Press release

Corporate Lending Market Global Opportunity Analysis and Industry Forecast, 2021 - 2031

Allied Market Research published a report, titled, "Corporate Lending Market by Loan Type (Term Loan, Overdraft, Invoice Finance, Loan Against Securities, Others), by Type (Secured Lending, Unsecured Lending), by Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises), by Provider (Banks, NBFCs, Credit Unions): Global Opportunity Analysis and Industry Forecast, 2021- 2031" According to the report, the global corporate lending industry generated $17.6 trillion in 2021, and is estimated to reach $47.2 trillion by 2031, witnessing a CAGR of 10.7% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, key investment pockets, value chain, regional landscape, and competitive scenario.Download Sample Report @ https://www.alliedmarketresearch.com/request-sample/13325

Drivers, Restraints, and Opportunities

Flexible long-term lending offered by corporate lending options, the faster processing and sanctioning of loans by corporate lending options, increasing collaboration between digital lending organizations and FinTech companies for payment collection, and corporate lending's benefit of allowing small firms and green lending company to access substantial sums of money by aggregating all their funding into one loan drive the growth of the global corporate lending market. However, non-performing assets (NPA), especially during the pandemic hampered the global market growth. On the other hand, developing economies increasingly digitizing various banking operations, advancements in smartphones, and the growing adoption of digital lending services among euro lending company present new growth opportunities for the global market in the coming years.

Covid-19 Scenario

The COVID-19 pandemic impacted the corporate lending industry positively, owing to an increase in corporate loans as most businesses went bankrupt.

Moreover, many banks were overburdened by the increase in corporate loans during the pandemic as firms sought financing. Moreover, the pandemic also resulted in the financial industry's enhanced attention on digital services as well as their demand from customers.

Owing to the closure of bank offices and significant wait times for phone help, previously hesitant internet users also adopted these channels for corporate loans during the pandemic. This factor became one of the major growth factors for the corporate lending market during the period.

The term loan segment to maintain its revenue dominance during the forecast period

Based on loan type, the term loan segment was the largest market in 2021, contributing to nearly half of the global corporate lending market, and is expected to maintain its leadership status during the forecast period. This is because term loans generally carry no penalties if they are paid off ahead of schedule. They are also offered at lower interest rates which attracts corporates to choose it. The interest rates are fixed, and do not vary during the loan's lifetime. On the other hand, the loan against securities segment is projected to witness the fastest CAGR of 14.7% from 2022 to 2031. This is because loan against securities of any kind is secured and has a lower interest rate than most unsecured loans and credit cards.

The secured lending segment to maintain its dominance during the forecast period

Based on type, the secured lending segment held the largest market share of nearly three-fourths of the global corporate lending market in 2021 and is expected to maintain its dominance during the forecast period. Rise in real estate industry in recent years boosted the need for secured loans in finance. Customers opting for loans to purchase new properties for the expansion of business aided the growth of the market. On the other hand, the unsecured lending segment is projected to witness the largest CAGR of 13.6% from 2022 to 2031. Businesses are increasingly opting for unsecured lending to get quick loan approval and save time for paperwork. This is primarily due to the widespread use of credit bureau ratings, as well as high moral responsibility of borrowers not to default, and the use of data analytics in underwriting and credit monitoring.

The large enterprises segment to garner the largest revenue during the forecast period

Based on enterprise size, the large enterprises segment was the largest market in 2021, contributing to more than three-fifths of the global corporate lending market, and is expected to maintain its leadership status during the forecast period. This is because large enterprises are opting for corporate loans to expand their businesses and improve the cash flow. In addition, they mostly choose business loans to acquire other firms for business expansion. On the other hand, the small and medium-sized enterprises segment is projected to witness the fastest CAGR of 13.2% from 2022 to 2031. The surge in entrepreneurs, either aspiring to set up a new business or modify and expand a current establishment is boosting the segmental growth.

Interested in Procuring the Data? Inquire Here (Get Full Insights in PDF - 276 Pages) @ https://www.alliedmarketresearch.com/purchase-enquiry/13325

Asia-Pacific to achieve a progressive revenue growth by 2031

Based on region, Asia-Pacific was the largest market in 2021, capturing two-fifths of the global corporate lending market. The lending processes in Asia-Pacific banks implement unprecedented number of loan deferrals, payment holidays and government guarantee using rapidly installed technology such as FinTech, Machine Learning and others to fasten the process of loan approvals. However, the market in LAMEA is expected to lead in terms of revenue and manifest the fastest CAGR of 13.8% during the forecast period. New-age FinTech players in the LAMEA region are capturing SME businesses with their shorter, faster, and transparent loan approval processes.

Leading Market Players

Morgan Stanley

UBS

Ashurst

Citigroup, Inc.

CREDIT SUISSE GROUP AG

GOLDMAN SACHS

JULIUS BAER

Bank of America Corporation

Clifford Chance

JPMorgan Chase & Co.

Trending Reports:

South Africa Asset-based Lending Market https://www.alliedmarketresearch.com/south-africa-asset-based-lending-market-A74622

Mobile Travel Booking Market https://www.alliedmarketresearch.com/mobile-travel-booking-market-A07603

Advanced Authentication in Financial Services Market https://www.alliedmarketresearch.com/advanced-authentication-in-financial-services-market-A11870

Unsecured Business Loans Market https://www.alliedmarketresearch.com/unsecured-business-loans-market-A15157

Saudi Arabia Personal Loan Market https://www.alliedmarketresearch.com/saudi-arabia-personal-loan-market-A74407

RPA in Insurance Market https://www.alliedmarketresearch.com/rpa-in-insurance-market-A53549

Cardless ATM Market https://www.alliedmarketresearch.com/cardless-atm-market-A12958

Surety Market https://www.alliedmarketresearch.com/surety-market-A31385

Banking CRM Software Market https://www.alliedmarketresearch.com/banking-crm-software-market-A07431

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of the domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Corporate Lending Market Global Opportunity Analysis and Industry Forecast, 2021 - 2031 here

News-ID: 4354318 • Views: …

More Releases from Allied Market Research

Americas Paints and Coatings Market Aims to Expand at Double-Digit Growth Rate b …

Allied Market Research published a report, titled, "Americas Paints and Coatings Market By Resin Type (Acrylic, Alkyd, Epoxy, Polyester, Vinyl, and Others), By Product Type (Waterborne Coatings, Solvent-borne Coatings, Powder Coatings, and Others), By Application (Coil and Can Coatings, Automotive Car Refinishing, Automotive Parts (OEM Coatings), Wood Coatings, Industrial Coatings, Architectural Coatings, Marine Protective Coatings, and, Others): Americas Opportunity Analysis And Industry Forecast, 2023-2032". According to the report, the Americas…

Milk Powder Market Size worth USD 50.7 Billion Globally, by 2031 at a CAGR of 4. …

The global milk powder industry was generated $29.6 billion in 2021, and is anticipated to generate $50.7 billion by 2031, witnessing a CAGR of 4.8% from 2022 to 2031.

The global milk powder market is driven by factors such as growth in the expansion of the dairy industry along with the rise in the adoption of organic food among health-conscious consumers. However, the increase in the availability of milk powder alternatives…

U.S Packaging and Protective Packaging Market Growth, Share to 2032

Allied Market Research published a report, titled, "U.S. Packaging and Protective Packaging Market By Material (Paper and Paper Board, Rigid Plastics, Flexible, Metal, Glass, and Others), By Function (Cushioning, Blocking and Bracing, Void-fill, Insulation, Wrapping, and Others), and By Application (Food, Beverage, Healthcare, Cosmetics, Industrial, and Others): Global Opportunity Analysis And Industry Forecast, 2023-2032". According to the report, the U.S. packaging and protective packaging market was valued at $185.3 billion…

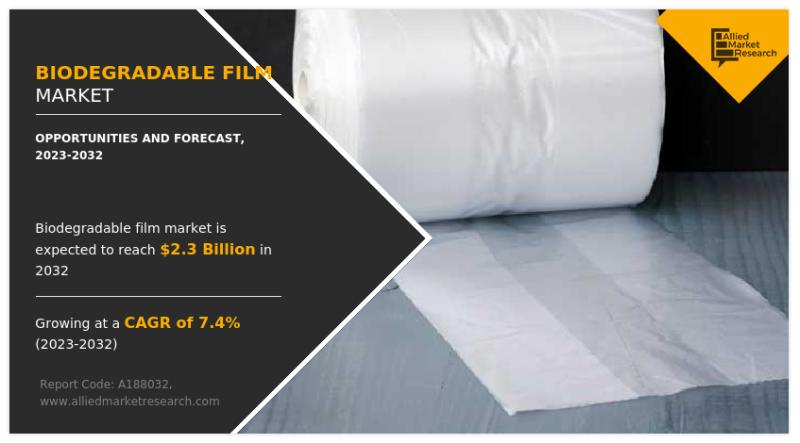

Biodegradable Film Market Forecast 2032 | An overview of Technology with Excitin …

Allied Market Research published a report, titled, "The biodegradable films market is segmented on the basis of raw material, application, and region. On the basis of raw material, the market is categorized into polylactic acid (PLA), biodegradable starch, polyhydroxyalkanoates (PHA), and others. On the basis of application, it is divided into food packaging, agriculture mulching, pharmaceutical packaging, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and…

More Releases for Loan

Travel Loan Personal Loan Guide To Finance Domestic And International Trips Easi …

Image: https://www.abnewswire.com/upload/2026/02/71bfa2bd36a80322c40217cb0777143c.jpg

Travel opens up new worlds, fresh perspectives, and unforgettable memories. Whether it is a peaceful beach escape, a mountain adventure, or an international holiday, planning the perfect trip often requires careful budgeting. This is where a travel loan can help you turn your plans into reality without financial stress. As a type of personal loan, it offers flexible funding, easy repayment, and quick access to money, making travel planning…

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…