Press release

Top 30 Indonesian Cement Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)PT Indocement Tunggal Prakarsa Tbk. (INTP) Cement producer

PT Semen Indonesia (Persero) Tbk. (SMGR) Indonesias largest cement producer

PT Semen Baturaja (Persero) Tbk. (SMBR) Regional cement producer

PT Solusi Bangun Indonesia Tbk. (SMCB) Cement and construction materials

PT Waskita Beton Precast Tbk. (WSBP) Beton, precast, and aggregates

PT Wijaya Karya Beton Tbk. (WTON) Beton & construction materials

PT Agro Yasa Lestari Tbk (AYLS) Construction supplies

PT Benteng Api Technic Tbk (BATR) Construction tech & materials

PT Berkah Beton Sadaya Tbk (BEBS) Concrete products

PT Superior Prima Sukses Tbk (BLES) Construction materials

PT Cemindo Gemilang Tbk (CMNT) Semen Merah Putih cement producer

PT Xolare RCR Energy Tbk (SOLA) Materials/energy in construction

PT Jakarta Kyoei Steel Works Tbk (JKSW) Steel for construction

PT Agro Yasa Lestari Tbk (AYLS)

PT Benteng Api Technic Tbk (BATR)

PT Berkah Beton Sadaya Tbk (BEBS)

PT Superior Prima Sukses Tbk (BLES)

PT Xolare RCR Energy Tbk (SOLA)

PT Asahimas Flat Glass Tbk (AMFG) Glass materials for construction

PT Steel Pipe Industry of Indonesia Tbk (ISSP)

PT Betonjaya Manunggal Tbk (BTON)

PT Jakarta Kyoei Steel Works Tbk (JKSW)

PT Panca Budi Idaman Tbk (PBID) (materials)

PT Trias Sentosa Tbk (TRST) aggregates/infra materials

PT Indospring Tbk (INDS) steel products (supporting infrastructure)

PT Gunawan Dianjaya Steel Tbk (GDST) (infra metals)

PT Suparma Tbk (SPMA) glass/construction printing

PT Lion Metal Works Tbk (LION) metals for construction

PT Alaska Industrindo Tbk (ALKA) materials (construction adjacent)

PT Intan Wijaya International Tbk (INCI) industrial materials

2) Revenue results of major public companies in Indonesia summarized (per company)

PT Indocement Tunggal Prakarsa Tbk (INTP) - Q3 2025 results: Domestic cement & clinker sales ~14.02 million tons for 9M2025, down 3.6 % y/y; exports +124.2 % to 423 thousand tons. Strong cash position: IDR 3.7 trillion (~USD 243 million).

PT Semen Indonesia (Persero) Tbk (SMGR) - Net profit (9M 2025): IDR 114.83 billion (~USD 6.9 m) down 84 % YoY. Revenue: IDR 25.30 trillion (~USD 1.52 billion), 3.8 % YoY. Margin pressures and profit collapse reflect industry headwinds.

PT Semen Baturaja Tbk (SMBR) - Revenue: IDR 1.78 trillion (~USD 107 m). Net profit: IDR 146.3 billion (~USD 8.8 m) (more than 4× YoY). Cement sales volume ~1.87 million tons, +21 % YoY.

PT Solusi Bangun Indonesia Tbk (SMCB) - Laba (net profit) Q3 2025: ~IDR 474.5 billion (~USD 28.5 m) up +12.3 % YoY. Performance supported by disciplined cost control and operational efficiency.

PT Cemindo Gemilang Tbk (CMNT) - Net loss Q3 2025: ~IDR 186.8 billion (~USD 11.2 m) Revenue (9M): ~IDR 6.43 trillion (~USD 386 m) with moderate gross profit. Loss widened compared to prior periods reflects competitive and cost pressures.

PT Waskita Beton Precast Tbk (WSBP) precast & construction materials

PT Wijaya Karya Beton Tbk (WTON) concrete & building materials

PT Cemindo Gemilangs alternative segments impacts overall performance

PT Eco Cement or related subsidiaries regional players in cement distribution

PT Cement-related issuers with building materials exposure certain conglomerate affiliates in building materials distribution

3) Key trends & insights from Q3 2025

Volume & Market Demand

Domestic cement demand remained soft or slightly contracted, with ASI reporting overall domestic cement market decline around -3.1% for 9M2025.

Cement export volumes surged, notably for Indocement, balancing softer domestic demand.

Profitability Pressures

Large players like SMGR faced severe net profit compression with margins pulled down by energy prices and competitive pricing.

Smaller peers like SMBR leveraged regional demand growth, contributing to strong YoY profitability growth.

Operational Efficiency Efforts

Companies invested in alternative fuels (AF) and terminal acquisitions to improve margins and logistics.

Broad Industrial Influence

Industrial peers in basic materials show dispersed earnings, where cement firms often underperformed compared to petrochemical and heavy equipment sectors.

4) Outlook for Q4 2025 and beyond

Demand Recovery Expected

Analysts forecast modest rebound in cement demand in late 2025 linked to infrastructure activities and stable government project pipelines that could lift volumes in Q4.

Export as Buffer

Export markets remain an important growth buffer especially for producers with capacity for international shipments.

Cost & Efficiency Focus

Focus on cost savings (e.g., biomassa/adaptation of alternative fuels, logistics optimization) and diversification of products may support margin recovery.

Capital Markets Expectations

Broker-analyst recommendations suggest selective overweight on cement stocks with expectations of stabilization into early 2026

5) Conclusion

The Indonesian cement industry in Q3 2025 exhibited a mixed performance landscape. While major names like SMGR and INTP navigated weak domestic demand and compressed margins, regional players like Semen Baturaja delivered strong profit growth. Broader sector dynamics point toward gradual recovery with supportive export and infrastructure activity, but cost control and operational effectiveness remain central to future performance.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Cement Public Companies Q3 2025 Revenue & Performance here

News-ID: 4356386 • Views: …

More Releases from QY Research

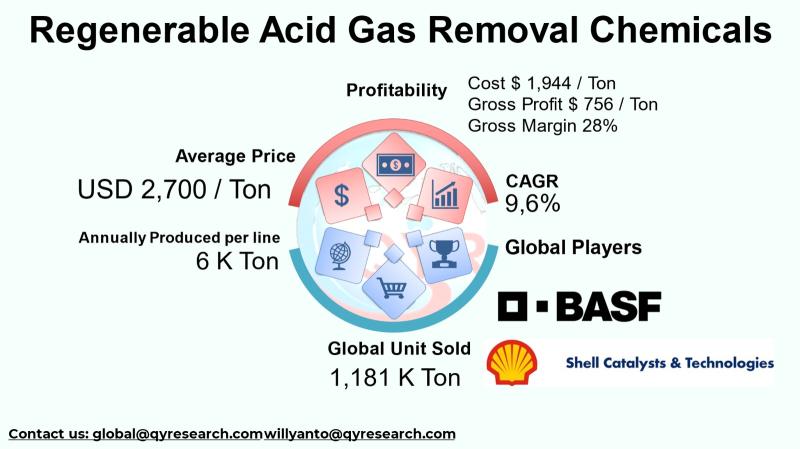

How Technological Breakthroughs are Reshaping Global Acid Gas Removal Markets

The global regenerable acid gas removal chemicals industry plays a critical role in industrial gas purification and emissions control, enabling removal and repeated regeneration of contaminants such as carbon dioxide (CO2), hydrogen sulfide (H2S), sulfur oxides (SOx), and other acidic gases from fossil fuel streams and industrial emissions. Regenerable chemicals are designed to be reused through absorption and desorption cycles, offering cost efficiency and sustainability compared with single-use sorbents. With…

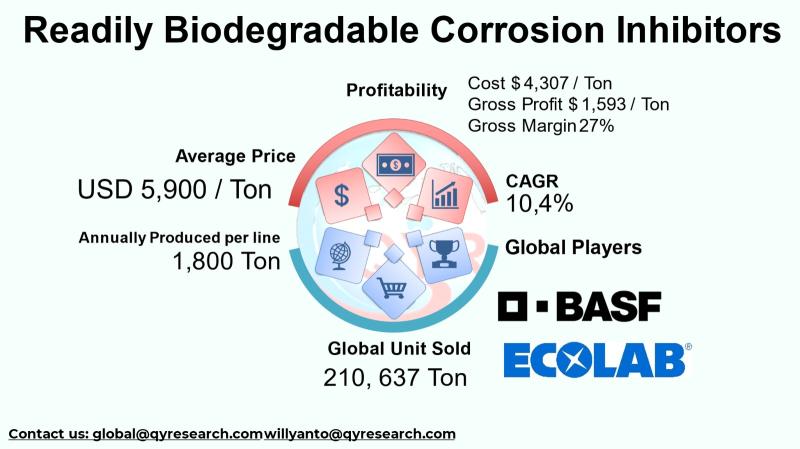

Green Protection, Global Growth: Inside the USD 1,190 Million Biodegradable Corr …

The global market for readily biodegradable corrosion inhibitors represents a dynamic subset of the broader corrosion control chemicals industry, driven by increasing environmental regulations and operator demand for sustainable solutions. Unlike traditional corrosion inhibitors that may persist in ecosystems, these biodegradable alternatives are engineered to break down rapidly in environmental conditions while still providing robust protection against metal degradation in industrial systems. These products are critical in sectors such as…

Fueling Growth: The Global Clean Energy Drinks Market Outlook to 2031 Asia & ASE …

The Clean Energy Drinks industry comprises beverage products formulated to provide a perceived cleaner source of energy compared to traditional energy drinks, often emphasizing natural, low-sugar, organic, plant-based, or transparent ingredient lists. These products align with growing consumer preference for wellness-oriented beverages that offer sustained energy without artificial additives or high sugar content. A strong consumer demand driven by health awareness, urbanization, and lifestyle trends favoring functional nourishment over synthetic…

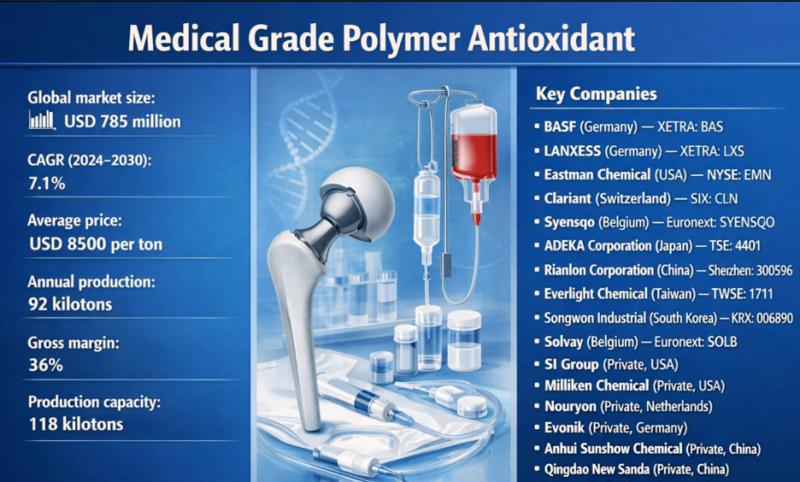

From Degradation to Durability: How Medical-Grade Polymer Antioxidants Transform …

Problem

Abbott Laboratories faced oxidative degradation and material aging during processing, sterilization, and long-term use. High-temperature molding, gamma irradiation, ethylene oxide (EtO), and autoclave sterilization often caused polymer chain scission, discoloration, loss of mechanical strength, and reduced biocompatibility. These issues increased rejection rates, limited device lifespan, and created regulatory challenges for implantable and patient-contact medical products.

Solution

BASF adopted Medical Grade Polymer Antioxidants, highly purified stabilization additives specifically engineered for healthcare applications. These…

More Releases for Tbk

Indonesia Textile Industry Market Valuation Expected to Hit USD 28.57 billion by …

USA, New Jersey: According to Verified Market Research analysis, the global Indonesia Textile Industry Market size was valued at USD 21.7 Billion in 2023 and is projected to reach USD 28.57 Billion by 2031, growing at a CAGR of 3.50% from 2024 to 2031

How AI and Machine Learning Are Redefining the future of Indonesia Textile Industry Market?

AI-powered production planning systems optimize yarn selection, fabric blends, and loom utilization, improving output…

Infrastructure Market 2021 Strategic Assessments - PT. Acset Indonusa Tbk.., Pt. …

The Infrastructure Market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The Infrastructure sector in Indonesia is…

Indonesia Telecom Tower Market Demand, Size, Share, Scope & Forecast To 2025 |To …

The Indonesia telecom tower market accounted to US$ 557.9 Mn in 2017 and is expected to grow at a CAGR of 27.1% during the forecast period 2018 – 2025, to account to US$ 3,695.5 Mn by 2025.

Get Sample Copy of this Indonesia Telecom Tower Market research report at - https://www.businessmarketinsights.com/sample/TIPRE00004113

The Business Market Insights provides you regional research analysis on “Indonesia Telecom Tower Market” and forecast to 2025. The research report…

Coal Mining in Indonesia Market 2022| PT Bumi Resources Tbk, PT Adaro Energy Tbk …

Researchmoz added Most up-to-date research on "Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption" to its huge collection of research reports.

Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption

Summary

GlobalData's "Coal Mining in Indonesia to 2022", provides a comprehensive coverage on Indonesias coal industry. It provides historical and forecast data on coal production by grade, reserves, consumption and exports by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes

Summary

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by type; exports, exports by type and exports by country. Detailed analysis of the…