Press release

Supply Chain Finance Market is set to reach US$ 4.0 billion by 2030, at a strong CAGR of 13.4%. Asia Pacific leads the market with 39.5% market share.

The Global Supply Chain Finance Market reached USD 1.5 billion in 2022 and is expected to reach USD 4.0 billion by 2030, growing with a CAGR of 13.4% during the forecast period 2024-2031.The Supply Chain Finance Market involves financial solutions that optimize cash flow between buyers and suppliers, enabling faster payments, reducing risks, and improving liquidity across global supply chains for businesses of all sizes.

DataM Intelligence unveils its latest report on the " Supply Chain Finance Market size 2025," offering an in-depth analysis of market trends, growth drivers, competitive landscape, and regional dynamics. The study covers market size in value and volume, CAGR forecasts, and emerging opportunities that can guide businesses in seizing growth potential and crafting winning strategies. Packed with data-driven insights on current developments and future trends, this report is essential for companies aiming to stay ahead in the competitive Market.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/supply-chain-finance-market?ptk

United States: Key Industry Developments (2025)

✅ July 2025: J.P. Morgan Payments launched a new Supply Chain Finance solution integrated with Oracle Fusion Cloud ERP, enabling companies like FedEx to optimize working capital by offering early payment options and streamlined invoice financing directly through ERP systems.

✅ August 2025: Flexport partnered with BlackRock to expand a $250 million supply chain financing pool, aiming to support U.S. importers facing higher tariff costs and cash flow pressures by providing extended financing capacity and liquidity.

✅ October 2025: JPMorgan Chase unveiled its Security and Resiliency Initiative, earmarking up to $10 billion toward critical U.S. supply chain investments including advanced finance and liquidity solutions for key manufacturing and logistics sectors.

Japan: Key Industry Developments (2025)

✅ July 2025: Fujitsu launched an AI‐driven global supply chain resilience solution that enhances rapid impact analysis and decision‐making as part of its Data Intelligence PaaS, improving supply chain finance planning and operational risk mitigation.

✅ January 2025: Sustainable Shared Transport and Fujitsu introduced an open logistics platform in Japan that optimizes joint transportation and delivery indirectly supporting supply chain financing needs by enhancing digital information exchange and shared assets efficiency.

✅ 2025 (market trend context): Japan's supply chain finance market size was reported to reach about USD 481 million in 2025, driven by digitalization, working capital management needs, and resilience strategies among enterprises.

📌 Supply Chain Finance Market 2025-26 M&A Deals

→ In October 2025, Allica Bank acquired Kriya, a UK‐based embedded finance and SME working capital fintech, marking a strategic move into supply chain‐adjacent finance and invoice financing solutions for small and medium enterprises. The deal strengthens Allica's SME finance proposition and supports planned advancement of £1 billion in working capital finance over the next three years; financial terms were not publicly disclosed.

→ In December 2025, Mollie signed an agreement to acquire GoCardless, a payments and direct debit fintech often used in SMB invoice and receivables workflows (relevant to supply chain payment/financing), for about €1.05 billion ($1.1 billion) in a mostly stock‐based transaction expected to close by mid‐2026.

→ In March 2025, 9fin, a British financial data and analytics provider, acquired Bond Radar, a primary issuance data provider, in a deal that expands analytical capabilities in debt and financing markets. The acquisition value was not disclosed.

→ 2025, Banca Ifis completed the acquisition of illimity Bank for €298 million, integrating banking and financing operations, including trade and receivables finance capabilities that can support supply chain funding.

Supply Chain Finance Market Drivers:-

⏩ Growing complexity in supply chains has increased the need for tools that unlock cash tied up in receivables and inventories.

⏩ SCF solutions such as reverse factoring and dynamic discounting are gaining significant traction: reverse factoring alone accounts for 35% of SCF market growth drivers.

⏩ In fragmented supply networks, especially among SMEs, SCF becomes a vital liquidity mechanism to sustain operations without relying on traditional bank creditaccelerating adoption globally.

⏩ Digital platforms, fintech‐driven products, and automation tools are core to SCF growth. Adoption of AI, cloud, and data analytics is a recurring theme across industry forecasts.

⏩ Solutions using blockchain provide enhanced transaction transparency and security, estimated as an 8-10% opportunity factor in SCF growth.

⏩ Cloud‐based deployment is expected to hold a majority share by 2035, due to ease of integration and scalability.

⏩ Globalization has made supply chains more interconnected and financially complex, increasing demand for cross‐border SCF financing.

⏩ Firms operating internationally are using SCF to mitigate foreign exchange risk and enhance working capital flows across markets.

📌 Buy Now & Unlock 360° Market Intelligence:https://www.datamintelligence.com/buy-now-page?report=supply-chain-finance-market?ptk

Supply Chain Finance Major Players:-

Citibank, J.P. Morgan Chase, HSBC, Standard Chartered, Wells Fargo, Banco Santander, BNP Paribas, Deutsche Bank oracle and Taulia.

Key players highlights:-

Citibank (Citigroup) - A leading global bank in supply chain finance, Citi supports thousands of buyer‐led programs through its Citi Supplier Finance platform and ranks among the top SCF providers worldwide. Citi's strong global footprint places it consistently in the top tier of SCF revenue and participation.

J.P. Morgan Chase - JPMorgan is a major SCF provider leveraging its trade finance and working capital solutions to help large corporates optimize cash flows; it ranks among the key bank players in global SCF. Market estimates show JPMorgan often among the top several banks by revenue share in related finance services.

HSBC Holdings plc - HSBC is recognised for its extensive global trade and supply chain finance network, investing in digital platforms and sustainable finance integration; it's frequently listed among the top SCF banks. HSBC's substantial banking share contributes to its strong competitive position in SCF services.

Standard Chartered - Standard Chartered has a strong focus on emerging markets and cross‐border SCF solutions, partnering with fintech platforms to enhance working capital offerings. It is regularly cited as a key global SCF player, especially in Asia, Africa, and the Middle East.

Banco Santander - Santander operates one of the largest SCF networks in Latin America, Europe, and beyond via its confirming and supplier finance platforms, engaging hundreds of thousands of suppliers. Reports suggest Santander holds notable share in global SCF volumes though exact % varies by region.

Supply Chain Finance Regional Highlights

Asia Pacific

• Holds the largest share of the global market (39.5%) driven by strong manufacturing bases in China, India & Southeast Asia.

• Rapid digitalization, fintech expansion, and government support are accelerating SCF adoption across industries.

• Projected to continue high growth with strong SME participation and technology-led platform uptake.

North America

• Accounts for 34.8% of the global market, led by the United States and Canada.

• Growth driven by advanced financial infrastructure, digital platforms, and mature corporate SCF programs.

• Fintech innovation and working capital optimization remain key development drivers.

Europe

• Represents around 24% of the global supply chain finance market.

• Market expansion fueled by cross‐border trade, regulatory harmonization, and ESG‐linked financing.

• Growing adoption of digital SCF platforms to improve transparency and risk management.

Get Customization in the report as per your requirements:https://www.datamintelligence.com/customize/supply-chain-finance-market?ptk

Supply Chain Finance market segmentation :

By Provider: Includes Banks, Trade Finance Houses, and other financial institutions offering supply chain solutions.

By Offering: Covers instruments like Letters of Credit, Export/Import Bills, Performance Bonds, Shipping Guarantees, and others.

By Application: Divided into Domestic and International supply chain transactions.

By End-User: Targets Large Enterprises and Small & Medium-sized Enterprises (SMEs).

FAQ'S

Q: What is driving the growth of the Supply Chain Finance Market?

A: Increasing demand for liquidity optimization, digital financing platforms, and trade automation is fueling market growth.

Q: Which regions are leading the Supply Chain Finance Market?

A: Asia-Pacific is witnessing the fastest adoption due to expanding trade and SMEs.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Supply Chain Finance Market is set to reach US$ 4.0 billion by 2030, at a strong CAGR of 13.4%. Asia Pacific leads the market with 39.5% market share. here

News-ID: 4352648 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

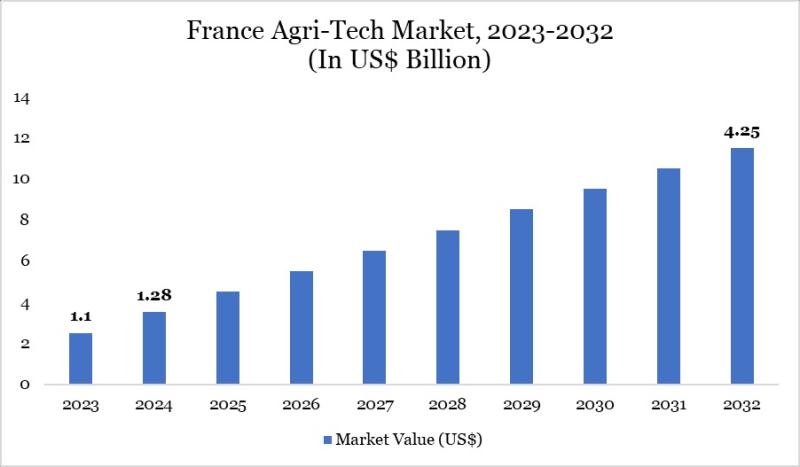

France Agri Tech Market to Reach USD 4.25 Billion by 2032 at 16.20% CAGR | Stron …

The France Agri Tech Market reached USD 1.28 billion in 2024 and is projected to grow to USD 4.25 billion by 2032, expanding at a CAGR of 16.20% during the forecast period from 2025 to 2032. This strong growth is driven by rapid technological modernization across the agricultural sector, increasing investment in digital farming solutions, and rising demand for sustainable and high productivity food systems. Expanding use of precision agriculture…

Autoimmune Treatment Market Forecast to Reach USD 108.07 Bn by 2031 at 5.19% CAG …

The Autoimmune Treatment Market is projected to expand from USD 79.74 billion in 2025 to USD 83.92 billion in 2026, reaching USD 108.07 billion by 2031, growing at a CAGR of 5.19% during 2026-2031. Market growth is driven by increasing early-onset autoimmune diagnoses, growing adoption of biosimilars, and faster regulatory approvals of advanced cell-based therapies.

The treatment paradigm is shifting from conventional broad immunosuppression toward targeted, precision-based interventions. Innovative CAR-T therapies…

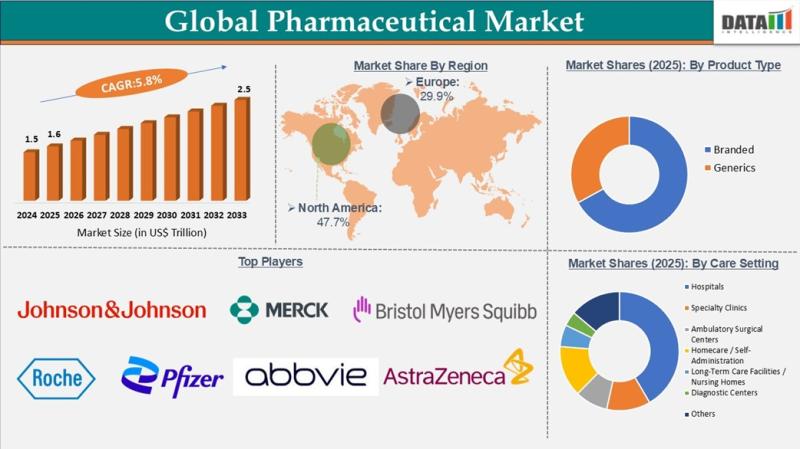

Pharmaceuticals Market to Reach USD 2.5 Trillion by 2033 at 5.8% CAGR | North Am …

The Pharmaceuticals Market reached USD 1.5 trillion in 2024, rising to USD 1.6 trillion in 2025, and is projected to reach USD 2.5 trillion by 2033, expanding at a CAGR of 5.8% during the forecast period from 2026 to 2033. Steady market growth is being driven by global population aging, increasing prevalence of chronic and lifestyle related diseases, and rising demand for advanced therapeutics across hospitals, specialty clinics, and homecare…

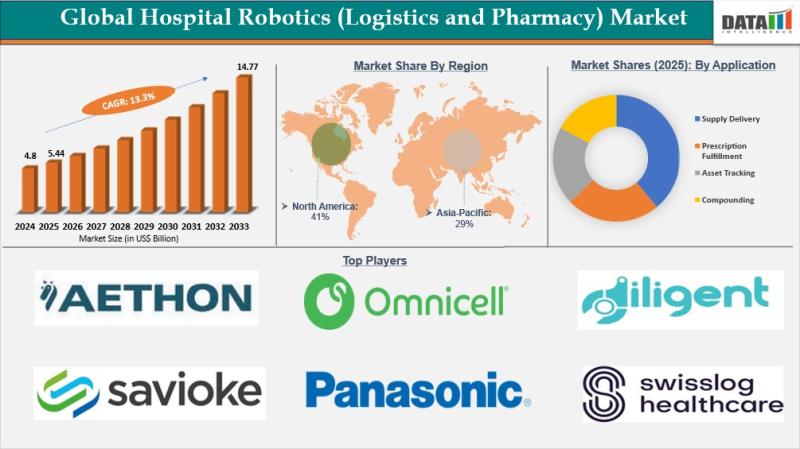

Hospital Robotics (Logistics and Pharmacy) Market to Reach USD 14.77 Billion by …

The Hospital Robotics (Logistics and Pharmacy) Market reached USD 4.8 billion in 2024, rising to USD 5.44 billion in 2025, and is projected to reach USD 14.77 billion by 2033, expanding at a CAGR of 13.3% during the forecast period from 2026 to 2033. Market growth is driven by increasing hospital workload, rising complexity of medication management, and persistent shortages of skilled healthcare personnel. Population aging and the growing prevalence…

More Releases for SCF

Digital Supply Chain Finance (SCF) Solution Market Growth Opportunities in the G …

The global market for Digital Supply Chain Finance (SCF) Solution was estimated to be worth US$ 13650 million in 2024 and is forecast to a readjusted size of US$ 28940 million by 2031 with a CAGR of 11.5% during the forecast period 2025-2031.

A 2025 latest Report by QYResearch offers on -"Digital Supply Chain Finance (SCF) Solution - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031" provides…

Stem Cell Factor(SCF) Market Size, Trends, Growth Analysis, and Forecast | Val …

Stem Cell Factor(SCF) Market Size

The global Stem Cell Factor(SCF) market was valued at US$ 12900 million in 2023 and is anticipated to reach US$ million by 2030, witnessing a CAGR of 11.4% during the forecast period 2024-2030.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-10V18247/Global_Stem_Cell_Factor_SCF_Market_Research_Report_2024

The major global manufacturers of Stem Cell Factor(SCF) include PeproTech, Prospec, Proteintech, NeoScientific, STEMCELL Technologies, MP Biomedicals, AJINOMOTO, Enzo, FUJIFILM Irvine Scientific, SigmaAldrich, etc. In 2023, the world's top three vendors…

Dangerous Goods Container Market Size: 2022, Growth Strategic Assessment, Develo …

The Global "Dangerous Goods Container Market" report provides a comprehensive overview of the emerging market trends, drivers, and constraints. This report evaluates historical data on the Dangerous Goods Container market growth and compares it with current market situations. This report provides data to the customers that are of historical & statistical significance and informative. It helps to enable readers to have a detailed analysis of the development of the market.…

Slow Release Fertilizers Market 2018 Global Growth Analysis & Forecast to 2025 | …

UpMarketResearch offers a latest published report on “Global Slow Release Fertilizers Market Analysis and Forecast 2018-2023” delivering key insights and providing a competitive advantage to clients through a detailed report. The report contains pages which highly exhibit on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing and profitability.

Get Free Exclusive PDF Sample Copy of This Report: https://www.upmarketresearch.com/home/requested_sample/5703

Slow Release Fertilizers Industry research report delivers a…

Global Control Release Fertilizers Market Size and Forecast 2025: Hanfeng, Prill …

Qyresearchreports include new market research report Global Control Release Fertilizers Market Professional Survey Report 2018 to its huge collection of research reports.

This report studies Control Release Fertilizers in Global market, especially in North America, China, Europe, Southeast Asia, Japan and India, with production, revenue, consumption, import and export in these regions, from 2013 to 2018, and forecast to 2025.

The global Control Release Fertilizers market is broadly shed light upon in…

Global Slow Release Fertilizers Market Insights, Forecast to 2025 : Hanfeng, Pri …

Researchmoz added Most up-to-date research on "Global Slow Release Fertilizers Market Insights, Forecast to 2025" to its huge collection of research reports.

This report researches the worldwide Slow Release Fertilizers market size (value, capacity, production and consumption) in key regions like North America, Europe, Asia Pacific (China, Japan) and other regions.

This study categorizes the global Slow Release Fertilizers breakdown data by manufacturers, region, type and application, also analyzes the market status,…