Press release

OCR Invoice Processing: Automate Accounts Payable Workflows

Why OCR Invoice Processing Is Reshaping Accounts PayableFinance and accounting teams are being pressured to process invoices faster, with fewer errors, and under tighter compliance controls. Manual workflows are no longer scalable. As a result, OCR Invoice Processing Services has been widely adopted to support accuracy, visibility, and operational control across accounts payable functions. In many US organizations, invoice volumes are increasing while teams remain lean, which makes automation a strategic necessity rather than an option.

For more details: https://www.relyservices.com/schedule-your-discovery-call

The Shift Toward Automation in Finance Operations

Invoices are received in multiple formats and from multiple vendors. When handled manually, delays and data entry errors are often introduced. To address this, OCR Invoice Processing is being used to capture invoice data automatically and route it through standardized workflows. Through Automated Invoice Processing, invoices are validated, coded, and approved with minimal manual intervention. As a result, cycle times are reduced and compliance risks are better managed.

The Role of Technology in Modern AP Teams

Advanced Invoice OCR Software is designed to extract structured and unstructured data with high accuracy. When combined with Accounts Payable Automation, invoice handling is transformed into a controlled and auditable process. For finance leaders, OCR Invoice Processing supports better cash flow forecasting and real-time reporting. In addition, OCR Invoice Processing enables teams to focus on exception handling and analysis rather than repetitive tasks. As finance functions evolve, OCR Invoice Processing continues to play a central role in building efficient, compliant, and future-ready AP operations.

Visit at https://www.relyservices.com/ocr-services

What Is OCR Invoice Processing in Accounts Payable?

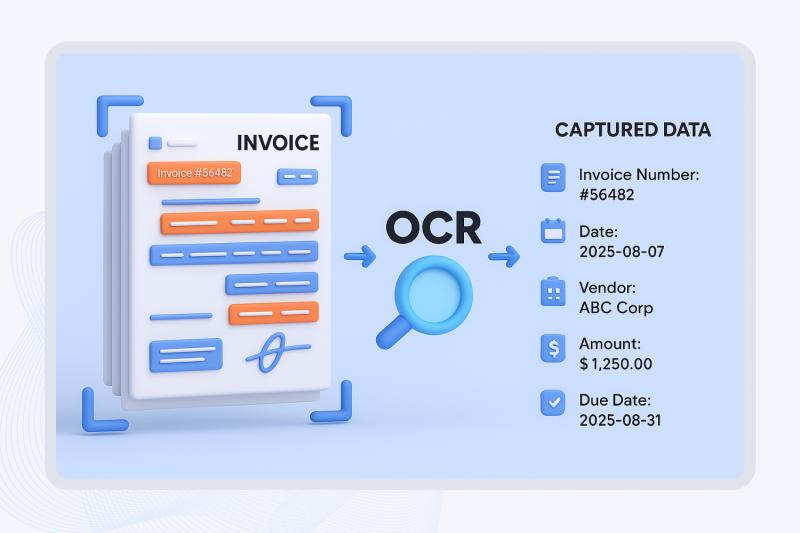

OCR Invoice Processing is used to convert invoice data from paper or digital formats into structured, usable information within accounts payable systems. For finance and accounting teams, OCR Invoice Processing allows invoice details such as vendor name, invoice number, dates, line items, and totals to be captured automatically without manual data entry. This process is designed to improve accuracy while reducing processing time and operational risk.

How OCR Invoice Processing Works in Finance Operations

Invoices are first scanned or uploaded into a centralized system. Through OCR Invoice Processing, text is extracted and mapped to predefined invoice fields. The extracted data is then validated using business rules before being pushed into ERP or accounting platforms. When combined with Automated Invoice Processing, approvals and exception handling are completed in a controlled workflow. As a result, OCR Invoice Processing ensures consistency and reliability across high-volume invoice environments.

Why OCR Invoice Processing Matters for AP Leaders

For finance leaders, OCR Invoice Processing provides visibility and control over invoice workflows. With the support of Invoice OCR Software, data accuracy is improved and audit trails are maintained automatically. When aligned with Accounts Payable Automation, invoices are processed faster and with fewer touchpoints. In growing organizations, OCR Invoice Processing is relied upon to scale AP operations without increasing headcount. As finance functions modernize, OCR Invoice Processing continues to be a foundational element of efficient and compliant accounts payable management.

How OCR Invoice Processing Works in Automated Accounts Payable

Invoice Capture and Data Extraction Using OCR Invoice Processing

Invoices enter accounts payable in many formats, including paper, PDF, email attachments, and vendor portals. These documents are first captured through scanning or digital upload. Using OCR Invoice Processing, invoice data is extracted from both structured and unstructured formats. Key fields such as invoice number, vendor details, dates, line items, tax amounts, and totals are identified automatically. This step ensures that manual data entry is minimized while consistency is maintained across large invoice volumes.

Data Validation and Exception Handling in Automated Invoice Processing

Once data is extracted, it is validated against predefined business rules. Through Automated Invoice Processing, checks are applied for duplicate invoices, mismatched totals, missing fields, and policy violations. Invoices that meet validation criteria are routed forward, while exceptions are flagged for review. With the support of OCR Invoice Processing, exception handling is streamlined and focused only on invoices that require human intervention. This controlled approach improves accuracy while reducing processing delays.

ERP Integration Through Accounts Payable Automation

After validation, invoice data is automatically transferred into ERP or accounting systems. With Accounts Payable Automation, invoices move through approval workflows based on authorization levels and compliance requirements. Invoice OCR Software ensures that supporting documents and audit trails are preserved throughout the process. By using OCR Invoice Processing as the foundation, finance teams gain real-time visibility into invoice status, liabilities, and cash flow. As a result, accounts payable operations become faster, more transparent, and easier to scale without increasing operational risk.

OCR Invoice Processing vs Manual Invoice Processing: Cost, Risk, and Efficiency

Manual invoice processing has long been associated with high costs, slow turnaround times, and increased operational risk. In contrast, OCR Invoice Processing is adopted to address these limitations by reducing dependency on manual data entry. When invoices are processed manually, errors are frequently introduced due to fatigue, inconsistent formats, and high workloads. As a result, payment delays and compliance issues are often experienced by finance teams.

From a cost perspective, OCR Invoice Processing is considered more efficient because repetitive tasks are automated and staff time is optimized. Through Automated Invoice Processing, invoices are captured, validated, and routed with minimal human involvement. This leads to lower cost per invoice and improved productivity across accounts payable teams. In comparison, manual processing requires additional labor for data entry, corrections, and follow-ups.

Risk exposure is also reduced when OCR Invoice Processing is implemented. With the help of Invoice OCR Software, duplicate invoices, missing fields, and mismatched totals are detected early in the workflow. When combined with Accounts Payable Automation, audit trails and approval controls are maintained consistently. In contrast, manual workflows often lack visibility and are more difficult to audit. Overall, OCR Invoice Processing delivers greater efficiency, lower risk, and stronger financial control than traditional manual invoice handling methods.

The Role of Invoice OCR Software in Modern Accounts Payable Automation

Enabling Accurate OCR Invoice Processing at Scale

Modern Invoice OCR Software is designed to support high-volume OCR Invoice Processing with improved accuracy and consistency. Invoice data is captured from multiple formats and layouts without relying on rigid templates. As a result, OCR Invoice Processing is performed more reliably even when invoices vary by vendor or industry. For finance teams, this capability ensures that invoice data is standardized before entering downstream workflows.

Supporting Automated Invoice Processing Workflows

When integrated with accounts payable systems, Invoice OCR Software becomes a key component of Automated Invoice Processing. Extracted data is automatically validated, coded, and routed for approval based on predefined rules. Through this approach, OCR Invoice Processing reduces manual intervention and shortens invoice cycle times. In addition, approval workflows are enforced consistently, which improves governance and internal controls across finance operations.

Strengthening Control Through Accounts Payable Automation

With Accounts Payable Automation, invoice data processed through Invoice OCR Software is tracked at every stage of the workflow. Approval histories, exception handling, and supporting documents are stored for audit purposes. By using OCR Invoice Processing as the foundation, finance leaders gain better visibility into liabilities and cash flow. As organizations scale, OCR Invoice Processing supported by robust Invoice OCR Software enables accounts payable teams to maintain accuracy, compliance, and operational efficiency without increasing overhead.

Key Benefits of OCR Invoice Processing for Finance and Accounting Teams

Faster Invoice Cycle Times With OCR Invoice Processing

Invoice delays directly impact cash flow visibility and vendor relationships. By adopting OCR Invoice Processing, invoices are captured and processed faster than manual methods. Data extraction, validation, and routing are completed automatically, which reduces processing bottlenecks. When combined with Automated Invoice Processing, invoice approval cycles are shortened and on-time payments are improved across accounts payable operations.

Improved Accuracy and Compliance Across AP Functions

Manual invoice handling often leads to data entry errors and inconsistent controls. With OCR Invoice Processing, invoice data is extracted using predefined rules and validation checks. The use of Invoice OCR Software helps ensure that critical fields are captured correctly and consistently. When supported by Accounts Payable Automation, approval workflows and audit trails are maintained, which strengthens compliance and reduces financial risk.

Lower Operating Costs and Better Resource Utilization

Finance teams are under pressure to do more with fewer resources. Through OCR Invoice Processing, repetitive and labor-intensive tasks are automated, allowing staff to focus on higher-value activities. Automated Invoice Processing reduces the cost per invoice by minimizing rework and manual corrections. As a result, accounts payable operations become more cost-efficient and scalable.

Stronger Vendor Relationships and Visibility

Timely and accurate payments help build trust with vendors. By using OCR Invoice Processing, invoices are processed consistently and with fewer delays. With the support of Accounts Payable Automation, finance teams gain real-time visibility into invoice status and liabilities. Overall, OCR Invoice Processing enables finance and accounting teams to operate with greater efficiency, control, and transparency.

Common Challenges in OCR Invoice Processing and How They Are Addressed

Handling Poor Invoice Quality and Format Variations

Invoices are often received in inconsistent formats and varying quality levels. Low-resolution scans, handwritten fields, and unstructured layouts can affect data accuracy. In such cases, OCR Invoice Processing may face challenges during data extraction. These issues are addressed by applying advanced recognition models and validation rules that improve data capture reliability. As a result, OCR Invoice Processing remains effective even when invoice quality is not uniform.

Managing Exceptions in Automated Invoice Processing

Not all invoices follow standard patterns. Pricing discrepancies, missing purchase order numbers, or unmatched line items can interrupt workflows. Through Automated Invoice Processing, these exceptions are automatically flagged and routed for review. With OCR Invoice Processing, finance teams are only required to focus on invoices that truly need attention. This controlled approach reduces processing delays while maintaining accuracy and compliance.

Ensuring Accuracy With Invoice OCR Software

Data accuracy is a common concern for finance leaders. Errors introduced during extraction can impact payments and reporting. Modern Invoice OCR Software addresses this challenge by combining intelligent data recognition with rule-based validation. When supported by OCR Invoice Processing, extracted data is verified before being posted into accounting systems. This layered approach improves confidence in invoice data quality.

Maintaining Control Through Accounts Payable Automation

Security and audit readiness are critical in accounts payable operations. Manual workflows often lack transparency and traceability. With Accounts Payable Automation, every step of OCR Invoice Processing is documented and tracked. Approval histories and supporting documents are preserved, which simplifies audits and strengthens internal controls. By addressing these challenges systematically, OCR Invoice Processing continues to support reliable and scalable accounts payable operations.

Best Practices for Implementing OCR Invoice Processing Successfully

Prepare Invoices and Vendors for OCR Invoice Processing

A successful implementation of OCR Invoice Processing starts with proper preparation. Invoice formats, vendor templates, and data standards should be reviewed before automation is introduced. When vendors are encouraged to submit invoices in consistent digital formats, OCR Invoice Processing performs with higher accuracy. This preparation phase reduces downstream exceptions and improves overall processing efficiency.

Apply Human-in-the-Loop Controls in Automated Invoice Processing

While automation improves speed, human oversight remains important for complex scenarios. Through Automated Invoice Processing, routine invoices are handled automatically, while exceptions are routed for manual review. With OCR Invoice Processing, this human-in-the-loop approach ensures that critical invoices are validated without slowing down standard workflows. Accuracy and compliance are maintained without overburdening finance teams.

Implement OCR Invoice Processing in Phases

A phased rollout is recommended when deploying OCR Invoice Processing. Initial implementation should focus on high-volume, low-complexity invoices. Once stability is achieved, more complex invoice types can be added. This phased approach allows Accounts Payable Automation to be optimized gradually, reducing operational risk and user resistance.

Track Performance Metrics for Continuous Improvement

Clear performance metrics should be defined to measure success. Metrics such as invoice cycle time, exception rate, and cost per invoice are commonly used. With Invoice OCR Software, these insights are captured automatically and reported in real time. By monitoring these metrics, finance leaders can continuously refine OCR Invoice Processing and ensure long-term efficiency, scalability, and control within accounts payable operations.

OCR Invoice Processing Use Cases Across Industries

OCR Invoice Processing in Healthcare Finance Operations

Healthcare organizations manage high invoice volumes from suppliers, service providers, and third-party partners. With OCR Invoice Processing, invoice data is captured accurately despite complex formats and compliance requirements. Through Automated Invoice Processing, invoices are validated and routed efficiently, which supports timely payments and audit readiness. As a result, finance teams gain better control over costs and vendor management.

Manufacturing and Supply Chain Accounts Payable

Manufacturing companies deal with invoices related to raw materials, logistics, and production services. By using OCR Invoice Processing, line-item details and pricing information are extracted consistently. When supported by Invoice OCR Software, data accuracy is improved even when invoices vary by vendor. Integrated Accounts Payable Automation helps ensure that invoices are matched correctly and processed without delays.

Retail and eCommerce Invoice Processing

Retail and eCommerce businesses handle invoices from a wide range of suppliers and locations. With OCR Invoice Processing, invoices received through multiple channels are captured and standardized. Automated Invoice Processing enables faster approvals and better visibility into outstanding liabilities. This approach helps finance teams manage seasonal volume spikes without increasing operational overhead.

Financial Services and Professional Organizations

In financial services and professional firms, accuracy and compliance are critical. OCR Invoice Processing supports structured data capture and detailed audit trails. When paired with Accounts Payable Automation, invoices are processed in line with internal controls and regulatory expectations. Across industries, OCR Invoice Processing is relied upon to streamline accounts payable operations while maintaining accuracy, compliance, and scalability.

How OCR Invoice Processing Supports Compliance and Audit Readiness

Regulatory compliance and audit preparedness are critical across industries such as healthcare, life sciences, financial services, and manufacturing. Manual invoice handling often creates gaps in documentation and approval tracking. With OCR Invoice Processing, invoice data is captured consistently and stored in a structured format, which improves traceability. Every invoice is logged with time stamps and supporting documents, reducing audit risk.

Through Accounts Payable Automation, approval workflows are enforced based on internal controls and authorization hierarchies. Invoices are processed only after required validations are completed. When combined with Automated Invoice Processing, compliance checks such as duplicate detection and policy validation are applied automatically. This structured approach ensures that audit requirements are met without increasing manual workload.

Modern Invoice OCR Software further supports compliance by maintaining digital records that are easy to retrieve during internal or external audits. As regulations continue to evolve, OCR Invoice Processing enables organizations across industries to maintain consistent controls, reduce compliance gaps, and strengthen financial governance.

FAQs on OCR Invoice Processing for Automated Accounts Payable

What is OCR Invoice Processing used for in accounts payable?

OCR Invoice Processing is used to extract invoice data automatically and convert it into structured information for accounts payable systems. This reduces manual data entry and improves processing accuracy.

Can OCR Invoice Processing handle complex invoice formats?

Yes, modern Invoice OCR Software is designed to process invoices with varying layouts, multiple line items, and different formats. When combined with Automated Invoice Processing, exceptions are flagged for review.

Is OCR Invoice Processing suitable for mid-sized and enterprise organizations?

OCR Invoice Processing is widely used by mid-sized companies and large enterprises across industries. It supports scalability without requiring additional headcount.

How does OCR Invoice Processing improve financial control?

When integrated with Accounts Payable Automation, OCR Invoice Processing ensures consistent approvals, audit trails, and visibility into invoice status and liabilities.

Why OCR Invoice Processing Is a Strategic Priority for Finance Leaders

Finance leaders are expected to deliver speed, accuracy, and control while managing growing transaction volumes. OCR Invoice Processing is increasingly viewed as a strategic capability rather than a tactical tool. It enables finance teams to standardize invoice handling across departments, locations, and vendors.

With Automated Invoice Processing, invoice workflows become predictable and measurable. Processing delays are reduced, and real-time visibility into payables is improved. OCR Invoice Processing also supports better working capital management by enabling faster approvals and timely payments.

Across industries, organizations are prioritizing digital finance transformation. OCR Invoice Processing, supported by Accounts Payable Automation, helps finance leaders meet operational goals while strengthening governance and scalability.

How Rely Services Enables Scalable OCR Invoice Processing

Rely Services delivers managed OCR Invoice Processing solutions designed for organizations across industries, including healthcare, life sciences, manufacturing, retail, and financial services. A hybrid model combining intelligent automation with human validation is applied to ensure accuracy and compliance.

Through integrated Invoice OCR Software and domain-trained teams, invoices are processed efficiently while exceptions are handled with precision. Accounts Payable Automation workflows are configured to align with client-specific approval structures and ERP systems. This approach allows organizations to scale invoice processing without increasing operational risk.

By outsourcing OCR Invoice Processing to Rely Services, finance teams gain predictable performance, improved audit readiness, and reduced processing costs, while maintaining full visibility and control.

Conclusion: The Future of OCR Invoice Processing Across Industries

As invoice volumes continue to grow, manual processes are no longer sustainable. OCR Invoice Processing is becoming a foundational component of modern finance operations across industries. It enables faster processing, improved accuracy, and stronger compliance without adding complexity.

When supported by Automated Invoice Processing and Accounts Payable Automation, invoice workflows are transformed into structured, auditable, and scalable processes. With ongoing advancements in Invoice OCR Software, organizations can expect even greater efficiency and reliability.

For finance and accounting leaders, investing in OCR Invoice Processing is not just about automation. It is about building resilient, future-ready accounts payable operations that support business growth and regulatory confidence.

957 N Plum Grove Rd STE B,

Schaumburg, IL 60173

Rely Services is a trusted global Business Process Outsourcing (BPO) and managed services provider with over 25 years of expertise in helping businesses simplify complex operations and focus on strategic growth.

At its core, Rely Services delivers end-to-end solutions across key back-office and data-intensive areas - including healthcare revenue cycle management, finance & accounting services, data management, invoice processing, and accounts payable/receivable workflows.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release OCR Invoice Processing: Automate Accounts Payable Workflows here

News-ID: 4351362 • Views: …

More Releases from Rely Services Inc

Outsourced Medical Billing Services | End-to-End Revenue Cycle Management by Rel …

Looking to streamline your revenue cycle, reduce costs, and boost your bottom line? Our outsourced medical billing services offer end-to-end billing solutions tailored to the needs of healthcare providers, clinics, and hospitals. Whether you're a small practice or a large medical group, our expert medical billing specialists are here to help you navigate the complexities of revenue cycle management (RCM) with precision and efficiency.

Why Rely Services for Medical Billing?

The healthcare…

Unlocking the Power of Data Enrichment: A Game-Changer for Your Business

Data enrichment gives your customer data a transformative boost by enhancing the quality and value of the information your business relies on. It's not just about collecting more data-it's about intelligently integrating additional insights from external sources to amplify the impact of your existing datasets. This process sharpens your understanding and empowers smarter, more informed decisions.

In today's data-driven landscape, enriched data serves as a catalyst for improved operations, sharper strategies,…

What is Outsourcing? A Simple Guide for Businesses | Rely Services Inc

Outsourcing means hiring another company to manage certain tasks or operations for your business. By outsourcing, you can focus on what matters most while an external provider handles other work. This can range from back-office tasks like data entry to specialized areas like IT management.

Every outsourcing provider offers different services and has unique strengths, but their primary goal is to help businesses succeed by lightening their workload.

For detailed information reach…

More Releases for Invoice

Invoice Automation Software Market Valuation Expected to Hit USD 9.6 billion by …

New Jersey, US State: "The global Invoice Automation Software market in the Information Technology and Telecom category is projected to reach USD 9.6 billion by 2031, growing at a CAGR of 12.1% from 2025 to 2031. With rising industrial adoption and continuous innovation in Information Technology and Telecom applications, the market is estimated to hit USD 3.5 billion in 2024, highlighting strong growth potential throughout the forecast period."

Invoice Automation Software…

Invoice Management System Market Future Business Opportunities 2025-2032 | Stamp …

IMR posted new studies guide on Invoice Management System Market Insights with self-defined Tables and charts in presentable format. In the Study you may locate new evolving Trends, Drivers, Restraints, Opportunities generated via targeting market related stakeholders. The boom of the Invoice Management System Market place became specifically driven with the aid of the growing R&D spending internationally.

Some of the Top Leading Key Players:

Stampli

Concur Invoice

Opentext

Katana

Tipalti

Nanonets

Sana Commerce

Corcentric

Melio

Zoho Invoice

Quickbooks

Xero

Workflowmax

Download Sample…

Enhance Your Invoice in Your Local Language with Moon Invoice

Moon Invoice software has always been on the top when offering the best invoicing features. With its best features, it always simplifies the overall financial strategy for the professionals. Be it a small business, mid-size business, or a large one, Moon Invoice is always a compatible financial platform for all.

To enhance its services, Moon Invoice always incorporates advancement to upgrade its work to the next level. Following this, it…

Invoice Temple Launches Free Invoice Generator Online for Small Businesses and F …

Chennai, India - Invoice Temple, a trusted invoicing solution, is excited to announce the launch of its Free Invoice Generator Online. This user-friendly tool is designed to simplify the invoicing process for small businesses and freelancers worldwide.

The Free Invoice Generator Online allows users to create, customize, and send professional invoices with ease. With no need for complex software, users can generate up to 5 invoices for free and access affordable…

Invoice Software Market Giants Spending Is Going To Boom | Invoice Ninja, Simply …

Latest Study on Industrial Growth of Invoice Software Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Invoice Software market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and developments…

Invoice Software Market to See Huge Growth by 2028 | Invoice Ninja, Wave Invoici …

Latest Study on Industrial Growth of Invoice Software Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Invoice Software market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and developments…