Press release

Aether Holdings, Inc. (NASDAQ: ATHR) Is Building the AI-Fueled Investor Toolbox

Global markets are entering 2026 amid mixed macroeconomic signals, shifting investor sentiment, and continued debate around inflation, labor strength, and geopolitical risk. As information velocity increases and market narratives turn more quickly, investors are placing greater emphasis on how data is interpreted rather than simply how much data is available.At the same time, advances in artificial intelligence and machine learning are influencing not only large-cap technology leaders but also a growing ecosystem of tools designed to help market participants analyze behavior, sentiment, and risk in real time.

Within this context, attention turns to Aether Holdings, Inc. (Nasdaq: ATHR), a financial technology company developing an analytics platform that blends proprietary data, financial media, and AI-driven modeling with the goal of generating insight from investor behavior itself.

Reframing Market Analytics Through Media and Data

Aether Holdings is an early-stage financial technology company pursuing an unconventional strategy within market analytics. Rather than focusing solely on tools, trading infrastructure, or transactional revenue, ATHR is attempting to integrate financial media, proprietary data collection, and artificial intelligence into a single ecosystem designed to extract insight from investor behavior itself.

The result is not a traditional fintech model, nor a conventional financial media business. Instead, the company is working toward a platform where content distribution and analytics development reinforce one another. Whether this approach ultimately scales remains uncertain, but the structure is distinct enough to warrant attention from investors evaluating emerging models in market intelligence.

SentimenTrader as the Analytical Base Layer

ATHR's foundation is SentimenTrader.com, a sentiment analytics platform that evaluates market psychology across equities and options. The platform incorporates more than two decades of historical sentiment data and applies machine learning techniques to track crowd positioning, emotional extremes, and behavioral inflection points.

SentimenTrader does not attempt to forecast price targets. Its utility lies in identifying environments where risk-reward conditions may be shifting before those changes are fully reflected in price or fundamentals. This framing has historically resonated with traders and investors who view sentiment as a complementary input rather than a standalone signal.

Importantly, SentimenTrader already operates as a functional, revenue-generating product. That existing user base and data infrastructure provide ATHR with a starting point, not a finished solution. The broader opportunity depends on how effectively additional data sources and distribution channels can be layered onto this core.

Alpha Edge Media and the Data Thesis

The company's expansion through Alpha Edge Media represents a meaningful strategic pivot. Over the past year, Aether Holdings has launched and acquired multiple digital newsletters covering equities, IPOs, small caps, and digital assets. These include publications such as Alpha Edge Digest, IPO Stream, The Russell Report, StockCastr, AltcoinInvesting.co, and WhaleTales, alongside SentimenTrader's own media extensions.

The underlying thesis is that financial media can function as more than marketing or audience growth. Reader engagement, expressed opinions, and interaction patterns may serve as valuable behavioral data when captured systematically. In theory, that data can be processed and incorporated into analytics models, improving tools while also informing future content.

If executed effectively, this structure gives ATHR a degree of control over both data creation and distribution that many analytics platforms lack. Most competitors rely heavily on third-party data feeds or external marketing channels. Aether's approach attempts to internalize both, though doing so introduces execution and integration risk.

Acquisitions as Ecosystem Expansion

Recent acquisitions reinforce this strategy. The purchase of AI-powered crypto news platform 21Bitcoin.xyz expands ATHR's reach within digital assets while adding another stream of real-time content and engagement data. The platform retained its brand identity while integrating its technology and datasets into the broader Alpha Edge Media framework.

Earlier acquisitions, including WhaleTales and AltcoinInvesting.co, follow a similar pattern. Each brings an established audience rather than immediate scale revenue. The common thread is not near-term monetization, but the accumulation of engaged users across asset classes.

Whether these properties ultimately contribute to durable margins depends on ATHR's ability to convert engagement into paid subscriptions, licensing arrangements, or premium analytics products. At present, these outcomes remain potential rather than proven.

Financial Context

From a financial standpoint, ATHR remains in an early commercialization phase, with trailing twelve-month revenue of approximately $1.4 million. Current losses largely reflect deliberate investment in platform development, customer acquisition, and infrastructure rather than a lack of demand or structural margin issues. At this stage, profitability is not the primary objective; scale and platform maturity are.

Importantly, the balance sheet provides meaningful near-term flexibility. The company carries no debt, maintains a healthy current ratio, and has previously secured capital sufficient to fund ongoing expansion initiatives. This financial positioning allows ATHR to prioritize execution and growth without immediate liquidity pressure.

Valuation remains oriented toward future potential rather than present earnings, which is typical for emerging technology platforms at this stage of development. Investors are effectively underwriting the company's ability to translate early traction into a scalable revenue model over time. As execution progresses, operating leverage and margin improvement remain key inflection points to monitor.

Why Investors Are Paying Attention to ATHR

Aether Holdings is building a fundamentally different model for market intelligence. The company is combining financial media, proprietary data collection, and AI-driven analytics into a single integrated platform. At a time when investors face information overload but diminishing insight, ATHR's strategy is to control both how signals are generated and how they are interpreted.

Unlike traditional fintech platforms that rely on third-party data or compete on execution and tools, Aether is constructing closed-loop infrastructure. Its owned media assets generate continuous streams of first-party behavioral data. That data feeds directly into machine learning models developed at Aether Labs. Those models then enhance SentimenTrader and future analytics products. Scale improves intelligence, and improved intelligence expands monetization potential.

This structure positions ATHR at the intersection of artificial intelligence, behavioral finance, and direct-to-investor distribution. All three areas are experiencing structural tailwinds. As Alpha Edge Media expands across equities, IPOs, small caps, and digital assets, Aether continues to grow both its audience reach and the depth of its proprietary datasets. Few competitors control distribution, engagement data, and analytics development simultaneously.

For investors focused on early-stage platforms with asymmetric upside, ATHR represents a bet on the future of investor intelligence. The company is not optimizing legacy systems. It is building new market infrastructure designed for an AI-driven trading environment. If successful, Aether's long-term profile could resemble a scaled intelligence platform with multiple monetization paths across subscriptions, data licensing, and advanced investor tools.

Image: https://www.abnewswire.com/upload/2026/01/816f70224a8543222146c77d13e58ea5.jpg

Disclaimers: RazorPitch Inc. "RazorPitch" is not operated by a licensed broker, a dealer, or a registered investment adviser. This content is for informational purposes only and is not intended to be investment advice. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performances are not statements of historical fact and may be forward-looking statements. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties that could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this action may be identified through the use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor's investment may be lost or impaired due to the speculative nature of the companies profiled. RazorPitch has been retained and compensated by the company to assist in the production and distribution of content related to ATHR. RazorPitch is responsible for the production and distribution of this content. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. This content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, or offer by RazorPitch or any third-party service provider to buy or sell any securities or other financial instruments. All content in this article is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in this article constitutes professional and/or financial advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. RazorPitch is not a fiduciary by virtue of any persons use of or access to this content.

Media Contact

Company Name: RazorPitch

Contact Person: Mark McKelvie

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=aether-holdings-inc-nasdaq-athr-is-building-the-aifueled-investor-toolbox]

City: NAPLES

State: Florida

Country: United States

Website: https://razorpitch.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Aether Holdings, Inc. (NASDAQ: ATHR) Is Building the AI-Fueled Investor Toolbox here

News-ID: 4346462 • Views: …

More Releases from ABNewswire

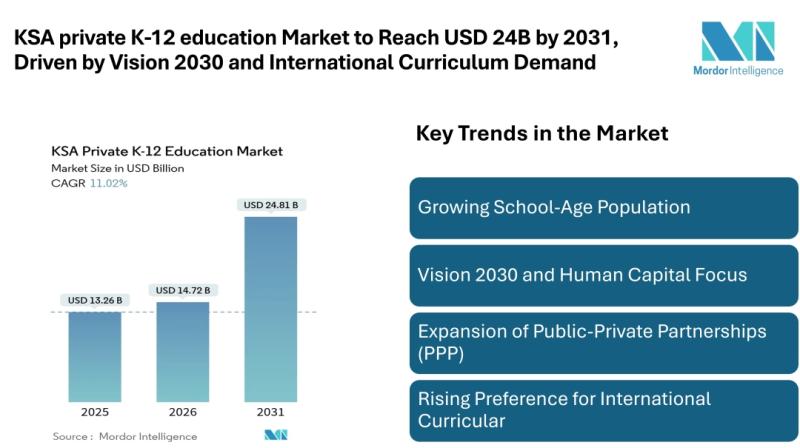

KSA private K-12 education Market to Reach USD 24.81 Billion by 2031, Driven by …

Mordor Intelligence has published a new report on the KSA private K-12 education market, offering a comprehensive analysis of trends, growth drivers, and future projections.

KSA private K-12 education Market Overview

According to Mordor Intelligence, the KSA private K-12 education market size [https://www.mordorintelligence.com/industry-reports/ksa-private-k12-education-market?utm_source=abnewswire] was valued at USD 13.26 billion in 2025 and is estimated to grow from USD 14.72 billion in 2026 to reach USD 24.81 billion by 2031, registering a CAGR…

Connected Ship Market to Reach USD 7.35 Billion by 2031, Driven by IMO e-Navigat …

Mordor Intelligence has published a new report on the educational robot market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Connected Ship Market Overview

According to Mordor Intelligence, the connected ship market size is estimated at USD 4.24 billion in 2026, growing from USD 3.80 billion in 2025, and is projected to reach USD 7.35 billion by 2031, expanding at a CAGR of 11.63% during the forecast period. This…

Specialty Chemicals Industry is estimated at $1.26 Trillion in 2026, Forecast to …

Mordor Intelligence has published a new report on the Specialty Chemicals Market, offering a comprehensive analysis of trends, growth drivers, and future projections.

The global [https://www.mordorintelligence.com/industry-reports/specialty-chemicals-market?utm_source=abnewswire] is expected to reach USD 1.54 trillion by 2031, up from USD 1.26 trillion in 2026, growing at a CAGR of 4.09% during the forecast period. Market growth is being driven by large-scale infrastructure projects in Asia-Pacific and GCC countries, rising demand for high-purity chemicals…

Foliar Fertilizer Market Size to Reach USD 30.32 Billion by 2031 - Mordor Intell …

Mordor Intelligence has released a comprehensive report on the foliar fertilizer market, outlining market size expansion, growth catalysts, precision agriculture adoption, and regional opportunities shaping the global industry.

Foliar Fertilizer Market Size and Forecast Outlook

According to a research report by Mordor Intelligence, the global foliar fertilizer market size [https://www.mordorintelligence.com/industry-reports/foliar-fertilizer-market?utm_source=abnewswire] is projected to grow from USD 22.63 billion in 2026 to USD 30.32 billion by 2031, registering a CAGR of 6.03% during…

More Releases for ATHR

Aether Holdings, Inc. (NASDAQ: ATHR): Turning Investor Attention Into Actionable …

Retail participation is quietly rebuilding momentum in early 2026. Trading activity across equities and digital assets is increasing, speculative interest is returning, and investor attention is spreading across more platforms, newsletters, and social channels than ever before. Yet while participation is rising, signal quality remains uneven. Investors face more data, more commentary, and more noise, but not necessarily better insight.

That gap between participation and actionable intelligence is becoming increasingly visible.…

Heading Into Year-End, Aether Holdings (ATHR) Poised to Redefine Investor Intell …

As 2025 draws to a close, U.S. equity markets are once again grappling with a familiar tension. Investors are trying to price in the possibility of future interest rate cuts while simultaneously navigating sharp sector rotations, crowded positioning, and growing dispersion beneath headline index performance. While major benchmarks have held up, leadership has shifted repeatedly, leaving many portfolios exposed to sudden reversals driven more by sentiment and flows than by…

Aether Holdings, Inc. (NASDAQ: ATHR) Targets $28B AI Analytics Market With a Dat …

Artificial intelligence is transforming how investors interpret markets, but one area is quickly emerging as the new frontier: real-time sentiment analytics linked directly to investor-focused media. With the AI-driven financial analytics market projected to reach $28 billion by 2029, demand is shifting toward platforms that can combine behavioral signals, predictive modeling, and continuous data inputs into actionable intelligence. Investors don't just want information anymore-they want early reads on crowd behavior…

Capturing Market Insight: Aether Holdings (Nasdaq: ATHR) in the Growing Financia …

The market for multi-asset financial intelligence is growing rapidly, driven by rising retail participation, institutional demand for behavioral insights, and the increasing application of AI in investing. U.S. retail brokerage accounts exceeded 110 million in 2023, a nearly 10% increase from the previous year, while assets under management in quantitative and data-driven strategies surpassed $1.5 trillion. Investors are seeking platforms that can synthesize equities, options, IPOs, small-caps, and digital assets…

Charting the Intelligence Economy: 4 Companies Transforming Market Data (ATHR, T …

In the modern market, information doesn't just guide trades; it is the trade. The distance between reading and reacting has collapsed to milliseconds, and in that blur, data itself has become the most valuable asset on the screen. Artificial intelligence is turning every article, comment, and market signal into a feedback loop of prediction. The result is a new financial ecosystem where algorithms study investors as closely as investors study…

Aether Holdings (Nasdaq: ATHR): Building the Future of Investor Intelligence

The modern market runs on noise. Every day, millions of traders compete to interpret it faster, sharper, and with fewer blind spots. Price moves are dissected in seconds, sentiment shifts ripple through social feeds, and algorithms scrape the web for clues about what comes next. In this environment, the edge no longer comes from data alone. The advantage comes from understanding the emotion behind it. That is the opportunity Aether…