Press release

Smartphone Image Sensors Market is to reach USD 18.83 billion by 2031, Asia Pacific leads the market with 47.23% market share | Major Players:- Sony Corporation, Samsung Electronics, On Semiconductors

The Smartphone Image Sensors Market was valued at USD 11.20 billion in 2024 and is projected to reach USD 18.83 billion by 2031, growing at a CAGR of 7.7%.DataM Intelligence unveils its latest report on the "Smartphone Image Sensors Market size 2025," offering an in-depth analysis of market trends, growth drivers, competitive landscape, and regional dynamics. The study covers market size in value and volume, CAGR forecasts, and emerging opportunities that can guide businesses in seizing growth potential and crafting winning strategies. Packed with data-driven insights on current developments and future trends, this report is essential for companies aiming to stay ahead in the competitive Market.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/smartphone-image-sensors-market?pratik

United States: Key Industry Developments ( 2025)

✅ December 2025: Sony Semiconductor Solutions launched the LYTIA 901, its first 200 MP smartphone image sensor with built-in AI remosaic and advanced HDR capabilities, enabling higher resolution and enhanced low-light video capture for future flagship devices.

✅ September 2025: Apple unveiled the iPhone 17 Pro and iPhone 17 Pro Max, featuring three 48 MP Fusion cameras and an improved advanced front camera system, reflecting rising demand for high-performance image sensors in leading U.S. smartphone platforms.

✅ Aug 2025: Industry analysts reported strong CMOS image sensor market rebound and growth forecasts, with renewed demand driven largely by smartphone imaging improvements and multimedia applications, signaling expanded opportunities for sensor makers.

Japan: Key Industry Developments ( 2025)

✅ December 2025: Sony (Japan) officially introduced the LYTIA 901 200 MP sensor, boosting Japan's image sensor leadership in high-resolution smartphone components and signaling competitive momentum against global rivals.

✅ October 2025: Market forecasts released in Japan projects continued growth in the global image sensor market through 2037, emphasizing smartphone innovation as a major driver for sensor adoption and technological investments.

✅ August - October 2025: Regional industry analysis affirmed that Japan's CMOS image sensor market remains a critical hub for imaging technology R&D and production, particularly for components used by leading global smartphone brands.

📌 Smartphone Image Sensors Market 2025-26 M&A Deals

→ On 12 January 2026, OmniVision Group completed a secondary listing on the Hong Kong Stock Exchange, raising about HK$4.8 billion (US$615 million), with approximately 70 % of proceeds earmarked for research, expansion, and acquisitions in core imaging technologies. While not a direct acquisition, this financing strongly positions the company to pursue future M&A in smartphone imaging segments.

→ In May 2025, Will Semiconductor rebranded itself as OmniVision Group after effectively integrating OmniVision's operations into its business. Although the original OmniVision acquisition by Will Semiconductor occurred prior to 2025, the 2025 rebranding & strategic repositioning aims to strengthen global competition with Sony and Samsung in the CMOS image sensor arena. This move reflects a consolidation strategy to scale the combined entity's portfolio and market presence.

→ In August 2025, Samsung Electronics struck a strategic manufacturing agreement to produce advanced digital image sensors for Apple's iPhone 18 lineup at its Austin, Texas facility. This deal while technically a manufacturing supply partnership rather than an outright acquisition marks a major strategic collaboration between two historically competitive suppliers and could reshape supply chains in high-end smartphone imaging. Financial terms were not publicly disclosed.

→ In May 2025, Samsung Electronics and LG Innotek announced a strategic partnership to co-develop next-generation mobile camera modules integrating Samsung's ISOCELL sensors with advanced autofocus and compact module designs. This collaboration aimed at enhancing Samsung's smartphone image sensor performance and competitiveness reflects ongoing consolidation efforts via co-innovation (deal value undisclosed).

→ In June 2025, Samsung and Xiaomi deepened image sensor cooperation with expanded shipments of Samsung's new ISOCELL JNP sensor to Xiaomi's flagship devices, helping to challenge Sony's market dominance. While this is a strategic supply agreement rather than an acquisition, it significantly aligns two key players in the smartphone image sensor supply belt (deal value undisclosed).

Why the Smartphone Image Sensors Market is growing?

⏩ Smartphones continue to be ubiquitous worldwide, with global annual shipments exceeding 1.3 billion units, almost all of which integrate advanced camera systems requiring high-performance sensors.

⏩ Consumers now expect smartphone cameras to deliver DSLR-like results, especially for social sharing and content creation. This is fueling adoption of higher megapixel counts, better low-light performance, and faster frame rates-all of which depend on sophisticated image sensors

⏩ The shift from single-lens to multi-lens camera systems (wide, ultra-wide, telephoto, macro, depth) has multiplied sensor count per device. Today's smartphones often deploy 3-5 sensors per unit, up from 1.4 a decade ago.

⏩ This trend dramatically expands the addressable sensor count and value per device, driving market expansion both in volume (units) and value (higher BOM costs).

⏩ Emerging markets in Asia-Pacific, especially China and India, are not only driving smartphone unit growth but also accelerating the adoption of higher-spec camera capabilities as disposable incomes rise.

📌 Buy Now & Unlock 360° Market Intelligence:https://www.datamintelligence.com/buy-now-page?report=smartphone-image-sensors-market?pratik

Smartphone Image Sensors Market Major Players:-

Omnivision Technologies, Sony Corporation, Samsung Electronics, On Semiconductors, Panasonic Corporation, ST Microelectronics, Himax Technologies, SK Hynix, Superpix micro Technologies, Toshiba.

Key players highlights:-

1. Sony Corporation - 44% share

Sony leads globally with dominant CMOS sensor technology found in premium smartphones and broad automotive/industrial imaging partnerships. Its Exmor stacked‐architecture sensors drive high‐performance photography and video.

2. Samsung Electronics - 35% share

Samsung's ISOCELL sensors power its own Galaxy phones and supply others, with strong focus on high‐resolution and power‐efficient designs. Its vertical integration and foundry scale support rapid innovation.

3. OmniVision Technologies - 12% share

OmniVision specializes in compact, low‐power CMOS sensors for mobile and automotive use, gaining share in mid‐tier smartphone segments. The company's dynamic range and HDR tech strengthen its competitive positioning.

4. SK Hynix - 3.8% share

SK Hynix integrates CIS units with memory expertise, providing competitive sensors for select smartphones and leveraging foundry relationships. Its focus includes efficient imaging solutions for mobile markets.

5. On Semiconductor (Onsemi) - 2.4% share

Onsemi develops image sensors with high dynamic range and low‐light performance for mobile, industrial, and automotive applications. Its stacked sensor architectures target emerging imaging needs across segments.

Smartphone Image Sensors Market Regional Highlights

Asia Pacific

• Accounts for the largest share of the smartphone image sensor market at 47.23% of global revenue.

• Rapid development driven by major manufacturers and strong local production ecosystems in China, South Korea and Japan.

• Fastest‐growing region with expanding adoption of advanced sensors in both premium and mass‐market phones.

North America

• Holds approximately 26.21% global share of smartphone image sensor revenue.

• Growth supported by high smartphone penetration and demand for premium imaging technology.

• Development focused on innovation, R&D and adoption of 5G‐enabled advanced camera systems.

Europe

• Contributes around 18.23% of the global smartphone image sensor market.

• Growth driven by demand for quality imaging and innovation in adjacent tech sectors.

• Development includes steady integration of higher‐end sensors in European smartphones.

Latin America

• Represents about 8.32% global share of the smartphone image sensor market.

• Market development aided by rising smartphone adoption and expanding digital infrastructure.

• Growth steadies as more mid‐range imaging smartphones enter the region.

Get Customization in the report as per your requirements:https://www.datamintelligence.com/customize/smartphone-image-sensors-market?pratik

Smartphone Image Sensors Market segmentation :

The Global Smartphone Image Sensor Market is primarily segmented by technology, use, and region. By technology, the market is divided into Complementary Metal-Oxide Semiconductor (CMOS) and Charge-Coupled Device (CCD) sensors, with CMOS dominating due to its low power consumption, compact size, and high integration capabilities. By use, the market is categorized into single primary camera, single secondary camera, and dual-camera smartphones, reflecting the growing trend of multi-camera setups for advanced photography and enhanced user experience. Regionally, the market spans North America, Latin America, Europe, Asia Pacific, Middle East, and Africa, with Asia Pacific leading in adoption due to rapid smartphone penetration, technological innovation, and large-scale manufacturing hubs, while North America and Europe focus on premium segment growth and advanced sensor integration.

Smartphone Image Sensors Market - FAQs

Q: What is driving the growth of the Smartphone Image Sensors Market?

A: Rising smartphone adoption, demand for high-resolution cameras, and AI-enabled imaging technologies.

Q: Which companies dominate the Smartphone Image Sensors Market?

A: Sony, Samsung Electronics, Omnivision Technologies, On Semiconductor, and Panasonic lead the market.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Smartphone Image Sensors Market is to reach USD 18.83 billion by 2031, Asia Pacific leads the market with 47.23% market share | Major Players:- Sony Corporation, Samsung Electronics, On Semiconductors here

News-ID: 4346149 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

United States Power Transistor Market (2026-2033)., North America's Hold 32% Mar …

Market Size and Growth

Global power transistor market grows with rising demand in EVs, industrial electronics, and renewable energy (2026-2033)

United States: Recent Industry Developments

✅ February 2026: Infineon Technologies (U.S. operations) introduced next-generation silicon carbide (SiC) power transistors for EV and renewable energy applications.

✅ January 2026: ON Semiconductor launched high-efficiency gallium nitride (GaN) power transistors for data centers and industrial automation.

✅ December 2025: Texas Instruments released new automotive-grade MOSFETs to enhance power…

United States International Express Delivery Market (2026-2033)., North America …

Market Size and Growth

Market expansion outlook: The International Express Delivery Market was hit huge Growth (2026-2033)

United States: Recent Industry Developments

✅ February 2026: FedEx expanded its global express delivery network, introducing faster cross-border services for e-commerce shipments.

✅ January 2026: UPS launched AI-enabled route optimization to improve delivery speed and reduce operational costs.

✅ December 2025: DHL implemented sustainable delivery solutions using electric cargo vehicles for urban international shipments.

Downlaod Free Custom Research: https://www.datamintelligence.com/custom-research?kb=ied

Japan:…

United States Fibrin Sealants Market Witness high Growth (2026-2033)., North Ame …

Market Size and Growth

Fibrin Sealants Market to hit at a high CAGR during the forecast period (2026-2033)

United States: Recent Industry Developments

✅ February 2026: Baxter International launched a next-generation fibrin sealant with enhanced adhesive strength for surgical applications.

✅ January 2026: Medtronic expanded distribution of its fibrin sealant portfolio to support minimally invasive and robotic surgeries.

✅ December 2025: Integra LifeSciences introduced a fast-acting fibrin sealant optimized for wound closure in cardiovascular procedures.

Download…

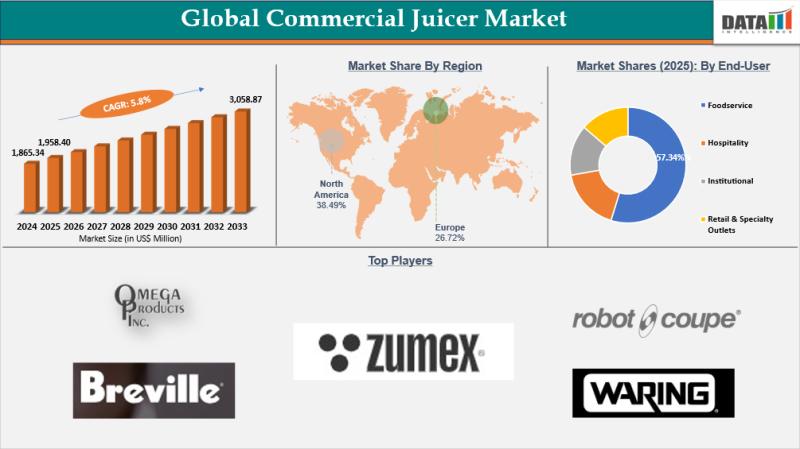

United States Commercial Juicer Market (2026-2033) | Global Market Growth Projec …

Market Size and Growth

commercial juicer market reached US$ 1,865.34 Million in 2024, rising to US$ 1,958.40 Million in 2025 and is expected to reach US$ 3,058.87 Million by 2033, growing at a strong CAGR of 5.8% during the forecast period from 2026 to 2033.

demand is driven by investments in modern processing technologies, such as the US$ 6.3 million funding provided by the government to Greenhouse Juice Company in Mississauga, Canada.

United…

More Releases for Smartphone

Surge In Smartphone Adoption Propels Growth In The Smartphone Processor Market: …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

Smartphone Processor Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

The market size for smartphone processors has experienced quick expansion in the past few years. It is projected to balloon from $23.33 billion in 2024 to $26.43 billion in 2025, boasting a compound annual growth…

Leading Growth Driver in the Smartphone Processor Market in 2025: Surge In Smart …

Which drivers are expected to have the greatest impact on the over the smartphone processor market's growth?

The anticipated expansion of the smartphone processor market is predicted to be influenced by the rising global popularity of smartphones. It has been observed that younger generations worldwide have been adopting smartphones at a faster pace. For instance, a study from Cybercrew, a UK company specializing in cybersecurity solutions for businesses of varying sizes,…

India Smartphone Market

Anticipated Growth in Revenue:

The India Smartphone Market was valued at USD 169.72 Bn in 2023 and is expected to reach USD 341.40 Bn by 2030, at a CAGR of 10.5 % during the forecast period

India Smartphone Market Overview:

The India smartphone market is one of the fastest-growing in the world, driven by a large and young population, increasing internet penetration, and the rise of affordable smartphones. With a shift toward digitalization…

SMARTPHONE MARKET IN CHINA INTRODUCTION, CHINA SMARTPHONE SHIPMENTS AND USERS, C …

Smartphone Market in China

As the largest market in the world, mainland China remains among the fastest-growing nations in smartphone industry. This report provides OMR's updated statistics and predictions for smartphone market in China based on a summary of OMR independent research and a filtration of comparative data from third-party sources. An overview of the global smartphone market is also included. Historical data covers 2009-2014 period which was projected over the…

Mobile Phone (Smartphone) LED Market - Rising Smartphone Average Costs Along Wit …

Mobile phone LEDs are used as small illumination source for various purposes such as backlight display, camera flash and keypad illumination. Display panels are the surfaces used for display and control components which acts as the direct interface for the human/machine interaction.

LED applications in mobile phones have expanded over the years. Conventional mobile phone application field mainly include keyboard backlighting and displays. Over the years, the smartphone shipments have grown…

Smartphone Trends In Asia: The Rise Of Domestic Brands In Southeast Asias Smartp …

Summary

Domestic mobile handset manufacturers are rapidly gaining a strong foothold in Southeast Asian countries with their feature-rich devices at much more affordable prices compared global vendors such as Apple, Samsung and Microsoft. Domestic smartphone vendors have enjoyed significant success in the Philippines and Indonesia on the back of low-cost devices accompanied with offers on entertainment and social media content and applications. Filipino vendor Cherry Mobile offers 4G mobile at $299,…