Press release

The Unlicensed Spectrum LTE Market is projected to reach a market size of USD 6.49 Billion by the end of 2030.

According to the report published by Virtue Market Research The Unlicensed Spectrum LTE Market was valued at USD 2.16 Billion in 2024 and is projected to reach a market size of USD 6.49 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 20.1%.Request Sample Copy of this Report @https://virtuemarketresearch.com/report/unlicensed-spectrum-lte-market/request-sample

The world of wireless communication has been changing fast, and one of the most interesting parts of this change is the rise of Unlicensed Spectrum LTE. This technology allows mobile operators and enterprises to use parts of the radio spectrum that are not owned by anyone. By using these shared frequencies, it becomes possible to deliver better network performance without needing to buy expensive licenses. The idea has grown stronger over the years as demand for data keeps increasing and devices like smart cameras, connected machines, and mobile phones require faster and more reliable internet access.

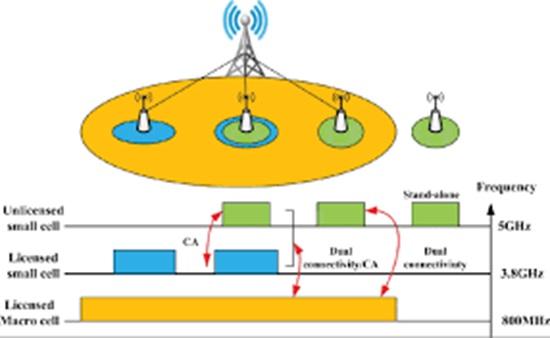

One long-term driver for the Unlicensed Spectrum LTE market is the ever-growing need for high-speed data connectivity across urban and rural areas. As people watch more videos, play online games, and use multiple connected devices at once, the amount of data traveling through the air keeps rising. This puts pressure on existing networks, especially in places where licensed spectrum is limited or too costly to acquire. The use of unlicensed spectrum offers a clever way to ease this problem by combining it with traditional licensed LTE bands through carrier aggregation. It lets operators handle more traffic without facing huge spectrum costs. Over time, this trend helps improve the overall quality of mobile services while keeping them affordable for users.

The COVID-19 pandemic had a noticeable effect on how this market evolved. During lockdowns, people relied heavily on home internet and mobile connections for work, school, and entertainment. This sudden increase in data traffic revealed weaknesses in many existing networks. It pushed governments, telecom operators, and tech companies to look for faster and cheaper ways to expand coverage. Unlicensed Spectrum LTE emerged as a practical solution because it allowed quick deployment of enhanced connectivity without waiting for new spectrum auctions or regulatory delays. The pandemic became an unexpected accelerator, making more organizations realize the importance of flexible spectrum use to handle unpredictable spikes in data demand.

A short-term driver currently pushing the market forward is the rapid rollout of private LTE networks in industries like manufacturing, logistics, and energy.

These networks use unlicensed spectrum to connect equipment and sensors within factories or warehouses. They are cheaper and faster to set up than traditional networks and can be tailored to specific operational needs. The ability to quickly deploy such systems is especially attractive to businesses that want secure communication without depending on public mobile operators. This short-term growth factor is helping the technology gain practical acceptance across different industrial sectors.

An interesting opportunity in this market lies in the integration of Unlicensed Spectrum LTE with next-generation 5G technologies. As more 5G deployments take shape, unlicensed spectrum can serve as an extra layer of capacity for 5G networks, improving coverage in crowded urban spaces or indoor environments. It can also help small and medium enterprises build cost-effective 5G-based private networks without the need for licensed bands. This opens the door for innovation in smart factories, ports, hospitals, and educational campuses where reliable connectivity is crucial but budgets are limited. The combination of LTE and 5G in unlicensed frequencies has the potential to reshape how industries communicate and operate.

A key trend observed in the Unlicensed Spectrum LTE industry is the growing focus on coexistence and harmony among different wireless technologies. Since unlicensed spectrum is shared, it must accommodate Wi-Fi, IoT devices, and LTE signals all at once. Companies are developing advanced coordination mechanisms and adaptive transmission techniques to make sure that all users get fair and efficient access. New standards and software solutions are being introduced to prevent interference and improve spectrum sharing efficiency. This trend reflects a broader move toward collaboration between different connectivity systems rather than competition. It shows how the industry is evolving to make smarter use of every available frequency.

Segmentation Analysis:

By Type: LTE-U, LAA, MulteFire, and CBRS

The Unlicensed Spectrum LTE market by type shows a colorful mix of technologies, each playing its own part in shaping faster and broader connectivity. LTE-U uses unlicensed bands alongside licensed ones to improve speed in crowded areas, making it an early bridge between old and new wireless systems. LAA extends this idea but with a stronger focus on fair coexistence with Wi-Fi networks, ensuring better harmony in shared spectrum environments. MulteFire steps further, enabling LTE to operate entirely without licensed spectrum, making it ideal for private networks and industrial sites where control and flexibility are key. CBRS brings a unique model, allowing shared spectrum access through a managed, three-tier system that balances public and private needs. Among these, CBRS is the largest in this segment because of its structured spectrum-sharing framework and rapid adoption in enterprises and communication networks. MulteFire is the fastest growing during the forecast period as industries and smart facilities increasingly adopt private LTE solutions that deliver secure, low-latency communication without relying on carriers or licensed bands.

By Application: Small Cell Deployment, Industrial IoT, Smart Cities, Healthcare, and Others

In the Unlicensed Spectrum LTE market by application, each field uses the technology differently to solve unique connectivity puzzles. Small cell deployment supports dense data traffic areas such as malls and stadiums, providing strong signals where users need it most. Industrial IoT applications rely on stable wireless links for monitoring robots, sensors, and automated systems within factories and warehouses. Smart cities use unlicensed LTE to connect infrastructure such as lighting, surveillance, and public services, enabling data-driven urban management.

In healthcare, it powers secure medical communications, remote monitoring, and smart hospital operations without overloading public networks. Other applications include education and logistics, which benefit from flexible and scalable connections. Small cell deployment is the largest in this segment due to its wide use in strengthening mobile capacity in high-demand zones. Industrial IoT is the fastest growing during the forecast period as industries push for more resilient, private, and low-latency wireless environments to support digital transformation and automation in complex production setups.

Read More @https://virtuemarketresearch.com/report/unlicensed-spectrum-lte-market

Regional Analysis:

Across regions, the Unlicensed Spectrum LTE market develops at different speeds depending on regulations, investment levels, and technology readiness. North America leads the charge, fueled by early CBRS adoption, enterprise 5G trials, and a strong ecosystem of telecom innovators. Europe shows steady progress as governments encourage efficient spectrum sharing and promote industrial digitalization initiatives. Asia-Pacific, driven by nations like China, Japan, and South Korea, rapidly advances in smart manufacturing and urban connectivity, supported by government-led digital infrastructure projects. South America witnesses gradual adoption as local operators explore cost-effective connectivity for expanding internet access.

The Middle East & Africa are emerging participants, focusing on smart city development and industrial modernization in growing economies. Among all these, North America is the largest in this segment owing to its mature regulatory environment and strong demand from enterprise and telecom sectors. Asia-Pacific is the fastest growing during the forecast period due to rising investments in private LTE networks, expanding industrial automation, and large-scale deployment of connected systems across cities and manufacturing clusters.

Latest Industry Developments:

• Private and enterprise network adoption : Enterprises and large venues are increasingly turning to unlicensed-spectrum LTE options as part of a broader move toward private cellular networks, buying turnkey systems, partnering with system integrators, and using CBRS-style shared models to avoid long licensing waits; this trend emphasizes managed offerings that bundle radios, core software, security, and operations so non-carrier buyers can deploy quickly and scale, and it has accelerated as CBRS upgrades and vendor ecosystems reduced technical friction and lowered total cost of ownership for factories, ports, campuses, and logistics hubs.

• Coexistence and intelligent sharing : The market shows a clear move toward smarter coexistence techniques to let LTE variants share airwaves fairly with Wi-Fi and other users; vendors and standards bodies are pushing listen-before-talk improvements, dynamic channel selection, centralized coordination, and AI-driven scheduling so that high-density venues can run mixed Wi-Fi and LTE deployments without severe throughput loss, while academic and industry studies on LAA/LTE-U and Wi-Fi 6E coexistence influence real-world product choices and spectrum management tools.

• Edge, small cells and 5G convergence : Companies are packaging unlicensed-spectrum LTE into solutions that combine edge compute, small cells, and 5G-ready cores so customers get low latency and local processing for automation and analytics; neutral-host small-cell offerings and cloudified cores let building owners and operators host multi-tenant services while vendors advertise seamless handover to licensed 5G or NR-U as needed, turning unlicensed LTE into a capacity/coverage layer within broader 5G and edge strategies.

customize the Full Report Based on Your Requirements @https://virtuemarketresearch.com/report/unlicensed-spectrum-lte-market/customization

CONTACT US :

Virtue Market Research

Kumar Plaza, #103, SRPF Rd, Ramtekadi, Pune, Maharashtra 411013, India

E-mail: megha@virtuemarketresearch.com

Phone: +1-917 436 1025

ABOUT US:

"Virtue Market Research stands at the forefront of strategic analysis, empowering businesses to navigate complex market landscapes with precision and confidence. Specializing in both syndicated and bespoke consulting services, we offer in-depth insights into the ever-evolving interplay between global demand and supply dynamics. Leveraging our expertise, businesses can identify emerging opportunities, discern critical trends, and make decisions that pave the way for future success."

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The Unlicensed Spectrum LTE Market is projected to reach a market size of USD 6.49 Billion by the end of 2030. here

News-ID: 4343127 • Views: …

More Releases from Virtue Market Research

The Global Tomato Concentrate Market is projected to reach a market size of USD …

According to the report published by Virtue Market Research in The Tomato Concentrate Market was valued at USD 1.69 billion and is projected to reach a market size of USD 2.51 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.8%.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/tomato-concentrate-market/request-sample

The tomato concentrate market has seen steady growth over the…

Global Student Safety Solutions Market is projected to reach the value of $ 4.09 …

According to the report published by Virtue Market Research in 2024, the Global Student Safety Solutions Market was valued at $2.74 Billion, and is projected to reach a market size of $ 4.09 Billion by 2030. Over the forecast period of 2025-2030, market is projected to grow at a CAGR of 6.9%.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/students-safety-solutions-market/request-sample

The Global Student Safety Solutions Market is experiencing steady growth,…

Global Sorbitan Peroleate Market is projected to reach the value of $ 248.96 Bil …

According to the report published by Virtue Market Research in 2024, the Global Sorbitan Peroleate Market was valued at $ 134.55 Billion, and is projected to reach a market size of $ 248.96 Billion by 2030. Over the forecast period of 2025-2030, market is projected to grow at a CAGR of 10.8 %.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/sorbitan-peroleate-arket/request-sample

The global sorbitan peroleate market is influenced by various…

Global Solar Ingot Wafer Market is projected to reach the value of $82.08 Billio …

According to the report published by Virtue Market Research in 2024, the Global Solar Ingot Wafer Market was valued at $45.96 Billion, and is projected to reach a market size of $82.08 Billion by 2030. Over the forecast period of 2025-2030, market is projected to grow at a CAGR of 12.3%.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/solar-ingot-wafer-market/request-sample

The solar ingot wafer market is seeing strong growth due to…

More Releases for LTE

LTE CPE Market the Falling Prices of LTE-Capable Devices

LTE CPE stands for Long Term Evolution Customer Premises Equipment. It is a type of customer premises equipment (CPE) that is used to connect to an LTE network. LTE CPE can be used for both home and business applications. LTE CPE typically includes an LTE modem, WiFi router, and LTE antenna.

LTE is the latest and greatest in wireless data technology, and LTE CPE devices are the customer-premise equipment (CPE) that…

Perle IRG5521 LTE Routers provide LTE coverage when WiFi is unavailable

When the power goes down, so does the WiFi. Cellular systems, however, keep working. A Case Study about Winning Strategies’ new stand-alone multi-power-source wireless surveillance system.

PRINCETON, N.J. (Mar. 30, 2021) Establishing a contingency plan to recover IT services after an emergency, or system disruption, is a critical step in the network design process. IT systems are vulnerable to a variety of interruptions that range from short-term power outages to severe…

2018-2025 LTE Communication Market analysis report with Leading players, Applica …

LTE Communication Market

The Global LTE Communication Market is defined by the presence of some of the leading competitors operating in the market, including the well-established players and new entrants, and the suppliers, vendors, and distributors. The report also analyzes the development proposals and the feasibility of new investments. The LTE Communication Market report has been collated in order to provide guidance and direction to the companies and individuals interested in buying this research report.

To Access PDF…

LTE-Advanced (LTE-A) Mobile Technologies Market 2017 Emerging Trends

This report studies the global LTE-Advanced (LTE-A) Mobile Technologies market, analyzes and researches the LTE-Advanced (LTE-A) Mobile Technologies development status and forecast in United States, EU, Japan, China, India and Southeast Asia. This report focuses on the top players in global market, like

Nokia Solutions and Networks

Alcatel-Lucent

EE Limited

Cisco

Ericsson

AT&T

SK Telecom

Royal KPN

Samsung

NTT Docomo

LG

Huawei

ZTE

For more information about this report at http://www.reportsweb.com/global-lte-advanced-lte-a-mobile-technologies-market-size-status-and-forecast-2022

Market segment by Regions/Countries, this report covers

United States

EU

Japan

China

India

Southeast Asia

Market segment by Type, LTE-Advanced…

Global LTE (LTE-FDD, TD-LTE and LTE Advanced) Market Analysis, Size, Share, Grow …

Researchmoz added Most up-to-date research on "LTE (LTE-FDD, TD-LTE and LTE Advanced) Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast, 2013 - 2019" to its huge collection of research reports.

LTE, an initial of Long Term Evolution and marketed as 4G LTE, is a wireless communication standard for high-speed data for data terminals and mobile phones. LTE technology reduces the cost per gigabyte with enhanced capacity per site.…

The LTE, LTE-Advanced & 5G Ecosystem Technology Advancement, Emerging Evolution

As a natural upgrade path for carriers from the previously detached GSM, CDMA and TD-SCDMA ecosystems, LTE has emerged as the first truly global mobile communications standard. Commonly marketed as the “4G” standard, LTE promises to provide higher data rates and lower latency at a much lower TCO (Total Cost of Ownership) than 3G technologies.

The TCO and performance is further enhanced by deployment of small cells and the LTE-Advanced standard.…