Press release

B2B2C Insurance Market Insights on Large Enterprise and Small Medium Enterprise Adoption

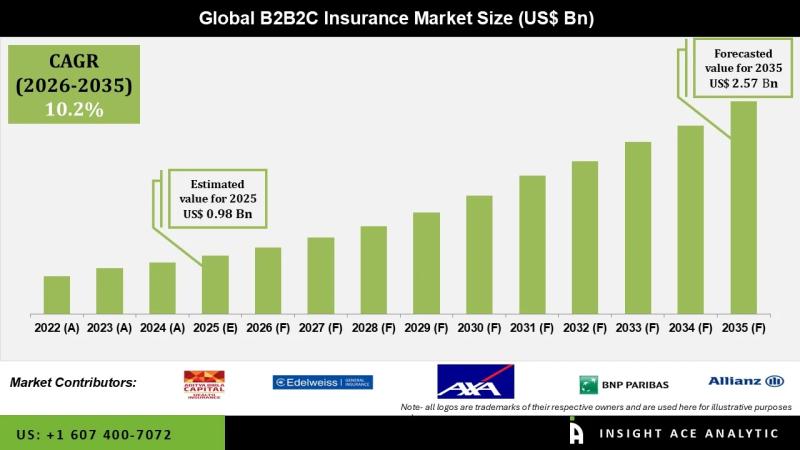

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size (Large Enterprise, Small & medium Enterprise), By Nature of business (Brick & Mortar, E-Commerce, Multi-channel, Non-Commercial, Service Company), By End Use Industry (Banks & Financial Institution, Automotives, Utilities, Retailers, Travel, Housing, Others (Lifestyle, Telecom, etc.)), By Distributional Channel (Online, Offline), By Application (Individual, Corporation)), Trends, Industry Competition Analysis, Revenue and Forecast To 2035."B2B2C Insurance Market Size is valued at USD 0.98 Bn in 2025 and is predicted to reach USD 2.57 Bn by the year 2035 at a 10.2% CAGR during the forecast period for 2026 to 2035.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/2162

The 2B2C (business-to-business-to-consumer) insurance model facilitates collaboration between insurance providers and intermediaries, such as retailers, to deliver insurance products directly to end consumers. This distribution framework typically leverages multiple channels, including insurance agents, telecommunications firms, private banks, retail outlets, and digital platforms. The global 2B2C insurance market is expected to experience substantial growth, driven by increasing consumer awareness of insurance products and the expansion of insurance providers.

Intensifying competition among key market participants is anticipated to further accelerate development, while stringent regulatory frameworks across regions provide additional support for market expansion. Moreover, ongoing digital transformation and the growing influence of social media platforms are likely to reinforce market growth.

Technological innovations, including artificial intelligence (AI), telematics, and chatbot integration, are shaping the market by enabling more efficient and personalized insurance solutions. The rising adoption of digital insurance-related devices is also expected to contribute to market growth in the coming years. This model allows businesses to offer tailored insurance products that address the specific needs of their customers, thereby enhancing customer satisfaction and promoting long-term loyalty.

List of Prominent Players in the B2B2C Insurance Market:

• Aditya Birla General Insurance

• Edelweiss General Insurance Company Limited

• AXA SA

• BNP Paribas SA.

• Allianz S

• Assicurazioni Generali S.p.A.

• Berkshire Hathaway Inc

• ICICI Lombard

• UnitedHealth Group Inc

• Tata-AIG General Insurance Co. Ltd.

• Aviva plc

• Berkshire Hathaway Inc.

• China Life Insurance Group

• Japan Post Holdings Co., Ltd.

• Munich Re Group

• Prudential plc

• UnitedHealth Group Inc.

• Others.

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-02

Market Dynamics

Drivers:

The ongoing digital transformation within the insurance sector is a key growth driver for B2B2C models, enabling insurers and commercial partners to utilize digital platforms for more efficient product distribution and enhanced customer engagement. Rising consumer demand for personalized insurance solutions is fostering collaboration between businesses and insurers to develop tailored offerings, thereby improving customer satisfaction and loyalty.

Technological advancements-including artificial intelligence (AI), telematics, and chatbot integration-have further accelerated global market growth. Additionally, the increasing adoption of insurance-related digital devices is expected to contribute significantly to future expansion. This model empowers businesses to deliver customized insurance products that align with specific consumer needs, enhancing relevance and promoting higher retention rates.

Challenges:

The involvement of multiple stakeholders-including insurers, commercial partners, and consumers-within B2B2C frameworks can introduce operational complexities and challenges in aligning objectives. Economic volatility and market fluctuations may influence insurance demand and profitability, necessitating adaptability to changing economic conditions and evolving consumer preferences.

Furthermore, integrating emerging technologies into existing B2B2C infrastructures presents significant challenges, particularly in reconciling legacy systems with modern digital platforms. These integration efforts can be resource-intensive, costly, and time-consuming, potentially limiting market growth.

Regional Trends:

The Asia-Pacific region is projected to capture a substantial share of the B2B2C insurance market, driven by growing awareness and adoption of this distribution model. North America is expected to maintain a strong market presence, supported by expanding urban populations and rising per capita incomes, particularly in developed economies. In countries such as the United States and Canada, increasing demand for secure, accessible, and reliable insurance solutions is further reinforcing the adoption and development of the B2B2C insurance framework.

Recent Developments

• In July 2023, Aviva agreed with Barclays UK to acquire its home insurance portfolio, which includes a consumer base of 350,000 individuals. This acquisition facilitated the insurer's aspirations to expand its retail insurance division, ensured that customers continued to receive exceptional service, and preserved Aviva's dominant position in the home insurance sector.

• In Dec 2020, ICICI Lombard has launched a digital platform for small and medium companies (SMEs) to purchase business insurance. The SME owners found the new site convenient for purchasing or renewing insurance products, endorsing policies, and registering claims. The corporation revealed that the business owners chose several insurance choices, including marine insurance and workmen's compensation.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/2162

Segmentation of B2B2C Insurance Market-

By Product-

• Life

• Non-life

o Health Insurance

o Home Insurance

o Vehicle Insurance

o Personal Insurance

o Accident Insurance

o Others (Transport, Credit Insurance, etc.)

By Geographical scope

• National

• Multi-Country

• Regional

• Global

By Company size

• Large Enterprise

• Small & medium Enterprise

By Nature of business

• Brick & Mortar

• E-Commerce

• Multi channel

• Non-Commercial

• Service Company

By End Use Industry

• Banks & Financial Institution

• Automotives

• Utilities

• Retailers

• Travel

• Housing

• Others (Lifestyle, Telecom, etc.)

By Distributional Channel

• Online

• Offline

By Application

• Individual

• Corporation

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• Southeast Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

Read Overview Report- https://www.insightaceanalytic.com/report/b2b2c-insurance-market/2162

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: https://www.insightaceanalytic.com/

Tel : +1 607 400-7072

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release B2B2C Insurance Market Insights on Large Enterprise and Small Medium Enterprise Adoption here

News-ID: 4359019 • Views: …

More Releases from insightace

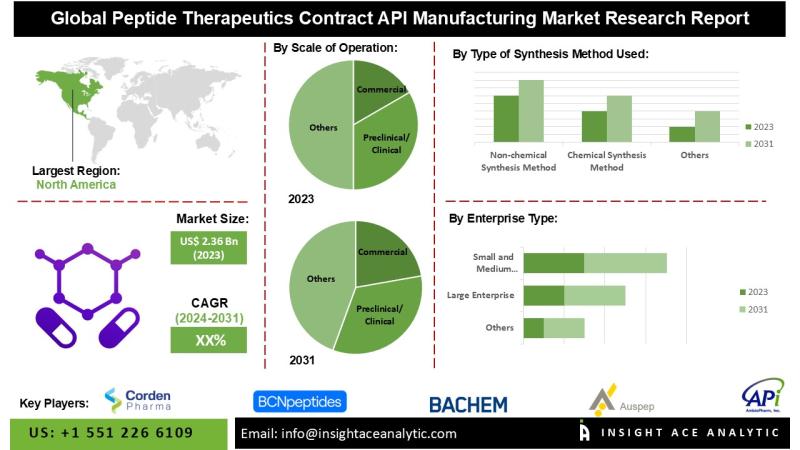

Peptide Therapeutics Contract API Manufacturing Market Know the Scope and Trends

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the " Peptide Therapeutics Contract API Manufacturing Market - (By Scale of Operation (Preclinical/Clinical and Commercial), Type of Synthesis Method Used (Non-Chemical Synthesis Method and Chemical Synthesis Method), And Enterprise Type (Large Enterprises and Small and Medium Enterprises), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."

Global Peptide Therapeutics Contract API Manufacturing Market is valued at US$…

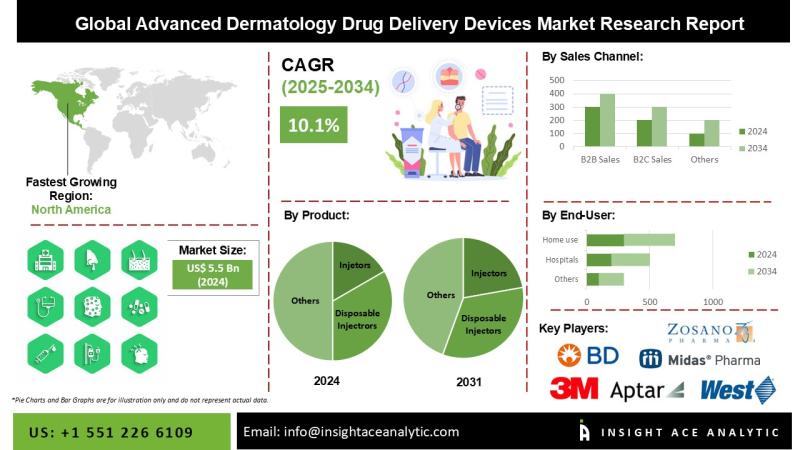

Advanced Dermatology Drug Delivery Devices Market Deep Research Report with Fore …

Insightace Analytics Pvt. Ltd. announces the release of a market assessment report on the "Global Advanced Dermatology Drug Delivery Devices Market- by Product (Injectors, Disposable Injectors, Reusable Injectors, Wearable Injectors, Patches, Microneedle Patches, Solid Removable Microneedles, Coated Microneedles, Dissolving Microneedles, Hollow Microneedles, Hydrogel Forming Microneedles, Needle-Less Patches, Dermal Pumps, Airless Dispensers and Bottles, Valves and Other Devices), Sales Channel (B2B Sales Channel and B2C Sales Channel), End-User (Hospitals, Dermatology Practices…

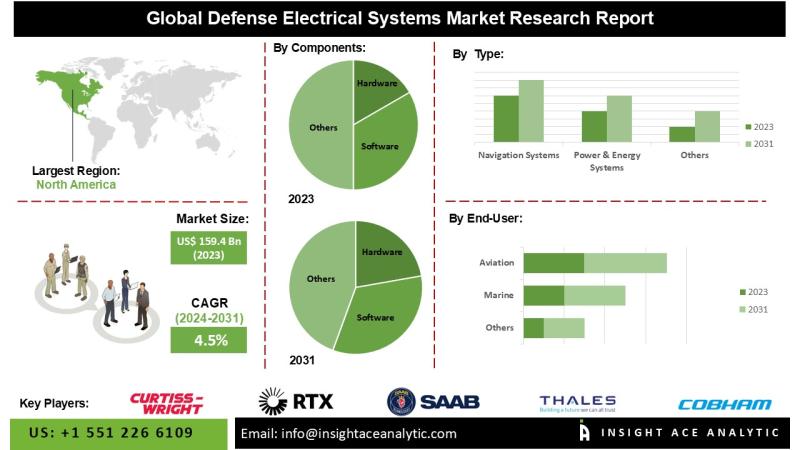

Defence Electrical Systems Market Report on the Untapped Growth Opportunities in …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Defence Electrical Systems Market - (By Component (Hardware, Software, Services), By Type (Navigation Systems, Power & Energy Systems, Communication & Display Systems, C4ISR (Command, Control, Communication, Intelligence, Surveillance, Reconnaissance system), Electronic Warfare (Others (Cyber Security, Radar, Optronics, Etc.)), By End-User (Aviation, Marine, Land, Space)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."

According to the…

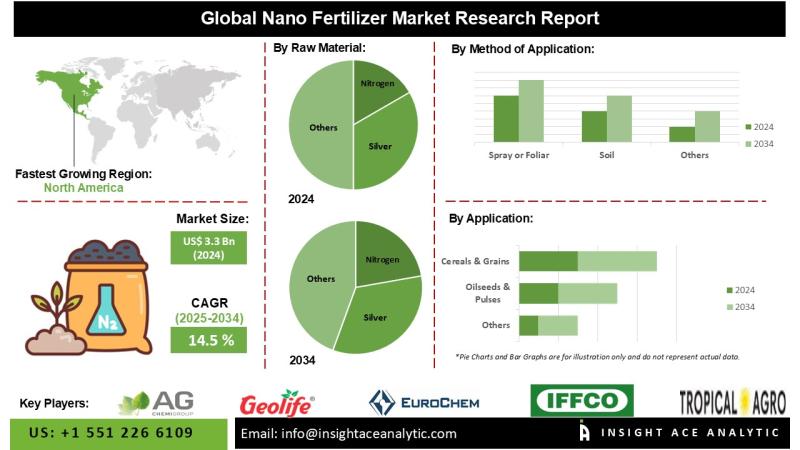

Nano Fertilizer Market Current Scenario with Future Trends Analysis to 2034

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Nano Fertilizer Market Size, Share & Trends Analysis Report By Raw Materials (Nitrogen, Silver, Carbon, Zinc), Methods Of Applications (Spray Or Foliar And Soil) And Application (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables And Others)- Market Outlook And Industry Analysis 2034"

The global nano fertilizer market is estimated to reach over USD 12.6 billion…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…