Press release

Digital Banking Platform Market Growth Outlook: $168.3 Billion by 2032 at 20.9% CAGR

Allied Market Research published a report, titled, "Digital Banking Platform Market by Component (Solutions and Services), Deployment Model (On-Premises and Cloud), Type (Retail Banking and Corporate Banking), and Mode (Online Banking and Mobile Banking): Global Opportunity Analysis and Industry Forecast, 2024-2032". According to the report, the digital banking platform market was valued at $30.4 billion in 2023, and is estimated to reach $168.3 billion by 2032, growing at a CAGR of 20.9% from 2024 to 2032.Get a Sample Copy of this Report: https://www.alliedmarketresearch.com/request-sample/5539

Prime determinants of growth

The global digital banking platform is experiencing growth due to several factors such as surge in the number of Internet users, growth in a shift from traditional banking to online banking and rise in demand for personalized banking services. However, security and compliance issues in digital banking platforms, lack of digital literacy in emerging countries, and technical concerns associated with new technology integration and legacy systems hinder the market growth. Moreover, growth in the usage of machine learning and artificial intelligence in digital banking platforms, along with the increase in innovative banking services offer remunerative opportunities for the expansion of the global digital banking platforms market.

Segment Highlights

The solution segment is expected to lead the market during the forecast period.

By component, the solution segment held the highest market share in 2023, accounting for nearly three-fourths of the global digital banking platform market. Increase in focus on customer acquisition among bankers, rising investment in for solutions loan processing, and the effective management of established communication among bank professionals and customers are expected to drive the demand for the solution segment in the digital banking platform market.

The cloud segment is expected to lead the market during the forecast period.

By deployment mode, the on-premises segment held the highest market share in 2023, accounting for more than half of the global digital banking platform revenue and is likely to retain its dominance during the forecast period. The on-premises model is considered widely useful in large enterprises, as it involves a significant investment and organizations need to purchase interconnected servers, as well as software to manage the system, which is expected to drive market growth.

However, the cloud segment is projected to attain the highest CAGR between 2023 and 2032, owing to the adoption of a cloud strategy delivers several numbers of key benefits for businesses in the digital banking industry, such as the ease of implementation, low cost, and unlimited accessibility, which propels the growth of the cloud segment.

The retail banking segment is expected to garner the highest CAGR during the forecast period.

By type, the retail banking segment held the highest market share in 2023, accounting for almost two-thirds of the global digital banking platform revenue and is likely to retain its dominance during the forecast period. The growth is attributed to a surge in the customer base who are willing to shift towards online methods of banking, as it provides easy and convenient access to banking services. In addition, the increase in internet penetration globally contributes to this segment's growth.

The mobile banking segment is expected to garner the highest CAGR during the forecast period.

By mode, the online banking segment held the highest market share in 2023, accounting for nearly three-fourths of the global digital banking platform revenue and is likely to retain its dominance during the forecast period. The growth is driven by an increase in preference for digitization & automation, rise in usage of Fintech, which are computer programs, and financial services supported by technology drive the growth of this segment.

However, the mobile banking segment is projected to attain the highest CAGR between 2023 and 2032, owing to the technological advancements in mobile banking such as the delivery of personalized real-time customer service through smart bots, rise in usage of mobile devices allowing users to obtain instant customer assistance, drive the market growth.

Request Customization: https://www.alliedmarketresearch.com/request-for-customization/5539

North America to maintain its dominance by 2032

Based on region, North America held the highest market share in terms of revenue in 2023, accounting for almost two-fifths of the global digital banking platform revenue and is expected to rule the roost in terms of revenue during the forecast timeframe. The growth is driven by the constant advancements in information technology causing increased development of interactive and consumer-friendly user interfaces of the websites and applications that have led to changes in the preference of consumers for banking services.

Players

Appway

Cor Financial Solution Ltd.

Edgeverve

FIS Global

Fiserv, Inc.

nCino Inc.

Oracle Corporation

SAP SE

Temenos

Vsoft Corporation

The report provides a detailed analysis of these key players in the global digital banking platform. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the digital banking platform market segments, current trends, estimations, and dynamics of the digital banking platform market analysis from 2024 to 2032 to identify the prevailing digital banking platform market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the digital banking platform market segmentation assists to determine the prevailing digital banking platform market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global digital banking platform market trends, key players, market segments, application areas, and market growth strategies.

Enquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/5539

Trending Reports:

Business Credit Cards Market https://www.alliedmarketresearch.com/business-credit-cards-market-A323692

Landlord Insurance Market https://www.alliedmarketresearch.com/landlord-insurance-market-A259985

Drone Insurance Market https://www.alliedmarketresearch.com/drone-insurance-market-A323694

Term Life Insurance Market https://www.alliedmarketresearch.com/term-life-insurance-market-A177239

Online Payment API Market https://www.alliedmarketresearch.com/online-payment-api-market-A283242

Annuity Insurance Market https://www.alliedmarketresearch.com/annuity-insurance-market-A323697

Reverse Factoring Market https://www.alliedmarketresearch.com/reverse-factoring-market-A323715

Medical Loans Market https://www.alliedmarketresearch.com/medical-loans-market-A323693

Southeast Asia Travel Insurance Market https://www.alliedmarketresearch.com/southeast-asia-travel-insurance-market-A324610

Europe Aviation Insurance Market https://www.alliedmarketresearch.com/europe-aviation-insurance-market-A324609

Biometric Payment Card Market https://www.alliedmarketresearch.com/biometric-payment-card-market-A192413

Note Sorter Market https://www.alliedmarketresearch.com/note-sorter-market

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of the domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Platform Market Growth Outlook: $168.3 Billion by 2032 at 20.9% CAGR here

News-ID: 4342312 • Views: …

More Releases from Allied Market Research

USD 2.2 Billion Face Compact Market Market Value Cross by 2031 | Top Players suc …

According to the report published by Allied Market Research, the global face compact market was estimated at $1.3 billion in 2021 and is expected to hit $2.2 billion by 2031, registering a CAGR of 5.7% from 2022 to 2031. The report provides a detailed analysis of the top investment pockets, top winning strategies, drivers & opportunities, market size & estimations, competitive landscape, and evolving market trends. The market study is…

Fitness Rings Market 2026 : Why You Should Invest In This Market ?

Allied Market Research published a report, titled, "Fitness Rings Market by Compatibility (iOS, Android, Windows, Others), by Distribution Channel (Online, Offline): Global Opportunity Analysis and Industry Forecast, 2021-2031" According to the report, the global fitness rings industry was valued at $408.40 million in 2021 and is estimated to generate $869.4 million by 2031, witnessing a CAGR of 7.9% from 2022 to 2031. The report offers a detailed analysis of changing…

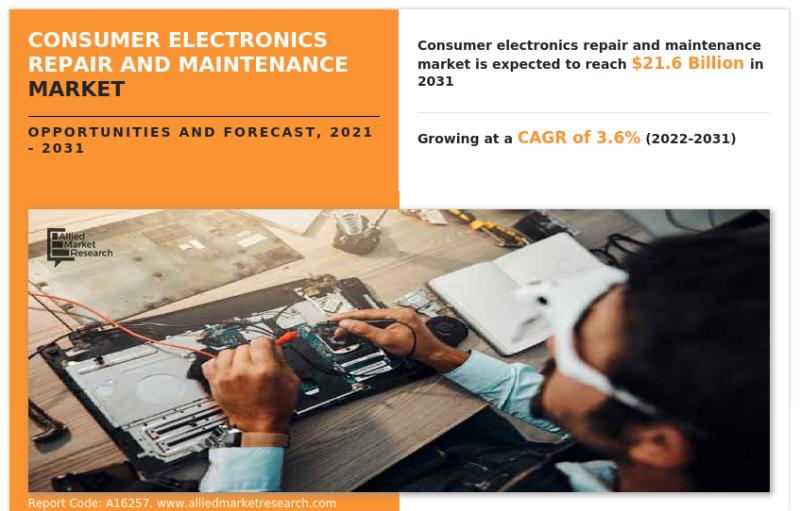

USD 21.6 Billion Consumer Electronics Repair And Maintenance Market Value Cross …

Allied Market Research published a report, titled, "Consumer Electronics Repair and Maintenance Market By Equipment Type (Mobile, PC, Washing Machine, Refrigerators, Others), By End User (Residential, Commercial), By Service Type (In-Warranty, Out of Warranty): Global Opportunity Analysis And Industry Forecast, 2021-2031". According to the report, the global consumer electronics repair and maintenance industry generated $15.3 billion in 2021 and is anticipated to generate $21.6 billion by 2031, witnessing a CAGR…

Lab Grown Diamonds Market in 2026 : Competitive Analysis and Industry Forecast | …

Allied Market Research published a report, titled, "Lab Grown Diamonds Market By Manufacturing Method (HPHT and CVD), Size (Below 2 Carat, 2-4 Carat, and Above 4 Carat), Nature (Colorless and Colored), and Application (Fashion and Industrial): Global Opportunity Analysis and Industry Forecast, 2023-2032.". According to the report, the global lab grown diamonds market was valued at $24.0 billion in 2022, and is projected to reach $59.2 billion by 2032, growing…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…