Press release

Digital Payments Market to Reach US$ 22,300 Billion by 2032 at 12.9% CAGR; Asia Pacific Leads with 38% Share | Key Players Visa, Mastercard, PayPal

The Digital Payments Market reached US$ 8,450 billion in 2024 and is expected to reach US$ 22,300 billion by 2032, growing at a CAGR of 12.9% during the forecast period 2025-2032. The market is expanding rapidly as consumers and businesses increasingly shift toward cashless transactions driven by convenience, speed, and enhanced security across online and offline payment ecosystems.Growth is supported by the widespread adoption of smartphones, rising e-commerce penetration, and the expansion of real-time payment infrastructure across emerging and developed economies. Advancements in AI-based fraud detection, contactless payments, digital wallets, and blockchain-enabled transactions are improving trust and efficiency. Additionally, government initiatives promoting financial inclusion and digital economies are accelerating the adoption of digital payment solutions across retail, banking, healthcare, and transportation sectors.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/digital-payment-market?sai-v

Digital Payments Market is the global market for electronic payment technologies and platforms that enable cashless transactions through cards, mobile wallets, online banking, and real-time payment systems.

Key Developments

✅ January 2026: In the United States, financial institutions and fintech companies expanded real-time and embedded digital payment capabilities, integrating AI-driven fraud detection and tokenization to enhance transaction security and customer experience.

✅ January 2026: In Europe, regulatory alignment with open banking frameworks accelerated adoption of instant payments, digital wallets, and account-to-account payment solutions across retail and enterprise segments.

✅ January 2026: In Japan, payment service providers advanced cashless ecosystems through expanded QR code payments, contactless cards, and mobile wallet interoperability.

✅ December 2025: In the United States, rising e-commerce volumes and subscription-based business models increased demand for seamless digital payment processing and cross-platform payment integration.

✅ December 2025: In Asia-Pacific, rapid growth of mobile commerce and super-app ecosystems supported wider adoption of digital wallets and real-time payment infrastructure.

✅ November 2025: In Europe, increased focus on cross-border digital payments drove enhancements in interoperability, settlement speed, and compliance capabilities.

Mergers & Acquisitions

✅ January 2026: In the United States, a global payment technology provider acquired a fintech specializing in embedded payments and APIs to strengthen its merchant services portfolio.

✅ December 2025: In Europe, a digital payments company completed the acquisition of a cross-border payments platform to expand international transaction capabilities.

✅ December 2025: In Japan, a financial services group strengthened its cashless payment offerings through the acquisition of a mobile wallet technology provider.

✅ October 2025: In Asia-Pacific, a fintech conglomerate acquired a regional digital payments startup to enhance mobile payment reach and financial inclusion initiatives.

Key Players

Mastercard | Google | Amazon | Alipay | Visa | PayPal | ACI Worldwide | Aurus | Apple Pay | Paysafe | Others

Key Highlights

Visa and Mastercard dominate the ecosystem through their global card networks, extensive merchant acceptance, and strong partnerships with banks and fintech platforms.

PayPal remains a leading digital wallet and online payments provider, driven by strong adoption in e-commerce, peer-to-peer payments, and cross-border transactions.

Alipay plays a critical role in the Asia-Pacific market, supported by its deep integration with Alibaba's ecosystem and widespread usage in mobile and QR-code payments.

Apple Pay and Google Pay continue to expand contactless and mobile payment adoption, leveraging smartphone penetration, secure tokenization, and seamless user experience.

Amazon strengthens its position through embedded payment solutions, one-click checkout capabilities, and integration across its global e-commerce platforms.

ACI Worldwide and Aurus focus on enterprise-grade payment processing, real-time payments, and omnichannel transaction management for banks and merchants.

Paysafe addresses niche and high-growth segments, including digital wallets, alternative payments, online gaming, and cross-border commerce.

Others include emerging fintech players and regional payment service providers enhancing competition through innovations in real-time payments, BNPL, and digital wallets.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=digital-payment-market?sai-v

Market Drivers

- Rapid growth in e-commerce and mobile commerce driving demand for secure, convenient digital payment solutions.

- Increasing smartphone penetration and expanding internet connectivity facilitating mobile wallet and UPI usage.

- Rising consumer preference for contactless payments due to convenience, speed, and hygiene concerns.

- Strong investments in fintech innovations, blockchain, and secure digital payment infrastructure.

- Supportive government initiatives and regulatory frameworks promoting cashless economies and financial inclusion.

Industry Developments

- Launch of next-generation digital wallets, QR-based payments, and real-time payment platforms.

- Integration of AI, machine learning, and biometrics for enhanced fraud detection and secure authentication.

- Strategic partnerships among banks, fintech firms, payment networks, and merchants to expand acceptance and interoperability.

- Introduction of buy-now-pay-later (BNPL), tokenization, and value-added services integrated with digital payments.

- Growing adoption of cross-border payment solutions and APIs for seamless global transactions.

Regional Insights

Asia Pacific - 38% share: "Driven by massive digital payment adoption, government-led financial inclusion initiatives, rapid surge in UPI and mobile wallets, and expanding fintech ecosystem."

North America - 32% share: "Supported by high e-commerce penetration, advanced payment infrastructure, strong consumer credit usage, and innovation in contactless and mobile pay."

Europe - 22% share: "Fueled by robust PSD2 frameworks, growth in digital banking, and rising adoption of contactless and open banking payments."

Latin America - 5% share: "Driven by expanding acceptance networks, rising mobile money usage, and growing e-commerce transactions."

Middle East & Africa - 3% share: "Supported by government digitization programs, mobile wallet growth, and expanding financial services access."

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/digital-payment-market?sai-v

Key Segments

By Component

Solutions hold the largest share of the market, driven by widespread adoption of integrated payment platforms, transaction processing software, fraud detection, and analytics tools. Services are gaining strong traction as organizations increasingly rely on consulting, system integration, maintenance, and managed services to ensure secure and seamless payment operations.

By Mode of Payment

Point of sales remains a dominant segment, supported by extensive use in retail, hospitality, and physical commerce environments. Digital wallets are experiencing rapid growth, driven by rising smartphone penetration, convenience, and contactless payment adoption. Bank cards continue to represent a significant share due to their global acceptance and established infrastructure. Digital currencies are an emerging segment, gaining attention as blockchain-based payments evolve. Net banking maintains steady adoption for high-value and business transactions, while other payment modes contribute through niche and region-specific solutions.

By Deployment

Cloud-based deployment dominates the market, driven by scalability, flexibility, lower upfront costs, and ease of integration with digital ecosystems. On-premises deployment continues to be preferred by organizations with strict data security, compliance, and customization requirements.

By Organization Size

Large enterprises account for a major share, supported by high transaction volumes and complex payment needs across multiple channels. Small and medium-sized enterprises are witnessing strong growth, driven by increasing digitalization, affordability of cloud-based solutions, and expanding e-commerce adoption.

By End-User

Banking, financial services, and insurance represent the largest end-user segment, driven by continuous innovation in digital payments and financial services. Retail and e-commerce hold a substantial share due to omnichannel commerce expansion. Healthcare is growing steadily as digital payments simplify billing and patient transactions. Transportation, travel and hospitality, media and entertainment, and transportation and logistics are expanding rapidly, supported by digital ticketing, subscriptions, and on-demand services. Other end users contribute through diverse industry-specific payment applications.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Payments Market to Reach US$ 22,300 Billion by 2032 at 12.9% CAGR; Asia Pacific Leads with 38% Share | Key Players Visa, Mastercard, PayPal here

News-ID: 4355618 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

Control Moment Gyroscope (CMG) Market Growth Analysis (2026-2033) | Asia-Pacific …

Market Size and Growth

control moment gyroscope (CMG) market to reached US$ 1.58 billion in 2024, rising to US$ 1.70 billion in 2025, and is expected to reach US$ 3.05 billion by 2033, growing at a strong CAGR of 7.58% during the forecast period from 2026 to 2033

✅ Asia-Pacific is expected to be the fastest-growing region in the Control Moment Gyroscope (CMG) Market, accounting for approximately 29.5% of the market by…

Future of North & Central America Medical Ambulances Market (2026 ): Holds High …

Market Size and Growth

North & Central America Medical Ambulances Market size to hit at a CAGR during the forecast period 2024-2031

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/north-and-central-america-medical-ambulances-market?kb

North & Central America Medical Ambulances Market is a vital segment of the emergency medical services (EMS) ecosystem, encompassing ground ambulances, air ambulances, and associated equipment/services for transporting patients in medical emergencies and non-emergency scenarios.…

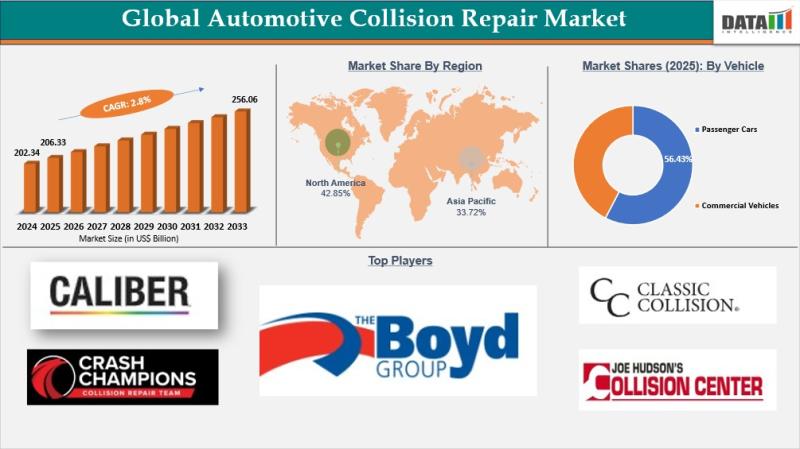

Automotive Collision Repair Market to Reach USD 256.06 Billion by 2033 at 2.8% C …

The Automotive Collision Repair Market was valued at USD 202.34 billion in 2024, rising to USD 206.33 billion in 2025, and is projected to reach USD 256.06 billion by 2033, growing at a CAGR of 2.8% during the forecast period from 2026 to 2033. Market growth is primarily driven by increasing global vehicle ownership, rising traffic congestion, and the continued incidence of road accidents that elevate demand for professional repair…

United States Food Robotics Market Witness to Reach US$ 5.22 Billion by 2032 at …

Market Size and Growth

Food Robotics Market reached US$ 1.95 Billion in 2024 and is expected to reach US$ 5.22 Billion by 2032, growing with a CAGR of 13.1% during the forecast period 2024-2032.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://datamintelligence.com/download-sample/food-robotics-market?kb

The Food Robotics Market is rapidly transforming how food is processed, packaged, and even served, bringing efficiency, precision, and hygiene to an…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…