Press release

Launch of MNATracker.com

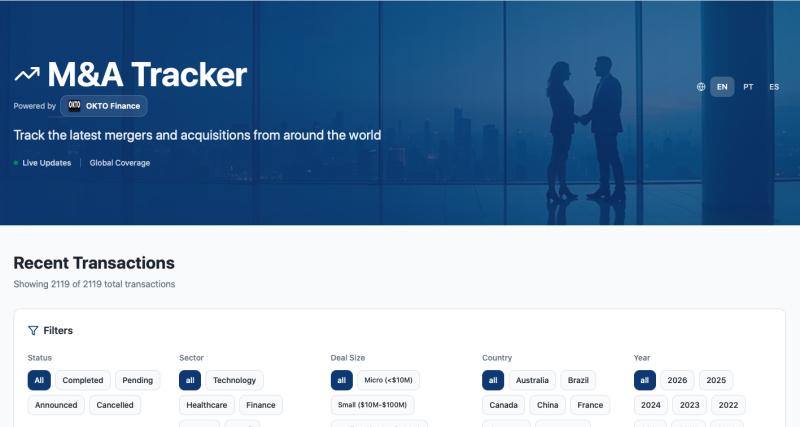

Launch of MNATracker.com, a new digital platform designed to make global mergers and acquisitions easier to follow, analyze, and understand. Built for finance professionals, investors, founders, and anyone tracking corporate activity, MNATracker centralizes deal information in a clear and accessible interface.In an environment where M&A activity is increasingly fast-moving and fragmented across dozens of news outlets and filings, MNATracker.com offers a streamlined way to stay informed. The platform aggregates relevant deal announcements from around the world, providing users with an organized and intuitive experience.

In a market where deal information is dispersed across multiple sources and often difficult to track in real time, MNATracker was created to offer a more efficient experience. The platform aggregates relevant mergers and acquisitions from around the world and presents them in a clean, objective format designed for finance professionals, investors, executives, and researchers.

OKTO

Av Paulista 726

São Paulo

Brazil

David - okto@oktofinance.com

MNATracker.com - your new source for fast, clean, global M&A deal tracking.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Launch of MNATracker.com here

News-ID: 4342908 • Views: …

More Releases for M&A

industrials m&a,m&a project management,corporate finance mergers and acquisition …

Mergers and acquisitions (M&A) in the industrial sector refer to the process of one company acquiring another company or assets in the manufacturing, construction, and engineering industries. The industrial sector is characterized by a diverse range of businesses, including heavy machinery, aerospace, and defense, chemicals, and engineering services.

https://upworkservice.com/

China M&A advisory

E-mail:nolan@pandacuads.com

The industrial sector is characterized by a high level of consolidation, with companies looking to acquire other companies to gain access…

m&a company,m&a integration,cross border merger,m&a due diligence,m&a strategy,m …

Mergers and acquisitions (M&A) are a common way for companies to grow and diversify their business operations. The process of merging or acquiring another company can be complex and time-consuming, but when executed successfully, it can bring significant benefits to the acquiring company, such as access to new markets, technologies, and customers.

https://upworkservice.com

China M&A advisory

E-mail:nolan@pandacuads.com

When it comes to successful M&A, the key is to ensure that the two companies are a…

private equity m&a,international mergers and acquisitions,technology m&a,m&a pro …

Mergers and acquisitions (M&A) are a common strategy for companies looking to expand their operations, enter new markets, or acquire new technologies. In the M&A process, there are two main parties involved: the buyer and the seller. One type of buyer that is becoming increasingly prevalent in the M&A landscape is private equity firms.

https://upworkservice.com/

China M&A advisory

E-mail:nolan@pandacuads.com

Private equity firms are investment firms that raise capital from institutional investors and high net…

buy side m&a,global m&a,bank mergers and acquisitions,m&a advisory firms,success …

Mergers and acquisitions (M&A) are a common strategy for companies looking to expand their operations, enter new markets, or acquire new technologies. In the M&A process, there are two main parties involved: the buyer and the seller. The term "buy side" refers to the party that is acquiring the target company. In contrast, the "sell side" refers to the party that is being acquired.

https://upworkservice.com/

China M&A advisory

E-mail:nolan@pandacuads.com

The buy side M&A process…

due diligence in mergers and acquisitions,recent m&a deals 2023,m&a management,m …

Due diligence is an investigation process that companies undertake prior to a merger or acquisition (M&A) in order to assess the target company's financial and operational condition. The goal of due diligence is to identify any potential risks or opportunities that may impact the value of the acquisition and to ensure that the deal is in the best interest of the acquiring company. Due diligence is a critical step in…

m&a valuation,corporate mergers,m&a business,merger integration,sell side m&a pr …

Mergers and acquisitions (M&A) are a common strategy for companies looking to expand their operations, enter new markets, or acquire new technologies. One crucial aspect of the M&A process is the valuation of the target company. Valuation is the process of determining the fair value of a company, and it is an essential step in the M&A process because it helps companies to determine the terms of the acquisition, such…