Press release

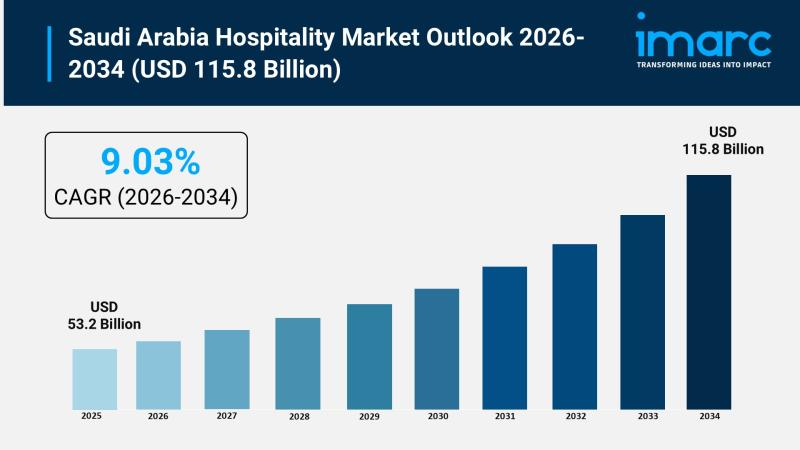

Saudi Arabia Hospitality Market Size To Exceed USD 115.8 Billion By 2034 | CAGR of 9.03%

Saudi Arabia Hospitality Market OverviewMarket Size in 2025: USD 53.2 Billion

Market Size in 2034: USD 115.8 Billion

Market Growth Rate 2026-2034: 9.03%

According to IMARC Group's latest research publication, "Saudi Arabia Hospitality Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia hospitality market size was valued at USD 53.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 115.8 Billion by 2034, exhibiting a CAGR of 9.03% during 2026-2034.

How AI is Reshaping the Future of Saudi Arabia Hospitality Market

● AI-powered chatbots and virtual assistants enhance guest services by providing instant responses to inquiries, personalized recommendations, and seamless booking experiences, transforming customer interactions across Saudi hotels and resorts.

● Predictive analytics driven by AI optimize revenue management and dynamic pricing strategies, enabling hospitality operators to maximize occupancy rates and profitability while responding to real-time market demand fluctuations.

● Machine learning algorithms analyze guest preferences and behavioral patterns to deliver hyper-personalized experiences, from customized room settings to tailored dining recommendations, elevating satisfaction levels across luxury and mid-scale properties.

● Smart hotel technologies utilizing AI and IoT enable automated energy management, keyless entry systems, and intelligent climate control, reducing operational costs while providing modern, frictionless experiences that appeal to tech-savvy international travelers.

● AI-driven workforce management systems streamline staff scheduling, training programs, and performance monitoring across large hotel chains, supporting Saudi Arabia's ambitious goals to develop local hospitality talent and improve service quality throughout the Kingdom.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-hospitality-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Hospitality Industry

Saudi Arabia's Vision 2030 is fundamentally revolutionizing the hospitality industry by positioning tourism as a cornerstone of economic diversification and reducing the Kingdom's reliance on oil revenues. The ambitious initiative drives unprecedented investments in world-class hotels, luxury resorts, and integrated tourism destinations that showcase Saudi culture while meeting international standards of excellence. Mega-projects including NEOM, The Red Sea, Qiddiya, and Diriyah create massive demand for hospitality infrastructure, attracting global hotel brands and establishing Saudi Arabia as an emerging luxury travel destination. Regulatory reforms including tourist e-visas for over sixty countries and streamlined licensing procedures through programs like the Tourism Investment Enabler Program dramatically reduce barriers to market entry for international hospitality operators. The Public Investment Fund provides substantial financing and co-investment opportunities through initiatives like the Tourism Development Fund, de-risking hotel development projects and encouraging private sector participation. Government-backed training programs and Saudization initiatives develop local hospitality talent, ensuring the sector creates meaningful employment for Saudi nationals while building sustainable service excellence. Vision 2030 targets attracting one hundred fifty million annual visitors and increasing tourism's GDP contribution to ten percent by 2030, establishing clear metrics that guide infrastructure planning and hospitality capacity expansion. Ultimately, Vision 2030 transforms Saudi Arabia's hospitality landscape from primarily religious tourism focused on Makkah and Madinah to a diversified ecosystem encompassing luxury leisure, wellness tourism, cultural heritage experiences, and major international events, positioning the Kingdom as a premier global tourism destination.

Saudi Arabia Hospitality Market Trends & Drivers:

Saudi Arabia's hospitality market is experiencing extraordinary growth driven by massive government investments under Vision 2030 and the rapid development of tourism infrastructure across the Kingdom. The sector benefits from mega-projects including NEOM, The Red Sea Project, Qiddiya, and Diriyah that collectively represent hundreds of billions of dollars in investment, creating unprecedented demand for hotels, resorts, and serviced apartments. The Red Sea Project alone plans to deliver fifty resorts by 2030, while Amaala targets thirty resorts focused on wellness and luxury tourism, demonstrating the scale of hospitality expansion underway. The Public Investment Fund actively finances these developments through strategic investments and partnerships with global hospitality brands, ensuring projects maintain world-class standards while supporting local economic development. International hotel chains including Marriott, Hilton, IHG, Accor, and Hyatt have announced aggressive expansion plans, with some brands planning to triple their room inventory in Saudi Arabia by 2030, reflecting strong confidence in long-term market fundamentals. The government's commitment to hosting major international events including Expo 2030 in Riyadh, the Asian Games 2029, and FIFA World Cup 2034 creates sustained demand drivers that extend beyond traditional tourism cycles, ensuring robust occupancy rates and revenue growth for hospitality operators across multiple segments.

Religious tourism continues to represent the hospitality market's foundation, with Makkah and Madinah experiencing consistently high demand from millions of annual pilgrims performing Hajj and Umrah. The Ministry of Tourism reports Saudi Arabia welcomed approximately thirty-five million Umrah pilgrims in 2024, marking significant year-over-year growth and demonstrating sustained demand for accommodations serving religious travelers. The government plans to add over two hundred thousand hotel rooms across the Holy Cities by 2030 to accommodate projected increases in religious tourism, with ambitious targets of hosting fifty million religious visitors annually. Major infrastructure developments including the expansion of the Prophet's Mosque in Madinah and ongoing improvements to pilgrimage facilities create opportunities for luxury and mid-scale hotel operators to serve higher-spending religious tourists seeking premium accommodations and services. Simultaneously, leisure and business tourism segments are experiencing rapid expansion as Saudi Arabia diversifies its tourism appeal beyond religious travel. The introduction of tourist e-visas for citizens of sixty-six countries removes historical barriers to leisure tourism, while marketing campaigns under the Visit Saudi brand promote the Kingdom's natural beauty, cultural heritage sites, and modern entertainment offerings. Cultural destinations including AlUla's ancient Nabatean ruins, Diriyah's historical significance as the birthplace of the Saudi state, and heritage areas throughout the Kingdom attract culturally curious international travelers seeking authentic Arabian experiences. Business tourism benefits from Riyadh's emergence as a regional financial and corporate hub, with major companies establishing Middle East headquarters in the capital and driving demand for business hotels, conference facilities, and serviced apartments catering to corporate travelers and expatriate professionals.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=16899&flag=E

Saudi Arabia Hospitality Market Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

● Chain Hotels

● Independent Hotels

Segment Insights:

● Service Apartments

● Budget and Economy Hotels

● Mid and Upper Mid-scale Hotels

● Luxury Hotels

Breakup by Region:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Recent News and Developments in Saudi Arabia Hospitality Market

● August 2025: The Hospitality Network announced its strategic expansion into Saudi Arabia by establishing a dedicated Riyadh hub designed to facilitate networking, knowledge sharing, and partnership development among hospitality industry stakeholders, supporting the Kingdom's rapidly evolving tourism sector through enhanced collaboration between hotel operators, real estate developers, and technology providers.

● November 2025: IHG Hotels & Resorts celebrated fifty years of operations in Saudi Arabia and announced surpassing one hundred hotels open and in the pipeline across the Kingdom, demonstrating the company's long-term commitment to the market while establishing a dedicated Riyadh office to support growth, enhance operational excellence, and deepen engagement with local partners and government stakeholders.

● December 2025: Red Sea Global officially opened the InterContinental Resort on Shura Island, marking a significant milestone in the development of the Red Sea destination as one of the world's most ambitious regenerative tourism projects, with the eco-friendly luxury resort setting new benchmarks for sustainable hospitality while demonstrating progress toward the destination's goal of delivering sixteen resorts in its first phase.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Hospitality Market Size To Exceed USD 115.8 Billion By 2034 | CAGR of 9.03% here

News-ID: 4359456 • Views: …

More Releases from IMARC Group

India Fasteners Market to Reach USD 17.0 Billion by 2034, Growing at 4.67% CAGR …

Source: IMARC Group | Category: Chemical & Materials | Author Name: Gaurav

Report Introduction

According to IMARC Group's latest report titled "India Fasteners Market Size, Share, Trends and Forecast by Product, Sales Channel, End Use, and Region, 2026-2034", this study offers a granular analysis of the industry's steady growth driven by the expansion of the automotive and infrastructure sectors. The study offers a profound analysis of the industry, encompassing market share, size,…

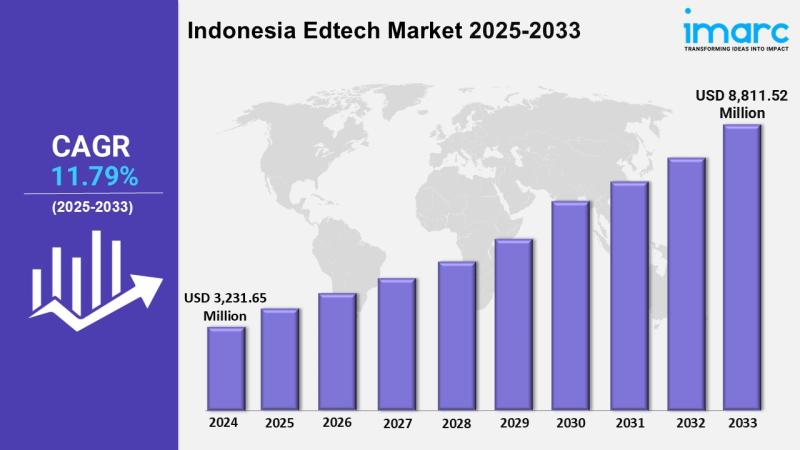

Indonesia Edtech Market to Reach USD 8,811.52 Million by 2033 | 11.79% CAGR | Ge …

According to IMARC Group's report titled "Indonesia Edtech Market Size, Share, Trends and Forecast by Sector, Type, Deployment Mode, End User, and Region, 2025-2033" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Indonesia Edtech Market Overview

The Indonesia Edtech market size reached USD 3,231.65 Million in 2024 and is projected to reach USD 8,811.52 Million by 2033, exhibiting a compound annual growth rate…

Aniline Hydrochloride Production Cost Analysis Report: Raw Materials, Process Ec …

Aniline hydrochloride is an important chemical intermediate produced by the reaction of aniline with hydrochloric acid. It is widely used in pharmaceuticals, dyes and pigments, rubber processing chemicals, agrochemicals, and specialty chemical synthesis. Due to its role as a precursor in multiple value-added chemical products, aniline hydrochloride holds significant importance in the fine chemicals and specialty chemicals industry.

With increasing demand from pharmaceutical manufacturing, textile dyes, and rubber additives, the global…

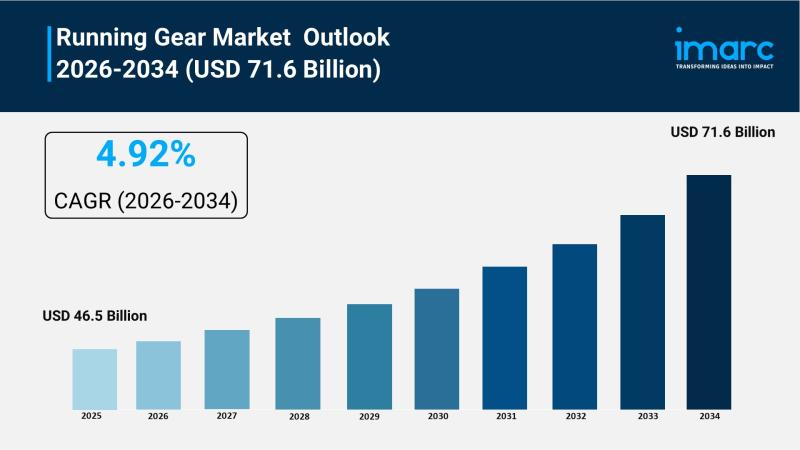

Running Gear Market Size Worth USD 71.6 Billion, Globally, by 2034 at a CAGR of …

Market Overview:

According to IMARC Group's latest research publication, "Running Gear Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The global running gear market size was valued at USD 46.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 71.6 Billion by 2034, exhibiting a CAGR of 4.92% from 2026-2034.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…