Press release

Open Banking Market Forecast for Explosive Growth to USD 129.8 Billion by 2030 at 25.7% CAGR, Anchored by Europe's Leadership | DataM Intelligence

The Open Banking Market reached USD 20.9 billion in 2022 and is expected to reach USD 129.8 billion by 2030, growing with a CAGR of 25.7% during the forecast period 2023-2030.Market growth is driven by increasing demand for personalized financial services, regulatory mandates like PSD2 in Europe and similar frameworks globally, and the rise of fintech innovations enabling seamless data sharing. Advancements in APIs, growing adoption of embedded finance, expanding partnerships between banks and tech firms, and heightened consumer expectations for real-time financial insights are further accelerating market expansion.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/open-banking-market?ram

Europe: Key Industry Developments

✅ October 2025: Eurozone banks became mandated to send SEPA Instant Credit Transfers, enhancing open banking interoperability for real-time A2A payments and boosting adoption of payment initiation services across the EU.

✅ July 2025: The European Commission advanced PSD3 negotiations with a compromise text, refining open banking APIs for better security, standardized Verification of Payee, and smoother third-party data access.

✅ January 2025: EU banks were required to receive SEPA Instant payments at no extra cost, accelerating open banking use cases like embedded finance and fraud prevention via instant account verification.

United States: Key Industry Developments

✅ December 2025: Plaid expanded its open banking API platform with enhanced data aggregation features for fintech apps, enabling real-time transaction insights and improved fraud detection amid rising CFPB regulatory support for consumer data access.

✅ October 2025: Visa launched its Visa Open Banking Network initiative, partnering with major US banks to standardize account-to-account payments and accelerate A2A adoption for e-commerce and P2P transfers.

✅ August 2025: The CFPB finalized new rules mandating banks to share customer data via secure APIs upon request, boosting interoperability and spurring fintech innovation in lending and wealth management services.

Key Mergers and Acquisitions(2025 - 26):

✅ Global Payments solidified payments leadership with its $24.25 billion proposed acquisition of Worldpay, enhancing open banking integration capabilities and transaction processing scale.

✅ FIS advanced its fintech portfolio through the proposed $13.5 billion acquisition of Global Payments' Issuer Solutions business, targeting open banking payment infrastructures.

✅ Capital One completed its $35.3 billion acquisition of Discover in May 2025, expanding open banking-enabled credit and digital payment ecosystems.

Market Segmentation Analysis:

-By Service: Payment Initiation Services Dominate Transaction Volumes

Payment initiation services lead with 45% share in 2024, enabling seamless P2P transfers and bill payments via APIs for fintech apps.

Account information services hold 30%, powering aggregation of financial data for budgeting and credit scoring.

Open data services claim 25%, supporting personalized insights and analytics for banks and third-party providers.

-By Deployment: Cloud-Based Leads for Scalability

Cloud deployment captures 55% market share, offering flexible, cost-effective integration and rapid scaling for global banks.

On-premises follows at 30%, preferred by large institutions prioritizing data security and regulatory compliance.

Hybrid models take 15%, blending cloud agility with on-site control for balanced operations.

-By Distribution Channel: Mobile Apps Drive User Adoption

Mobile apps command 50% share, leveraging smartphone ubiquity for instant banking access and high engagement.

Web portals hold 35%, favored for desktop-based comprehensive services in corporate banking.

APIs account for 15%, fueling B2B integrations for embedded finance solutions.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=open-banking-market?ram

Growth Drivers:

-Regulatory Support

Government regulations like PSD2 in Europe mandate API openness, spurring competition and innovation among banks and fintechs.

-Customer Engagement

Open banking APIs enhance user experiences through personalized services, boosting adoption via seamless app integrations.

-Fintech Collaborations

Partnerships between banks and fintechs accelerate new product launches, such as embedded finance solutions.

-Digital Payment Demand

Rising need for instant, low-cost payments drives the payments segment, with open APIs enabling direct transfers.

-Consumer Demand

Increasing preference for digital financial services and transparency propels market penetration globally.

Regional Insights:

-Europe leads the global Open Banking market with the largest revenue share of 36.4% in 2024, driven by mandatory PSD2 regulations and widespread API adoption across major financial institutions. The U.K. dominates within the region, supported by strong fintech ecosystems and regulatory mandates fostering innovation in payment initiation and account aggregation.

-North America holds a significant share of approximately 28% of the global market, propelled by major banks like JPMorgan Chase and Bank of America embracing open APIs and platform models. The United States leads regional growth through partnerships with fintechs and developer portals enhancing customer experiences.

-Asia Pacific accounts for around 20% of the market and emerges as the fastest-growing region due to rapid fintech expansion and supportive policies in countries like China, India, and Japan. Rising digital payment demands and local regulatory frameworks fuel adoption amid increasing smartphone penetration.

-Latin America and Middle East & Africa together represent roughly 13% of the global share, with steady growth potential from fintech booms in Brazil and emerging frameworks promoting financial inclusion. Brazil drives South American demand, while the Middle East benefits from new regulations enhancing competition and transparency.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/open-banking-market?ram

Key Players:

Banco Bilbao Vizcaya Argentaria S.A. | Plaid Inc. | TrueLayer Ltd. | Finleap Connect | Finastra | Tink | Jack Henry & Associates, Inc. | Mambu | MuleSoft | NCR Corporation

Key Highlights (Top 5 Key Players) for Open Banking Market:

-Plaid Inc. provides a data connectivity platform that enables secure aggregation of consumer bank account data for fintech apps, powering payments, lending, and personal finance tools across thousands of financial institutions.

-TrueLayer Ltd. offers an open banking API gateway for real-time payments, account information services, and payouts, supporting developers in building compliant financial experiences in Europe and beyond.

-Tink delivers a unified open banking platform that connects apps to over 6,000 European banks, facilitating account verification, transaction insights, and payment initiation for e-commerce and fintechs.

-Finastra develops open banking solutions including APIs and orchestration layers that help banks expose data and services securely, enabling partnerships with third-party providers for enriched customer experiences.

-Mambu provides a cloud-native core banking platform with composable open banking APIs, allowing financial institutions to integrate payment initiation, account aggregation, and embedded finance capabilities rapidly.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription?ram

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Open Banking Market Forecast for Explosive Growth to USD 129.8 Billion by 2030 at 25.7% CAGR, Anchored by Europe's Leadership | DataM Intelligence here

News-ID: 4355264 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

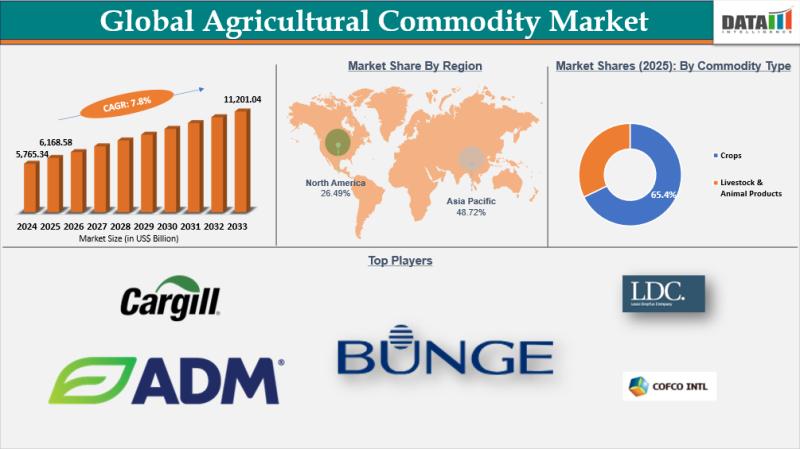

United States Agricultural Commodity Market to Grow US$ 11,201.04 billion by 203 …

Market Size and Growth

agricultural commodity market reached US$ 5,765.34 billion in 2024, rising to US$ 6,168.58 billion in 2025 and is expected to reach US$ 11,201.04 billion by 2033, growing at a strong CAGR of 7.8% during the forecast period from 2026 to 2033.

In 2025, the Asia-Pacific region led the global agricultural commodity market, capturing a 48.72% revenue share, fueled by its large population, robust food demand, extensive agricultural infrastructure,…

Astaxanthin Market to Grow US$ 3.47 Billion by 2033 | Growth Drivers, Trends & M …

Market Size and Growth

astaxanthin market was valued at US$ 1.61 Billion. The global Astaxanthin market size reached US$ 1.73 Billion in 2024 and is expected to reach US$ 3.47 Billion by 2033, growing at a CAGR of 8.1% during the forecast period 2025-2033.

Download Free Sample PDF Report (Get Higher Priority for Corporate Email ID):- https://datamintelligence.com/download-sample/astaxanthin-market?kb

astaxanthin a powerhouse antioxidant that's not just a pretty face in nature but a rising star…

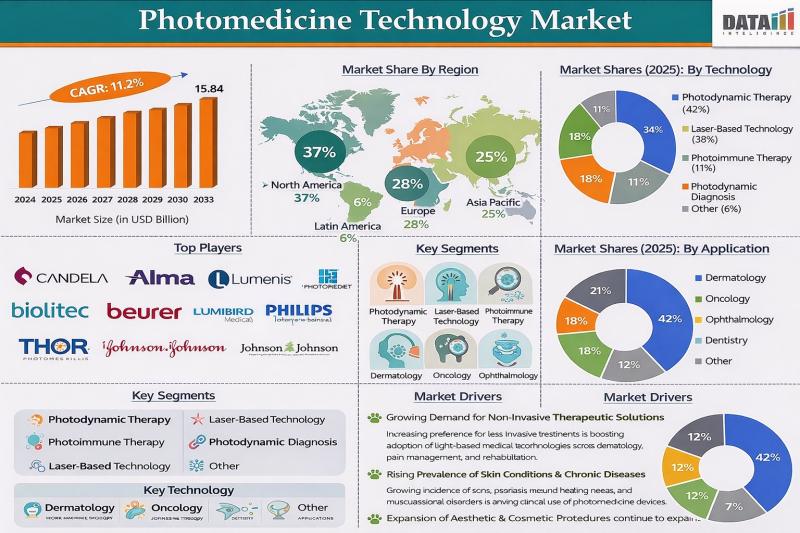

Photomedicine Technology Market to Reach USD 15.84 Billion by 2033 at 11.2% CAGR …

The Photomedicine Technology Market was valued at USD 6.25 billion in 2024 and is projected to reach USD 15.84 billion by 2033, expanding at a CAGR of 11.2% during the forecast period from 2025 to 2033. This rapid growth is driven by rising demand for non-invasive diagnostic and therapeutic solutions across dermatology, oncology, ophthalmology, and pain management. Photomedicine technologies, such as low-level laser therapy, photodynamic therapy, intense pulsed light systems,…

United States Pest Control Market Trends 2026 | IPM, Biocontrol, and Chemical So …

Market Size and Growth

Pest Control Market is expected to grow at a CAGR of 4.5% during the forecasting period (2024-2031).

Download Free Sample PDF Report (Get Higher Priority for Corporate Email ID):- https://datamintelligence.com/download-sample/pest-control-market?kb

Pest control refers to the management and elimination of unwanted insects, rodents, and other pests in residential, commercial, and agricultural settings. Advanced methods combine chemical treatments, biological solutions, and integrated pest management (IPM) to ensure safety, efficiency, and…

More Releases for API

API Management Market Size, Trends Analysis 2032 by Key Vendors- Google, Cloud A …

USA, New Jersey: According to Verified Market Research analysis, the global API Management Market size was valued at USD 4.37 Billion in 2024 and is projected to reach USD 33.07 Billion by 2032, growing at a CAGR of 28.77% from 2026 to 2032.

What is the current outlook of the API Management Market and its expected growth potential?

The API Management Market is witnessing robust expansion due to the growing need…

Api 607 Vs API 608: A Comprehensive Comparison Guide Of Industrial Valve

Introduction: Why are API standards so important for industrial valves?

In high-risk industries such as oil and gas, chemicals and power, the safety and reliability of valves can directly affect the stability of production systems. The standards set by API (American Petroleum Institute) are the technical bible of industrial valves around the world. Among them, API 607 and API 608 are key specifications frequently cited by engineers and buyers.

This article will…

Vehicle API Market 2023 | Futuristic Technology- CarAPI, Caruso, One Auto API, A …

The Vehicle API market research report delivers accurate data and innovative corporate analysis, helping organizations of all sizes make appropriate decisions. The Vehicle API report also incorporates the current and future global market outlook in the emerging and developed markets. Moreover, the report also investigates regions/countries expected to witness the fastest growth rates during the forecast period.

The Vehicle API research report also provides insights of different regions that are…

Face Recognition API Market Growth, Business Overview 2023, and Forecast to 2030 …

Facial recognition is a way of recognizing a human face through technology. A facial detection system uses biometrics to map facial features from a photograph or video. It compares information with a database of known faces to find a match. Moreover, the accuracy of facial recognition systems has improved way better in the last decade. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger,…

API Management Market Report 2018: Segmentation by Solution (API Portal, API Gat …

Global API Management market research report provides company profile for Akana, Inc. (U.S.), Apiary, Inc. (U.S.), Axway, Inc. (France), CA Technologies, Inc. (U.S.), Cloud Elements, Inc. (U.S.), Dell Boomi, Inc. (U.S.), DigitalML (U.S.), Fiorano Software, Inc. (U.S.), Google, Inc. (U.S.), Hewlett-Packard Enterprises Co. (U.S.), IBM Corporation (U.S.), Mashape Inc. (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical…

Telecom API Market: OTT Service Providers Continue Cutting into Telecom API Prof …

The highly fragmented market of telecom API holds a staggering number of service providers and aggregators that are already offering their APIs to various telecom carriers. Alcatel Lucent, Apigee Corp., and Fortumo OU were the leading providers of telecom API from a global perspective in 2014. Telecom carriers have partnered with them and other prominent players in the past to launch APIs in the market.

According to Transparency Market Research’s latest…