Press release

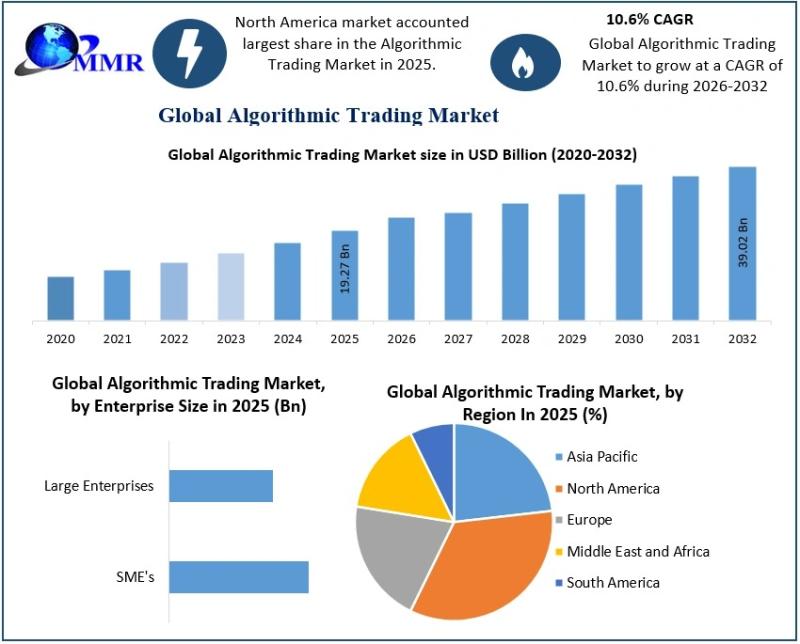

Algorithmic Trading Market Expected to Grow at a Robust 10.6% CAGR Through 2032

The Algorithmic Trading Market size was valued at USD 19.27 Billion in 2025 and the total Algorithmic Trading revenue is expected to grow at a CAGR of 10.6% from 2025 to 2032, reaching nearly USD 39.02 Billion by 2032.Algorithmic trading has rapidly transformed global financial markets by enabling faster, data-driven, and emotion-free trading decisions. By leveraging advanced mathematical models, artificial intelligence, and high-speed computing, algorithmic trading systems are reshaping how institutional investors, hedge funds, banks, and even retail traders participate in capital markets.

Access your personalized sample of this report now:https://www.maximizemarketresearch.com/request-sample/29843/

Market Size and Forecast

The algorithmic trading market has witnessed steady expansion as financial institutions increasingly prioritize speed, accuracy, and scalability in trade execution. Rising transaction volumes across equities, derivatives, forex, and commodities are further fueling demand for automated trading solutions.

Market Size Overview

Year Estimated Market Size (USD)

2025 ~USD 19.27 Billion

2032 ~USD 39.02 Billion

CAGR 10.6%

Key Market Drivers

Growing Market Volatility

Frequent market fluctuations and geopolitical uncertainties have increased the need for real-time decision-making, making algorithmic trading an essential risk-management tool.

Rise of High-Frequency Trading (HFT)

High-frequency trading strategies rely heavily on algorithmic systems to execute thousands of trades within microseconds, driving demand for ultra-low latency solutions.

AI and Machine Learning Integration

Advanced AI models enhance predictive accuracy, pattern recognition, and adaptive strategies, significantly improving trading performance.

Demand for Cost Efficiency

Automation reduces manual intervention, lowers operational costs, and minimizes human errors, making algorithmic trading attractive for financial institutions.

Expansion of Electronic Trading Platforms

Increased digitization of exchanges and financial markets worldwide is supporting the rapid adoption of algorithmic trading solutions.

Market Challenges

Regulatory Complexity

Strict regulations, compliance requirements, and surveillance obligations create operational challenges for algorithmic trading firms.

High Initial Investment

Infrastructure costs related to high-speed networks, co-location services, and advanced software can be prohibitive for smaller players.

Technology Risks

System failures, algorithm errors, and cybersecurity threats can lead to significant financial losses.

Market Fragmentation

Trading across multiple venues and asset classes increases execution complexity and latency management challenges.

Skill Shortage

There is a growing demand for professionals with combined expertise in finance, data science, and software development.

Need Reliable Market Data? Save 30% This New Year : https://www.maximizemarketresearch.com/market-report/global-algorithmic-trading-market/29843/

Market Segmentation Analysis

by Component

Solutions

Platforms

Software Tools

Services

Professional Services

Managed Services

by Trading Type

Foreign Exchange (FOREX)

Stock Markets

Exchange-Traded Fund (ETF)

Bonds

Cryptocurrencies

Others

by Deployment Mode

ON-PREMISE

CLOUD

by Enterprise Size

SME's

Large Enterprises

Major Players

The algorithmic trading market is characterized by intense competition, with players focusing on innovation, speed optimization, and AI-driven strategies. Key participants include:

1. Algo Trader GmbH (Switzerland)

2. Trading Technologies (USA)

3. Info Reach (USA)

4. Tethys Technology (USA)

5. Lime Brokerage LLC (USA)

6. Flex Trade Systems (USA)

7. Tower Research Capital (USA)

8. Virtu Financial (USA)

9. Hudson River Trading (USA)

10. Citadel (USA)

11. Technologies International (USA)

12. Argo Software Engineering (USA)

Which Regions Are Leading

North America

North America dominates the market due to advanced financial infrastructure, strong regulatory frameworks, and early adoption of high-frequency trading.

Europe

European markets benefit from increased automation, strong institutional participation, and evolving regulatory oversight.

Asia-Pacific

Asia-Pacific is witnessing rapid growth driven by expanding capital markets, rising retail investor participation, and increasing adoption of digital trading platforms.

Middle East & Latin America

These regions are gradually embracing algorithmic trading as financial markets modernize and electronic trading gains traction.

Emerging Opportunities

Retail Algorithmic Trading

User-friendly platforms and AI-powered tools are enabling retail traders to deploy algorithmic strategies with minimal technical expertise.

Cloud-Based Trading Infrastructure

Cloud deployment offers scalability, flexibility, and cost efficiency, making it attractive for emerging trading firms.

AI-Driven Predictive Models

Advanced analytics and deep learning models can improve trade accuracy and adaptive decision-making.

Multi-Asset Strategy Expansion

Traders are increasingly deploying algorithms across equities, commodities, cryptocurrencies, and derivatives.

ESG-Focused Trading Algorithms

Growing emphasis on sustainable investing is creating opportunities for ESG-driven algorithmic strategies.

Recent Market Developments

Increased adoption of AI-powered trading algorithms

Expansion of cloud-based algorithmic trading platforms

Rising use of alternative data for predictive trading

Strong growth in retail algorithmic trading participation

Enhanced regulatory focus on algorithm transparency and risk controls

Frequently Asked Questions

1] What is driving the growth of the Algorithmic Trading Market?

Automation, AI integration, rising market volatility, and demand for faster trade execution are key growth drivers.

2] Which region leads the Algorithmic Trading Market?

North America currently leads due to advanced infrastructure and widespread adoption by institutional investors.

3] Who are the primary users of algorithmic trading?

Institutional investors, hedge funds, investment banks, and increasingly retail traders.

4] What are the key challenges in algorithmic trading?

Regulatory complexity, high infrastructure costs, technology risks, and skill shortages.

5] How is AI influencing algorithmic trading?

AI improves predictive accuracy, strategy optimization, risk management, and adaptive trading decisions.

Related Reports:

High-frequency Trading Server Market : https://www.maximizemarketresearch.com/market-report/global-high-frequency-trading-server-market/110163/

Facades Market : https://www.maximizemarketresearch.com/market-report/global-facades-market/29372/

Event Stream Processing Market : https://www.maximizemarketresearch.com/market-report/global-event-stream-processing-market/34822/

Most performing reports:

Healthcare Workforce Management Systems Market https://www.maximizemarketresearch.com/market-report/global-healthcare-workforce-management-systems-market/6539/

Big Data Security Market https://www.maximizemarketresearch.com/market-report/big-data-security-market/199436/

Network Automation Market https://www.maximizemarketresearch.com/market-report/global-network-automation-market/673/

Email Marketing Market https://www.maximizemarketresearch.com/market-report/global-email-marketing-market/31834/

Connect with us:

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

sales@maximizemarketresearch.com

About Maximize Market Research

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. The company delivers data-driven insights and growth-focused strategies across industries including IT & telecom, BFSI, healthcare, chemicals, and advanced technologies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Algorithmic Trading Market Expected to Grow at a Robust 10.6% CAGR Through 2032 here

News-ID: 4341589 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

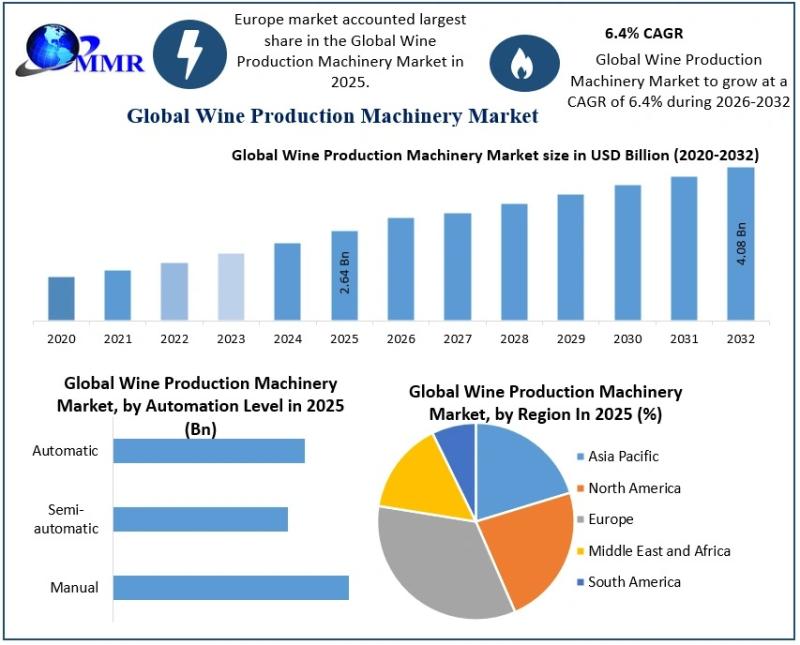

Wine Production Machinery Market Growing at a Robust CAGR of 6.4% Driven by Auto …

The Wine Production Machinery Market size was valued at USD 2.64 Billion in 2025 and the total Wine Production Machinery revenue is expected to grow at a CAGR of 6.4% from 2026 to 2032, reaching nearly USD 4.08 Billion by 2032.

Wine Production Machinery Market Overview:

The Wine Production Machinery Market is witnessing steady transformation as wineries across the globe increasingly adopt modern equipment to enhance efficiency, consistency, and product quality. From…

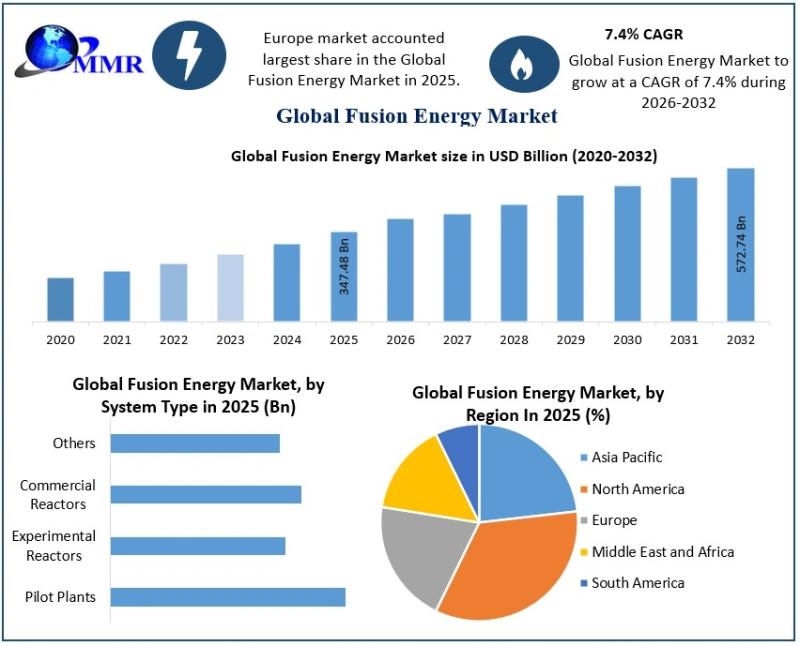

Fusion Energy Market Outlook Highlights Strong Growth at 7.4% CAGR

The Fusion Energy Market size was valued at USD 347.48 Billion in 2025 and the total Fusion Energy revenue is expected to grow at a CAGR of 7.4% from 2026 to 2032, reaching nearly USD 572.74 Billion by 2032.

Fusion Energy Market Overview:

The Fusion Energy Market is gaining global attention as nations, industries, and researchers intensify efforts to develop cleaner and more sustainable power alternatives for the future. Fusion energy is…

India Gold Loan Market Shows Strong Momentum Driven by Trust, Technology, and Fi …

The India Gold Loan Market size was valued at USD 67.40 Billion in 2024 and the total India Gold Loan Market is expected to grow at a CAGR of 12.30 % from 2025 to 2032, reaching nearly USD 170.49 Billion.

India Gold Loan Market Overview:

The India Gold Loan Market has steadily evolved into a trusted financial solution for individuals and small businesses seeking quick access to funds without liquidating their long-term…

Coffee Beans Market Trends Highlight Rising Demand for Specialty, Sustainable, a …

The Coffee Beans Market size was valued at USD 36.41 Billion in 2024 and the total Coffee Beans revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 61.64 Billion.

Coffee Beans Market Overview:

The Coffee Beans Market reflects a complex ecosystem that begins at farms and extends to global distribution networks. Coffee beans are cultivated across diverse climatic regions, each contributing unique taste profiles…

More Releases for Trading

Algorithmic Trading Market Showing Impressive Growth : Hudson River Trading, Jum …

The competitive landscape which incorporates the Algorithmic Trading Market ranking of the major players, along with new service/product launches, partnerships, business expansions and acquisitions in the past five years of companies profiled are also highlighted in the Algorithmic Trading Market report. Extensive company profiles comprising of company overview, company insights, product benchmarking and SWOT analysis for the major Algorithmic Trading Market players.

Top 10 key companies…

Increasing Awareness about Algorithmic Trading Market In Coming Years By Virtu F …

Global Algorithmic Trading Industry 2019 Research report provides information regarding market size, share, trends, growth, cost structure, capacity, revenue and forecast 2025. This report also includes the overall and comprehensive study of the Algorithmic Trading market with all its aspects influencing the growth of the market. This report is exhaustive quantitative analyses of the Algorithmic Trading industry and provides data for making Strategies to increase the market growth and effectiveness.

Algorithmic…

Algorithmic Trading Market 2024 SWOT Analysis by Key Players like Virtu Financia …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time. Algorithmic Trading are mainly used in investment banks, pension funds, mutual funds, hedge funds, etc.

Key trend which will predominantly effect the market in coming…

Automated Trading Market By Top Key Players- Citadel, KCG, Optiver, DRW Trading, …

The report "Automated Trading Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2016 - 2024", has been prepared based on an in-depth market analysis with inputs from industry experts.

An automated trading system, also referred to as mechanical trading system or algorithmic trading system, enables vendors to set up specific rules for money management, trade entries, and trade exits. Automated trading systems are generally programmed in a way…

Search4Research Announced Algorithmic Trading Market Forecast to 2024 - Virtu Fi …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time.

Algorithmic Trading Market provides a detail overview of latest technologies and in-depth analysis that reflect top vendor’s portfolios and technology; examines the strategic planning, challenges…

Algorithmic Trading Market 2019 | Flow Traders, Jump Trading, Spot Trading, DRW …

Global Algorithmic Trading market is also presented to the readers as a holistic snapshot of the competitive landscape within the given forecast period. The report also educates about the market strategies that are being adopted by your competitors and leading organizations. The report also focuses on all the recent industry trends. It presents a comparative detailed analysis of the all regional and player segments, offering readers a better knowledge of…