Press release

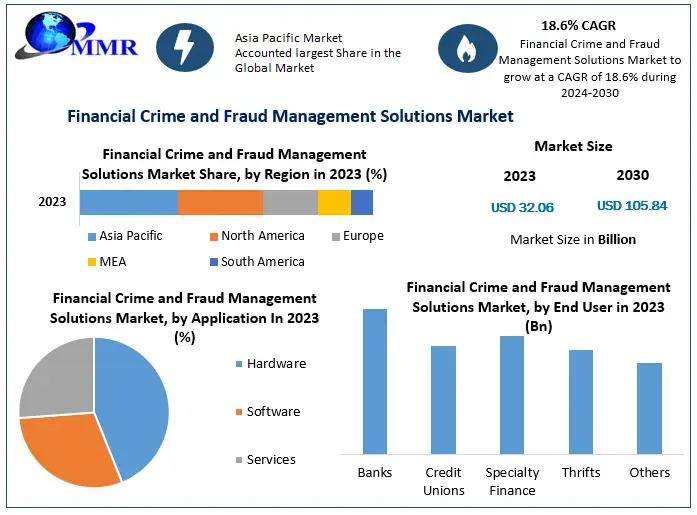

Financial Crime and Fraud Management Solutions Market to Reach USD 105.84 Billion by 2030, Growing at 18.6% CAGR

The Financial Crime and Fraud Management Solutions Market is witnessing unprecedented expansion as organizations worldwide strengthen defenses against escalating financial crimes. Valued at USD 32.06 billion in 2023, the market is projected to surge to US$ 105.84 billion by 2030, registering a robust CAGR of 18.6% during the forecast period (2024-2030).The growth is driven by the rapid adoption of digital banking, cashless transactions, real-time payments, and AI-powered fraud detection technologies, making fraud prevention a top strategic priority for financial institutions and enterprises.

Want to know what's really driving fraud losses in global finance? Get the sample report: https://www.maximizemarketresearch.com/request-sample/33426/

Financial Crime and Fraud Management Solutions Market - Key Highlights

Market value projected to reach US$ 105.84 Bn by 2030

Strong 18.6% CAGR (2024-2030)

Software solutions dominate adoption

Banks remain the leading end-user segment

Asia Pacific emerges as the fastest-growing region

AI-driven fraud detection reshaping market dynamics

Financial Crime Is a Trillion-Dollar Global Challenge

According to industry analysis, financial institutions globally spent nearly US$ 1.28 trillion in a single year to combat financial crime, while estimated revenue losses exceeded US$ 1.45 trillion. Financial crimes such as fraud, identity theft, money laundering, tax evasion, counterfeiting, and embezzlement continue to evolve alongside technological innovation.

High-profile incidents-such as the Westpac financial crime case in Australia-demonstrate how regulatory violations and fraud exposure can severely impact corporate reputation, customer trust, and long-term profitability.

Technology Emerges as the Primary Catalyst for Market Growth

Modern financial crime prevention relies heavily on advanced technologies, including:

Artificial Intelligence (AI) & Machine Learning (ML)

Behavioral analytics

Real-time transaction monitoring

Advanced biometrics

Cloud-based fraud detection platforms

Continuous monitoring through intelligent software solutions has become the most effective method for detecting and preventing increasingly complex financial crimes.

Market Drivers and Growth Factors

Key factors accelerating the Financial Crime and Fraud Management Solutions Market include:

Rapid growth in digital banking and fintech platforms

Rising cyber fraud and identity theft cases

Increased regulatory compliance requirements

Expansion of cross-border transactions

Growing demand for real-time fraud detection

Increasing focus on consumer trust and data security

Large enterprises report losses ranging between 60% and 70% due to fraud-related activities, making advanced fraud management solutions indispensable across industries.

Discover the hidden trends shaping the future of financial crime prevention. Access the sample: https://www.maximizemarketresearch.com/request-sample/33426/

Software Segment to Dominate Market Demand

The software segment is expected to account for 45%-50% of total demand during the forecast period.

Strong adoption across banks, government institutions, private enterprises, and financial service providers.

Service sectors, including BPO, KPO, and outsourcing firms, are investing heavily in fraud detection and risk mitigation platforms.

Surveys indicate over 66.36% of end-users feel significantly more protected when using advanced fraud detection technologies.

End-User Insights: Banks Lead Adoption

Based on end-user analysis, the market is segmented into:

Banks

Credit Unions

Specialty Finance

Thrifts

Others

The banking and corporate sector is expected to command the largest market share, driven by regulatory mandates and the need to minimize reputational and financial risk.

Key Players in the Financial Crime and Fraud Management Solutions Market

Major companies profiled include:

IBM Corporation

Capgemini SE

Oracle Corporation

Fiserv, Inc.

SAS Institute, Inc.

ACI Worldwide

Fidelity National Information Services (FIS)

Experian PLC

NICE Ltd.

FICO

SAP SE

DXC Technology

Cloudera

Temenos

Guardian Analytics

Securonix, Inc.

SIMILITY

Software AG

These players are actively investing in AI, cloud security, strategic partnerships, and global expansion to strengthen market positioning.

Regional Analysis: Asia Pacific Leads Global Market

The Asia Pacific (APAC) region held the largest market share in 2023 and is expected to maintain its dominance throughout the forecast period.

Key growth contributors in APAC:

Large and rapidly digitizing population

Expansion of mobile banking and fintech ecosystems

Rising foreign direct investments (FDIs)

Government initiatives to reduce financial fraud

Other major regions analyzed include:

North America

Europe

Middle East & Africa

South America

Explore strategic insights used by industry leaders-download the sample: https://www.maximizemarketresearch.com/market-report/global-financial-crime-and-fraud-management-solutions-market/33426/

Market Challenges and Restraints

Despite strong growth prospects, the market faces challenges such as:

High initial setup and integration costs

Complexity in integrating solutions with legacy banking systems

Temporary productivity slowdowns during deployment

Skills gap in advanced analytics and fraud technologies

These factors may slightly restrain adoption, particularly among smaller financial institutions.

Frequently Asked Questions:

1. Which region has the largest share in Global market ?

Ans: Asia Pacific region held the highest share in 2023.

2. What is the growth rate of Global market ?

Ans: The Global market is growing at a CAGR of 18.6% during forecasting period 2024-2030.

3. What is scope of the Global market report?

Ans: Global market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

4. Who are the key players in Global market ?

Ans: The important key players in the Global market are - IBM Corporation, Capgemini SE, Oracle Corporation, Fiserv, Inc., SAS Institute, Inc., ACI Worldwide, Fidelity National Information Services, Inc. (FIS), Dell EMC, ACI Worldwide, Inc., Experian PLC, NICE Ltd., Polaris Consulting & Services Limited., FICO, Cloudera, SAP SE, First Data Corporation, DXC Technology Company, Software AG, SIMILITY, Securonix, Inc., Temenos Headquarters SA, Guardian Analytics.

5. What is the study period of this Market?

Ans: The Global market is studied from 2023 to 2030.

Related Reports:

NoSQL Database Market https://www.maximizemarketresearch.com/market-report/global-nosql-database-market/97851/

Security and Surveillance Equipment Market https://www.maximizemarketresearch.com/market-report/security-and-surveillance-equipment-market/100554/

Application Server Market https://www.maximizemarketresearch.com/market-report/application-server-market/104258/

Explore Our Most Performing Reports:

Warehouse Management System Market https://ictpresswire.com/warehouse-management-system-market/

Global Transportation Management System (TMS) Market https://ictpresswire.com/transportation-management-system-market/

Human Resource Management Software Market https://ictpresswire.com/human-resource-management-software-market/

Mechanical Keyboard Market https://ictpresswire.com/mechanical-keyboard-market/

MOOC market https://ictpresswire.com/massive-open-online-course-market/

Connect with us:

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Financial Crime and Fraud Management Solutions Market to Reach USD 105.84 Billion by 2030, Growing at 18.6% CAGR here

News-ID: 4358902 • Views: …

More Releases from Maximize Market Research Pvt. Ltd.

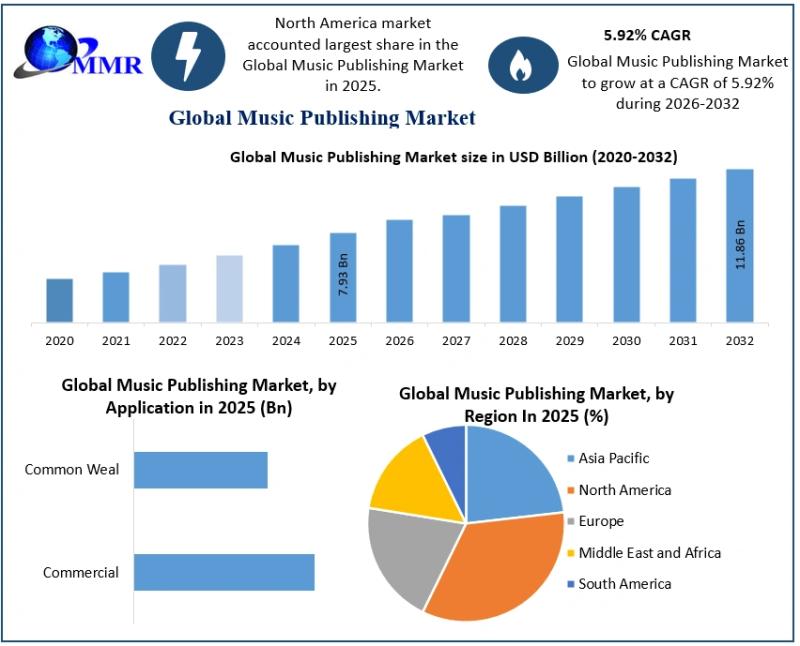

Music Publishing Market Set to Reach USD 11.86 Billion by 2032, Driven by Stream …

The Music Publishing Market is witnessing steady expansion, supported by the rapid evolution of digital platforms, streaming services, and new licensing ecosystems. According to industry analysis, the Music Publishing Market size was valued at USD 7.93 Billion in 2025 and is projected to reach USD 11.86 Billion by 2032, growing at a CAGR of 5.92% during the forecast period (2026-2032).

Market Scope & Report Coverage

Base Year: 2025

Forecast Period: 2026-2032

Market Size (2025):…

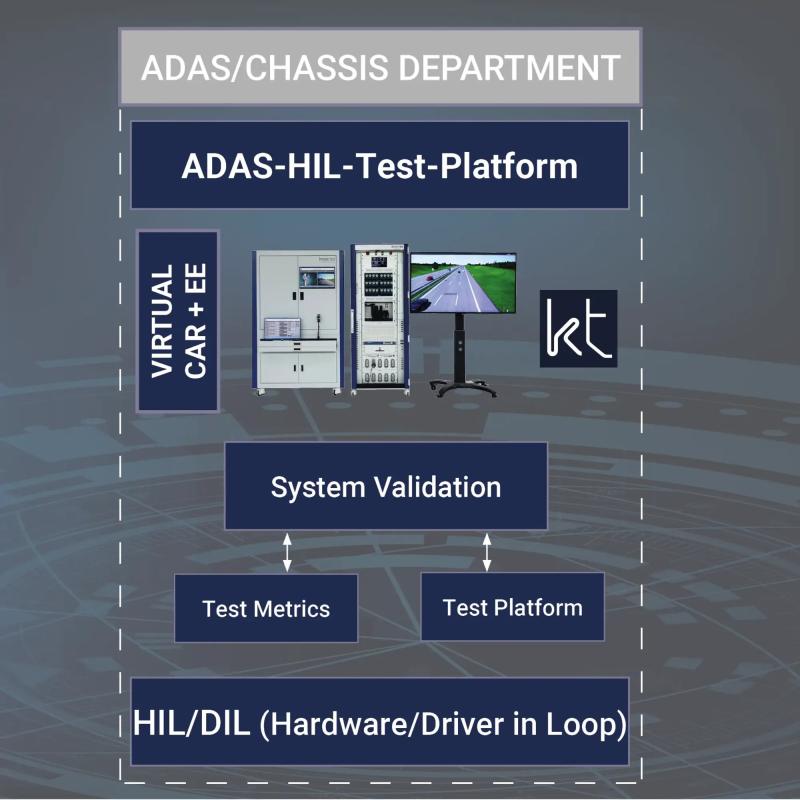

Hardware in the Loop (HIL) Market Set to Reach USD 2.07 Billion by 2032, Driven …

The Global Hardware in the Loop (HIL) Market is witnessing strong momentum as industries increasingly rely on advanced simulation and validation technologies to accelerate product development and ensure safety, reliability, and regulatory compliance. Valued at USD 1.01 billion in 2024, the market is projected to grow at a robust CAGR of 9.37% from 2025 to 2032, reaching nearly USD 2.07 billion by 2032. This growth trajectory is largely driven by…

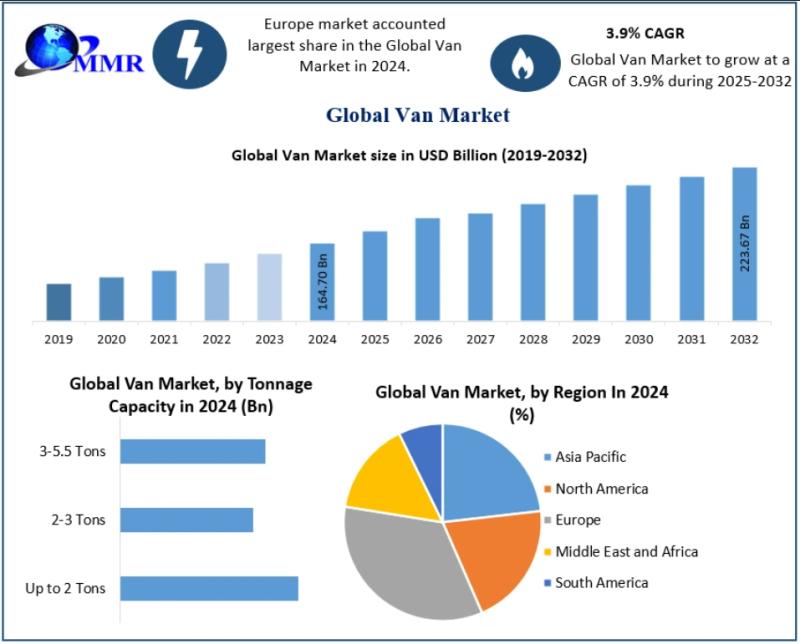

Van Market Projected to Grow from USD 164.70 Billion in 2024 to USD 223.67 Billi …

Van Market Overview

The Global Van Market was valued at USD 164.70 billion in 2024 and is projected to reach USD 223.67 billion by 2032, growing at a CAGR of 3.9% from 2025 to 2032. Vans play a crucial role in commercial logistics, passenger transport, school transportation, and last‐mile delivery services. Their flexible design, reconfigurable seating, and cargo optimization make them essential across urban and semi‐urban transport networks.

Increasing demand from e‐commerce,…

Personal Watercraft Market to Reach USD 3.36 Billion by 2032, Driven by Rising W …

The Global Personal Watercraft (PWC) Market is experiencing steady and sustainable growth as recreational boating, adventure tourism, and water sports gain widespread popularity worldwide. Valued at approximately USD 2.03 billion in 2024, the market is projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2025 to 2032, reaching nearly USD 3.36 billion by 2032. This growth trajectory reflects the increasing consumer preference for leisure-driven experiences, innovations…

More Releases for Management

Gym Management Software Market By Functions - Scheduling Appointments, Waitlist …

MarketResearchReports.Biz announces addition of new report "Gym Management Software Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2017 - 2025" to its database.

Gym management software is a software solution which allows the users to manage the different processes associated with running a gym in an efficient and effective manner. These software solutions are generally multifunctional and can manage all the diverse processes associated with managing a gym…

Water Network Management, Water Network Management trends, Water Network Managem …

MarketStudyReport.com adds a new 2018-2023 Global Water Network Management Market Report focuses on the major drivers and restraints for the global key players providing analysis of the market share, segmentation, revenue forecasts and geographic regions of the market.

This report presents a comprehensive overview, market shares, and growth opportunities of by Water Network Management product type, application, key manufacturers and key regions. Over the next five years, Water Network Management will…

Cloud Project Portfolio Management Market Report 2018: Segmentation by Applicati …

Global Cloud Project Portfolio Management market research report provides company profile for CA Technologies (New York, U.S.), HPE (California, U.S.), Changepoint Corporation (Richmond Hill, Ontario), Clarizen, Inc. (California, U.S.), Microsoft Corporation (Washington, U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and…

Prescriptive analytics Market Outlook 2025 focus On: Risk Management, Operation …

A detailed market study on "Global Prescriptive analytics Market" examines the performance of the Prescriptive analytics Market. It encloses an in-depth Research of the Prescriptive analytics Market state and the competitive landscape globally. This report analyzes the potential of Prescriptive analytics Market in the present and the future prospects from various prospective in detail.

Get Free Sample Report@ https://databridgemarketresearch.com/request-a-sample/?dbmr=global-prescriptive-analytics-market

Prescriptive analytics market accounted for USD 1.20 billion growing at a CAGR of…

Facility Management Market Solutions & Services (Real Estate & Lease Management, …

ReportsWeb.com added “Global Facility Management Market to 2025” to its vast collection of research Database. The report classifies the global Facility Management Market in a precise manner to offer detailed insights into the aspects responsible for augmenting as well as restraining market growth.

Facility Management is an essential part which handles all functions related to enterprise and helps in streaming all the operations with reducing cost. Managing life cycle management of…

Telecom Expense Management Market Analysis For Financial Management, Order Manag …

The telecom expense management (TEM) market report provides analysis for the period 2014–2024, wherein the period from 2016 to 2024 is the forecast period and 2015 is the base year. The report covers all the major trends and technologies playing a key role in telecom expense management market growth over the forecast period. It also highlights the drivers, restraints, and opportunities expected to influence the market’s growth during the said…