Press release

Ocean County Debt Negotiation Attorney Daniel Straffi Jr. Discusses Debt Relief Options in New Jersey

Ocean County debt negotiation attorney Daniel Straffi Jr. discusses how New Jersey residents can address financial hardship through debt settlement options. At Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/new-jersey-debt-negotiation-attorney/), Straffi works with clients in Toms River, Lakewood, Brick Township, and surrounding communities to reduce unsecured debts like credit cards and medical bills. As a debt negotiation attorney, he focuses on helping clients understand the benefits and risks of negotiating directly with creditors.Debt negotiation can be an alternative to bankruptcy for many Ocean County families, especially when dealing with mounting bills and limited income. An Ocean County debt negotiation attorney like Daniel Straffi Jr. can help individuals approach creditors to request a lower balance or new payment terms. "A lawyer or company speaks with your creditors on your behalf. The goal is simple: cut your balance so you can move forward," Straffi explains in a guide offered by the firm. He also assists clients in reviewing whether debt negotiation or bankruptcy might be the better path forward.

Working with an Ocean County debt negotiation attorney offers the chance to resolve unsecured debts without court proceedings. This includes obligations like credit card balances, medical bills, personal loans, and certain utility debts. According to Daniel Straffi Jr., these types of debt are often eligible for negotiation because creditors may prefer a partial recovery over the risk of total loss in a bankruptcy case. Straffi & Straffi Attorneys at Law also helps with Chapter 7 and Chapter 13 bankruptcy when necessary, giving clients multiple legal tools to address debt.

Debt negotiation does come with potential consequences. Straffi outlines several important issues New Jersey residents should be aware of. Settled debts typically appear on credit reports as "settled for less than the full amount," which can lower credit scores and remain visible for seven years. Forgiven debt may be considered taxable income, requiring recipients to report it to the IRS using Form 1099-C. While some exceptions apply-such as insolvency or discharge through bankruptcy-these tax rules must be carefully followed. Straffi advises clients to consult tax professionals to avoid unexpected liabilities.

Another area of concern is the presence of fraudulent or noncompliant debt relief companies. Some organizations make false promises or demand fees upfront before doing any work. Straffi notes that federal regulations prohibit these practices in many cases, and clients should never make payments before receiving a written settlement agreement. Scam companies may tell consumers to stop paying creditors, which can lead to worsening credit, collection lawsuits, and lost money.

In contrast, working with a debt negotiation attorney like Daniel Straffi Jr. provides a more secure process. Straffi urges clients to get all settlement terms in writing before sending any money. The agreement should confirm the reduced amount, the payment timeline, and whether the creditor will report the debt as settled or paid. Without written proof, creditors may deny verbal agreements or pursue further collection. Straffi also encourages clients to save all records and correspondence to protect themselves from future disputes.

New Jersey law offers protections against aggressive collection tactics. The Fair Debt Collection Practices Act (FDCPA) prevents harassment, false threats, or improper communication from debt collectors. Additionally, the New Jersey Consumer Fraud Act requires collection agencies to hold a $5,000 surety bond and follow specific rules. Ocean County residents can send debt validation letters to request proof of any claims and may be entitled to damages for FDCPA violations. A debt negotiation attorney can step in to stop unwanted contact and evaluate whether collectors have violated these laws.

In some cases, bankruptcy may offer stronger legal protections than debt negotiation. Unlike private settlement efforts, bankruptcy provides court oversight and immediate relief through the automatic stay, which halts lawsuits and collection actions. Daniel Straffi Jr. helps clients compare both options based on their financial status, long-term goals, and available income. Chapter 13 bankruptcy, for example, allows debt repayment over time under a structured plan, while Chapter 7 may provide quicker discharge of qualifying debts.

Daniel Straffi Jr. has worked with Ocean County clients for decades, helping them avoid financial traps and take control of their debt. While debt negotiation can be effective for unsecured obligations, Straffi ensures that clients are fully informed about possible risks and alternatives. From initial consultations to settlement agreements or bankruptcy filings, his goal is to guide families toward long-term financial stability.

Those facing high-interest debt or ongoing collection calls in Ocean County can find relief through legal support. With Daniel Straffi Jr. and Straffi & Straffi Attorneys at Law, individuals have access to practical advice and tailored legal solutions. Whether through negotiation or court-supervised bankruptcy, clients are empowered to make informed decisions and protect their financial future.

About Straffi & Straffi Attorneys at Law:

Straffi & Straffi Attorneys at Law serves Ocean County communities, including Toms River, Lakewood, Brick Township, Jackson, and beyond. The firm assists individuals and families with debt negotiation and bankruptcy matters. Led by Daniel Straffi Jr., the team provides legal support for those dealing with unsecured debt, creditor harassment, and financial hardship across New Jersey.

Embeds:

Youtube Video: https://www.youtube.com/watch?v=Z-3xrW8w2dM

GMB: https://www.google.com/maps?cid=18340758732161592314

Email and website:

Email: infodocuments@straffilaw.com

Website: https://www.straffilaw.com/

Media Contact

Company Name: Straffi & Straffi Attorneys at Law

Contact Person: Daniel Straffi, Jr.

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=ocean-county-debt-negotiation-attorney-daniel-straffi-jr-discusses-debt-relief-options-in-new-jersey]

Phone: (732) 341-3800

Address:670 Commons Way

City: Toms River

State: New Jersey 08755

Country: United States

Website: https://www.straffilaw.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Ocean County Debt Negotiation Attorney Daniel Straffi Jr. Discusses Debt Relief Options in New Jersey here

News-ID: 4358589 • Views: …

More Releases from ABNewswire

Self Employed Tax Software UK: Why Freelancers and Sole Traders Are Switching to …

With Many individuals are seeking software that simplifies tax filing while ensuring full compliance with HMRC requirements. Manual spreadsheets and paper-based calculations are being replaced by real-time, automated systems that give users visibility over their tax position throughout the year. Among the platforms gaining traction is Pie, a UK-based digital tax app built specifically to support self-employed individuals with modern income needs.

LONDON, United Kingdom - February 19, 2026 - Demand…

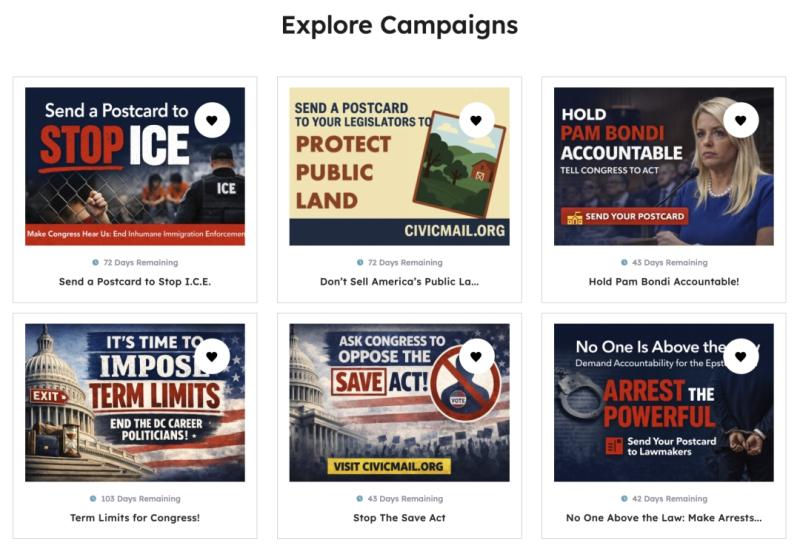

CivicMail.org Reinvents Postcard Campaigns for Grassroots Advocacy

CivicMail.org aims to bring civic engagement back to basics through the power of pen, paper, and postage.

Image: https://www.abnewswire.com/upload/2026/02/2addd1e9e0381d7e2262e1edbb064123.jpg

CivicMail.org [https://civicmail.org/] has announced its launch to help Americans send real, physical postcards to their elected officials with just a few clicks, delivering personalized messages directly to the desks of decision-makers at the local, state, and federal levels.

Research shows [https://www.concordia.ca/news/stories/2021/09/24/personalized-messages-are-more-likely-to-get-a-response-from-politicians-new-research-finds.html] that physical mail carries more weight with elected officials than petitions, emails, or…

New Children's Story: The Story of Sharin' Bear

A Heartfelt Message Of Courage, Kindness, And The True Meaning Of Giving

A pleasant new story for children, The Story of Sharin' Bear by Sharon Woods , introduces families to a lovable little cub whose journey of bravery and compassion changes him into a representation of sharing for children globally.

Entrenched in adventure, innocence, and emotional growth, this uplifting tale offers an unforgettable reminder that even the smallest acts of kindness can…

Fast-Growing Newman's Brew Combines Organic Coffee Excellence with Abandoned Ani …

Newman's Brew is experiencing rapid expansion by delivering on dual commitments that resonate with today's conscious consumers: exceptional fresh-roasted organic coffee and meaningful support for abandoned animals. The company's growing inventory and ethical business practices demonstrate that quality and social responsibility can drive sustainable business success in the competitive specialty coffee market.

Newman's Brew is riding a wave of growth that reflects fundamental shifts in how consumers approach coffee purchasing decisions.…

More Releases for Straffi

New Jersey Bankruptcy Attorney Daniel Straffi, Jr. Explains Chapter 7 Income Lim …

TOMS RIVER, NJ - Individuals considering Chapter 7 bankruptcy in New Jersey must meet specific income requirements determined by the federal means test, which compares a six-month income average against state median income guidelines. New Jersey bankruptcy attorney Daniel Straffi, Jr. of Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/what-are-income-limits-chapter-7-bankruptcy/) explains how the income thresholds work, what counts as income in the calculation, and what options exist for those whose income…

New Jersey Bankruptcy Attorneys Straffi & Straffi Attorneys at Law Announce Guid …

Toms River, NJ - New Jersey bankruptcy attorneys at Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/how-long-after-filing-bankruptcy-can-you-buy-a-house-in-new-jersey/), led by attorney Daniel Straffi Jr., announce comprehensive guidance for residents seeking a path to homeownership after bankruptcy. The firm's new advisory explains practical timelines, loan options, and documentation standards for applicants rebuilding credit, providing clear steps for pursuing a mortgage in New Jersey following Chapter 7 or Chapter 13 proceedings.

The guidance details how…

New Jersey Emergency Bankruptcy Attorney Daniel Straffi Provides Clarity on Emer …

Understanding how to protect assets during a financial crisis is critical, particularly when swift legal action is required. New Jersey emergency bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-is-an-emergency-bankruptcy-filing-in-new-jersey/) explains how an emergency bankruptcy filing can provide immediate relief for those facing foreclosure, wage garnishment, or other urgent creditor actions. In a recent article published by Straffi & Straffi Attorneys at Law, Daniel Straffi outlines the essential steps and key considerations involved in…

Straffi & Straffi Attorneys at Law Publishes New Article on No Asset Bankruptcy …

New Jersey Chapter 7 bankruptcy lawyer Daniel Straffi of Straffi & Straffi Attorneys at Law has published an article discussing the concept and implications of a no asset bankruptcy New Jersey [https://www.straffilaw.com/new-jersey-chapter-7-bankruptcy-lawyer/no-asset/]. This type of bankruptcy is commonly filed by individuals who have little to no nonexempt assets available for creditors. As explained by Straffi, a no asset bankruptcy can be an effective path toward financial relief for those who…

New Jersey Bankruptcy Attorney Daniel Straffi Discusses Medical Debt Relief Thro …

Medical debt continues to be a leading cause of financial distress for many Americans, and New Jersey residents are no exception. In a detailed article titled "Can My Medical Debt Be Paid Off With Bankruptcy?", New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/can-my-medical-debt-be-paid-off-with-bankruptcy/) explains how individuals burdened with overwhelming healthcare expenses may find relief through the bankruptcy process. The article, published by Straffi & Straffi Attorneys at Law, provides a comprehensive…

New Jersey Bankruptcy Attorney Daniel Straffi Explains Debt Restructuring Soluti …

New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-is-debt-restructuring-in-new-jersey/) offers important insights into how individuals and businesses can regain control of their finances through debt restructuring. In a recent article titled "What is Debt Restructuring in New Jersey?", Straffi addresses the growing financial strain many face due to job loss, unexpected expenses, or business challenges, and outlines the available options for restructuring debt to avoid default. Straffi & Straffi Attorneys at Law…