latest Insights and Forecast 2025-2033

IMARC Group has recently released a new research study titled "Mexico E-Wallet Market Size, Share, Trends and Forecast by Type, Ownership, Technology, Vertical, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico e-wallet market size reached USD 1.7 Billion in 2024 and is projected to grow to USD 12.1 Billion…

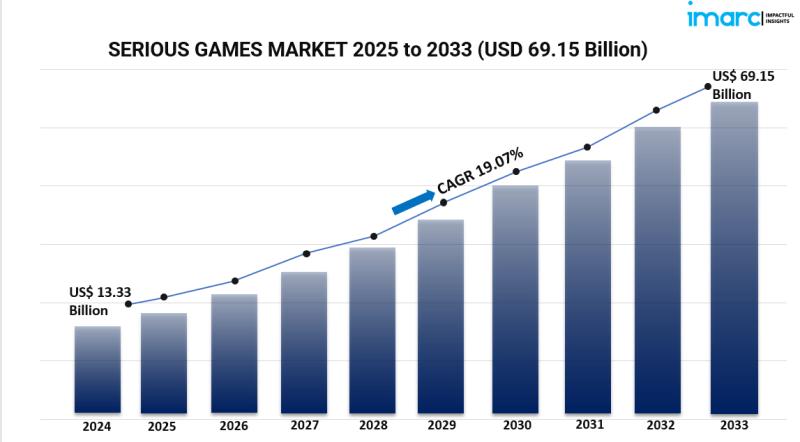

Serious Games Market Size, Share, Trends and Forecast by Gaming Platform, Applic …

Market Overview

The global serious games market was valued at USD 13.33 Billion in 2024 and is forecasted to reach USD 69.15 Billion by 2033, growing at a CAGR of 19.07% during the forecast period of 2025-2033. The market growth is driven by increasing adoption in education and corporate training, advancements in augmented reality (AR), virtual reality (VR), and artificial intelligence (AI), alongside government support for gamification. Asia Pacific leads the…

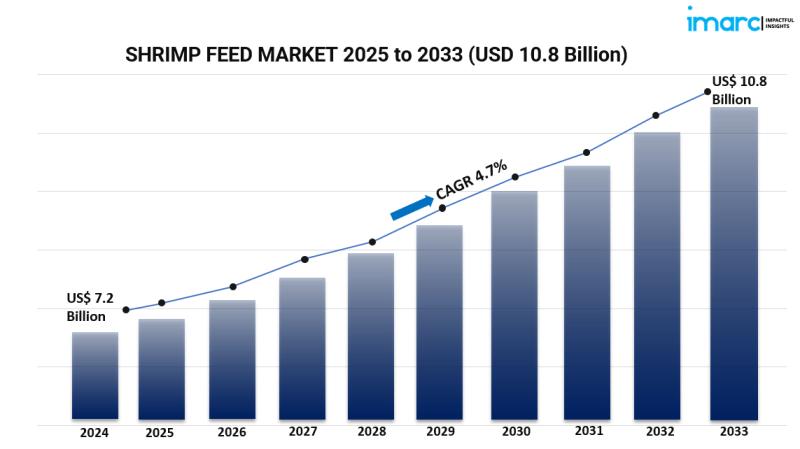

Shrimp Feed Market: Aquaculture Expansion and Nutritional Formulation Advancemen …

Market Overview

The global shrimp feed market size reached USD 7.2 Billion in 2024 and is projected to grow to USD 10.8 Billion by 2033. The market is expected to expand at a CAGR of 4.7% during the forecast period of 2025-2033. Growth is driven by rising global shrimp consumption, expanding aquaculture activities, and the development of specialized and nutritionally enhanced feed variants to enhance production efficiency. For more details, visit…

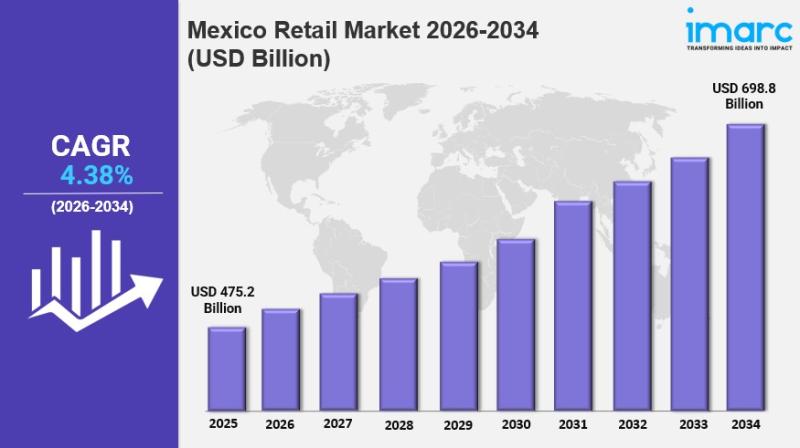

Mexico Retail Market 2026 : Industry Size to Reach USD 698.8 Billion by 2034, At …

IMARC Group has recently released a new research study titled "Mexico Retail Market Report by Product (Food and Beverages, Personal and Household Care, Apparel, Footwear and Accessories, Furniture, Toys and Hobby, Electronic and Household Appliances, and Others), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand…

More Releases for Mexico

Human Resources Mexico Releases Employer Guide To Mexico 2026 Minimum Wage Compl …

Mexico's National Minimum Wage Commission (CONASAMI) has confirmed the new minimum wage levels that will take effect on January 1, 2026. The general daily minimum wage will increase to MXN [315.04], while the Northern Border Free Zone rate will rise to MXN [440.87] for 2026.

Image: https://www.globalnewslines.com/uploads/2025/12/d53f76670eba46736b7e94c6a16fb975.jpg

The adjustment reflects an estimated 13 percent increase for the general zone and about 5 percent for the Northern Border Free Zone compared to 2025.…

Mexico Relocation Guide Helps Thousands Successfully Move to Mexico with Compreh …

Mexico City, Mexico - March 27, 2025 - Since 2019, Mexico Relocation Guide has helped thousands of retirees, digital nomads, and families successfully move to Mexico with its Complete Mexico Relocation Guide-an all-in-one online resource designed to simplify the relocation process. This comprehensive guide provides up-to-date, step-by-step instructions on everything from obtaining residency visas to navigating healthcare, real estate, and taxes, ensuring a seamless transition to life in Mexico.

Image: https://www.globalnewslines.com/uploads/2025/03/c0f68758919db47341ba6f02f686214a.jpg

A…

Mexico Rooftop Solar Market Research Report Segmented by Applications, Geography …

Mexico Rooftop Solar Market by Component, Application, Services, and Region- Forecast to 2025

The Global Mexico Rooftop Solar Market Research Report 2021-2025 published by Market Insights Reports is a significant source of keen information for business specialists. It furnishes the Mexico Rooftop Solar business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction of the Mexico…

Mexico Rooftop Solar Market Research Report Segmented by Applications, Geography …

Mexico Rooftop Solar Market by Component, Application, Services, and Region- Forecast to 2025

The Global Mexico Rooftop Solar Market Research Report 2021-2025 published by MarketInsightsReports is a significant source of keen information for business specialists. It furnishes the Mexico Rooftop Solar business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction of the Mexico Rooftop Solar…

The Mexico Online On-demand Home Services Market , Major Keyplayers - Aliada Inc …

Mexico Online On-demand Home Services Market 2021

Mexico online on-demand home services market offer a range of services within the comfort of home as well as save time and money. Additionally, these services help in bridging the gap between the real-world services and instant online services with improved efficiency. Recently, the demand for Mexico online on-demand home services marekt has started witnessing huge growth due to convenience and accessibility. The growing…

Mexico Agriculture Market, Mexico Agriculture Industry, Mexico Agriculture Grain …

Mexico Agriculture has been crucial sector of the country’s economy traditionally and politically even if it currently accounts for a really little share of Mexico’s GDP. Mexico is one in all the cradles of agriculture with the Mesoamericans emerging domesticated plants like maize, beans, tomatoes, squash, cotton, vanilla, avocados, cacao, number sorts of spices, and more. Domestic turkeys and Muscovy ducks were the solely domesticated fowl within the pre-Hispanic amount and little dogs…