Press release

Canadian Stocks to Watch for 2026: WRLG - PNPN - DOSE - AMY - Also Trading in the U.S. | More Inside

West Red Lake Gold Mines Ltd. (TSXV: WRLG | OTCQX: WRLGF) declared commercial production at its 100%-owned Madsen Gold Mine in Ontario's Red Lake District effective January 1, 2026, marking a key milestone just seven months after completing a bulk sample. In December 2025, the mill averaged 689 tpd (86% of permitted capacity) with 94.6% recoveries, producing 3,215 oz of gold; Q4 2025 output totaled 7,200 oz poured, sold at an average US$4,150/oz for US$30M in revenue. For full-year 2025, Madsen poured 20,000 oz for US$73M in sales and ended the year with C$46M in cash and gold receivables, while Q1 2026 feed is expected to average >6 g/t Au from the high-grade 4447 zone as the company targets sustained permitted capacity by mid-2026.Power Metallic Corp. (TSXV: PNPN | OTCQB: PNPNF) provides exposure to critical and battery metals tied to EVs, energy storage, and advanced manufacturing. Recent exploration progress has kept the stock active, with platinum group element (PGE) potential cited as a notable upside driver across its project portfolio. Over the last 30 days, shares rebounded from C$0.77 in mid-December to C$1.52 on Friday, Jan. 16, 2026. The company has also filed to uplist on the NYSE, adding a potential visibility catalyst heading into 2026.

Rapid Dose Therapeutics Corp. (CSE: DOSE | OTC: RDTCF) is a Canadian life sciences company focused on proprietary oral drug-delivery technologies designed to improve absorption and patient compliance. The stock is followed for licensing agreements, commercialization initiatives, and strategic partnerships, and has gained ~23% over the last 30 days, reflecting renewed investor interest.

RecycLiCo Battery Materials Inc. (TSXV: AMY | OTCQB: AMYZF) recently announced that construction permits have been approved for its new research and process-development laboratory in Delta, British Columbia. With design completed and early construction preparation underway, the project is now scaling toward substantial completion in early 2026. The new facility is expected to support commercialization readiness and advance RecycLiCo's hydrometallurgical technologies that recover battery-grade lithium, cobalt, nickel, and manganese from mined ore and end-of-life lithium-ion batteries.

Toogood Gold Corp. (TSXV: TGC | OTCQB: TGGCF) delivered final drilling assays from its 100%-owned Toogood Gold Project in Newfoundland, confirming a large, coherent gold system with gold intersected in all 30 drill holes completed to date. Highlights included a 29.31-meter intercept grading 2.20 g/t gold, expanded strike length to ~350 meters, and a doubled down-dip extent to ~240 meters. First-ever drilling at the Melange Contact achieved a 100% gold hit rate, unlocking more than 15 kilometers of district-scale exploration potential heading into 2026.

Also Watch: U.S.-Traded Stocks with Canadian Mining and Other Interests

Brookmount Gold Ltd. (OTC: BMXI) reported continued progress on its North American asset spinoff, transferring three gold properties in Canada and Alaska into a new subsidiary, North American Gold (NAG). Capitalized with 20 million shares-35% earmarked for distribution to BMXI shareholders-the assets carry NI 43-101 compliant resources exceeding US$100 million. Management is targeting U.S. underwriter meetings and a potential mid-2026 listing, positioning the spinoff as a near-term value-unlocking catalyst.

Clifton Mining Company (OTC: CFTN) owns extensive mining claims in Utah's Gold Hill/Clifton Mining District, covering ~14,027 acres across patented and unpatented claims. The company focuses on property management through leasing and joint ventures targeting gold and silver. Shares have doubled over the last 30 days, rising from $0.09 in mid-December 2025 to $0.18 on Friday, Jan. 16, 2026.

Karbon-X Corp. (OTCQX: KARX) Karbon-X Corp. operates a vertically integrated carbon-reduction platform spanning project origination, verification, credit issuance, and trading. The company targets growing demand for verified carbon offsets from individuals and corporations and recently gained broader U.S. visibility through a CEO interview aired on major financial networks, supporting increased awareness. See Entire Interview Now [https://www.theglobeandmail.com/investing/markets/markets-news/GetNews/36460803/karbonx-corp-otcqx-karx-nyse-interviews-to-air-on-bloomberg-fox-business-and-other-us-networks-accelerating-national-visibility/].

Bottom line: From critical minerals and battery recycling to gold exploration and carbon markets, these Canadian-linked names are showing price momentum, operational catalysts, and visibility drivers that investors are watching closely as 2026 approaches.

Disclaimers: The Private Securities Litigation Reform Act of 1995 provides investors with a safe harbor with regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, assumptions, objectives, goals, and assumptions about future events or performance are not statements of historical fact and may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties that could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements, indicating certain actions & quotes; may, could or might occur Understand there is no guarantee past performance is indicative of future results. Investing in micro-cap or growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor's investment may be lost or due to the speculative nature of the companies profiled. TheStreetReports (TSR) is responsible for the production and distribution of this content."TSR" is not operated by a licensed broker, a dealer, or a registered investment advisor. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. "TSR" authors, contributors, or its agents, may be compensated for preparing research, video graphics, podcasts and editorial content. "TSR" has not been compensated to produce content related to "Any Companies" appearing herein. As part of that content, readers, subscribers, and everyone viewing this content are expected to read the full disclaimer in our website.

Media Contact

Company Name: The Street Reports

Contact Person: Editor

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=canadian-stocks-to-watch-for-2026-wrlg-pnpn-dose-amy-also-trading-in-the-us-more-inside]

Country: United States

Website: http://www.thestreetreports.com

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Canadian Stocks to Watch for 2026: WRLG - PNPN - DOSE - AMY - Also Trading in the U.S. | More Inside here

News-ID: 4356190 • Views: …

More Releases from ABNewswire

Aether Holdings, Inc. (NASDAQ: ATHR): Turning Investor Attention Into Actionable …

Retail participation is quietly rebuilding momentum in early 2026. Trading activity across equities and digital assets is increasing, speculative interest is returning, and investor attention is spreading across more platforms, newsletters, and social channels than ever before. Yet while participation is rising, signal quality remains uneven. Investors face more data, more commentary, and more noise, but not necessarily better insight.

That gap between participation and actionable intelligence is becoming increasingly visible.…

Riverhouse Hospitality Celebrates Milestones, Maritime Legacy, and a Continued C …

Riverhouse Hospitality, one of Connecticut's premier hospitality and event groups, is celebrating a series of major milestones that underscore its long-standing commitment to quality, craftsmanship, and the preservation of historic venues across the state.

The company's latest expansion, Riverhouse Cruises, marks a new chapter in Riverhouse Hospitality's mission to create unforgettable experiences rooted in Connecticut's history and natural beauty. Anchored by the iconic Lady Kate, Riverhouse Cruises continues a proud maritime…

SendTurtle Introduces eSignature Upgrade with Cleaner Interface and Dedicated Ap …

SendTurtle launches an upgraded eSignature experience with a cleaner UI and a dedicated app section, built directly from user feedback to streamline signing workflows.

Arlington, VA - January 20, 2026 - SendTurtle, the smart eSignature and secure deal productivity platform, announced today a major upgrade to its eSignature experience. The update introduces a cleaner, more intuitive user interface and places eSignature into its own dedicated section of the SendTurtle app, making…

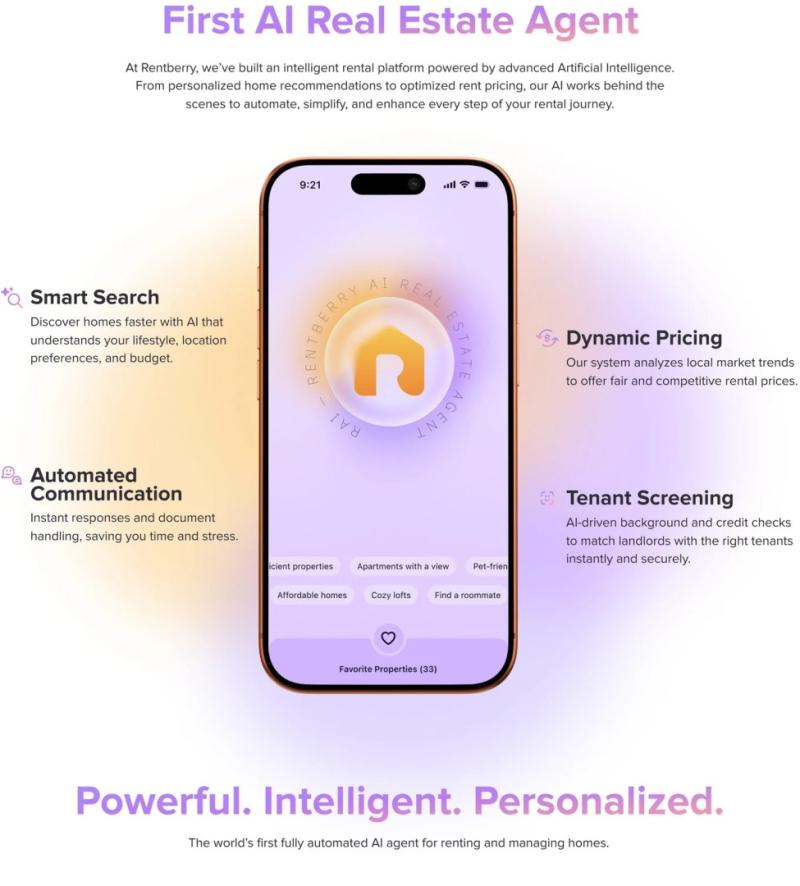

Top 5 AI-Driven Real Estate Platforms Disrupting the $13T Housing Market in 2026

Image: https://www.abnewswire.com/upload/2026/01/35142e24cce839d1166c5cf252dd2c14.jpg

The global real estate industry is undergoing a seismic transformation fueled by cutting-edge artificial intelligence. In 2026, several platforms stand out for their innovative use of AI to improve efficiency, transparency, and user experience. Here is our list of the top five AI-driven real estate platforms disrupting the market and why one of them is truly leading the charge.

1. Rentberry: The AI-Powered Unicorn Nearing Its NASDAQ Debut

Founded in 2015,…

More Releases for Gold

Gold Concentrate Market Is Going to Boom | Major Giants - Barrick Gold, Gold Fie …

HTF MI just released the Global Gold Concentrate Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Manufacturers are covered:

Barrick Gold (CAN), Newmont (US), AngloGold Ashanti…

Gold Mining Market - Key Players & Qualitative Insights 2025 | Gold Corp, Barric …

Global Gold Mining Market: Overview

A variety of techniques are typically used to obtain gold from gold ores in the ground. They are: placer mining, sluicing, gold panning, dredging, hard-rock mining, rocker box, and by product mining. Gold mining has been carried out since ages and is a flourishing market even today. The high demand for gold as a potential mode of investment and the use of gold for making jewelry…

Gold Mining Market key players 2017-2025 : Gold Corp, Barrick Gold, and Newcrest …

Global Gold Mining Market: Overview

A variety of techniques are typically used to obtain gold from gold ores in the ground. They are: placer mining, sluicing, gold panning, dredging, hard-rock mining, rocker box, and by product mining. Gold mining has been carried out since ages and is a flourishing market even today. The high demand for gold as a potential mode of investment and the use of gold for making jewelry…

Global Gold Mining Market to 2025: Newmont Mining, Gold Reserve, Royal Gold, Hom …

Researchmoz added Most up-to-date research on "Global Gold Mining Market Insights, Forecast to 2025" to its huge collection of research reports.

This report researches the worldwide Gold Mining market size (value, capacity, production and consumption) in key regions like North America, Europe, Asia Pacific (China, Japan) and other regions.

This study categorizes the global Gold Mining breakdown data by manufacturers, region, type and application, also analyzes the market status, market share, growth…

Gold Metals Market Demands with Major Quality Things: Pure Gold, Mixed Color Gol …

Gold Metals Market By Product (Pure Gold, Mixed Color Gold, Color Gold and Other Products) and Application (Luxury Goods, Automotive, Electronics and Other Applications) - Global Industry Analysis And Forecast To 2025.

Industry Outlook:

The gold is an element having the symbol Au (from the Latin name: aurum) and the atomic number been 79, making it the element with higher atomic number that happen normally. In the most pure form, it is…

Gold Mining Market Highlights On Product Demand 2025 | Gold Corp, Barrick Gold

Global Gold Mining Market: Overview

A variety of techniques are typically used to obtain gold from gold ores in the ground. They are: placer mining, sluicing, gold panning, dredging, hard-rock mining, rocker box, and by product mining. Gold mining has been carried out since ages and is a flourishing market even today. The high demand for gold as a potential mode of investment and the use of gold for making jewelry…