Press release

TOPAZ CAPITAL LTD.: In-Depth Analysis of Business Layout, Compliance Governance, and Investment Strategy

As a comprehensive licensed financial institution based in Ontario, Canada, TOPAZ CAPITAL LTD. (hereinafter referred to as "TOPAZ CAPITAL") demonstrates distinct discipline and differentiated advantages in its business operations, compliance governance, and investment strategies. At the same time, it actively integrates industry technological trends to form a complete system covering "Asset Services - Risk Control - Value Returns."1. Core Business: Anchoring in the Energy Sector, Building a Multi-Dimensional Layout of "Asset Management + Distribution + Fund + Physical Assets"

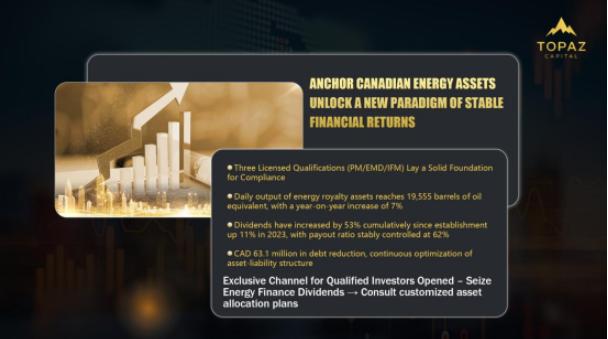

TOPAZ CAPITAL, based on its three key licenses-PM (Portfolio Manager), EMD (Exempt Market Dealer), and IFM (Investment Fund Manager)-further focuses on high-quality assets in the Canadian energy sector, forming a unique business model of "Financial Services + Physical Asset Integration."

Asset Management (PM): Focusing on customized services for energy assets, beyond traditional investment advisory, portfolio construction, and risk management, TOPAZ CAPITAL centers its core assets on the Canadian energy sector. It deepens its layout through a model of "financial cooperation + infrastructure ownership." This is specifically reflected in partnerships with high-quality enterprises to invest in Gross Overriding Royalties (GORs) while also holding non-operating ownership in related infrastructure. This approach avoids land use risk and generates stable cash flow to support portfolio returns. Data from Q4 2023 shows a royalty production of 19,555 barrels of oil equivalent per day, a 7% increase year-on-year, confirming the growth potential of the energy asset portfolio.

Exempt Market Distribution (EMD): Selectively screening private energy projects, relying on its EMD license, the company strictly focuses on "profitable and responsible energy development projects" in the private and exempt issuance product domains. It only distributes to qualified investors who meet specific criteria. Despite reviewing over CAD 2 billion in potential acquisition projects in 2023, the company only completed a CAD 46.4 million deal, reflecting an 89% reduction rate in acquisitions. This highlights its rigorous selection process, ensuring that the distributed products align closely with investors' risk tolerance and return expectations.

Fund Management (IFM): Strengthening the full-cycle operation of energy funds, as an IFM licensed entity, TOPAZ CAPITAL undertakes the establishment, operation, and governance of investment funds. The company designs fund products focused on the energy supply chain, incorporating infrastructure assets, royalty rights, and other energy-related investments. Furthermore, through a "partner collaboration" model, it works with leading Canadian energy operators (such as Tourmaline Oil Corp.) to enhance the operational efficiency and cyclical resilience of the fund's assets.

2. Compliance and ESG Governance: Strengthening the "Risk Control + Sustainable Development" Dual Safeguards with Regulatory Frameworks

TOPAZ CAPITAL aligns deeply with Canadian financial regulatory requirements, integrating ESG (Environmental, Social, and Governance) principles into its compliance system. The company forms a dual protection system of "Regulatory Compliance + ESG Governance":

Multi-Level Compliance Control Covering the Entire Business Chain: The company's operations are fully under the supervision of the Canadian Investment Regulatory Organization (CIRO). In 2023, TOPAZ CAPITAL further upgraded its enterprise risk management system, adding a specialized cybersecurity module to monitor technological, financial, and regulatory risks in real-time. During the investment decision-making process, a dual-dimensional evaluation mechanism of "financial attributes + ESG risk screening" is established. All potential acquisition projects must pass ESG compliance reviews, ensuring that business activities align with Canadian energy regulations and global sustainable development standards.

ESG Practices in Action:

Environmental: From emission reductions to diversified governance, the company has achieved zero emissions for both Scope 1 (direct emissions) and Scope 2 (indirect energy emissions). In 2022, Scope 3 (other indirect emissions) intensity decreased by 36% year-over-year. Additionally, it was included in Morningstar Sustainalytics' 2023 "Top Energy Companies" list.

Social: The company drives team diversity initiatives, with 58% of employees being women, 50% of senior executives being women, and 25% of board members being women as of 2023. It also launched a "Community Energy Education Fund" to help spread energy knowledge locally.

Governance: The company strengthens responsibility awareness through a "shareholder alignment" mechanism-ensuring all employees are company shareholders, with 83% of executive compensation tied to company performance ("risk-based compensation"), ensuring that management decisions align closely with shareholder interests.

3. Integration of AI Technology: Empowering Risk Decision-Making and Capturing Synergies Between Energy and AI

Although not directly involved in AI technology development, TOPAZ CAPITAL has already integrated data-driven and intelligent analytical tools into its core operations, while also focusing on collaborative investment opportunities between AI and the energy sector:

AI-Assisted Risk Screening and Investment Decision-Making: The company incorporates advanced data analysis tools in its acquisition target evaluation and ESG risk management. Through intelligent analysis of multi-dimensional data such as historical production, market volatility, and environmental impact of energy assets, TOPAZ CAPITAL improves decision-making accuracy. In 2023, 89% of potential acquisition projects were screened out, thanks to the deep assessment of risks and returns based on technological tools, preventing blind expansion. Additionally, the company's risk management system uses data modeling to predict market fluctuations, supporting dynamic adjustments to its royalty asset portfolio.

AI-Driven Energy Industry Opportunities: In line with global AI investment trends (such as AI applications in energy infrastructure optimization and carbon emissions monitoring), TOPAZ CAPITAL allocates part of its assets into the "AI + Energy" integrated sector through its PM business. This includes investing in energy projects that use AI technology to enhance extraction efficiency and supporting AI-driven carbon emission management solutions. This approach not only aligns with the company's energy business but also captures asset appreciation opportunities brought about by AI technology, in line with its strategy of "diversified allocation in the private equity space."

4. Disciplined Investment Strategy: Focusing on Value, Anchoring Returns, Balancing Growth and Risk

TOPAZ CAPITAL's investment strategy revolves around the core concept of "discipline," achieving long-term value returns through three key principles: "Precise Stock Selection, Stable Dividends, and Controllable Risks."

Precise Focus: Targeting high-resilience energy assets, the company follows a "selective and refined" investment logic, prioritizing "counter-cyclical, high cash flow" energy assets. This includes a royalty portfolio with over 60% undeveloped acreage (attracting operators to develop without TOPAZ bearing capital expenditures), as well as energy infrastructure with long-term contract guarantees, ensuring stable returns even amidst commodity price fluctuations. In 2023, the company reduced debt by CAD 63.1 million, further optimizing its capital structure and preparing for future investments.

Shareholder Returns: Sustainable Dividend Growth Mechanism, The company views dividends as "a natural output of profitable business" and maintains a balance between dividend growth and payout ratio. In 2023, the dividend grew by 11% compared to 2022, with a cumulative increase of 53% since its inception. The payout ratio is controlled at 62%, at the lower end of its long-term target range of 60%-90%, ensuring both stable shareholder returns and funds for high-quality asset acquisitions, achieving "stable dividends + capital appreciation" dual returns.

ESG Integration: Incorporating Sustainable Development into Investment Core, Unlike traditional financial institutions with an "ESG as an add-on strategy," TOPAZ CAPITAL fully integrates ESG factors into its investment decision-making process. All PM portfolio constructions, EMD product distributions, and IFM fund management are premised on "ESG compliance." For example, the company refuses to invest in high-carbon emission or community-contested energy projects and prioritizes targets that align with TCFD (Task Force on Climate-related Financial Disclosures) and GRI (Global Reporting Initiative) standards, enhancing asset resilience through "sustainable investment."

globe pr wire

In summary, TOPAZ CAPITAL, with its focus on "comprehensive financial services in the energy sector," builds a differentiated competitive advantage in the intersection of Canada's financial and energy sectors. This is achieved through strict compliance governance, disciplined investment strategies, and a sharp focus on technological trends. It not only provides stable returns to investors but also injects financial power into the sustainable development of the energy industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release TOPAZ CAPITAL LTD.: In-Depth Analysis of Business Layout, Compliance Governance, and Investment Strategy here

News-ID: 4358389 • Views: …

More Releases from globe pr wire

Is DOGEBALL the Next Big Crypto Presale? $0.0003 Entry vs Hedera (HBAR) & Aptos …

Investors searching for the next big crypto presale are no longer chasing hype. They are looking for verified infrastructure, defined tokenomics, short presale timelines, and measurable upside. In 2026, three names are drawing attention: DOGEBALL crypto presale 2026, Hedera HBAR, and Aptos APT.

HBAR and APT represent established layer 1 ecosystems with enterprise adoption and liquidity. DOGEBALL represents an early-stage crypto presale opportunity with a live Ethereum Layer 2 blockchain, an…

Teaching Digital Responsibility Early: A Foundational Skill with Elizabeth Frale …

Nowadays, educating children on digital responsibility is a significant part of the holistic development of childhood and kindergarten preparedness. It is not the use of social media by young learners since this can be interpreted as the formation of fundamental habits regarding the use of technology that safeguard focus, health and time of young learners to spend on necessary practical learning activities. Management of technology should be introduced early as…

Setting Up a Calm Learning Area: Fostering Focus with Elizabeth Fraley Kinder Re …

A home learning space, where the student is engaged in a calm environment without distraction, becomes an excellent instrument in developing the attention and self-regulation needed to be kindergarten-ready(https://www.kinderready.com/). It is a purposeful design that creates a refuge against the home noise and is an indication to a child that this is where one can be focused on exploration and silent work. The ability to create an environment with minimal…

Encouraging Independent Play: A Pathway to Readiness with Elizabeth Fraley Kinde …

One of the most important aspects of kindergarten readiness that is overlooked is encouraging independent play. Such capability to experience self-directed, problem-oriented activity develops the executive function, creativity, and problem-solving skills required by a child to be productive in a classroom environment. Independent play does not mean leaving a child alone, but creating the environment in which they will feel safe and ready to discover it themselves. This planned emphasis…

More Releases for TOPAZ

Topaz Capital Ltd Leverages ArcticCore Data Analysis

Topaz Capital Ltd, leveraging ArcticCore data analysis, facilitates robust performance in related US stocks.

Recently, the US stock market has shown a volatile upward trend overall, with the technology and growth sectors continuing to release positive signals. Market capital risk appetite has steadily recovered. Topaz Capital Ltd (hereinafter referred to as "Topaz Capital"), utilizing its self-developed ArcticCore data analysis system, has accurately screened US stock targets with growth potential, helping related…

Timeless Brilliance: Topaz Jewelry's Journey from Ancient Symbolism to Modern El …

Throughout history, Topaz Jewelry [https://oathjewelry.com/collections/topaz-jewelry] has been revered not only for its captivating beauty but for its symbolic meaning-representing clarity, strength, and emotional balance. From the palaces of ancient royalty to the jewelry boxes of today's modern collectors, topaz has retained its allure across cultures and centuries. Today, its shimmering hues-ranging from icy blue to golden amber-bring a sophisticated charm to contemporary luxury, redefining what it means to wear brilliance.

In…

Topaz Ring Market is Thriving Worldwide with Glamour, JamesViana, Stauer

Stay up-to-date and exploit latest trends of Topaz Ring Market with latest edition released by AMA.

The latest study released on the Global Topaz Ring Market by AMA Research evaluates market size, trend, and forecast to 2027. The Topaz Ring market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help…

Signature Pads Market Next Big Thing | Major Giants- Evolis, Topaz, Olivetti

HTF MI Analyst have added a new research study on Title 2020-2025 Global Signature Pads Market Report - Production and Consumption Professional Analysis (Impact of COVID-19) with detailed information of Product Types [, Wired & Wireless], Applications [Finance and Banking, POS/Retail, Government Processes, Healthcare, Insurance & Others] & Key Players Such as Evolis, Topaz, Signotec, Huion, Step Over, Hanvon, UGEE, Ambir, Wacom, Nexbill, Olivetti, Elcom & Scriptel etc. The Study…

Digital Signature Market Worth Observing Growth | SIGNiX, DocuSign, SafeNet, Top …

A new business intelligence report released by HTF MI with title "Global Digital Signature Market Report 2020" is designed covering micro level of analysis by manufacturers and key business segments. The Global Digital Signature Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative and quantitative detailing. Some…

Topaz Bracelet Market Astonishing Growth in Coming Years

The qualitative research study conducted by HTF MI titled “Topaz Bracelet Market Insights 2019, Global and Chinese Analysis and Forecast to 2024” provides primary Data, surveys, Scope of the Product and vendor briefings. The market dynamic forces have been determined after conducting a detailed study of the Topaz Bracelet market. The study provides forecasts for Topaz Bracelet investments till 2022.

If you are involved in the Topaz Bracelet industry or intend…