Press release

Top 30 Indonesian Aluminum Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)PT Aneka Tambang Tbk (ANTM) Diversified metal producer with gold, nickel, and light metals exposure; reported net profit ~USD 357.7 m in Q3 2025.

Bayan Resources Tbk (BYAN) Large coal/metal miner; Q3 profit ~USD 521.8 m.

Adaro Energy Tbk (ADRO) Coal and energy miner with diversified metals exposure; Q3 profit ~USD 301.3 m.

Indo Tambangraya Megah Tbk (ITMG) Coal/minerals; Q3 profit ~USD 130.6 m.

PT Bukit Asam Tbk (PTBA) Coal/minerals; Q3 profit ~USD 83.3 m.

Vale Indonesia Tbk (INCO) Nickel concentrator with metals markets linkage; Q3 profit ~USD 52.4 m.

PT Timah Tbk (TINS) Tin & metal producer; Q3 profit ~USD 36.1 m.

Harum Energy Tbk (HRUM) Mining group with positive Q3 earnings ~USD 37.3 m.

Merdeka Copper Gold Tbk (MDKA) Large metals producer; 9M 2025 revenue ~USD 1.298 bn.

Amman Mineral Internasional Tbk (AMMN) Metals & smelting; Q3 net loss ~USD 178.5 m.

Golden Energy & Resources (GEMS) Major energy/mining group with Q3 earnings.

Bumi Resources Tbk (BUMI) Integrated mining group with profit data available.

PT Merdeka Gold Resources (EMAS) Precious metals miner.

Borneo Olah Sarana Sukses (BOSS) Mining & metal services.

Baramulti Suksessarana (BSSR) Mining conglomerate.

Indika Energy Tbk (INDY) Energy & mining exposure.

Mitrabara Adiperdana Tbk (MBAP) Mining & logistics.

Sumber Mineral Global Smaller listed metals & mining entity.

J Resources (PSAB) Gold & metal miner.

Wilton Resources (SQMI) Nickel/metal mining exposure.

Bumi Resources Minerals (BRMS) Minerals segment with metals exposure.

Transcoal Pacific Tbk Coal & related mining; sector placement.

Petrosea Tbk Mining & heavy services.

Elnusa Tbk Oil & mining services.

TBS Energi Utama Tbk Energy & mining sectors.

Other IDX Metals/Mining Small Caps Represents multiple smaller listings with emerging metals exposure (lumped as IDX metal small caps).

PT Alumindo Light Metal Industry Tbk (ALMI) Light metals / aluminum products company

PT Cita Mineral Investindo Tbk (CITA) Materials/mining company with aluminum/bauxite linkage

2) Revenue results of major public companies in Indonesia summarized (per company)

1. PT Aneka Tambang Tbk (ANTM) - Net Profit: ~Rp 5.97 trillion (~USD 357.7 m) in Q3 2025. Profit improvement driven by higher downstream margins in metals, including ancillary contributions to processing volumes.

2. Bayan Resources Tbk (BYAN) - Net Profit: ~Rp 8.71 trillion (~USD 521.8 m). Strong earnings supported by consistent contract pricing and volume mix, placing Bayan among the top metal-sector earners.

3. Adaro Energy Tbk (ADRO) - Net Profit: ~Rp 5.03 trillion (~USD 301.3 m). Continues cash generation amid commodity pricing pressures.

4. Indo Tambangraya Megah Tbk (ITMG) - Net Profit: ~Rp 2.18 trillion (~USD 130.6 m). Reflects stable coal/metals operations despite softer benchmarks.

5. PT Bukit Asam Tbk (PTBA) - Net Profit: ~Rp 1.39 trillion (~USD 83.3 m). Volume growth offset by weaker realized pricing yields.

6. Vale Indonesia Tbk (INCO) - Net Profit: ~Rp 874.8 billion (~USD 52.4 m). Operational efficiencies amid stable nickel cycles.

7. PT Timah Tbk (TINS) - Net Profit: ~Rp 602.4 billion (~USD 36.1 m). Margins modest, tin price impact notable.

8. Harum Energy Tbk (HRUM) - Net Profit: ~Rp 622.3 billion (~USD 37.3 m). Positive cash flows amid tighter margins.

9. Merdeka Copper Gold Tbk (MDKA) - Performance: ~USD 1.3 bn 9M revenue; weaker YoY performance tied to lower nickel markets.

10. Amman Mineral Internasional Tbk (AMMN) - Net Loss: ~Rp 2.98 trillion (~USD 178.5 m). Quarterly loss driven by export constraints and smelter issues.

3) Key trends & insights from Q3 2025

Aluminum Demand and Production

INALUM Achievements: INALUM reported record production/sales for 2025 (≈280,082 MT production and 280,141 MT sales) - the best performance in its 50-year history, signaling strong operational momentum in Indonesian primary aluminum production.

Commodity Pricing

Global aluminum prices have shown resilience, supporting export-linked revenues for producers despite pressures in other metal segments.

Divergent Company Performance

Some metal companies recorded strong profits (e.g., BYAN, ANTM), while others like AMMN faced significant losses, highlighting mixed operational outcomes across the metal ecosystem.

Hilirisasi and Downstream Push

Companies like INALUM and related downstream players are advancing value-added aluminum processing (e.g., billets, extrusions) to capture greater margins domestically and internationally.

4) Outlook for Q4 2025 and beyond

Market Drivers

Stable Global Demand: Continued infrastructure, automotive, and renewable energy growth supports long-term aluminum demand.

Supply Chain Enhancements: Expansion of alumina refining capacity (e.g., ASEAN alumina projects) may lower input costs and improve margins.

Key Risks

Commodity Price Volatility: Fluctuating prices on global exchanges (e.g., LME) can compress earnings for producers.

Operational Challenges: Smelter constraints (as seen at AMMN) and export restrictions can erode quarterly performance.

Strategic Focus

Firms are expected to emphasize downstream integration, energy efficiency, and market diversification to mitigate cyclicality while capturing growth in both domestic and export markets.

5) Conclusion

The Q3 2025 financial results across Indonesian metals and aluminum-associated companies reveal a mixed yet resilient industry landscape. High performers like ANTM and BYAN anchor strong quarterly earnings, while strategic operations by INALUM continue to push Indonesias aluminum production capabilities to new highs. Despite the absence of standalone aluminum company earnings for many listings, the broader metals sector underscores the importance of diversified production, operational efficiency, and alignment with global demand trends as Indonesia positions itself as a key player in the aluminum value chain.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Aluminum Public Companies Q3 2025 Revenue & Performance here

News-ID: 4349756 • Views: …

More Releases from QY Research

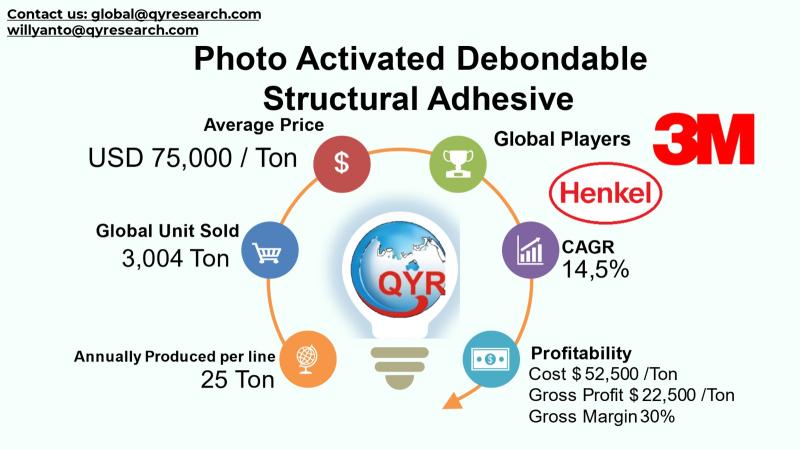

Light-Triggered Bonds: Why Photo-Activated Debondable Adhesives Are Reshaping As …

Photo-activated debondable structural adhesives represent a specialized but fast-growing class of high-performance bonding materials designed to provide strong structural adhesion during service while allowing controlled, on-demand debonding when exposed to specific wavelengths of light. This capability addresses a critical industry need for reversibility, repairability, and recyclability in advanced manufacturing, particularly as global industries move toward circular economy principles and more complex, multi-material assemblies. The photo-activated debondable structural adhesive industry sits…

High-Performance Polymers in Electromagnetic Systems: PEEK Magnet Market Analysi …

The global market for Polyetheretherne (PEEK) materials has been expanding steadily as manufacturers and end-users seek high-performance engineering plastics with exceptional thermal stability, chemical resistance, and mechanical strength. PEEK is widely used in demanding applications where conventional polymers or metals fall short, including aerospace components, automotive parts, electrical/electronic insulation, and medical devices. Its adaptation in magnet systems and magnet wire insulationthough niche is driven by PEEKs unique dielectric and temperature…

From Cost Structures to Innovation: Inside the 2024 Wood Preservative Chemicals …

The global low leaching wood preservative chemical industry encompasses the production, distribution, and application of specialized chemical formulations designed to protect wood products from decay, insect attack, and environmental degradation while minimizing the release of harmful substances into soil and water. These chemicals are engineered to adhere within the wood matrix to ensure longevity and safety, making them increasingly preferred over traditional preservatives that can leach toxic compounds. The industry…

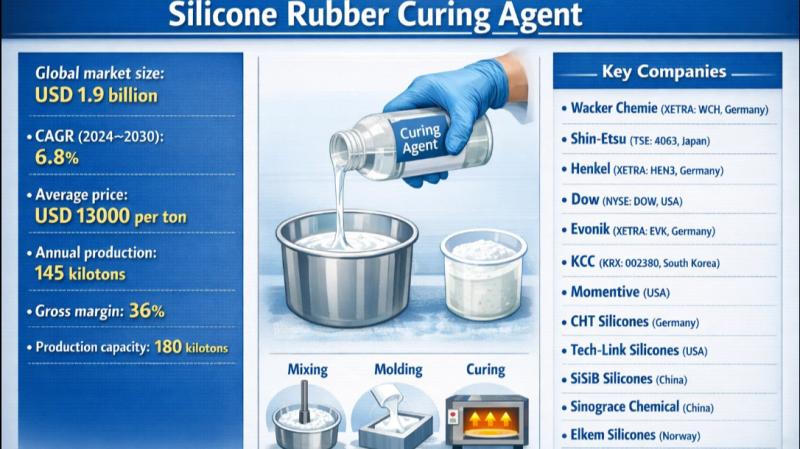

Silicone Rubber Curing Agents: From Slow Cure to Precision Performance

Problem

Cardinal Health using conventional curing systems for silicone rubber often faced slow curing speed, inconsistent crosslinking, and limited control over mechanical properties. Inadequate curing could lead to uneven hardness, poor tensile strength, surface tackiness, or reduced thermal and chemical resistance. These issues increased defect rates, extended production cycles, and constrained performance in demanding applications such as electronics, automotive, medical, and industrial sealing.

Solution

Shin-Etsu Chemical adopted Silicone Rubber Curing Agents, specialized additives…

More Releases for Tbk

Retain in Indonesia Market Size, Dynamics 2031 by Major Companies- PT. Djaru, PT …

USA, New Jersey: According to Verified Market Research analysis, the Retain in Indonesia Market size was valued at USD 48.56 Billion in 2024 and is projected to reach USD 70.67 Billion by 2032, growing at a CAGR of 4.8% from 2026 to 2032.

What is the current market outlook for the retail sector in Indonesia?

The retail sector in Indonesia is experiencing robust growth driven by rising consumer purchasing power, urbanization, and…

Infrastructure Market 2021 Strategic Assessments - PT. Acset Indonusa Tbk.., Pt. …

The Infrastructure Market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The Infrastructure sector in Indonesia is…

Indonesia Telecom Tower Market Demand, Size, Share, Scope & Forecast To 2025 |To …

The Indonesia telecom tower market accounted to US$ 557.9 Mn in 2017 and is expected to grow at a CAGR of 27.1% during the forecast period 2018 – 2025, to account to US$ 3,695.5 Mn by 2025.

Get Sample Copy of this Indonesia Telecom Tower Market research report at - https://www.businessmarketinsights.com/sample/TIPRE00004113

The Business Market Insights provides you regional research analysis on “Indonesia Telecom Tower Market” and forecast to 2025. The research report…

Coal Mining in Indonesia Market 2022| PT Bumi Resources Tbk, PT Adaro Energy Tbk …

Researchmoz added Most up-to-date research on "Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption" to its huge collection of research reports.

Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption

Summary

GlobalData's "Coal Mining in Indonesia to 2022", provides a comprehensive coverage on Indonesias coal industry. It provides historical and forecast data on coal production by grade, reserves, consumption and exports by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes

Summary

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by type; exports, exports by type and exports by country. Detailed analysis of the…