Press release

Debt Recovery Services Market Transforming Collections Through Technology, Compliance & Customer-Centric Strategies 2032

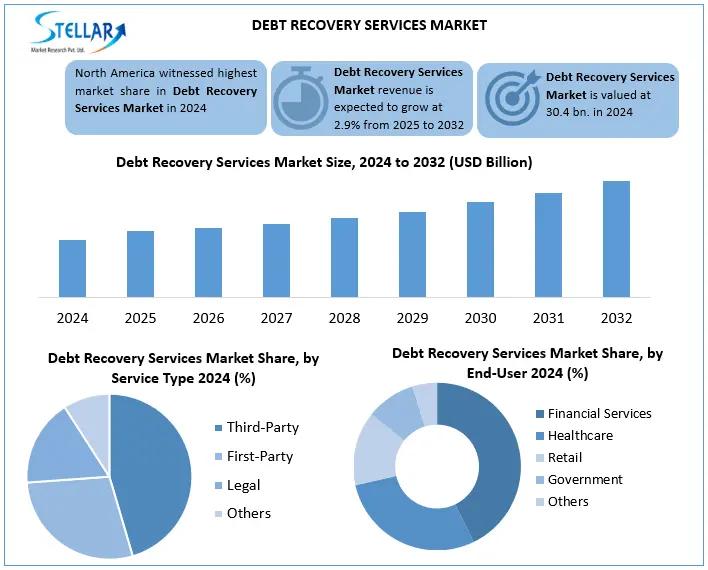

Debt Recovery Services Market was valued at USD 30.4 billion in 2024. Its total industry revenue is expected to grow by 2.9% from 2025 to 2032, reaching nearly USD 38.21 billion in 2032.The Debt Recovery Services Market is evolving rapidly as businesses across banking, telecom, utilities, retail, healthcare, and fintech strive to recover outstanding dues while maintaining customer relationships and regulatory compliance. With rising consumer debt, expanding credit portfolios, and increasing default cases across economies, efficient debt recovery solutions have become critical for financial stability. At the same time, the industry is experiencing a major shift from traditional, manual recovery methods to data-driven, automated, and digitally empowered strategies-making the market more innovative, scalable, and intelligent than ever before.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @ https://www.stellarmr.com/report/req_sample/debt-recovery-services-market/2816

Market Dynamics

The debt recovery services market is driven by a combination of economic cycles, credit expansion, technological advancement, and changing consumer behavior. As credit availability increases globally-through credit cards, personal loans, BNPL platforms, mortgages, SME financing, and digital lending-so does the potential risk of non-performing assets (NPAs). This has prompted financial institutions and enterprises to rely more heavily on professional recovery service providers to optimize collection strategies and minimize losses.

Digital transformation is reshaping the sector. AI-enabled predictive analytics, automated reminders, omnichannel engagement, chatbots, self-service portals, and cloud-based collection platforms are redefining how debts are tracked, communicated, and recovered. Moreover, the focus is shifting toward ethical, compliant, and customer-friendly recovery approaches, where maintaining brand reputation and customer trust is as important as securing recovery.

Regulatory environments are also maturing worldwide. Stricter laws around consumer rights, fair debt practices, and data protection have forced recovery companies to become more structured, transparent, and compliance-driven.

Key Market Drivers

Rising Global Debt Levels

Increasing personal, corporate, and government debt levels have significantly amplified the need for structured recovery mechanisms.

Growing Lending & Credit Ecosystem

Expansion in consumer finance, fintech lending, microfinance, and BNPL services has increased the volume of recoverable debts.

Digital Transformation in Financial Services

Automation, AI-driven analytics, robotic process automation (RPA), and digital contact strategies are powering efficiency and improved success rates.

Focus on Operational Efficiency & Cost Reduction

Businesses outsource debt recovery to minimize administrative burden, reduce cost pressure, and improve recovery timelines.

Strengthening Regulatory Frameworks

Standardized compliance practices encourage professional, organized debt recovery service adoption.

Get access to the full description of the report @ https://www.stellarmr.com/report/debt-recovery-services-market/2816

Opportunities in the Debt Recovery Services Market

The market offers significant opportunities for innovation and expansion:

• AI & Predictive Analytics in Collections - Smart analytics to predict borrower behavior, prioritize accounts, and personalize engagement strategies.

• Growth of Digital & Self-Service Recovery Platforms - Portals and apps enabling consumers to negotiate, schedule payments, and resolve dues independently.

• Expanding SME & Microfinance Recovery Needs - Rising credit activity in small businesses creates new service demand.

• Global Expansion of Fintech Lending - Digital lenders increasingly require professional recovery partners.

• Cross-Border Debt Recovery Services - Increasing international trade and global consumer credit offer new market avenues.

• Ethical Recovery & Consumer Experience Enhancement - Companies that position themselves as humane and compliant partners gain competitive advantage.

Pain Points & Challenges

Despite promising growth, the sector faces key challenges:

• Negative Perception & Customer Sensitivity

Debt collection is often associated with aggression and stress, requiring companies to carefully manage communication tone.

• Complex & Varying Regulatory Environments

Different regions follow distinct compliance norms, complicating global operations.

• Data Privacy & Security Risks

Handling sensitive financial and personal data demands robust cybersecurity frameworks.

• Economic Uncertainty

Recession, unemployment, and inflation can increase default risks and reduce repayment capacity.

• Integration Challenges with Client Systems

Legacy banking systems and fragmented data environments can hinder digital transformation.

Market Segmentation

By Debt Type

Commercial Debt

Consumer Debt

Others

By Service Type

First-Party Collections

Third-Party Collections

Legal Collections

Others

By End-User

Healthcare

Financial Services

Government

Retail

Others

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @ https://www.stellarmr.com/report/req_sample/debt-recovery-services-market/2816

Regional Insights

North America dominates the market driven by high consumer credit usage, structured recovery frameworks, advanced technologies, and strong regulatory enforcement. The U.S. remains a hub for tech-driven and compliance-focused debt recovery services.

Europe showcases a mature and highly regulated debt recovery ecosystem, emphasizing ethical practices, consumer protection, and structured outsourcing partnerships. Countries like the UK, Germany, Italy, and France lead adoption.

Asia-Pacific is emerging as the fastest-growing region with expanding digital lending, rising consumer borrowing, booming fintech ecosystems, and increasing corporate debt restructuring. India, China, Japan, and Southeast Asia are major growth arenas.

Latin America, Middle East & Africa are witnessing progressive growth due to increasing financial inclusion, credit penetration, and expanding business activities, gradually strengthening debt recovery frameworks.

Key Players in the Debt Recovery Services Market

North America

Encore Capital Group (USA)

PRA Group (USA)

Transworld Systems Inc. (TSI) (USA)

IC System (USA)

CBE Group (USA)

ConServe (USA)

GC Services (USA)

Prestige Services Inc. (PSI) (USA)

Allied Interstate LLC (USA)

Europe

Intrum AB (Sweden)

EOS Group (Norway)

Arrow Global Group PLC (UK)

Cerved Group (Italy)

KRUK Group (Poland)

Hoist Finance AB (Sweden)

B2Holding ASA (Norway)

Axactor ASA (Norway)

Lowell Financial Ltd. (UK)

iQera (France)

coeo Inkasso GmbH (Germany)

Bierens Debt Recovery Lawyers (Netherlands)

Atradius Collections (UK)

Asia-Pacific

Credit Corp Group Limited (Australia)

ACCS International (Japan)

Mobicule Technologies (India)

Middle East & Africa

Universal Group (MENA regional)

South America

TDX Group (Regional, incl. South America

Frequently Asked Questions

What is driving the growth of the market?

Rising consumer and corporate debt, especially in BNPL, credit cards, and loans, along with digital transformation and defaults.

Which region dominated the market and why?

North America led in 2024, due to high consumer delinquencies, strict regulations (FDCPA), and advanced AI adoption.

Which debt type segment dominates the market?

Consumer Debt - due to high personal loan and credit card usage, especially in emerging markets like India.

Who are the key players in the market?

Encore Capital Group, PRA Group, Transworld Systems Inc., IC System, Intrum AB, and EOS Group.

Which service type is most popular?

Third-party collections - preferred for their cost-efficiency and higher recovery rates.

Top Trending Reports:

Angel Funds Market: https://www.stellarmr.com/report/angel-funds-market/2819

Quantum AI Market: https://www.stellarmr.com/report/Quantum-AI-Market/2784

UK Esports Market: https://www.stellarmr.com/report/UK-Esports-Market/1707

Anime Merchandising Market: https://www.stellarmr.com/report/Anime-Merchandising-Market/1406

Automotive Cyber Security Market: https://www.stellarmr.com/report/automotive-cyber-security-market/2387

IoT Analytics Market: https://www.stellarmr.com/report/IoT-Analytics-Market/520

K12 Education Market: https://www.stellarmr.com/report/k12-education-market/2669

Spain Esports Market: https://www.stellarmr.com/report/Spain-Esports-Market/1709

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Debt Recovery Services Market Transforming Collections Through Technology, Compliance & Customer-Centric Strategies 2032 here

News-ID: 4346156 • Views: …

More Releases from Stellar Market Research. PVT. LTD

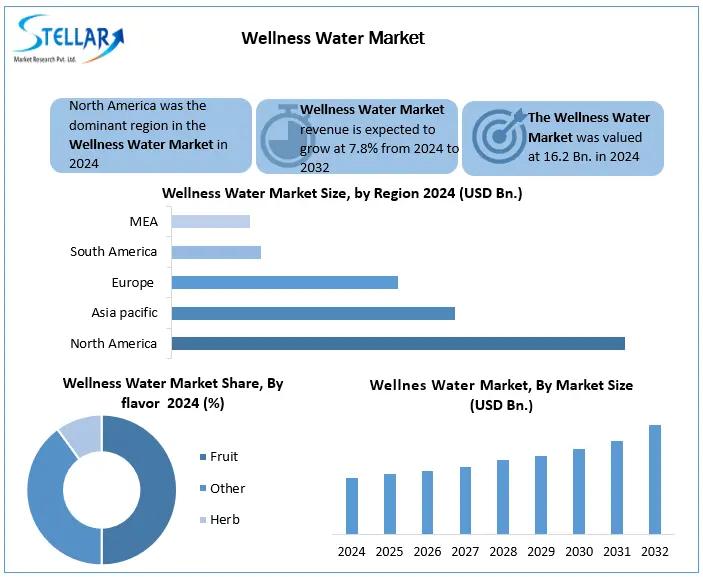

Wellness Water Market Expected To Reach USD 29.54 Billion by 2032, grow by 7.8% …

Wellness Water Market size was valued at USD 16.2 Bn. in 2024. The Global Wellness Water Industry revenue is expected to grow by 7.8% from 2024 to 2032, reaching nearly USD 29.54 Bn. by 2032.

The Wellness Water Market is experiencing a dynamic shift as consumers no longer see water as just a basic necessity but as a lifestyle upgrade and a tool for better health. From vitamin-infused hydration to alkaline…

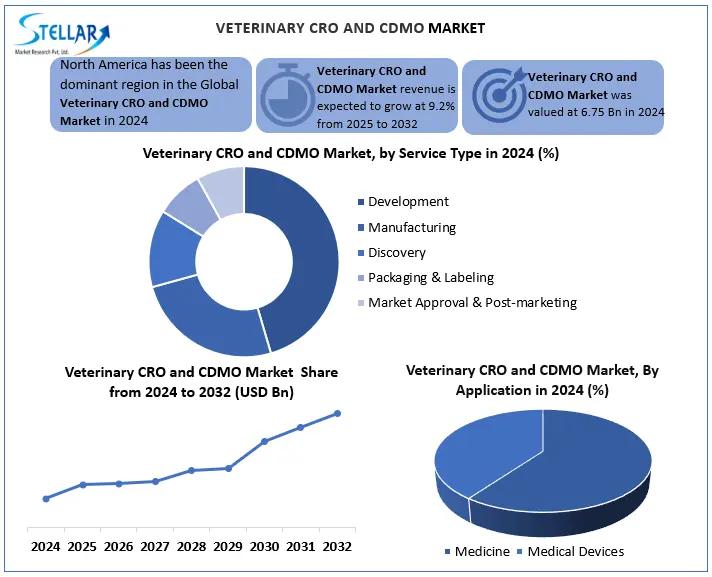

Veterinary CRO & CDMO Market Powering Innovation, Compliance, and Faster Path to …

The Veterinary CRO and CDMO Market was valued at USD 6.75 Bn in 2024 and is expected to reach USD 13.65 Bn by 2032, at a CAGR of 9.2% during the forecast period.

The Veterinary Contract Research Organization (CRO) and Contract Development & Manufacturing Organization (CDMO) Market is gaining remarkable momentum as the global demand for advanced animal healthcare, veterinary pharmaceuticals, biologics, vaccines, and diagnostics continues to expand. With rising pet…

Standing Desk Market Elevating Workplace Wellness and Productivity To Forecast 2 …

Standing Desk Market size was valued at USD 8.22 Bn in 2024, and is expected to grow at a CAGR of 5.4% from 2025 to 2032, reaching nearly USD 12.52 Bn by 2032.

TheStanding Desk Market is witnessing impressive momentum as organizations, home offices, and hybrid workers increasingly prioritize ergonomics, wellness, and productivity. What began as a niche trend in Silicon Valley has now become a mainstream workplace upgrade, driven by…

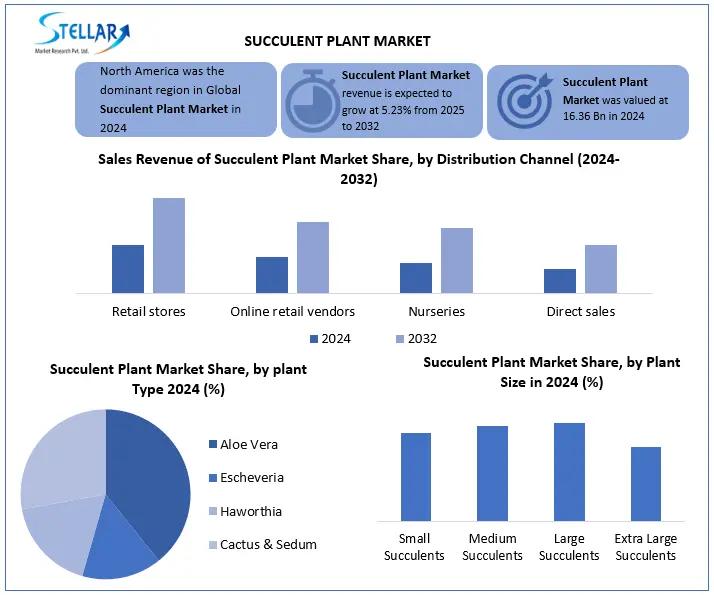

Succulent Plant Market Growing Green Beauty with Sustainable Lifestyle Trends

Succulent Plant Market was valued at USD 10.88 Bn in 2024 and is expected to grow at a CAGR of 5.23% from 2025 to 2032, reaching nearly USD 16.36 Bn by 2032.

The Succulent Plant Market is flourishing as consumers across the globe embrace greenery, minimal-care plants, and sustainable lifestyle aesthetics. Succulents-known for their thick, water-retaining leaves and striking forms-have rapidly moved from niche plant varieties to mainstream favorites. Whether used…

More Releases for Debt

Debt Settlement Solution Market Impressive Growth 2021-2028 | National Debt Reli …

The Insight Partners announces the research on Global Debt Settlement Solution Market [Report Page Link as it covers the key boundaries Required for your Research Need. This Global Debt Settlement Solution Market Report covers worldwide, local, and nation level market size, pieces of the overall industry, ongoing pattern, the effect of covid19 on worldwide

Market Research Report Investigations Research Methodology review comprises of Secondary Research, Primary Research, Company Share Analysis,…

Debt Settlement Market Emerging Growth Analysis, Demand and Business Opportuniti …

Debt settlement is the process of negotiating with creditors to reduce overall debts in exchange for a lump sum payment. A successful settlement occurs when the creditor agrees to forgive a percentage of total account balance. Normally, only unsecured debts not secured by real assets like homes or autos can be settled. Debt Settlement Market report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in…

Debt Settlement Market Emerging Growth Analysis, Demand and Business Opportuniti …

Debt settlement is the process of negotiating with creditors to reduce overall debts in exchange for a lump sum payment. A successful settlement occurs when the creditor agrees to forgive a percentage of total account balance. Normally, only unsecured debts not secured by real assets like homes or autos can be settled. Debt Settlement Market report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in…

Debt Settlement Market 2019 By Freedom Debt Relief National Debt Relief Rescue O …

This report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in which the debtor and creditor agree on a reduced balance that will be regarded as payment in full.

Request a Sample of this Report @ https://www.orbisresearch.com/contacts/request-sample/2575396 …

Debt Settlement Market 2018-National Debt Relief, Freedom Debt Relief, New Era D …

The report on Debt Settlement, documents a detailed study of different aspects of the ‘Debt Settlement’ market. It shows the steady growth in market in spite of the fluctuations and changing market trends. In the past four years the ‘Debt Settlement’ market has grown to a booming value of $xxx million and is expected to grow more.

Request a Sample of this Report@ http://www.orbisresearch.com/contacts/request-sample/2335800

Every market intelligence report is based on certain…

Debt Settlement Market 2018 | Global Demand, Top Companies Analysis- National De …

Global Debt Settlement Market Research Report 2018 is a professional and in-depth study on the current state of the global Debt Settlement industry with a focus on the regional market, analysis of industry share, growth factors, development trends, size, majors manufacturers and 2025 forecast. The report also analyze innovative business strategies, value added factors and business opportunities. The Debt Settlement report introduces market revenue, product & services, latest developments and…