Press release

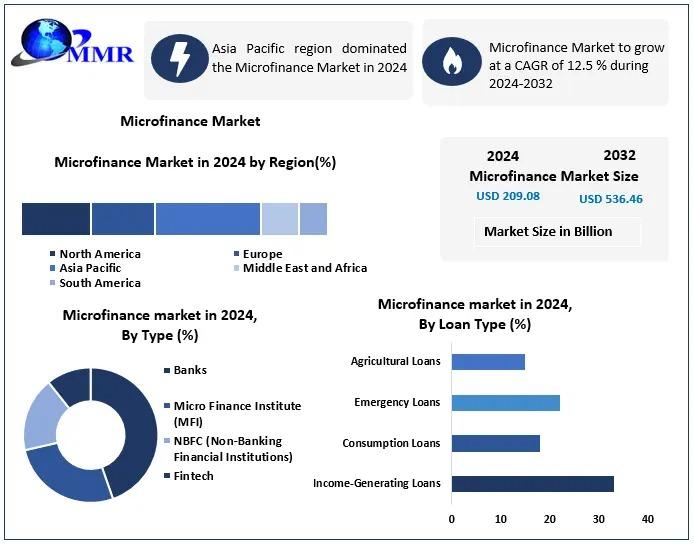

Microfinance Market Expected to Grow at a Strong 12.5% CAGR Through 2032

Microfinance Market size was valued at USD 209.08 Billion in 2024 and the total Microfinance Market revenue is expected to grow at a CAGR of 12.5 % from 2024 to 2032, reaching nearly USD 536.46 Billion.Microfinance Market Overview

Access to small-ticket financial services has become a cornerstone of inclusive economic development, and microfinance plays a critical role in bridging the credit gap for underserved populations. The microfinance market focuses on providing small loans, savings products, insurance, and remittance services to low-income individuals, self-employed workers, and micro-entrepreneurs who are typically excluded from traditional banking systems.

Over the years, microfinance has evolved beyond basic lending to include technology-driven financial solutions, digital disbursements, mobile-based repayments, and customized products for women entrepreneurs, rural households, and small businesses. With rising awareness of financial inclusion and supportive policy frameworks, the microfinance ecosystem continues to expand across both developing and emerging economies.

Access your personalized sample of this report now: https://www.maximizemarketresearch.com/request-sample/230628/

Market Size and Forecast

The microfinance market is witnessing steady expansion due to rising demand for accessible credit and financial services among unbanked and underbanked populations. Growth during the forecast period is supported by increasing penetration of micro-loans, favorable government initiatives, and the rapid adoption of digital financial platforms.

Market Size Overview

2024- 209.08 Bn

2032- 536.46 Bn

CAGR- 12.5%

Key Market Drivers

Rising Focus on Financial Inclusion

Governments and financial regulators across developing economies are prioritizing inclusive finance, encouraging MFIs to expand their outreach to rural and economically weaker sections.

Growth of Women Entrepreneurship

Microfinance has become a vital funding source for women-led enterprises, self-help groups, and small-scale businesses, driving higher loan demand and social impact.

Digital Transformation in Lending

Mobile banking, digital wallets, and cloud-based loan management systems are simplifying loan origination, disbursement, and repayment processes.

Expansion of Micro and Small Enterprises (MSEs)

Growing numbers of informal and micro-enterprises require small, flexible credit solutions to manage working capital and business expansion.

Supportive Policy and Regulatory Environment

Interest subsidies, refinancing schemes, and priority sector lending norms are strengthening the microfinance ecosystem.

Microfinance Market Challenges

Credit Risk and Loan Defaults

Income volatility among borrowers can lead to repayment challenges, particularly during economic disruptions or climate-related events.

High Operational Costs

Serving remote and rural populations increases costs related to field operations, staff training, and customer acquisition.

Regulatory Compliance Pressure

Frequent changes in lending norms, interest rate caps, and reporting requirements can affect profitability and operational planning.

Over-Indebtedness Concerns

Multiple borrowings from different lenders can strain borrower repayment capacity, increasing default risks.

Make Smarter Decisions in 2026 - Get Your Research Report Now : https://www.maximizemarketresearch.com/market-report/microfinance-market/230628/

Microfinance Market Segmentation Analysis

by Type

Banks

Micro Finance Institute (MFI)

NBFC (Non-Banking Financial Institutions)

Fintech

Other

by Loan Type

Income-Generating Loans

Consumption Loans

Emergency Loans

Agricultural Loans

Others

by End User

Individual Borrowers

Micro, Small, and Medium Enterprises (MSMEs)

Women Entrepreneurs

Farmers and Rural Communities

Major Players

The microfinance market includes a mix of established MFIs, regional lenders, cooperative institutions, and digital-first financial service providers. Market players are increasingly focusing on:

1. Bandhan Bank

2. Kiva

3. BRAC

4. Bank Rakyat Indonesia

5. BSS Microfinance Private limited

6. FINCA International

7. Grameen Bank

8. Al Amana Microfinance

9. Grameen Foundation

10. Accion International

11. Opportunity International

12. Bharat Financial Inclusion Limited

Emerging Opportunities

Fintech Integration and AI-Based Credit Scoring

Advanced analytics and alternative data sources enable better risk assessment and faster loan approvals.

Green and Climate-Linked Microfinance

Loans supporting renewable energy, clean cooking solutions, and sustainable agriculture are gaining traction.

Customized Products for Rural Markets

Tailored repayment cycles and seasonal loan structures can improve borrower retention and repayment rates.

Partnerships with Government and NGOs

Collaborations can enhance outreach, reduce risks, and improve social impact measurement.

Cross-Selling of Financial Products

Bundling credit with insurance and savings products improves customer engagement and revenue streams.

Recent Market Developments

Increased adoption of digital loan disbursement and mobile repayments

Growing use of biometric and e-KYC solutions

Expansion of microfinance services into semi-urban and rural areas

Rising investments in fintech-enabled MFIs

Focus on responsible lending and borrower protection frameworks

Frequently Asked Questions

1] What is the growth rate of the Microfinance Market?

The microfinance market is expected to grow at a steady CAGR during the forecast period, driven by financial inclusion initiatives.

2] Which region dominates the Microfinance Market?

Asia-Pacific leads the market due to high demand from rural and low-income populations.

3] Who are the key end users of microfinance services?

Individuals, self-help groups, micro-entrepreneurs, farmers, and small businesses are the primary users.

4] What factors are driving market growth?

Digital lending, government support, women entrepreneurship, and rising micro-enterprise activity are key drivers.

5] What challenges affect the microfinance industry?

Credit risk, regulatory changes, operational costs, and borrower over-indebtedness remain major challenges.

Related Reports

Solar Water Pumps Market : https://www.maximizemarketresearch.com/market-report/global-solar-water-pumps-market/90918/

Banking System Software Market : https://www.maximizemarketresearch.com/market-report/global-banking-system-software-market/16011/

Most performing reports:

Email Security Market https://www.maximizemarketresearch.com/market-report/global-email-security-market/63062/

DevOps Market https://www.maximizemarketresearch.com/market-report/global-devops-market/31505/

Telecom Cloud Market https://www.maximizemarketresearch.com/market-report/global-telecom-cloud-market/44583/

No-Code AI Platform Market https://www.maximizemarketresearch.com/market-report/no-code-ai-platform-market/213702/

Government Cloud Market https://www.maximizemarketresearch.com/market-report/global-government-cloud-market/4007/

Connect With Us

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT Park Phase 3,

Pune Bangalore Highway, Narhe

Pune, Maharashtra 411041, India

📞 +91 9607365656

📧 sales@maximizemarketresearch.com

About Maximize Market Research

Maximize Market Research is a rapidly growing market research and business consulting firm serving clients across multiple industries. The company delivers data-driven insights, competitive intelligence, and strategic analysis to help organizations make informed decisions and achieve sustainable growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Microfinance Market Expected to Grow at a Strong 12.5% CAGR Through 2032 here

News-ID: 4341641 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

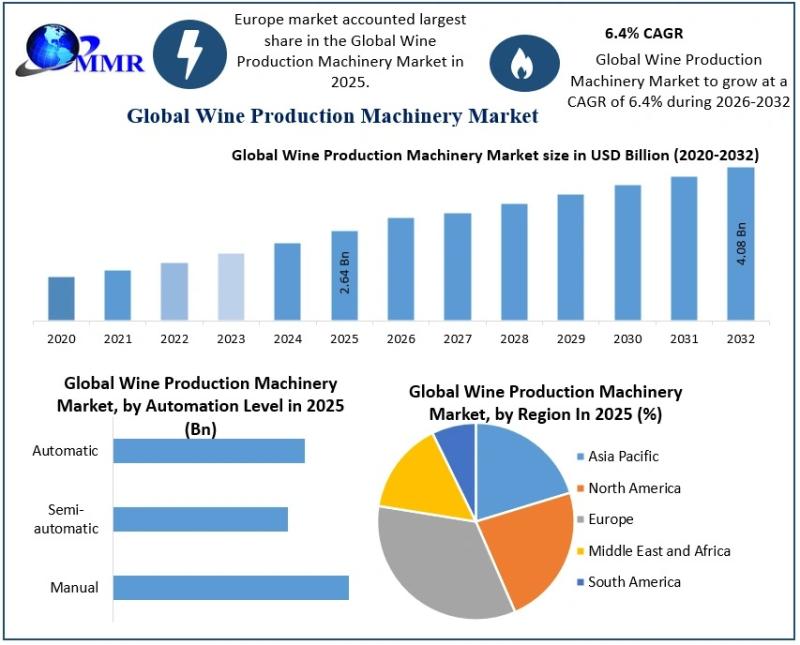

Wine Production Machinery Market Growing at a Robust CAGR of 6.4% Driven by Auto …

The Wine Production Machinery Market size was valued at USD 2.64 Billion in 2025 and the total Wine Production Machinery revenue is expected to grow at a CAGR of 6.4% from 2026 to 2032, reaching nearly USD 4.08 Billion by 2032.

Wine Production Machinery Market Overview:

The Wine Production Machinery Market is witnessing steady transformation as wineries across the globe increasingly adopt modern equipment to enhance efficiency, consistency, and product quality. From…

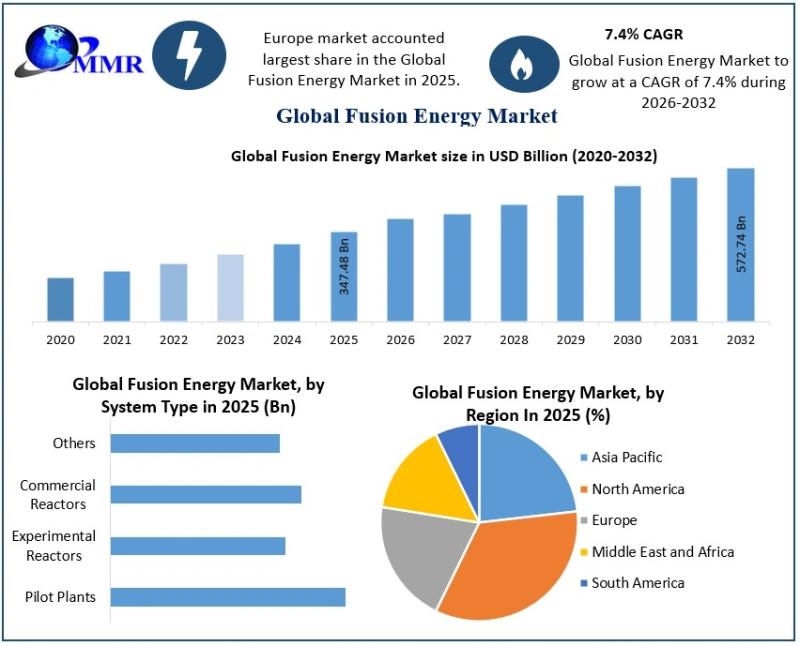

Fusion Energy Market Outlook Highlights Strong Growth at 7.4% CAGR

The Fusion Energy Market size was valued at USD 347.48 Billion in 2025 and the total Fusion Energy revenue is expected to grow at a CAGR of 7.4% from 2026 to 2032, reaching nearly USD 572.74 Billion by 2032.

Fusion Energy Market Overview:

The Fusion Energy Market is gaining global attention as nations, industries, and researchers intensify efforts to develop cleaner and more sustainable power alternatives for the future. Fusion energy is…

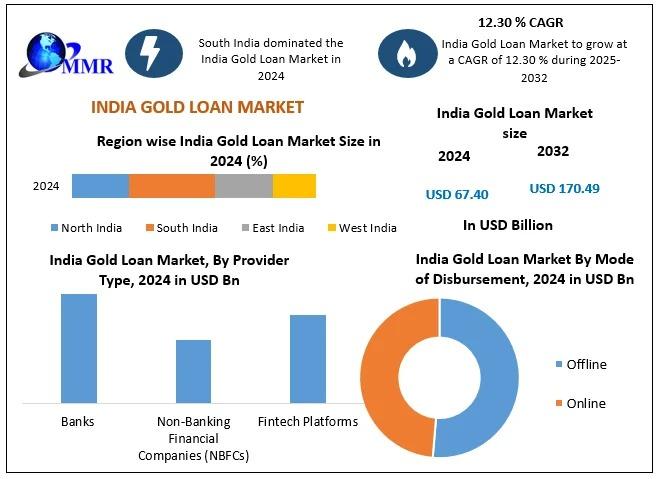

India Gold Loan Market Shows Strong Momentum Driven by Trust, Technology, and Fi …

The India Gold Loan Market size was valued at USD 67.40 Billion in 2024 and the total India Gold Loan Market is expected to grow at a CAGR of 12.30 % from 2025 to 2032, reaching nearly USD 170.49 Billion.

India Gold Loan Market Overview:

The India Gold Loan Market has steadily evolved into a trusted financial solution for individuals and small businesses seeking quick access to funds without liquidating their long-term…

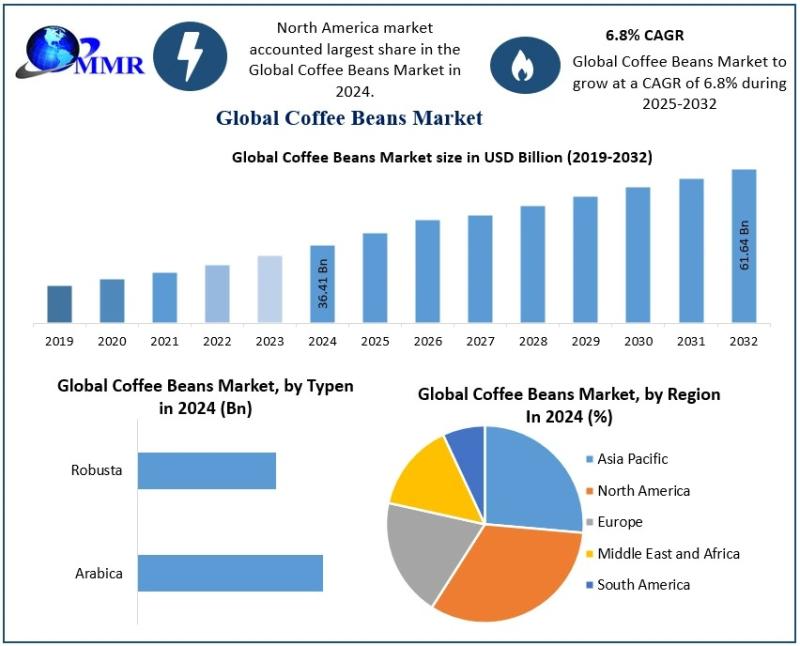

Coffee Beans Market Trends Highlight Rising Demand for Specialty, Sustainable, a …

The Coffee Beans Market size was valued at USD 36.41 Billion in 2024 and the total Coffee Beans revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 61.64 Billion.

Coffee Beans Market Overview:

The Coffee Beans Market reflects a complex ecosystem that begins at farms and extends to global distribution networks. Coffee beans are cultivated across diverse climatic regions, each contributing unique taste profiles…

More Releases for Micro

Micro and Ultra-Micro Balances Market Size Report 2025

"Global Micro and Ultra-Micro Balances Market 2025 by Manufacturers, Regions, Type and Application, Forecast to 2031" is published by Global Info Research. It covers the key influencing factors of the Micro and Ultra-Micro Balances market, including Micro and Ultra-Micro Balances market share, price analysis, competitive landscape, market dynamics, consumer behavior, and technological impact, etc.At the same time, comprehensive data analysis is conducted by national and regional sales, corporate competition rankings,…

Micro Mobility Revolution: Exploring the Growing Micro Cars Market

The term micro car is used for small-sized and lightweight cars, with an engine small than 700 cc. Bubble cars, cycle cars and quadricycles are defined as micro cars. This is usually three-wheeled and four-wheeled vehicle, available for personal and commercial usage. It is often used as a second or commuter car due to its low cost and fuel efficiency. This car is suitable for urban and suburban environment, as…

Micro Injection Molded Plastic Market worth $1,692 million by 2026 | Key players …

According to recent market research the "Micro Injection Molded Plastic Market by Material Type (Liquid-Crystal Polymer (LCP), Polyether Ether (PEEK), Polycarbonate (PC), Polyethylene (PE), Polyoxymethylene (POM)), Application and Region - Global Forecast to 2026", published by MarketsandMarkets, the micro injection molded plastic market is projected to reach USD 1,692 million by 2026, at a CAGR of 11.2% from USD 995 million in 2021.

Micro injection molded plastics are made of micro…

Micro Combined Heat & Power (Micro CHP) Market 2022 | Detailed Report

The Micro Combined Heat & Power (Micro CHP) research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the Micro Combined Heat & Power (Micro CHP) research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope,…

Micro-Invasive Glaucoma Implants Micro-Invasive Glaucoma Implants

Global Micro-Invasive Glaucoma Implants Market Definition: Micro-invasive glaucoma implants is performed for the treatment of the open- angle glaucoma and is done through an ab- interno approach. It is very safe and provides faster recovery as compared to the traditional methods. They usually lower the intraocular by increasing the flow or reducing the production of the aqueous humor. Increasing cases of the glaucoma worldwide is the major factor fueling the…

Comprehensive Analysis On Micro Welding Equipment Market 2019 : Pro-Fusion, OR L …

Up Market Research added a new Micro Welding Equipment Market research report for the period of 2019 – 2026. Report focuses on the major drivers and restraints providing analysis of the market share, segmentation, revenue forecasts and geographic regions of the market.

Get Sample Copy Of This Report @

https://www.upmarketresearch.com/home/requested_sample/108038

The report contains 112 pages which highly exhibit on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing…