Press release

Polymer Processing Aid Market Overview: Polyolefins, Film Packaging & Regulatory Impact | Top Companies are Arkema, Dow, 3M

The Global Polymer Processing Aid Market is expected to grow at a CAGR of 3% during the forecast period 2024-2031.Polymer Processing Aids (PPAs) are specialty additives used in polymer extrusion and molding to improve melt flow, eliminate surface defects such as melt fracture and die buildup, and enhance processing efficiency. They are widely applied in polyolefin films, pipes, and packaging to ensure smoother processing, higher output rates, and improved product quality. Growing demand for PFAS-free and sustainable materials is reshaping PPA innovation globally.

According to the report, demand remains structurally strong as plastics continue to underpin packaging, construction, agriculture, and consumer goods, reinforcing the need for higher processing efficiency at scale. The OECD reports global plastics production increased from 234 million tons in 2000 to ~460 million tons in 2019, while plastic waste generation more than doubled during the same period, underscoring the urgency for processing optimization. OECD projections further indicate plastics production and use could rise by nearly 70% by 2040, reaching approximately 736 million tons, directly expanding the addressable market for PPAs in high-volume processing.

The report also explains how tightening chemical regulations and sustainability priorities are reshaping the PPA landscape, especially as scrutiny increases across the polymer value chain. The UNEP identifies 13,000+ chemicals associated with plastics, with 3,200+ classified as chemicals of concern, intensifying regulatory and customer pressure on material safety. Historically, fluoropolymer- and PFAS-based PPAs were widely used to mitigate melt fracture and die build-up, but their environmental persistence is driving global regulatory action, accelerating the industry's shift toward safer and more sustainable processing aid solutions.

📌 Request Executive Market Intelligence Sample:- https://www.datamintelligence.com/download-sample/polymer-processing-aid-market?rk

Recent Developments:

United States: Recent Industry Developments

✅ In October 2025, a major U.S. agribusiness-led materials company launched a next-generation polymer processing aid designed for polyolefin extrusion.The solution improves surface smoothness, melt stability, and extrusion efficiency.It reflects increasing demand for environmentally safer, non-halogenated PPAs.

✅ In September 2025, a leading U.S. chemical manufacturer introduced a fluoropolymer-free silicone-based polymer processing aid for film packaging applications.The product enhances melt flow while meeting stricter food-contact and sustainability requirements.It supports the industry shift away from traditional PFAS-based additives.

✅ In September 2025, U.S. plastic converters accelerated adoption of PFAS-free polymer processing aids in response to regulatory pressure and brand sustainability commitments.This trend is driving reformulation of extrusion masterbatches across packaging and consumer goods.The transition is expected to redefine performance benchmarks in polymer processing.

Japan: Recent Industry Developments

✅ In December 2025, leading Japanese chemical companies advanced strategic integration of their polyolefin businesses to strengthen domestic polymer manufacturing.This consolidation supports downstream innovation in polymer additives and processing aids.It enhances supply stability and R&D collaboration in advanced materials.

✅ In December 2025, Japan hosted a major regional polymer processing conference focused on extrusion technologies, additives, and material efficiency.The event highlighted innovations in sustainable polymer processing aids and defect-reduction techniques.It reinforced Japan's role as a technology hub for advanced polymer processing.

✅ In September 2025, Japanese chemical producers announced expanded development of PFAS- and PTFE-free polymer processing aid technologies.These solutions target high-performance film and packaging applications.The move aligns with Japan's long-term environmental and regulatory compliance strategies.

Latest M&A Snapshot

✅ In Q4 2025, specialty chemical companies increased acquisition activity focused on polymer additives and sustainable processing technologies.The deals aim to strengthen fluoropolymer-free portfolios and advanced extrusion solutions.This signals rising consolidation across the polymer processing aid value chain.

📌 Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/polymer-processing-aid-market?rk

Rising Adoption of High-Melt-Strength Polyolefins Aid Market Demand

The adoption of high-melt-strength (HMS) polyolefins is accelerating globally as converters aim for lighter, stronger and more process-stable plastic films and molded components. According to the American Chemistry Council (ACC), polyethylene and polypropylene together make up over 55% of total US plastic resin production, exceeding 65 million tonnes annually. This massive production base is increasingly shifting toward HMS grades because their enhanced melt elasticity supports high-speed extrusion, improved bubble stability and downgauging, performance characteristics that demand greater use of polymer processing aids (PPAs) to prevent melt fracture and die-build-up.

The Plastics Industry Association (PLASTICS) highlights that US plastics machinery operating rates rose above 82% in 2023-24, driven by demand for flexible packaging, agricultural films and foams, segments where HMS PE and HMS PP are most used. Higher throughput directly increases reliance on PPAs to maintain smooth flow and optical clarity at elevated shear rates.

Tightening Regulations, Sustainability Mandates and Advancing Additive Innovation Accelerates Demand for PFAS-Free PPA

The PFAS-free Polymer Processing Aid (PPA) segment is rapidly emerging as a key growth driver in the global PPA market, supported by tightening regulations, sustainability mandates and advancing additive innovation. Traditionally, polymer processing aids used in extrusion applications relied heavily on fluoropolymers to control melt fracture, reduce die build-up and improve surface quality in polyethylene and polypropylene films.

However, increasing environmental and health concerns related to PFAS commonly referred to as "forever chemicals" due to their persistence in soil and water have fundamentally altered market dynamics. Scientific evidence highlighting the slow degradation and bioaccumulative nature of PFAS has led to heightened regulatory scrutiny worldwide.

Asia-Pacific Dominates Global Growth with The Sheer Scale and Continued Expansion of Plastics Production and Conversion Activities

Asia-Pacific remains the largest and fastest-growing region, driven by the sheer scale and continued expansion of plastics production and conversion activities, particularly in China, India, Japan, South Korea and Southeast Asia. Asia-Pacific accounts for the largest share of global plastics manufacturing and government and institutional statistics consistently confirm that extrusion-based processing, films, sheets, pipes, fibers and profiles, dominates polymer conversion in the region.

As PPAs are essential for stabilizing melt flow, preventing surface defects and enabling higher line speeds, their demand closely tracks the intensity and sophistication of regional plastics processing rather than just resin output growth. China is the central pillar of Asia-Pacific polymer processing aid demand due to the scale of its plastics industry. China produced about 137.9 million tonnes of plastics in 2023, representing roughly 33% of global plastics production out of an estimated 413.8 million tonnes worldwide, firmly establishing its global dominance.

📌 Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=polymer-processing-aid-market?rk

Competitive Landscape and Strategic Initiatives

The polymer processing aid market features strong competition among global industry leaders, including Arkema, Daikin Industries, Ltd., 3M Company, Dow Inc., Avient Corporation, Clariant AG, Kaneka Corporation, SYENSQO, Cargill, Incorporated and The Chemours Company. The companies drive market dynamics through extensive product portfolios, advanced material technologies, large-scale manufacturing capabilities and continuous investments in innovation and sustainability.

Leading Company Profiles and Strategic Developments

Arkema (France)

Arkema Group is a global specialty materials and chemicals company. Built on deep expertise in materials science, Arkema develops high-performance materials and innovative chemical solutions that address global challenges in mobility, electronics, energy, water access, recycling and urbanization. The Group is structured into three complementary segments dedicated to Specialty Materials that are Adhesive Solutions, Advanced Materials and Coating Solutions, which together account for most of its portfolio.

Arkema operates in around 55 countries and focuses on sustainability and cutting-edge performance across multiple industries, leveraging advanced polymers, adhesives, resins and additives for diverse applications. Arkema's PPA offerings is a part of its high performance polymers solutions designed to improve polymer processing performance.

3M Company (US)

3M Company is known for creating a broad range of products that improve everyday life and industrial performance. 3M operates globally with sales in 200 countries across numerous industries, including safety and industrial, transportation and electronics, health care and consumer markets and produces products such as adhesives, abrasives, films, tapes and protective materials.

3M's innovation is grounded in deep materials science expertise, allowing the company to develop advanced solutions for customers in sectors like automotive, construction, electronics and healthcare. Its products often combine functional polymers with precision processing to deliver durability, safety and performance across applications. 3M offers polymer processing additives under the 3M Dynamar Polymer Processing Additive brand.

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Polymer Processing Aid Market Overview: Polyolefins, Film Packaging & Regulatory Impact | Top Companies are Arkema, Dow, 3M here

News-ID: 4358077 • Views: …

More Releases from DataM Intelligence 4market Research LLP

Biomass Briquette Market to Grow at 7% CAGR from 2025 to 2031, Led by North Amer …

The Biomass Briquette Market is expected to expand at a CAGR of about 7% from 2025 to 2031 as industries and households increasingly adopt sustainable and eco‐friendly solid fuel alternatives to traditional fossil fuels, driven by rising energy demand and environmental concerns.

Growth is supported by increasing demand across key applications such as industrial fuel, power generation, cooking fuel, and residential heating, driven by abundant agricultural and forestry residues that are…

Protein Engineering Market to Grow at 15.6% CAGR from 2025 to 2033, Driven by No …

The global protein engineering market reached US$ 2,854.54 Million in 2024 and is expected to reach US$ 8,646.10 Million by 2033, growing at a CAGR of 15.6 % from 2025 ro 2033 as demand for tailored biological solutions accelerates across pharmaceuticals, biotechnology, diagnostics, and industrial applications.

Growth is supported by increasing adoption of advanced protein modification, design and synthesis techniques to develop high‐efficacy therapeutics, enzymes, and biomaterials, driven by rising…

Substation Automation Market to Reach USD 67B by 2031 at 6.5% CAGR | Driven by R …

According to DataM Intelligence, the Substation Automation Market reached USD 41 billion in 2022 and is expected to reach USD 67 billion by 2031, growing at a CAGR of 6.5% during the forecast period (2024-2031).The global Substation Automation Market is undergoing a significant transformation as utilities and grid operators modernize aging infrastructure and transition toward digital substations. Substation automation systems (SAS) integrate intelligent electronic devices (IEDs), communication networks, SCADA platforms,…

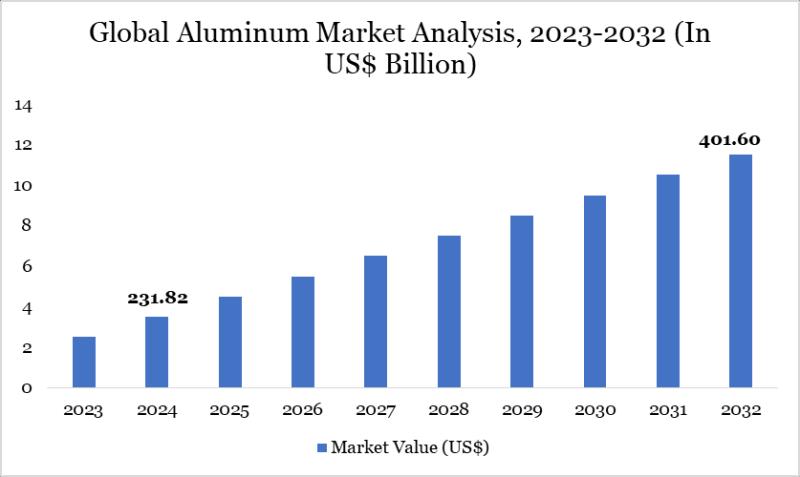

Aluminum Market to Reach US$ 401.60 Billion by 2032 Driven by Infrastructure Gro …

The Aluminum Market reached US$ 231.82 billion in 2024 and is expected to reach US$ 401.60 billion by 2032, growing at a CAGR of 7.11% during the forecast period 2025-2032.

Growth is driven by rising demand across construction, automotive, aerospace, packaging, and electrical industries, where aluminum is valued for its lightweight properties, corrosion resistance, high strength-to-weight ratio, and recyclability. Increasing focus on vehicle lightweighting, electric vehicle production, and sustainable packaging solutions…

More Releases for PPA

PFAS-Free PPA Solution for Polyolefin Blown Film Extrusion

What Is Polyolefin Blown Film Extrusion?

Polyolefin blown film extrusion is widely used to produce packaging films for food, consumer goods, industrial liners, agricultural films, and protective packaging.

Modern blown film production increasingly requires thin gauge films, high output rates, smooth surface quality, and stable long-term extrusion.

To achieve these goals, processors commonly use LLDPE, mLLDPE, LDPE, and metallocene polyolefins, which place higher demands on extrusion processability.

Typical Processing Challenges in Blown Film Extrusion

As…

Understanding PPA Polymer Processing Aids, the Risks of Fluorinated PPA, and the …

Introduction:

Polymer Processing Aids (PPA) [https://www.siliketech.com/pfas-free-and-fluorine-free-polymer-processing-aidsppa-silimer-9300-product/] are essential in the plastics industry, enhancing the processing and performance of polymers. This article explores what PPA is, the risks associated with fluorinated PPA, and the importance of finding non-PFAS (Per- and Polyfluoroalkyl Substances) alternatives.

What is PPA Polymer Processing Aid?

PPA, particularly those that are fluorinated, are polymer processing aids based on fluoropolymers that significantly improve the processing performance of polymers. They are known to…

What are PPA processing aids for plastics processing? How to Find Highly Functio …

PPA polymer processing aids is a general term for several types of materials used to improve the processing and handling properties of high molecular weight polymers. Mainly in the melt state of the polymer matrix to play a role in reducing the polymer melt viscosity. However, compared with traditional lubricants, processing aids have the advantages of high efficiency and low addition volume. In addition, PPA polymer processing aids have the…

What are SILIKE PFAS-free polymer processing aids (PPA)?

Introduction:

Polymer processing aids (PPAs) are indispensable in optimizing the performance of polyolefin films and extrusion processes, particularly in blown film applications. They serve crucial functions such as eliminating melt fractures, improving film quality, enhancing machine throughput, and minimizing die-lip build-up. Traditionally, PPAs have heavily relied on fluoropolymer chemistry for their efficacy.

However, the utilization of fluoropolymers has faced scrutiny due to their categorization as PFAS materials (per or poly- fluoroalkyl substances).…

PPA Resin Market Size, Share, Forecast 2023 - 2029 |

The report comes out as an intelligent and thorough assessment tool as well as a great resource that will help you to secure a position of strength in the global PPA Resin market. It includes Porter's Five Forces and PESTLE analysis to equip your business with critical information and comparative data about the Global PPA Resin Market. We have provided deep analysis of the vendor landscape to give you a…

Global Polyphthalamide (PPA) Market Huge Growth Opportunity between 2020-2025

LP INFORMATION recently released a research report on the Polyphthalamide (PPA) market analysis, which studies the Polyphthalamide (PPA)'s industry coverage, current market competitive status, and market outlook and forecast by 2025.

Global "Polyphthalamide (PPA) Market 2020-2025" Research Report categorizes the global Polyphthalamide (PPA) market by key players, product type, applications and regions,etc. The report also covers the latest industry data, key players analysis, market share, growth…