Press release

United States Account Reconciliation Software Market | CAGR 2.9% | North America Leads with 35% Share | Key Players: Oracle, SAP, BlackLine, Trintech, Fiserv, Broadridge

Account Reconciliation Software Market OverviewThe Global Account Reconciliation Software Market is projected to grow at a CAGR of 2.9% during 2024-2031, driven by the increasing adoption of automated financial management solutions. Account reconciliation is the process of comparing monthly statements from external sources such as banks, financial institutions, and credit card providers with an organization's internal financial records to ensure accuracy and consistency. The rising demand for standardized banking activities, coupled with the need to reduce operational risks, improve data quality, and save time, is fueling the adoption of reconciliation software. By automating complex accounting processes, these solutions help organizations streamline financial workflows, minimize human errors, and ensure regulatory compliance across industries.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/account-reconciliation-software-market?Juli

Recent Developments:

✅ January 2026: A leading financial software provider launched an AI-powered account reconciliation platform that automates matching of transactions, reduces manual errors, and provides real-time insights for finance teams.

✅ November 2025: A global enterprise software company introduced a cloud-based reconciliation solution integrated with ERP systems, enabling seamless data synchronization across multiple financial sources.

✅ September 2025: A fintech startup expanded its reconciliation software portfolio to include bank statement parsing and automated exception management, enhancing efficiency for large organizations.

✅ June 2025: A major accounting software firm partnered with a cloud-based analytics provider to offer predictive reconciliation, fraud detection, and risk management capabilities in real-time.

✅ March 2025: Several multinational corporations adopted robotic process automation (RPA) for account reconciliation, reducing manual intervention and accelerating month-end and year-end closing processes.

Mergers & Acquisitions:

✅ January 2026: A leading global financial software provider acquired a specialized reconciliation automation startup, expanding its AI-driven offerings for enterprise accounting and finance teams.

✅ October 2025: A major ERP solutions company merged with a cloud-based reconciliation software firm, strengthening its integrated finance and accounting capabilities for multinational organizations.

✅ August 2025: A fintech platform provider acquired a bank statement parsing and exception management technology company, enhancing automation and efficiency for large-scale financial operations.

Buy Now & Unlock 360° Market Intelligence:-https://www.datamintelligence.com/buy-now-page?report=account-reconciliation-software-market?JUli

Key Players:

Oracle Corporation | SAP SE | BlackLine | Trintech | Fiserv | Broadridge Financial Solutions

Key Highlights:

• Oracle Corporation - Holds a 22% share, driven by its cloud-based ERP and reconciliation solutions that integrate AI and automation for enterprise finance operations.

• SAP SE - Holds a 20% share, supported by its intelligent finance suite and real-time analytics tools, enabling efficient reconciliation across multiple financial systems.

• BlackLine - Holds an 18% share, fueled by its cloud-native account reconciliation and financial close platform, widely adopted by large organizations globally.

• Trintech - Holds a 15% share, driven by its automated reconciliation and risk management software, helping companies streamline financial operations and ensure regulatory compliance.

• Fiserv - Holds a 13% share, supported by solutions that automate bank statement matching, exception management, and transaction verification for financial institutions.

• Broadridge Financial Solutions - Holds a 12% share, fueled by its reconciliation, reporting, and workflow management solutions for banks, broker-dealers, and corporate clients.

Market Segmentation:

By type, cloud-based solutions dominate with a 65% share, driven by the increasing adoption of SaaS platforms, scalability, real-time data access, and reduced IT infrastructure costs. On-premise solutions hold a 35% share, primarily preferred by large enterprises and financial institutions requiring enhanced data control and compliance with internal IT policies.

By application, banks account for 50% of the market, reflecting the widespread use of reconciliation software to streamline transaction matching, reduce errors, and ensure regulatory compliance. Enterprise users represent 50%, driven by adoption in large organizations across manufacturing, retail, technology, and professional services, seeking to automate financial close processes, improve accuracy, and gain real-time visibility into their accounts.

Speak to Our Analyst and Get Customization in the report as per your requirements:-https://www.datamintelligence.com/customize/account-reconciliation-software-market?Juli

Regional Insights:

North America leads with a 35% share, supported by the presence of key software providers, advanced banking infrastructure, and high adoption of cloud-based financial solutions. Europe accounts for 25%, driven by strong demand from financial institutions, enterprises, and stringent accounting and audit regulations across countries like the UK, Germany, and France.

Asia-Pacific is the fastest-growing region with a 30% share, fueled by digitalization initiatives, expanding banking and enterprise sectors, and increasing adoption of cloud-based reconciliation solutions in India, China, and Southeast Asia.

Market Dynamics:

Drivers:

The global Account Reconciliation Software Market is being increasingly driven by the integration of artificial intelligence (AI) and machine learning (ML) into reconciliation processes. Leading software providers, including Oracle Corporation, SAP SE, Fiserv, and others, are embedding AI and ML into their solutions to streamline end-to-end reconciliation workflows, reduce human errors, and enhance transaction visibility. AI-enabled solutions, such as Ascent AutoRecon, provide real-time reconciliation rates of up to 99%, helping financial institutions improve efficiency, accuracy, and value. In 2018, SAP SE introduced its SAP Cash Application, leveraging AI and ML to improve reconciliation and cash flow management. Such technologies allow businesses to automate data entry, transaction categorization, and analytics, significantly reducing operational costs. In fact, implementing AI and robotic process automation (RPA) in financial operations can save organizations up to 80% in costs over time, representing a lucrative opportunity for market growth during the forecast period.

However, the market faces a major restraint in the form of high implementation costs. Many account reconciliation software solutions, particularly on-premise ERP platforms, require substantial upfront investment and a longer payback period compared to cloud-based alternatives. Some solutions are complex, feature-limited, or not user-friendly, requiring organizations to invest continuously in upgrades or switch providers to access the functionality they need. These high costs and complexity can slow adoption, particularly among small and mid-sized enterprises, despite the clear efficiency and cost-saving benefits offered by advanced reconciliation software.

📌 Request for 2 Days FREE Trial Access: https://www.datamintelligence.com/reports-subscription

☛ Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

☛ Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg?Juli

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United States Account Reconciliation Software Market | CAGR 2.9% | North America Leads with 35% Share | Key Players: Oracle, SAP, BlackLine, Trintech, Fiserv, Broadridge here

News-ID: 4352639 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

Low-Code Development Platform Market to Reach US$ 107.3 Billion by 2030 | Key Dr …

The Global Low-Code Development Platform Market reached US$ 14.2 billion in 2022 and is projected to grow to US$ 107.3 billion by 2030, registering a CAGR of 28.9% during the forecast period 2024-2031.

The market is experiencing rapid growth due to the widespread adoption of cloud technology, which has democratized application development and made it accessible to businesses of all sizes including micro startups. By lowering infrastructure barriers and costs, low-code…

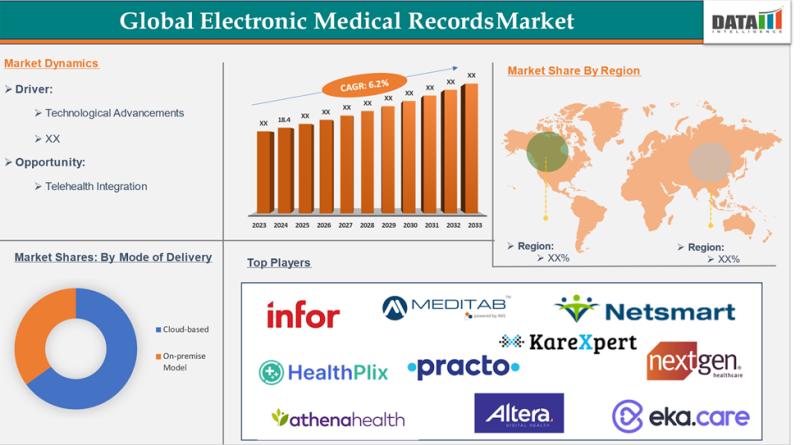

Electronic Medical Records Market to Reach US$ 31.55 Billion by 2033 | Key Playe …

The Global Electronic Medical Records (EMR) Market reached US$ 18.4 billion in 2024 and is projected to reach US$ 31.55 billion by 2033, growing at a CAGR of 6.2% during the forecast period of 2025-2033, according to DataM Intelligence research. Electronic Medical Records (EMRs) are digital versions of patients' health records, enabling healthcare providers to store, manage, and retrieve patient information electronically. EMRs typically include essential health data such as…

Cardiovascular Biologics Market to Reach US$ 4.23 Billion by 2033 | Key Players: …

The Global Cardiovascular Biologics Market was valued at US$ 2.20 billion in 2024 and is projected to reach US$ 4.23 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025-2033. The market is witnessing rapid expansion driven by advancements in RNA-based therapies and biologic innovations that enable precise targeting of cardiovascular disease mechanisms. Biologics, including recombinant proteins, monoclonal antibodies, and gene-modulating RNA therapeutics (such as siRNA…

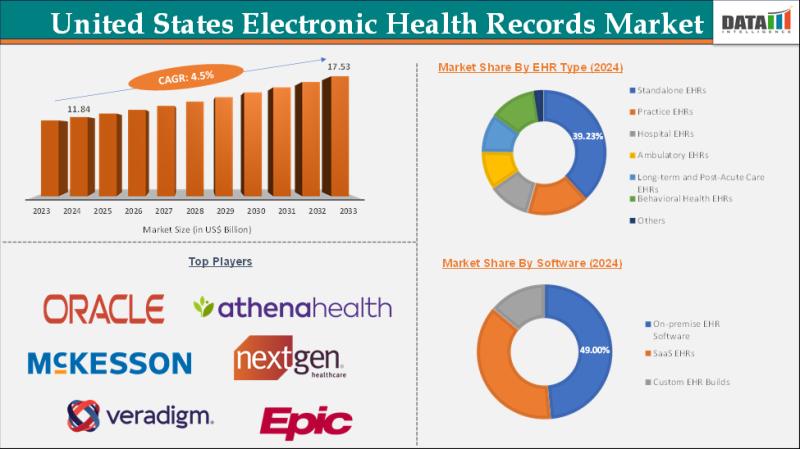

United States Electronic Health Records Market to Reach US$ 17.53 Billion by 203 …

The United States Electronic Health Records (EHR) Market reached US$ 11.84 billion in 2024 and is projected to grow to US$ 17.53 billion by 2033, exhibiting a CAGR of 4.5% during the forecast period 2025-2033. Electronic Health Records (EHRs) represent the digital consolidation of a patient's medical history, encompassing both administrative and clinical data that healthcare providers maintain and update over time. The EHR system enables seamless access to critical…

More Releases for Account

How to create binomo account?

Creating an account on Binomo is a straightforward process that opens the door to a world of online trading opportunities. Whether you're new to trading or have experience, the platform offers a user-friendly interface that makes the registration process quick and easy.

Step 1: Visit the Binomo Website

To get started, you'll first need to visit the official Binomo website. Simply enter https://binomo.ai/ into your browser's address bar and hit enter. This…

The SignStix New Senior Account Manager

SignStix is pleased to announce that Brian Holcroft has been appointed as the new Account Manager at SignStix. Brian is the newest recruit to the SignStix team to help our partners introduce the SignStix solution to even more customers.

With an impressive track record in new business development freelance work, Brian has accumulated more than 20 years of commercial sales and marketing experience across multiple industries and market sectors.

Prior to joining…

How to delete your LinkedIn account?

How to delete LinkedIn account? Step By Step

Do you want to delete your LinkedIn account? Have you come across an old account that isn't active anymore? Do you wish to close your current account and create a new one? You'll learn how to do it with the help of this guide. For a variety of reasons, you may desire to delete your LinkedIn account. LinkedIn is different, while most social…

Merchant account solutions

Acqualtscards As a favorable self-ruling Pro independent association of portion courses of appropriate action, we mutually support you at every independent movement of your business development.Since its private foundation, Acqualtscards has substantiated itself and to its potential clients to be one of the fundamental worldwide providers of re-appropriating and white imprint answers for electronic portion trades.

Acqualtscards offers Credit cards processing for Online business around the globe, including those for retailers/maker…

LeoPrime Introduces New Cent Account

LeoPrime is delighted to officially announce that we now offer our clients the opportunity to trade with a cent account, which will allow them to trade in cents while becoming familiar with trading.

Jaya Kumar, LeoPrime’s Group Head, said “The provision of the cent account opens many channels of opportunity of success for our loyal traders. With only a small deposit traders can test themselves and gain confidence in trading.…

Account Based Marketing

Today, most of the marketing organizations are moving towards the Account Based Marketing ( ABM ) . The ABM approach has been there for years but the recent technologies available have made this approach scalable and hence more effective and popular.

The traditional marketing approach has been around attracting your prospects from a larger pool. The account based marketing is about targeting accounts based on your best business connection. It is…