Press release

Mobile Digital Payment Market is set to reach US$ 587.52 billion by 2030, growing at a strong CAGR of 38.0%. North America leads the market with 41% market share.

The global mobile payment market size was valued at USD 88.50 billion in 2024 and is projected to reach USD 587.52 billion by 2030, growing at a CAGR of 38.0% from 2025 to 2030. Some of the key characteristics of mobile payments, such as enhanced safety, ease of use, quick functions, inexpensive operations, and ubiquity driven by the internet, have driven the growth of this market.Mobile payment refers to a digital transaction method enabling consumers to pay for goods or services using smartphones or wearable devices, offering convenience, security, and speed, increasingly adopted across retail, banking, and e-commerce sectors.

DataM Intelligence unveils its latest report on the " Mobile payment Market size 2025," offering an in-depth analysis of market trends, growth drivers, competitive landscape, and regional dynamics. The study covers market size in value and volume, CAGR forecasts, and emerging opportunities that can guide businesses in seizing growth potential and crafting winning strategies. Packed with data-driven insights on current developments and future trends, this report is essential for companies aiming to stay ahead in the competitive Market.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/mobile-payments-market?prtk

United States: Key Industry Developments (2025)

✅ October 2025: Venmo launched a "Teen Account" mobile payment product with parental controls and a debit card, targeting financial literacy while expanding user base engagement among younger demographics.

✅ September 2025: The Federal Reserve's FedNow real‐time payments system saw major U.S. bank adoption, enabling instant mobile bill payments and peer‐to‐peer transfersmodernizing the U.S. mobile payment infrastructure.

✅ August 2025: PayPal expanded use of its PYUSD stablecoin for mobile checkout, allowing users to transact with crypto across millions of merchants and enhancing digital wallet flexibility.

Japan: Key Industry Developments (2025)

✅ December 2025: PayPay reported reaching 65 million registered users, solidifying its position as Japan's leading QR‐code mobile payment app and reflecting strong user adoption growth.

✅ October 2025: NTT DATA signed a MoU with NPCI International Payments to bring India's real‐time mobile payment system UPI acceptance to Japan, expanding cross‐border mobile pay options for merchants.

✅ September 2025: Rakuten Pay introduced "Tap to Pay" for Android users, allowing contactless mobile payments without launching the appboosting convenience and NFC payment competitiveness.

📌 Mobile payment Market 2025-26 M&A Deals

→ In October 2025, New Zealand‐based Xero Limited completed the acquisition of Melio Payments Inc., a U.S. SMB bill‐pay and payments platform, in a deal valued at US $2.5 billion (upfront consideration, with up to US $500 million contingent earn‐outs tied to performance targets). The merger expands Xero's accounting software with integrated payment solutions for small and medium‐sized businesses.

→ In June 2025, Xero announced its acquisition of Melio Payments Inc. from U.S. founders and investors for US $2.5 billion (with additional contingent consideration of up to US $0.5 billion over three years). The deal was formally signed on 25 June 2025 and deepens Xero's payment capabilities as part of its global growth strategy.

→ On 3 April 2025, Peach Payments agreed to acquire PayDunya, a Dakar‐based West African mobile and online payment gateway platform. The deal marks Peach Payments' expansion into mainland Francophone Africa, although the financial terms were not publicly disclosed.

Mobile payment Market Drivers:-

⏩ Over 62% of global mobile phone users now leverage some form of mobile payment service, with smartphone usage cited as a leading growth catalyst.

⏩ Global smartphone adoption reached 6.8 billion connections in 2023, creating a vast addressable base for mobile payment solutions.

⏩ Contactless and friction‐free payments now account for a large share of digital transactions, with contactless POS penetration at 61% globally.

⏩ Surveys show that ~76% of consumers prefer contactless payment experiences, directly correlating with faster checkouts and reduced abandonment in e‐commerce.

⏩ E‐commerce's rapid expansion accelerates mobile payment adoption, as users demand payment options that match the convenience of shopping on their phones.

⏩ In the U.S., digital wallet usage now accounts for 29% of total retail transactions further evidence of mobile payments integrating with buying patterns.

⏩ In India alone, mobile wallet usage is projected to grow at a CAGR of 18.3% from 2024 to 2028, touching approximately $6.4 trillion in value thanks to initiatives like UPI that simplify real‐time payments.

⏩ Global regulatory frameworks (e.g., EU's PSD2) have encouraged innovation while maintaining security and interoperability crucial for broad adoption.

⏩ Adoption of biometric authentication, AI fraud detection, and real‐time monitoring is enhancing trust, with biometric and AI‐driven security now mainstream in mobile wallets.

⏩ Enhanced security and ease have converted hesitant users into active adopters, reducing friction and boosting confidence in digital payments.

📌 Buy Now & Unlock 360° Market Intelligence:https://www.datamintelligence.com/buy-now-page?report=mobile-payments-market?prtk

Mobile payment Major Players:-

Google, Alibaba Group Holdings Limited, Amazon.com Inc, Apple Inc, American Express Company, M Pesa, Money Gram International, PayPal Holdings Inc, Samsung Electronics Co. Ltd, Visa Inc and WeChat.

Key players highlights:-

Apple Inc. (Apple Pay) - 25% share globally in mobile payment transactions; dominant especially in NFC/contactless payments in the U.S. and other developed markets.

PayPal Holdings Inc. - 28% share in global mobile payment transaction volume; heavily used for e‐commerce & peer‐to‐peer payments worldwide.

Google LLC (Google Pay) - 19% share among mobile payment services, strong on Android devices and UPI markets like India.

Alibaba Group Holdings Ltd. (Alipay) - Major share in China (Alipay & affiliates account for a dominant portion of Chinese mobile payments); one of the largest platforms worldwide.

Tencent (WeChat Pay) - Significant market share in China (40%+) and over a billion active users globally, integrated in the WeChat ecosystem.

Regional Highlights

Asia‐Pacific (APAC)

• Holds the largest share of the global mobile payment market (41% of total) due to high mobile penetration and widespread digital wallet use.

• China dominates with strong mobile transactions via platforms like Alipay/WeChat Pay and India grows rapidly with UPI‐based systems.

• Continued rapid urban adoption and government cashless initiatives drive sustained high growth across Southeast Asia.

North America

• Accounts for around 28% of global mobile payment market share supported by advanced infrastructure and digital wallet adoption.

• The U.S. leads regional development with strong NFC/mobile wallet integration and extensive retailer acceptance.

• Innovation from major fintech/tech firms (Apple Pay, Google Pay, digital bank features) continues to expand services.

Europe

• Represents about 22% of global market share with strong regulatory support for secure digital payments.

• Growth propelled by contactless and mobile wallet adoption especially in major markets like Germany, UK, and France.

• Focus on improving cross‐border payments and regulatory frameworks enhances mobile payment integration.

Get Customization in the report as per your requirements:https://www.datamintelligence.com/customize/mobile-payments-market?prtk

Mobile payment market segmentation :

The Mobile Payments Market is segmented based on technology, including Near Field Communication (NFC), Direct Mobile Billing, Mobile Web Payment, SMS, Interactive Voice Response (IVR), and Mobile Apps. Payment types cover B2B, B2C, and B2G transactions. By location outlook, the market is divided into Remote Payments and Proximity Payments. End-users span sectors like BFSI, Healthcare, Retail & E-commerce, IT & Telecom, Media & Entertainment, and Transportation, reflecting the broad adoption of mobile payment solutions across industries.

Q: What is driving the growth of the Mobile Payments Market?

A: Rising smartphone adoption, digital wallets, and contactless payment demand are key growth drivers.

Q: Which regions are leading the Mobile Payments Market?

A: Asia-Pacific leads in transaction volume, followed by North America and Europe due to fintech adoption.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Digital Payment Market is set to reach US$ 587.52 billion by 2030, growing at a strong CAGR of 38.0%. North America leads the market with 41% market share. here

News-ID: 4357643 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

Artificial Intelligence (AI) Chip Market (2026-2033) | UAE's 4 Trillion Transist …

DataM Intelligence has published a new research report on "Artificial Intelligence (AI) Chip Market Size 2025". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.

Latest M & A

• Intel moves…

Japan Nurse Call Systems Market (2025-2033) | Opportunities in Hospitals and Sen …

DataM Intelligence has published a new research report on "Japan Nurse Call Systems Market Size 2025". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.

Get a Sample PDF Of This…

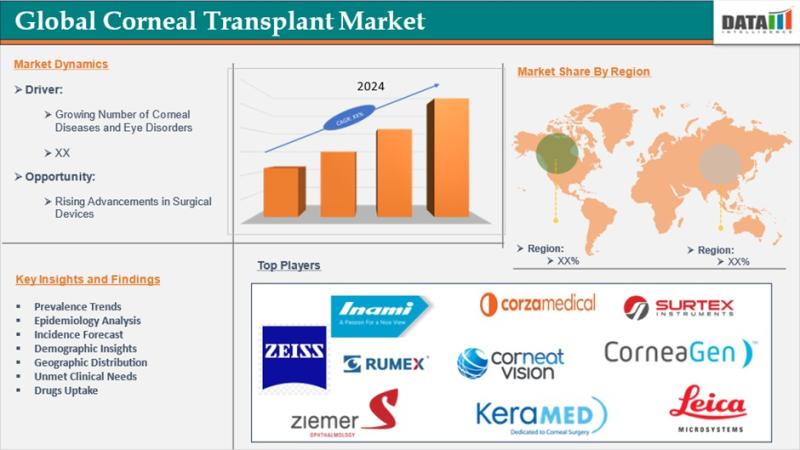

Corneal Transplant Market to Reach US$ 1,006.95 Million by 2033 at 7.59% CAGR | …

Corneal Transplant Market reached US$ 523.88 million in 2024 and is expected to reach US$ 1,006.95 million by 2033, growing at a CAGR of 7.59% during the forecast period 2025 to 2033.

Corneal transplantation, also known as keratoplasty, is a surgical procedure in which a damaged or diseased cornea is replaced with healthy donor tissue to restore vision and maintain ocular integrity. The cornea serves as the transparent outer layer of…

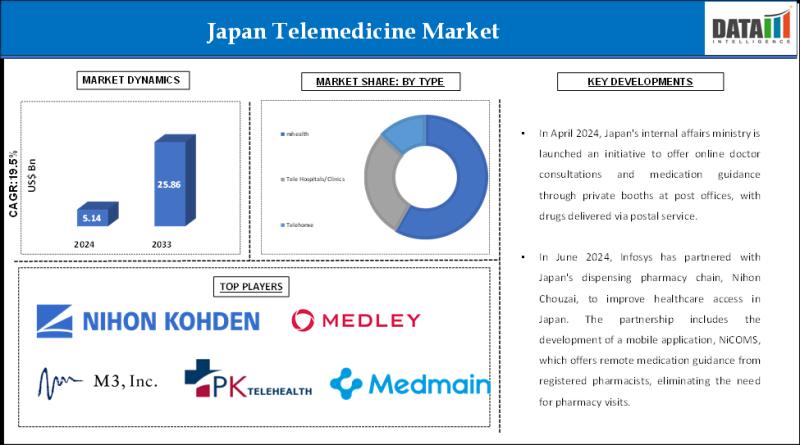

Japan Telemedicine Industry (2025-2033) | Technology Advancements and Market Pen …

DataM Intelligence has published a new research report on "Japan Telemedicine Market Size 2025". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.

Get a Sample PDF Of This Report (Get…

More Releases for Pay

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Mobile Wallet (NFC, Digital Wallet) Market to Witness Stunning Growth | Apple Pa …

HTF MI recently introduced Global Mobile Wallet (NFC, Digital Wallet) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Apple Pay, Google Pay, Samsung Pay, PayPal, Alipay, WeChat Pay,…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…