Press release

Top 30 Indonesian Asphalt Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)PT Xolare RCR Energy Tbk asphalt trading & related services (asphalt exposure).

PT Waskita Karya (Persero) Tbk major construction with asphalt/road works exposure.

PT Wijaya Karya Tbk construction/engineering with asphalt/bitumen materials involvement.

PT Adhi Karya (Persero) Tbk large contractor with asphalt/road segments.

PT PP (Persero) Tbk diversified construction, road projects included.

PT Nusa Raya Cipta Tbk contractor including road/asphalt surfacing works.

PT Total Bangun Persada Tbk construction with project exposure that often includes asphalt.

PT Surya Semesta Internusa Tbk construction & infrastructure partner.

PT Jaya Konstruksi Manggala Pratama Tbk construction contractor with roads.

PT Wijaya Karya Beton Tbk WIKA Beton, materials supplier (concrete/asphalt-adjacent).

PT Acset Indonusa Tbk contractor; civil engineering & infrastructure.

PT Nusantara Infrastructure Tbk infrastructure assets and project flows (incl. road/communications).

PT Indonesia Kendaraan Terminal Tbk logistics & infrastructure (road asset support).

PT PP Presisi Tbk precision civil works supportive of road/infrastructure delivery (honourable mention).

PT Perusahaan Perdagangan Indonesia (Persero) trading house with construction materials (incl. asphalt).

PT Semen Indonesia (Persero) Tbk building materials & aggregates supplier (cement/road products).

PT Indocement Tunggal Prakarsa Tbk materials supplier (not asphalt but core road construction materials).

PT Asphalt Bangun Sarana asphalt distributor/manufacturer (though not public, important asphalt player)

PT Aspal Polimer Emulsindo asphalt producer (core asphalt materials firm)

PT Marga Sarana Raya Tbk toll operator & road asset manager (infrastructure exposure).

PT Hutama Prima Tbk contractor with road infrastructure works.

PT Agro Yasa Lestari Tbk materials supplier (infrastructure-relevant).

PT Holcim Indonesia Tbk materials supplier (concrete & aggregates supporting asphalt infrastructure).

PT Delta Dunia Makmur Tbk general mining & materials (bitumen & road-related).

PT Surya Semesta Media Tbk related to Surya Semesta groups infrastructure operations.

PT Tower Bersama Infrastructure Tbk communications infrastructure often involving road access/works.

PT Indah Karya (Persero) Tbk state contractor with road project exposure.

PT Len Industri (Persero) Tbk electronics in infrastructure integration (signal/road systems).

PT Telekomunikasi Indonesia Tbk infrastructure support connected to road assets.

PT Jasa Marga (Persero) Tbk toll road operator (infrastructure including asphalt surface management)

2) Revenue results of major public companies in Indonesia summarized (per company)

1. PT Xolare RCR Energy Tbk (XOLARE) - Asphalt trading & processing, construction services. Xolare is a Jakarta-listed company focused on asphalt trading under trademark XOLABIT and asphalt processing industrial services.

2. PT Wijaya Karya Tbk (WIKA) - Q3 2025 Result: Net loss ~Rp 3.21 trillion (~USD 192 million). Construction revenue slowed; asphalt/bitumen subsidiary activity insufficient to offset broader cost pressures.

3. PT Nusa Raya Cipta Tbk (NRCA) - Q3 2025 Result: Net profit ~Rp 156.3 billion (~USD 9.36 million). Strong project execution and private sector contracts helped profitability including road surfacing work.

4. PT Total Bangun Persada Tbk (TOTL) - Q3 2025 Result: Net profit ~Rp 295.3 billion (~USD 17.7 million). Broader construction execution lifts income; asphalt deployment part of project mix.

5. PT Surya Semesta Internusa Tbk (SSIA) - Q3 2025 Result: Net profit ~Rp 6.5 billion (~USD 0.39 million). Mixed construction/property portfolio; road delivery contributed to marginal profit.

6. PT Waskita Karya Tbk (WSKT) - Q3 2025 Result: Net loss ~Rp 3.17 trillion (~USD 190 million). Despite asphalt works, major losses due to financing/working capital.

7. PT Adhi Karya Tbk (ADHI) - Q3 2025 Result: Net profit ~Rp 4.42 billion (~USD 0.26 million). Narrow profit; asphalt contracts were a small part of overall revenue.

8. PT PP (Persero) Tbk (PTPP) - Q3 2025 Result: Net profit ~Rp 5.55 billion (~USD 0.33 million). Limited contribution from asphalt/road works amid slow contract awards.

9. PT WIKA Beton Tbk (WTON) - Q3 2025 Result: Net profit ~Rp 8.4 billion (~USD 0.50 million). Concrete/asphalt-adjacent materials support niche segments.

10. PT Indonesia Kendaraan Terminal Tbk (IPCC) - Q3 2025 Result: Net profit ~Rp 190.3 billion (~USD 11.4 million). Logistics contribution including asphalt product terminal flows

3) Key trends & insights from Q3 2025

Profit Divergence

Larger construction contractors with asphalt business units frequently posted losses or narrow bottom lines due to project slowdowns and financing cost headwinds. Smaller or specialized firms with diversified materials portfolios often maintained modest profitability.

Asphalt Demand Drivers

Demand tied to government spending on road maintenance and civil infrastructure remained solid, although capital disbursements lagged expectations impacting contract revenues. Asphalt traders and distributors retained backlog strength where terminal access supported supply continuity.

Cost & Input Pressures

Elevated bitumen prices and FX pressures affected margins. Many contractors reported compressed earnings despite steady activity

4) Outlook for Q4 2025 and beyond

Optimistic Demand Growth:

Anticipated acceleration in road resurfacing programs, particularly government-backed projects targeting rural connectivity.

Earnings Improvement Potential:

Asphalt suppliers and trading firms (like Xolare) may benefit from wide bitumen distribution networks if payment cycles improve.

Contractors with integrated materials operations might see margin recovery if input cost volatility eases.

Risks:

Continued fiscal constraints could delay infrastructure spending.

FX and commodity price swings may compress profitability for exporters/importers of asphalt components.

5) Conclusion

Q3 2025 in Indonesias asphalt industry revealed a sector at an inflection point: demand remains anchored in public infrastructure, but profitability hinges on broader construction market dynamics, cost pressures, and contract flows. While comprehensive asphalt-specific earnings across 30 listed companies arent fully published, the available data shows a mixed but potentially resilient sector with growth prospects tied to national infrastructure priorities and firm-specific strategy execution.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Asphalt Public Companies Q3 2025 Revenue & Performance here

News-ID: 4351159 • Views: …

More Releases from QY Research

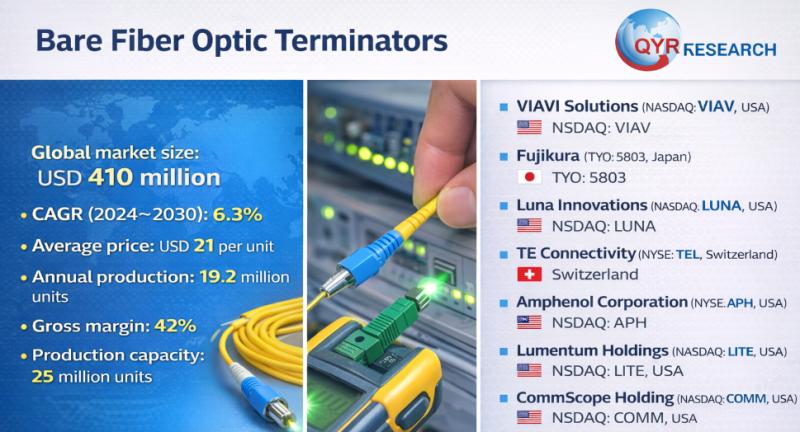

Global and U.S. Bare Fiber Optic Terminators Market Report, Published by QY Rese …

QY Research has released a comprehensive new market report on Bare Fiber Optic Terminators, precision optical components used to temporarily or permanently terminate unconnectorized (bare) optical fibers for testing, measurement, and laboratory evaluation. By providing controlled alignment, low back reflection, and repeatable coupling to optical instruments, bare fiber optic terminators are essential tools in fiber manufacturing, component R&D, photonics laboratories, and field diagnostics. As demand grows for high-performance optical networks,…

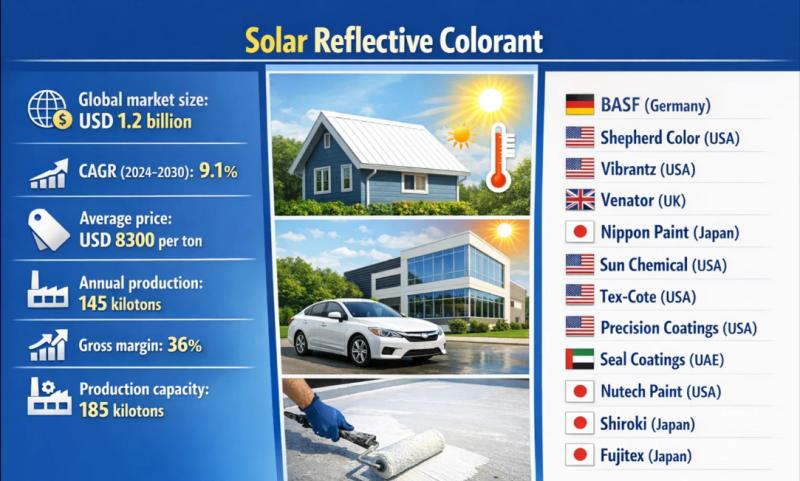

How GAF Cut Roof Temperatures by 20°C: Solar Reflective Colorants Redefining En …

Problem

GAF Materials Corporation used conventional pigments and colorants in coatings, plastics, and construction materials absorb a large portion of near-infrared (NIR) solar radiation-especially dark or saturated colors. This absorption causes excessive surface heat buildup, leading to higher indoor temperatures, increased cooling energy demand, accelerated material aging, and color fading. In roofing, façades, and outdoor equipment, these drawbacks raised operating costs and reduced service life.

Solution

Shepherd Color Company adopted Solar Reflective Colorants,…

Global and U.S. Ambient Light Meters Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Ambient Light Meters, devices used to measure the intensity of light in an environment, typically expressed in lux (illumination level). They help assess lighting conditions for photography, cinematography, workplace safety, architectural design, horticulture, and energy-efficient lighting. By quantifying ambient light, these meters ensure optimal visibility, comfort, and compliance with lighting standards.

Core Market Data

Global market size: USD 188 million

CAGR (2024-2030): 5.6%

Average…

Top 30 Indonesian Aluminum Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Aneka Tambang Tbk (ANTM) Diversified metal producer with gold, nickel, and light metals exposure; reported net profit ~USD 357.7 m in Q3 2025.

Bayan Resources Tbk (BYAN) Large coal/metal miner; Q3 profit ~USD 521.8 m.

Adaro Energy Tbk (ADRO) Coal and energy miner with diversified metals exposure; Q3 profit ~USD 301.3 m.

Indo Tambangraya Megah Tbk (ITMG) Coal/minerals; Q3…

More Releases for Tbk

Retain in Indonesia Market Size, Dynamics 2031 by Major Companies- PT. Djaru, PT …

USA, New Jersey: According to Verified Market Research analysis, the Retain in Indonesia Market size was valued at USD 48.56 Billion in 2024 and is projected to reach USD 70.67 Billion by 2032, growing at a CAGR of 4.8% from 2026 to 2032.

What is the current market outlook for the retail sector in Indonesia?

The retail sector in Indonesia is experiencing robust growth driven by rising consumer purchasing power, urbanization, and…

Infrastructure Market 2021 Strategic Assessments - PT. Acset Indonusa Tbk.., Pt. …

The Infrastructure Market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The Infrastructure sector in Indonesia is…

Indonesia Telecom Tower Market Demand, Size, Share, Scope & Forecast To 2025 |To …

The Indonesia telecom tower market accounted to US$ 557.9 Mn in 2017 and is expected to grow at a CAGR of 27.1% during the forecast period 2018 – 2025, to account to US$ 3,695.5 Mn by 2025.

Get Sample Copy of this Indonesia Telecom Tower Market research report at - https://www.businessmarketinsights.com/sample/TIPRE00004113

The Business Market Insights provides you regional research analysis on “Indonesia Telecom Tower Market” and forecast to 2025. The research report…

Coal Mining in Indonesia Market 2022| PT Bumi Resources Tbk, PT Adaro Energy Tbk …

Researchmoz added Most up-to-date research on "Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption" to its huge collection of research reports.

Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption

Summary

GlobalData's "Coal Mining in Indonesia to 2022", provides a comprehensive coverage on Indonesias coal industry. It provides historical and forecast data on coal production by grade, reserves, consumption and exports by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes

Summary

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by type; exports, exports by type and exports by country. Detailed analysis of the…