Press release

Where Automation Meets Infrastructure: Four Companies Capturing Durable Growth (ZENA, TRMB, PSN, FLR)

Infrastructure spending is accelerating, but execution is the binding constraint. Across energy, transportation, public works, and defense, project owners face pressure to move faster, operate safer, and document progress continuously. Manual surveying, on-site inspections, and fragmented data workflows are increasingly incompatible with these demands.This gap is driving rapid adoption of drone-enabled services, AI-driven analytics, and automated inspection platforms. The global drone services market is growing 36% annually and is projected to reach $355 billion by 2032, fueled by construction, utilities, telecom, and government demand. The investment opportunity lies not in hardware alone but in companies that can scale recurring, field-deployed services across regulated, high-value end markets.

Against this backdrop of accelerating demand for automated, data-driven infrastructure solutions, several companies are emerging as leaders in scaling technology, services, and execution capabilities. Now let's look at four companies driving the next phase of infrastructure execution.

ZenaTech, Inc. (NASDAQ: ZENA) is rapidly emerging as one of the most aggressive consolidators and platform builders in the global Drone-as-a-Service (DaaS) market, with recent developments materially strengthening both its commercial and government-facing growth trajectory.

Over the past twelve months, ZenaTech has executed an accelerated roll-up strategy, completing 20 acquisitions in its first year of DaaS operations, well ahead of internal timelines. Management has stated its goal is to reach 25 DaaS locations by the end of Q2 2026, building a geographically dense, multi-service network anchored by existing customers and immediate revenue. CEO Shaun Passley, Ph.D., emphasized that this approach targets "profitable businesses operating with legacy processes," modernizing them through drone automation, AI, and data-driven workflows.

Recent acquisitions span high-growth verticals including solar infrastructure, wildfire management, aviation surveying, telecom tower design, power washing, and precision agriculture. In November, ZenaTech signed an offer to acquire a Utah-based LiDAR and 3D mapping firm focused on large-scale solar projects, marking its formal entry into solar infrastructure. Management cited North America's solar systems market growing at over 15 percent annually, noting that many developers still rely on manual surveying methods, creating a clear efficiency gap for drone automation.

In January 2026, the company announced its 20th acquisition, adding L.D. King, Inc. in Southern California, a region highly exposed to wildfire risk and public works demand. Passley stated that the acquisition strengthens ZenaTech's ability to deploy drone-enabled services for "future wildfire management, post-disaster assessments, and regional planning activities." According to Pragma Market Research, the global drone services market is growing at over 36 percent annually, with an expected market size of $355 billion by 2032.

International expansion has also accelerated. In December, ZenaTech entered Australia, the UK, and Canada, extending DaaS into mining, natural resources, telecom infrastructure, and urban inspection markets. The UK telecom acquisition aligns with a sector undergoing heavy investment following consolidation and an 11 billion 5G rollout commitment, driving demand for faster, safer inspection and design workflows.

On the defense side, ZenaTech's January 6, 2026 update may prove pivotal. Following an FCC public notice restricting authorization of new foreign-made drones, management highlighted ZenaDrone's positioning as a U.S.-based, NDAA-compliant manufacturer pursuing Blue UAS certification. "The U.S. is moving quickly to secure trusted supply chains," Passley said, adding that ZenaDrone is aligned with rising demand for domestic ISR, cargo, and infrastructure protection platforms. The company disclosed that its ZenaDrone 1000 has already completed paid trials with the U.S. Air Force and Navy Reserve, underscoring real-world validation.

Taken together, ZenaTech's accelerating acquisition cadence, expanding recurring-revenue DaaS footprint, and improving regulatory alignment in defense markets position the company as a differentiated platform at the intersection of drones, AI, and mission-critical services.

Trimble Inc. (NASDAQ: TRMB) is a global technology company focused on positioning, geospatial data, modeling, and enterprise software used across construction, infrastructure, transportation, agriculture, and logistics markets. The company provides integrated hardware and software solutions that connect field data collection with office-based design, planning, and project management workflows.

Trimble has been executing its multi-year Connect & Scale strategy, which emphasizes recurring revenue, operational simplification, and margin expansion. This shift has materially changed the company's revenue mix. As of the third quarter of fiscal 2025, Trimble reported approximately $2.31 billion in annualized recurring revenue, reflecting consistent year-over-year growth driven by software subscriptions and services.

In its most recent quarterly results, Trimble posted revenue of approximately $901 million, representing modest year-over-year growth while delivering improved operating margins and solid non-GAAP profitability. Management also raised full-year fiscal 2025 revenue and earnings guidance, signaling confidence in execution despite uneven macro conditions. Capital allocation remains disciplined, with more than $700 million in share repurchases year to date, reinforcing management's long-term value creation focus.

Today, roughly 75 percent of Trimble's total revenue is recurring, reducing reliance on cyclical hardware sales and improving cash flow visibility. The company continues to invest in AI-enabled modeling, automation, and data analytics, while maintaining deep partnerships with major equipment manufacturers and infrastructure operators.

From a market standpoint, TRMB shares have shown relative resilience, though the stock remains below its 52-week high amid broader sector and macro volatility. Overall, Trimble's expanding recurring revenue base, improving margins, and continued execution of its Connect & Scale strategy position the company as a durable enterprise technology provider serving mission-critical physical asset industries.

Parsons Corporation (NYSE: PSN) is a U.S.-based technology-focused engineering and government contractor with core exposure to defense, intelligence, cybersecurity, and critical infrastructure markets. The company operates globally through two primary segments, Federal Solutions and Critical Infrastructure, delivering mission-critical systems and services to U.S. federal agencies, allied governments, and public-sector infrastructure owners.

Parsons' Federal Solutions segment supports national security priorities across cyber operations, electronic warfare, missile defense, geospatial intelligence, counter-unmanned aircraft systems, and secure digital integration. The company has increasingly embedded artificial intelligence, machine learning, and advanced data analytics into mission systems to enhance threat detection, decision support, and operational resilience across defense and intelligence programs.

Contract momentum remains strong. Recent awards include a $137 million task order from the Defense Threat Reduction Agency for cyber operations support, along with multiple contract wins exceeding $100 million across defense, intelligence, and civilian agency programs. These awards reinforce Parsons' position as a trusted prime contractor for complex, high-consequence government missions.

Within its Critical Infrastructure segment, Parsons delivers engineering, construction management, and digital modernization services for transportation networks, urban development, and environmental remediation projects. The company applies cloud-based platforms, digital twins, and autonomous systems integration to modernize roads, bridges, airports, transit systems, and public works infrastructure. Parsons has been selected by multiple state transportation departments to support advanced operations technology, inspection services, and long-term infrastructure planning initiatives.

Overall, Parsons' diversified government contract base, expanding use of AI-enabled technologies, and consistent contract execution position the company as a key integrator of advanced systems across defense and critical infrastructure markets.

Fluor Corporation (NYSE: FLR) is a global engineering, procurement, and construction firm with more than a century of operating history and a core focus on executing complex, large-scale capital projects across energy, industrial, infrastructure, and government markets. Headquartered in Irving, Texas, Fluor serves public and private sector clients worldwide, delivering transportation systems, energy facilities, mining and metals projects, life sciences campuses, and major public works programs. The company maintains a multi-year backlog measured in the tens of billions of dollars, providing long-term visibility into project execution.

Fluor operates through three primary segments: Urban Solutions, Energy Solutions, and Mission Solutions. Urban Solutions supports transportation infrastructure, mining, and life sciences construction. Energy Solutions focuses on LNG, power generation, renewables, and industrial facilities. Mission Solutions delivers engineering and project services to U.S. government agencies, including national security and critical infrastructure programs. Across all segments, Fluor has increasingly emphasized reimbursable and risk-managed contract structures to improve execution discipline and reduce exposure to fixed-price volatility.

The scale and complexity of Fluor's projects place a premium on accurate site intelligence, safety oversight, and real-time progress monitoring. Large transportation corridors, energy facilities, and industrial developments require continuous surveying, inspection, and documentation throughout the project lifecycle. Traditional manual methods are time-intensive and increase safety and cost risks, particularly across expansive or hazardous job sites.

As project owners and contractors push to reduce rework, improve safety performance, and maintain schedule certainty, digital workflows are becoming central to execution. Aerial surveying, LiDAR mapping, and drone-enabled inspection increasingly support construction planning, quality assurance, and asset verification across Fluor's end markets. These technologies enable faster data capture, remote monitoring, and more informed decision-making at scale.

Overall, Fluor's role as a leading executor of large capital projects highlights how advanced surveying, inspection, and data-driven workflows are becoming embedded within modern engineering and construction operations.

Disclaimers: RazorPitch Inc. "RazorPitch" is not operated by a licensed broker, a dealer, or a registered investment adviser. This content is for informational purposes only and is not intended to be investment advice. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performances are not statements of historical fact and may be forward-looking statements. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties that could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this action may be identified through the use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor's investment may be lost or impaired due to the speculative nature of the companies profiled. RazorPitch has been retained and compensated by ZenaTech Ltd. to assist in the production and distribution of content related to ZENA. RazorPitch is responsible for the production and distribution of this content. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. This content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, or offer by RazorPitch or any third-party service provider to buy or sell any securities or other financial instruments. All content in this article is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in this article constitutes professional and/or financial advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. RazorPitch is not a fiduciary by virtue of any persons use of or access to this content.

Image: https://www.abnewswire.com/upload/2026/01/903420e60d82a505be4c7cab9ba094d5.jpg

Media Contact

Company Name: RazorPitch

Contact Person: Mark McKelvie

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=where-automation-meets-infrastructure-four-companies-capturing-durable-growth-zena-trmb-psn-flr]

City: NAPLES

State: Florida

Country: United States

Website: https://razorpitch.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Where Automation Meets Infrastructure: Four Companies Capturing Durable Growth (ZENA, TRMB, PSN, FLR) here

News-ID: 4348138 • Views: …

More Releases from ABNewswire

MT Dunn Plumbing Expands Emergency Services in Hillsboro & Across Portland, Oreg …

MT Dunn Plumbing LLC (CCB# 234243) expands 24/7 emergency services across Hillsboro, Beaverton, Portland & Washington County. The licensed, bonded, and insured contractor provides immediate response for burst pipes, water heater failures, sewer backups, and drain clogs. Operating from Hillsboro, owner Michael T Dunn serves residential and commercial properties region-wide. Emergency contact: 503-640-2458 or mtdunnplumbing.com.

Hillsboro, OR - MT Dunn Plumbing LLC, a licensed and established plumbing contractor serving the Portland…

Beyond the Prompt: How Mimic Motion Architecture is Redefining the 2026 Passive …

Image: https://www.abnewswire.com/upload/2026/02/ac57e1a7b6e53a95f52ea0f18fcb990c.jpg

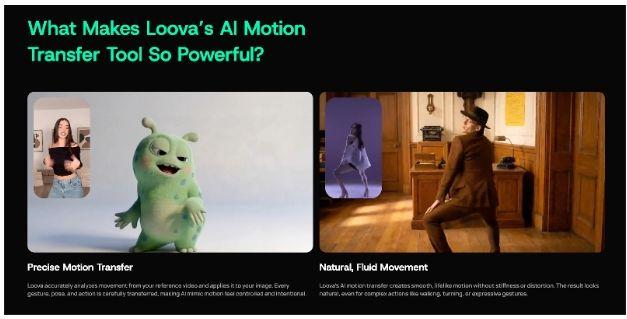

As we move through 2026, the digital economy is no longer just about "what" you show, but "how" it moves. Static content is losing ground to kinetic, motion-driven narratives that capture attention in seconds. At the center of this shift is Loova, whose proprietary Mimic Motion architecture has become the secret engine behind some of the most successful passive income streams this year.

This report breaks down the technical logic…

The Real Cost of Convenience: A Complete Guide to Vending Machine Startup Costs

Image: https://www.abnewswire.com/upload/2026/02/32ec9ac40420df59e70c21070d981def.jpg

The dream of earning passive income often leads aspiring entrepreneurs to the world of automated retail. It is a sector defined by low labor requirements and the ability to generate revenue around the clock. However, before you can stock your first row of snacks, you must understand the financial commitment required to get your equipment on-site. Many beginners find themselves asking how much do vending machines cost [https://dfyvending.com/vending-machine-startup-costs] as…

Benji Personal Injury Surpasses 1,000 Cases Won as California Accident Victims S …

Benji Personal Injury Accident Attorneys, A.P.C. has surpassed 1,000 personal injury cases resolved across California, reflecting a growing demand for trialready legal representation. The firm's litigationfirst approach has led to multimilliondollar verdicts and settlements, helping accident victims secure significantly higher compensation through courtroomfocused preparation.

LOS ANGELES, CA - Benji Personal Injury Accident Attorneys, A.P.C. announced today that the firm has successfully resolved over 1,000 personal injury cases, marking a significant milestone…

More Releases for ZenaTech

ZenaTech Inc. (Nasdaq: ZENA): Leveraging Drones to Solve Labor Constraints in In …

Global infrastructure spending is accelerating. Governments and enterprises are committing record capital to transportation, energy, utilities, telecom, and public works. The challenge is execution. Surveying, inspecting, documenting, and maintaining assets is hitting its limits. Labor shortages, rising insurance costs, and stricter compliance rules make traditional fieldwork expensive and slow.

That gap is fueling demand for drone-enabled services and automated data collection. The global drone services market is expected to grow more…

ZenaTech (NASDAQ: ZENA): From Flight Trials to Full-Scale National Security Plat …

Modern defense strategy is being reshaped by a simple reality: situational awareness wins conflicts. From border security to logistics, reconnaissance, and infrastructure protection, governments increasingly prioritize technologies that deliver persistent, real-time intelligence without placing personnel in harm's way. Drones have moved from experimental tools to foundational defense infrastructure, and recent U.S. policy actions are accelerating that transition. The global military drone market, valued at $11.9 billion in 2024, is projected…

ZenaTech (Nasdaq: ZENA) Emerges at the Crossroads of Defense, AI, and Quantum Co …

Autonomous technology is shifting from concept to necessity. Global defense spending on unmanned and AI-driven systems is projected to exceed $200 billion by 2030, reflecting how militaries are rethinking strategy for an era where machines interpret data faster than humans can react. Commercial interest is rising too, with AI-powered drones transforming industries from energy to logistics. The common thread is intelligence at the edge-machines that can sense, decide, and act…

ZenaTech, Inc. (NASDAQ: ZENA) Prepares 25 U.S. DaaS Hubs Amid $555 Billion Drone …

Tens of thousands of drones already crisscross American airspace-delivering packages, inspecting power lines, and surveilling borders. By 2030, that number will multiply. But most of them don't see, think, or decide. They fly preprogrammed routes, collect raw footage, and rely on human operators and a patchwork of off-the-shelf parts, many sourced from countries the United States cannot afford to trust.

This is the new blind spot in America's critical infrastructure: a…

ZenaTech Inc. (Nasdaq: ZENA): Harnessing AI, Drones, and Quantum Computing to Re …

Artificial intelligence is no longer a buzzword-it's reshaping industries and redefining competitive advantages. As global AI spending is projected to soar to $337 billion by 2025 (IDC), much of this investment is flowing into companies embedding AI into real-world operations. From streamlining agriculture to managing natural disasters, AI is powering transformative solutions in unexpected areas.

While industry giants dominate headlines, innovative up-and-comers like ZenaTech Inc. (Nasdaq: ZENA) are tackling critical challenges…

ZenaTech (Nasdaq: ZENA): Tackling Wildfires and Beyond with Cutting-Edge Technol …

Wildfire season across the western United States isn't what it used to be. Once confined to late summer and fall, wildfires now seem to ignore the calendar altogether. This January, massive blazes like the Palisades Fire have consumed tens of thousands of acres, displacing residents and devastating communities across Southern California. High winds and dry conditions have fueled these fires, leading to evacuations and overwhelming firefighting efforts.

As climate change accelerates,…