Press release

Ingram Insurance Group Expands Business Insurance Support Across Multiple States

Image: https://www.abnewswire.com/upload/2026/01/02104f0251f34ec461f334d85bf75f22.jpgDayton, Ohio - Ingram Insurance Group continues to strengthen its role as a regional insurance agency focused on helping businesses protect their operations, assets, and long term stability through tailored business insurance solutions. Based in Dayton and licensed to serve clients in Ohio, Kentucky, West Virginia, Tennessee, Pennsylvania, Michigan, and Florida, the agency supports a wide range of business owners with coverage designed around real operational risks rather than one size fits all policies.

Business insurance has become a growing concern for companies facing rising costs, regulatory pressure, and increased exposure across property, liability, and workforce related risks. Ingram Insurance Group addresses these challenges by offering access to business insurance [https://insuredbyingram.com/] through an independent agency model that allows coverage to be structured based on each client's size, industry, and risk profile. The agency works with multiple insurance carriers, giving clients flexibility and choice while maintaining clear guidance throughout the process.

The agency's business insurance offerings include core coverages such as business owners insurance, general liability insurance, commercial property insurance, business auto insurance, and commercial umbrella coverage. These policies help protect physical assets, vehicles, financial interests, and third party exposure that businesses face during normal operations. For companies with more complex needs, Ingram Insurance Group provides additional coverage options including builders risk insurance, cyber liability insurance, environmental insurance, liquor liability coverage, workers' compensation insurance, and employment practices liability insurance.

Specialty coverage plays an increasingly important role for businesses navigating industry specific risks. Ingram Insurance Group offers tailored insurance solutions for real estate investors, landlords, rental property owners, real estate developers, contractors, and restaurant operators. Coverage is designed to reflect the realities of each field, addressing risks tied to property ownership, construction activity, customer interaction, and regulatory compliance. Additional options include business interruption insurance, directors and officers liability insurance, errors and omissions coverage, crime insurance, fleet insurance, inland marine insurance, commercial flood, hurricane, and earthquake insurance, ocean marine insurance, captive insurance management, surety and commercial bonds, key person life insurance, fiduciary liability insurance, systems breakdown insurance, vacant building insurance, event insurance, and risk management services.

A distinguishing factor of Ingram Insurance Group is its operational background. The agency is owned and operated by experienced real estate investors, which shapes how coverage recommendations are evaluated and explained. This perspective allows the team to understand how insurance decisions affect cash flow, asset protection, and long term planning. Rather than focusing on policy volume, the agency emphasizes coverage clarity, proper limits, and alignment with real business exposure.

Policy management and accessibility are also central to the agency's approach. Clients are able to manage policies through a service center that supports certificates of insurance, policy reviews, claims reporting, auto ID card requests, and policy changes. This structure helps businesses respond quickly to compliance needs and operational changes without unnecessary delays. Communication options include phone, email, text, and Spanish language support, helping the agency serve a broader range of business owners and communities.

As businesses continue to adapt to shifting economic and regulatory conditions, insurance coverage has become a key component of risk planning rather than a background expense. Ingram Insurance Group positions itself as a long term resource for business owners seeking dependable guidance and flexible coverage options. By maintaining strong carrier partnerships and a clear advisory process, the agency supports businesses at different stages of growth, from small operations to established multi property and multi state enterprises.

More information about coverage options and services is available through Ingram Insurance Group [https://insuredbyingram.com/], which continues to serve Dayton and surrounding Montgomery County communities while supporting clients across multiple states.

About Ingram Insurance Group

Ingram Insurance Group is an independent insurance agency based in Dayton, Ohio, focused on protecting client investments through reliable and tailored insurance solutions. The agency serves clients throughout Ohio, Kentucky, West Virginia, Tennessee, Pennsylvania, Michigan, and Florida. With a strong foundation in real estate investment property insurance, Ingram Insurance Group also provides personal and commercial insurance products including home, auto, renters, motorcycle, condo, and a wide range of business insurance solutions. Owned and operated by experienced real estate investors, the agency delivers coverage guidance designed to protect assets, support long term stability, and adapt as client needs evolve. The agency operates from its physical office at 733 Salem Avenue in Dayton, Ohio, and emphasizes transparency, accessibility, and ongoing client support.

Media Contact

Company Name: Insured By Ingram

Contact Person: Media Relations

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=ingram-insurance-group-expands-business-insurance-support-across-multiple-states]

Phone: 937-741-5100

Address:733 Salem Avenue

City: Dayton

State: OH 45406

Country: United States

Website: https://insuredbyingram.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Ingram Insurance Group Expands Business Insurance Support Across Multiple States here

News-ID: 4352067 • Views: …

More Releases from ABNewswire

MT Dunn Plumbing Expands Emergency Services in Hillsboro & Across Portland, Oreg …

MT Dunn Plumbing LLC (CCB# 234243) expands 24/7 emergency services across Hillsboro, Beaverton, Portland & Washington County. The licensed, bonded, and insured contractor provides immediate response for burst pipes, water heater failures, sewer backups, and drain clogs. Operating from Hillsboro, owner Michael T Dunn serves residential and commercial properties region-wide. Emergency contact: 503-640-2458 or mtdunnplumbing.com.

Hillsboro, OR - MT Dunn Plumbing LLC, a licensed and established plumbing contractor serving the Portland…

Beyond the Prompt: How Mimic Motion Architecture is Redefining the 2026 Passive …

Image: https://www.abnewswire.com/upload/2026/02/ac57e1a7b6e53a95f52ea0f18fcb990c.jpg

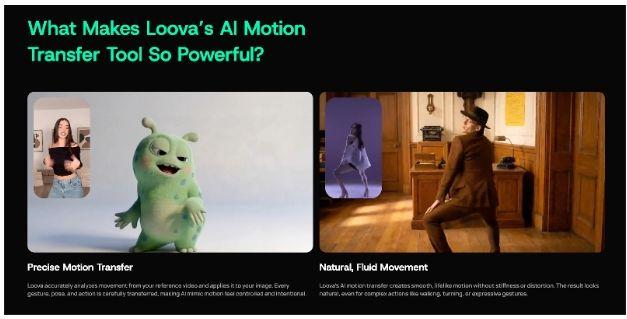

As we move through 2026, the digital economy is no longer just about "what" you show, but "how" it moves. Static content is losing ground to kinetic, motion-driven narratives that capture attention in seconds. At the center of this shift is Loova, whose proprietary Mimic Motion architecture has become the secret engine behind some of the most successful passive income streams this year.

This report breaks down the technical logic…

The Real Cost of Convenience: A Complete Guide to Vending Machine Startup Costs

Image: https://www.abnewswire.com/upload/2026/02/32ec9ac40420df59e70c21070d981def.jpg

The dream of earning passive income often leads aspiring entrepreneurs to the world of automated retail. It is a sector defined by low labor requirements and the ability to generate revenue around the clock. However, before you can stock your first row of snacks, you must understand the financial commitment required to get your equipment on-site. Many beginners find themselves asking how much do vending machines cost [https://dfyvending.com/vending-machine-startup-costs] as…

Benji Personal Injury Surpasses 1,000 Cases Won as California Accident Victims S …

Benji Personal Injury Accident Attorneys, A.P.C. has surpassed 1,000 personal injury cases resolved across California, reflecting a growing demand for trialready legal representation. The firm's litigationfirst approach has led to multimilliondollar verdicts and settlements, helping accident victims secure significantly higher compensation through courtroomfocused preparation.

LOS ANGELES, CA - Benji Personal Injury Accident Attorneys, A.P.C. announced today that the firm has successfully resolved over 1,000 personal injury cases, marking a significant milestone…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…