Press release

United States Wealth Management Platform Market is set to reach 30.26 US$ Billion by 2035, led by North America | Key Players:- SS&C Technologies, Inc., Fidelity National Information Services, Fiserv, Inc.

The Wealth Management Platform Market Size was estimated at 15.28 USD Billion in 2024. The Wealth Management Platform industry is projected to grow from 16.24 USD Billion in 2025 to 30.26 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.8% during the forecast period 2025 - 2035DataM Intelligence unveils its latest report on the "Wealth Management Platform Market size 2026," offering an in-depth analysis of market trends, growth drivers, competitive landscape, and regional dynamics. The study covers market size in value and volume, CAGR forecasts, and emerging opportunities that can guide businesses in seizing growth potential and crafting winning strategies. Packed with data-driven insights on current developments and future trends, this report is essential for companies aiming to stay ahead in the competitive Market.

Download a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/wealth-management-platform-market?pratik

United States: Key Industry Developments

✅ December 2025: BlackRock launched an AI-enhanced wealth management platform upgrade, integrating real-time ESG analytics and predictive portfolio optimization to boost returns by up to 15% for high-net-worth clients amid volatile markets.

✅ October 2025: Fidelity Investments rolled out its next-gen robo-advisory platform with hyper-personalized tax-loss harvesting features, reducing client tax liabilities by 20% on average through automated multi-asset rebalancing.

✅ August 2025: Charles Schwab expanded its wealth platform with blockchain-based secure asset tokenization, enabling fractional ownership of alternative investments and attracting $5 billion in new inflows from millennial investors.

Asia Pacific / Japan: Key Industry Developments

✅ November 2025: Nomura Securities introduced a cloud-native wealth management platform in Japan, featuring AI-driven behavioral finance tools that improved client retention by 25% via customized risk profiling and scenario simulations.

✅ September 2025: Mitsubishi UFJ Financial Group debuted its integrated digital wealth platform with quantum-secure encryption, supporting seamless cross-border portfolio management and onboarding 300,000 new users in the first quarter.

✅ July 2025: Sumitomo Mitsui Trust Bank launched a mobile-first wealth platform incorporating IoT-linked spending analytics, enhancing goal-based planning accuracy by 18% for Japan's aging affluent demographic

Latest M&A Activity

LPL Financial acquired Commonwealth Financial Network for $2.7 billion in 2025, marking a landmark consolidation with advisor transitions planned into 2026.

Deal volume surged 46% in H1 2025 versus H1 2024, fueled by private equity targeting scalable RIAs and holistic advisory platforms.

Over 1,500 transactions expected through 2029, with intra-sector mergers dominating independent wealth manager growth.

Recent Partnerships

Insurance brokerages formed nine cross-sector alliances with wealth firms by mid-2025, enhancing wallet share via integrated services.

Multi-office firms pursued private equity recapitalizations, retaining ownership while enabling M&A and infrastructure scaling.

Strategic collaborations between asset managers and insurers emerged for onshore market prioritization and profitability gains.

Recent Product Developments

Platforms integrated AI-driven personalization and private markets access to counter cost pressures and boost capabilities.

Fidelity emphasized AI, alternative assets, and M&A tools in 2026 trends for high-net-worth client success metrics.

New modules focused on secondaries trading and wealth consolidation streamlined operations for independent advisors.

Key Players:-

SS&C Technologies, Inc., Fidelity National Information Services, Fiserv, Inc., Profile Software, Broadridge Financial Solutions, Inc., InvestEdge, Inc., Temenos Group AG, InvestCloud, Inc., SEI Investments Company, and Comarch SA, among others.

Key Growth Drivers

◾ HNIs and Affluent Surge: India's HNI population grows 12%+ annually, pushing AUM from USD 1.1T (FY24) to USD 2.3T by FY29; platforms enable personalized robo-advisory for mass-affluent segments.

◾ Digital-First Platforms: UPI integration, AI-driven goal-based investing, and ESG tools attract 10M+ new retail investors; ARPU rises 17% to INR 18-20K by FY30 via cross-selling.

◾ Regulatory & Tech Boost: SEBI's digitization (T+3 listings, UPI-ASBA) and next-gen software adoption by SMEs drive robo-advisory (fastest segment at 15%+ CAGR).

◾ Investment Behavior Shift: Higher equity allocation (derivatives users up to 10.6M), capital market literacy, and disposable income growth favor hybrid human-robo models.

📌 Buy Now & Unlock 360° Market Intelligence:https://www.datamintelligence.com/buy-now-page?report=wealth-management-platform-market?pratik

Regional Highlights:-

North America Highlights

North America holds around 36% market share as of 2023, supported by regulatory innovation and sophisticated wealth management demands. The region's mature ecosystem benefits from high smartphone penetration and AI-driven tools for personalized services.

Asia-Pacific Growth

Asia-Pacific is projected to drive over 35% of global revenue growth, with a CAGR of 8.4% through 2035, reaching significant scale due to infrastructure investments and tech-savvy investors. Local partnerships and robo-advisory solutions accelerate penetration in emerging markets.

Other Regions

Middle East & Africa shows steady growth as Western banks target it as a financial hub, attracting new investors. South America grows moderately through family-owned firms adopting these platforms.

Get Customization in the report as per your requirements:https://www.datamintelligence.com/customize/wealth-management-platform-market?pratik

Market Segmentation:-

Advisory Model

Human advisory leads with 54% market share, offering personalized strategies for high-net-worth clients seeking trust and complex planning. Robo advisory holds 25% share, delivering automated, low-cost investment tools ideal for mass affluent users and digital natives. Hybrid advisory captures 21% share, blending human expertise with algorithmic efficiency for scalable, customized services.

Business Function

Financial advice management dominates at 28% share, enabling tailored investment recommendations and client engagement. Portfolio, accounting, and trading management accounts for 24% share, streamlining asset tracking, rebalancing, and transactions. Performance management holds 18% share for analytics and benchmarking; risk and compliance management 15% for regulatory adherence; reporting 10% for insights visualization; others 5% including billing.

Deployment Model

Cloud deployment commands 68% share, providing scalability, remote access, and cost savings for modern firms. On-premises retains 32% share, favored by institutions prioritizing data control and legacy system integration.

End-User

Banks lead with 35% share, leveraging platforms for comprehensive client services and regulatory compliance. Investment management firms hold 25% share for advanced portfolio tools; trading and exchange firms 18% for real-time execution; brokerage firms 15% for retail investor support; others 7%

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription?pratik

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United States Wealth Management Platform Market is set to reach 30.26 US$ Billion by 2035, led by North America | Key Players:- SS&C Technologies, Inc., Fidelity National Information Services, Fiserv, Inc. here

News-ID: 4342082 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

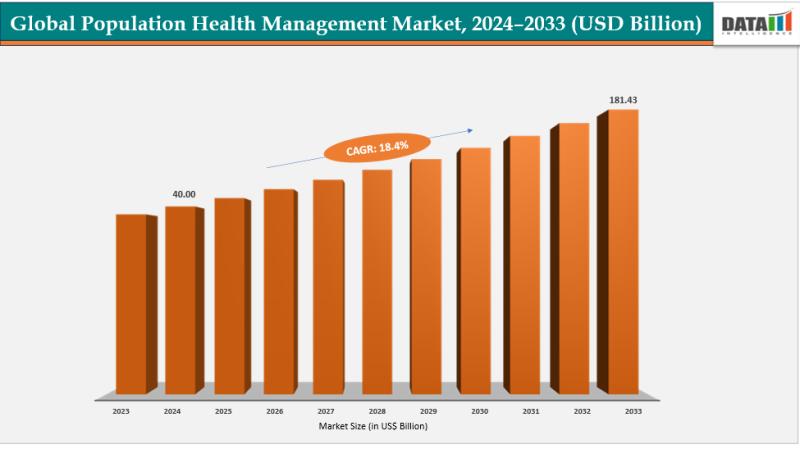

Population Health Management Market Set for Explosive Growth to USD 181.43 Billi …

The Global Population Health Management Market size reached USD 40.00 billion in 2024 and is expected to reach USD 181.43 billion by 2033, growing at a CAGR of 18.4% during the forecast period 2025-2033.

Market growth is driven by the rising prevalence of chronic diseases, increasing adoption of digital health solutions, and growing demand for value-based care models. Advancements in AI and predictive analytics, expanding healthcare IT infrastructure, surging investments in…

Organic Infant Formula Market Set to Grow to US$ 36,046 Million by 2032 at 6.3% …

AUSTIN, Texas and TOKYO -- According to DataM Intelligence, The Organic Infant Formula Market Size reached US$ 20,800 million in 2023, rose to US$ 22,110 million in 2024 and is projected to reach US$ 36,046 million by 2032, expanding at a CAGR of 6.3% from 2025 to 2032. The Organic Infant Formula Market is transforming early childhood nutrition by providing parents with certified organic, high-quality alternatives free from synthetic pesticides,…

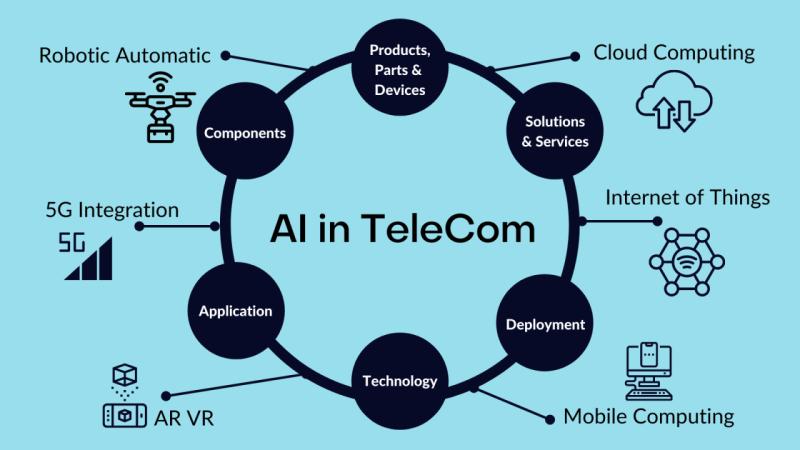

Future of Ai in telecommunication market. AI + Telecommunications Top Technologi …

The global AI in telecommunication market reached US$ 2.25 billion in 2023, with a rise to US$ 2.90 billion in 2024, and is expected to reach US$ 48.98 billion by 2033, growing at a CAGR of 36.9% during the forecast period 2025-2033.

AI in telecommunication market growth is driven by rising data traffic, demand for automated network optimization, predictive maintenance, improved customer experience, cost reduction, and rapid deployment of 5G and…

Bioresorbable Implants Market to Double, Reaching US$ 14.34 Billion by 2033 at 7 …

AUSTIN, Texas and TOKYO -- According to DataM Intelligence, The Bioresorbable Implants Market Size reached US$ 7.00 billion in 2024 and is projected to reach US$ 14.34 billion by 2033, expanding at a CAGR of 7.4% during the forecast period 2025-2033. The Bioresorbable Implants Market is transforming surgical outcomes by dissolving after fulfilling their role, leaving no permanent foreign body and lowering revision risks.

The shift from traditional metallic implants to…

More Releases for Wealth

Wealth Wave Script Review | Attract Wealth Fast

Today, we're diving into the Wealth Wave Script - a digital manifestation program that's been generating buzz in the personal development space. But here's the real question:

Is it just another batch of fluffy affirmations, or is there actual science and structure behind it?

Let's break down the truth behind the Wealth Wave Script and see how it stacks up against typical manifestation tools.

Visit the official Wealth Wave Script : https://rebrand.ly/WealthWaveScriptDiscount

What Is…

Wealth Geometric Code - Top Wealth Manifestation Program: A Comprehensive Review

The Wealth Geometric Cell is a revolutionary solution to unlock its potential as a manifestation of wealth. Imagine owning a tool that not only facilitates the effortless attraction of financial abundance, but also aligns with ancient wisdom and modern science. The Wealth Geometry Cell is designed to activate what is called the "geometric cell", a unique aspect of your being that has been inactive for too long. This innovative approach…

Wealth Brain Code: Breakthrough System for Wealth Building

Combining principles from psychology, neuroscience, and spirituality, programs like 'Wealth Brain Code' offer a holistic approach to personal and financial transformation. By leveraging psychological insights to challenge limiting beliefs, employing neuroscience techniques to rewire the brain for abundance, and integrating spiritual principles to foster purpose and growth, these programs aim to empower individuals to cultivate a mindset of prosperity and attract wealth effortlessly.

The program represents a holistic approach to personal…

Wealth DNA Code Wealth Manifestation Offer (Wealth DNA Code Audio Frequency) How …

Wealth DNA Code - Wealth Manifestation Offer: How To Make Money By Manifesting Your Desires

Did you know about Wealth Manifestation? It's a thrilling new method to generate income by manifestation of your goals! Wealth Manifestation is an effective tool to help discover the power of Manifestation which allows you to utilize the laws of attraction to manifest an abundant life as well as financial independence. In this article we'll look…

Wealth Management Market is Gaining Momentum with key players Bajaj Capital, Cen …

The "Wealth Management - Market Analysis, Trends, and Forecasts 2014-2025 " Study has been added to HTF MI offering. The study focus on both qualitative as well as quantitative side and follows Industry benchmark and NAICS standards to built coverage of players for final compilation of study. Some of the major and emerging players profiled are Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited,…

Wealth Management Market in India 2020: Bajaj Capital Limited, IIFL Wealth Manag …

A new research document is added in HTF MI database of 54 pages, titled as 'Wealth Management Market in India 2020’ with detailed analysis, Competitive landscape, forecast and strategies. The study covers geographic analysis that includes regions like North America, Europe or Asia and important players/vendors such as Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited, Edelweiss Asset Management Limited, IIFL Wealth Management Limited,…