Press release

The Financial Analytics Market is projected to reach a market size of USD 20.73 billion by the end of 2030.

According to the report published by Virtue Market Research The Financial Analytics Market was valued at USD 11.42 billion and is projected to reach a market size of USD 20.73 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 12.66%.Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/financial-analytics-market/request-sample

The Financial Analytics Market has grown into a quiet backbone of modern decision-making, shaping how organizations understand money, risk, and future choices. At its core, financial analytics turns large volumes of raw financial data into clear patterns that guide actions. Over the long term, the strongest driver of this market has been the steady digitalization of financial systems across industries. As companies moved from paper-based records to digital platforms, they began generating massive amounts of transactional data every day. This data, once ignored or stored away, became too valuable to waste.

Organizations realized that analyzing cash flows, spending behavior, credit risks, and investment performance could reduce losses and improve planning. This long-term shift created constant demand for tools that can clean data, spot trends, and predict outcomes. When COVID-19 struck, this need became sharper. The pandemic caused sudden drops in revenue, broken supply chains, and unpredictable customer behavior. Financial analytics helped firms simulate worst-case scenarios, manage liquidity, and reassess budgets in real time. While some investments were delayed, the crisis ultimately proved that relying on instinct alone was risky, pushing many organizations to adopt analytics faster than planned.

In the short term, one important driver has been the growing pressure for faster financial decisions. Markets now move at a pace where delays of days, or even hours, can cause missed opportunities or heavy losses. Businesses want instant insights into profit margins, cost leaks, and market movements. Financial analytics platforms answer this need by offering dashboards and automated reports that update almost instantly. This speed is especially important for banks, fintech firms, and large enterprises handling thousands of transactions every second.

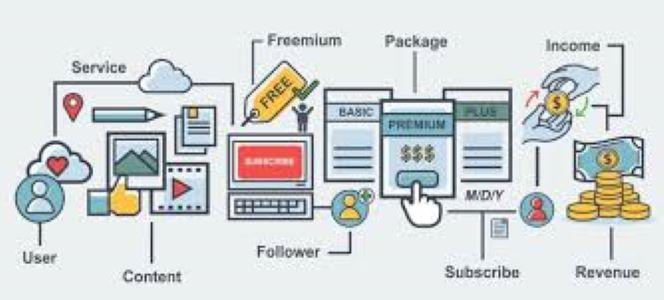

Alongside this driver, a clear opportunity is emerging in serving small and mid-sized businesses. For many years, advanced financial analytics tools were built mainly for large corporations with big budgets and expert teams. Today, cloud-based delivery models and subscription pricing are lowering entry barriers. Smaller firms can now access forecasting, fraud detection, and budgeting tools without heavy upfront costs. This opens a wide market where vendors can design simpler, more intuitive solutions tailored to non-expert users who still want reliable insights.

A strong trend shaping the industry is the increasing use of artificial intelligence and machine learning within financial analytics solutions. These technologies go beyond basic calculations and historical comparisons. They learn from past patterns and improve predictions over time. For example, systems can flag unusual transactions that may signal fraud, or suggest budget adjustments based on changing sales trends. What makes this trend important is not just accuracy, but adaptability. As markets shift due to inflation, interest rate changes, or global events, AI-driven tools can adjust models quickly without manual reprogramming. This trend also supports automation, reducing the need for repetitive human tasks and allowing finance teams to focus on strategy rather than data preparation.

The market is also influenced by growing regulatory complexity. Governments and financial authorities continue to introduce new rules around reporting, transparency, and risk management. Financial analytics tools help organizations stay compliant by tracking required metrics and generating audit-ready reports. This adds another layer of value beyond profit-focused analysis. Companies increasingly see analytics not as optional software, but as essential infrastructure that supports trust and stability.

Looking ahead, the Financial Analytics Market is expected to remain resilient. Economic uncertainty, rather than slowing adoption, often increases the need for deeper insight. Organizations want clearer visibility into where money is earned, lost, or at risk. As data volumes grow and decision windows shrink, analytics becomes less about advantage and more about survival. The market's future will likely be shaped by simplicity, speed, and intelligence working together. Tools that can explain complex financial realities in plain terms will gain wider acceptance across industries. In this way, financial analytics continues its shift from a specialized function to a daily companion in business decision-making.

Segmentation Analysis:

By Component: Software, Services

The Financial Analytics Market by component shows a clear split between tools and support. Software stands as the largest part of this segment because organizations rely on platforms that can process numbers, detect patterns, and display results in simple screens.

These tools sit at the center of daily financial work, quietly running calculations that guide spending and planning. Services, however, are the fastest growing during the forecast period. Many users struggle to connect new analytics tools with older systems or lack trained staff to interpret results. This gap increases demand for consulting, integration, and managed services. Companies often seek outside help to set rules, adjust models, and train teams. Software delivers the engine, while services help steer it. As financial systems grow more complex, the balance slowly shifts toward expert support, even though software remains the foundation holding this segment together.

By Application: Risk Management, Fraud Detection and Prevention, Budgeting and Forecasting, Regulatory Compliance

When viewed by application, risk management emerges as the largest area within the Financial Analytics Market. Organizations focus heavily on understanding credit exposure, market swings, and operational threats before damage appears. These tools help leaders see weak spots early, even when warning signs feel scattered. Fraud detection and prevention is the fastest growing during the forecast period. Rising digital payments and online transactions create new hiding places for fraudsters, pushing companies to adopt smarter detection systems. Budgeting and forecasting maintain steady demand as planners seek clearer views of income and costs, while regulatory compliance tools quietly support reporting duties. Each application plays a role, but the sharp rise in digital crime shifts attention toward fraud-focused analytics, making growth in that area noticeably quicker than others.

By Deployment Mode: On-Premises, Cloud-Based

Deployment choices shape how financial analytics tools are used. On-premises systems remain the largest in this segment, especially among institutions that prefer tight control over sensitive financial data. These setups offer a sense of stability and familiarity, which appeals to organizations with strict internal rules. Cloud-based deployment, however, is the fastest growing during the forecast period. Cloud platforms allow faster setup, easier updates, and flexible access from different locations. Smaller teams benefit from not managing hardware, while larger firms enjoy scalable capacity during busy periods. The cloud model also supports quicker experimentation with new features. While on-premises solutions hold the lead today, cloud-based options steadily gain ground as comfort with remote data handling improves.

By End-User Industry: Banking, Financial Services, and Insurance (BFSI), Retail and E-commerce, Healthcare

Among end-user industries, BFSI holds the largest share of the Financial Analytics Market. Banks and insurers deal with complex products, strict rules, and constant risk checks, making analytics essential to daily operations. Retail and e-commerce represent the fastest growing industry during the forecast period. Rapid online sales, changing customer habits, and thin margins push retailers to analyze pricing, demand, and payment behavior more deeply. Healthcare adopts analytics more slowly, focusing on cost tracking and billing accuracy. Each industry uses analytics differently, but the speed of digital trade fuels faster growth in retail and e-commerce, even as BFSI continues to dominate overall usage.

Read More @https://virtuemarketresearch.com/report/financial-analytics-market

Regional Analysis:

Regional patterns show varied adoption levels across the Financial Analytics Market. North America is the largest region in this segment, supported by advanced financial systems and early use of data-driven tools. Europe follows with steady demand shaped by regulatory needs and cross-border finance. Asia-Pacific is the fastest growing during the forecast period, driven by expanding digital economies, rising fintech activity, and growing data volumes. South America shows gradual adoption as financial infrastructure develops, while the Middle East & Africa progress through targeted investments in banking and public finance. Different speeds and priorities define each region, creating a global landscape where growth and scale do not always move together.

Latest Industry Developments:

• Expanding and Deepening Technology Offerings: Companies in the financial analytics market increasingly invest in integrating advanced technologies such as artificial intelligence, machine learning, and cloud-native architectures into their analytics platforms. This trend reflects a shift toward automated, real-time data insights that can handle large volumes of financial information with greater speed and precision. By enhancing technological capabilities, providers aim to attract a broader range of clients seeking smarter tools for risk assessment, forecasting, and compliance, differentiating their offerings from more traditional analytics packages. This technological expansion is reshaping competitive dynamics across the market.

• Forming Strategic Partnerships and Ecosystem Alliances: A notable trend sees firms building collaborative relationships with cloud providers, data platforms, and fintech innovators to widen their reach and enrich service portfolios. These alliances often allow analytics providers to embed their offerings into larger enterprise ecosystems, increasing customer access and adoption. Strategic tie-ups also help in co-developing solutions tailored to specific market needs, such as AI-integrated analytics or industry-specific data models. This collaborative approach enhances visibility and relevance across diverse customer segments.

• Targeting Specialized Markets and Use Cases: Another trend is the deliberate expansion into niche applications and emerging sectors where financial analytics can unlock new value. This includes enhanced support for fraud detection in digital transactions, tailored analytics for regulatory reporting, or industry-specific financial planning tools. By focusing on particular vertical needs or underserved segments, companies broaden their addressable market and build unique value propositions that capture customer interest and loyalty beyond generic analytics solutions.

customize the Full Report Based on Your Requirements @https://virtuemarketresearch.com/report/financial-analytics-market/customization

CONTACT US :

Virtue Market Research

Kumar Plaza, #103, SRPF Rd, Ramtekadi, Pune, Maharashtra 411013, India

E-mail: megha@virtuemarketresearch.com

Phone: +1-917 436 1025

ABOUT US :

"Virtue Market Research stands at the forefront of strategic analysis, empowering businesses to navigate complex market landscapes with precision and confidence. Specializing in both syndicated and bespoke consulting services, we offer in-depth insights into the ever-evolving interplay between global demand and supply dynamics. Leveraging our expertise, businesses can identify emerging opportunities, discern critical trends, and make decisions that pave the way for future success."

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The Financial Analytics Market is projected to reach a market size of USD 20.73 billion by the end of 2030. here

News-ID: 4359163 • Views: …

More Releases from Virtue Market Research

The Global Vodka Seltzer Market is projected to reach a market size of USD 16.22 …

The Vodka Seltzer Market was valued at USD 9.4 billion in 2024 and is projected to reach a market size of USD 16.21 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.1%.

Request Sample @ https://virtuemarketresearch.com/report/vodka-seltzer-market/request-sample

The vodka seltzer market has grown from a niche beverage choice into a mainstream favorite, supported by shifting consumer lifestyles and evolving…

The Global Telehealth Services Market and is projected to reach a market size of …

The Global Telehealth Services Market was valued at USD 126.1 billion and is projected to reach a market size of USD 302.49 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 15.7%.

Request Sample @ https://virtuemarketresearch.com/report/telehealth-services-market/request-sample

The perennial shift towards patient-centric healthcare has been a pivotal long-term market driver for telehealth services. Over the years, the industry has witnessed…

The Subscription Box/Subscription E-Commerce Market is projected to reach a mark …

The Subscription Box/Subscription E-Commerce Market is valued at USD 47.19 billion in 2024 and is projected to reach a market size of USD 97.73 billion by the end of 2030. Over the outlook period of 2025-2030, the market is anticipated to grow at a CAGR of 12.9%.

Request Sample @ https://virtuemarketresearch.com/report/subscription-e-commerce-market/request-sample

The subscription e-commerce market has grown into one of the most dynamic parts of the digital economy. It began as a…

The Global Aramid Fibre Reinforced Polymer Composites Market is projected to rea …

According to the report published by Virtue Market Research in Aramid Fibre Reinforced Polymer Composites Market was valued at USD 5.55 billion and is projected to reach a market size of USD 8.57 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.5%.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/aramid-fibre-reinforced-polymer-composites-market/request-sample

The Aramid Fibre Reinforced Polymer Composites…

More Releases for Financial

Financial Leasing Services Market Share, Size, Financial Summaries Analysis from …

Infinity Business Insights has recently released a comprehensive research report titled "Financial Leasing Services Market Insights, Extending to 2031." This publication spans over 110+ pages and offers an engaging presentation with visually appealing tables and charts that are self-explanatory. The worldwide Financial Leasing Services market is expected to grow at a booming CAGR of 6.3% during 2024-2031. It also shows the importance of the Financial Leasing Services market main players…

Global Financial Aid Management Software Market Streamlining Financial Assistanc …

Overview for the report "Financial Aid Management Software Market" Helps in providing scope and definations, Key Findings, Growth Drivers, and Various Dynamics by Infinitybusinessinsights.com. This report will help the viewer in Better Decision Making.

At a predicted CAGR of 10.9% from 2023 to 2028, The Market for Financial Assistance Management Software will increase from USD 1.07 billion in 2022 to USD X.XX billion by 2030. The market's expansion can be attributed…

What will be Driving Growth Financial Leasing Market 2027 | Bank Financial Leasi …

Financial Leasing Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report analysis.

Ask for…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Is Booming | KLC Financial, SMFL Leasing, GM Financial, …

HTF MI recently introduced Global Financial Leasing Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Sumitomo Mitsui Finance and Leasing, Maldives, HNA Capital, KUKE S.A., KLC…

Financial Analytics Market: Banking & financial sector expected to make most of …

The Financial Analytics Market deals with the development, manufacture and distribution of financial analytics tools for enterprises of all kinds and sizes. Financial data analytics can be described as a set of tools, techniques and processes used to find out answers for various business questions as well as to forecast future scenarios regarding finance and the economy.

The services provided by the Financial Analytics Market are used for analyzing the equity…