Press release

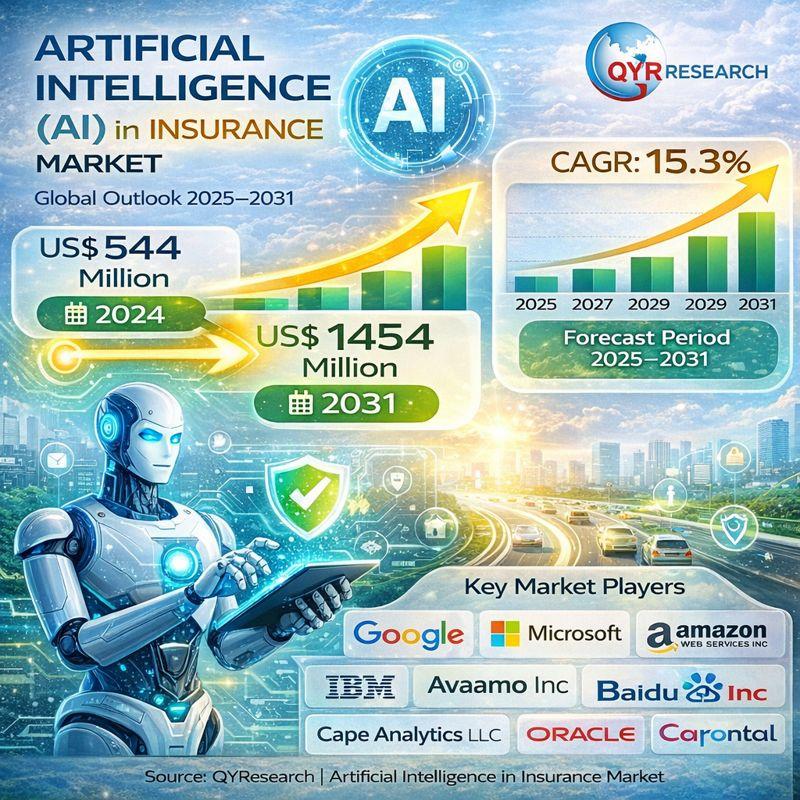

Artificial Intelligence (AI) in Insurance Market to Grow at a Strong CAGR of 15.3% Through 2031 on Increasing Use of Predictive Analytics

Market Summary -According to QY Research, a new publication titled "Global Artificial Intelligence (AI) in Insurance Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031" provides an in-depth, data-driven analysis of the global Artificial Intelligence (AI) in Insurance market to support informed decision-making and sustainable growth strategies. Authored by experienced market analysts and subject-matter experts, the report delivers accurate market data, validated insights, and actionable recommendations for industry participants. It evaluates historical performance alongside future forecasts to clearly explain competitive dynamics, key growth drivers, market challenges, and emerging opportunities. With detailed coverage of market dynamics, segmentation, leading companies, and regional trends, this comprehensive report serves as a reliable strategic resource for businesses looking to gain a competitive edge in the global Artificial Intelligence (AI) in Insurance market.

The global Artificial Intelligence (AI) in Insurance market was valued at US$ 544 million in 2024 and is anticipated to reach US$ 1454 million by 2031, witnessing a CAGR of 15.3% during the forecast period 2025-2031.

Get Full PDF Sample Copy of the Report: (Including Full TOC, Tables & Charts): https://qyresearch.in/request-sample/service-software-global-artificial-intelligence-ai-in-insurance-market-insights-industry-share-sales-projections-and-demand-outlook-2025-2031

The report offers a detailed analysis of the competitive landscape of the global Artificial Intelligence (AI) in Insurance market, with a strong focus on recent developments, future expansion plans, and key growth strategies adopted by leading players. It profiles nearly all major companies operating in the market, highlighting critical business aspects such as production capabilities, geographic presence, and product portfolios. Each company is evaluated using essential performance indicators including market share, growth rate, company size, production volume, revenue, and earnings. This comprehensive competitive assessment helps stakeholders understand market positioning, benchmark competitors, and identify strategic opportunities within the global Artificial Intelligence (AI) in Insurance market.

Artificial intelligence (AI) plays a key role in insurance sacam detection by detecting false claims. As a result, insurers can achieve an efficient and effective claims management system. Insurance AI algorithms can analyze huge amounts of data rapidly to find patterns and spot anomalies that don"t fit the patterns.

China and the United States are two leaders in AI industry. On the AI 100 list (2022) released by CB Insights, the number of companies in the United States ranks first, with more than 70 companies, followed by the United Kingdom, with 8 companies on the list. China and Canada both holds 5 companies on the list. According to data from the China Academy of Information and Communications Technology, the scale of China"s core artificial intelligence industry reached ¥508 billion in 2022, a year-on-year increase of 18%. From 2013 to November 2022, the cumulative number of patent applications for artificial intelligence inventions in the world reached 729,000, and the cumulative number of applications in China reached 389,000, accounting for 53.4%. However, the Global Artificial Intelligence Innovation Index Report 2021 released by the China Institute of Scientific and Technological Information shows that the overall strength of the United States is still far ahead. The number of artificial intelligence companies in the United States is about 4,670, while China has only 880. China"s data center is less than 1/68 of that of the United States.

Major Company Included: -

Microsoft Corporation

Amazon Web Services Inc

IBM Corporation

Avaamo Inc

Baidu Inc

Cape Analytics LLC

Oracle Corporation

Recent Developments -

The report highlights recent developments undertaken by key participants in the global Artificial Intelligence (AI) in Insurance market, providing up-to-date insights into evolving industry trends. It covers major strategic initiatives by manufacturers, including mergers and acquisitions, joint ventures, collaborations, product innovations, new offerings, and ongoing research and development activities. By tracking these strategic moves, the study offers a clear understanding of how leading companies are strengthening their market positions and driving innovation. This focused analysis helps readers stay informed about critical advancements and emerging opportunities shaping the future of the global Artificial Intelligence (AI) in Insurance market.

Market Drivers, Challenges & Restraints -

This section outlines the various elements influencing the trajectory of the Artificial Intelligence (AI) in Insurance market:

Key Growth Drivers -

- Supportive policy frameworks and regulatory reforms

- Advancement in product innovation and technological breakthroughs

- Growing demand in emerging application areas

- Shift in global supply chain structures

Restraints & Challenges -

- Regulatory uncertainties

- Competitive pricing pressures

- Operational risks

- Market-entry barriers

Market Segmentation and Regional -

By Type

Software

Platform

By Application

Life Insurance

Car Insurance

Property Insurance

Other

The report provides valuable insights into the key segments of the global Artificial Intelligence (AI) in Insurance market, with a strong focus on CAGR, market size, market share, and future growth potential. The market is comprehensively segmented by product type, application, and region, with each segment thoroughly analyzed to identify growth prospects, demand patterns, and emerging trends. This detailed segmental analysis plays a crucial role in uncovering high-growth and high-return opportunities across the market. By offering precise data on product- and application-level demand, the report enables businesses to prioritize profitable segments and develop targeted strategies within the global Artificial Intelligence (AI) in Insurance market.

Regional Analysis -

✔ North America (U.S., Canada, China)

✔ Europe (Germany, U.K., France, Italy, Russia, Spain, Rest of Europe)

✔ Asia-Pacific (Japan, South Korea, China Taiwan, Southeast Asia, India)

✔ Middle East, Africa, Latin America (Brazil, Mexico, Turkey, Israel, GCC Countries)

Reasons to Procure this Report: -

►The research would help top administration/policymakers/professionals/product advancements/sales managers and stakeholders in this market in the following ways.

►The report provides Artificial Intelligence (AI) in Insurance market revenues at the worldwide, regional, and country-level with a complete analysis to 2028 permitting companies to analyze their market share and analyze projections, and find new markets to aim.

►The research includes the Artificial Intelligence (AI) in Insurance market split by different types, applications, technologies, and end-uses. This segmentation helps leaders plan their products and finances based on the upcoming development rates of each segment.

►Artificial Intelligence (AI) in Insurance market analysis benefits investors by knowing the scope and position of the market giving them information on key drivers, challenges, restraints, and expansion chances of the market and moderate threats.

►This report would help to understand competition better with a detailed analysis and key strategies of their competitors and plan their position in the business.

►The study helps evaluate Artificial Intelligence (AI) in Insurance business predictions by region, key countries, and top companies' information to channel their investments.

Key questions answered in the report include:

►This Artificial Intelligence (AI) in Insurance report gives all the information about the industry analysis, revenue, and overview, of this market.

►What will be the rate of increase in Artificial Intelligence (AI) in Insurance market size and growth rate by the end of the forecast period?

►What are the major global Artificial Intelligence (AI) in Insurance market trends influencing the development of the market?

►What are the vital results of SWOT analysis of the major players operating in the Artificial Intelligence (AI) in Insurance market?

►What are the potential growth opportunities and threats faced by Major competitors in the Artificial Intelligence (AI) in Insurance market?

►What are the market opportunities and threats faced by vendors in the Global Artificial Intelligence (AI) in Insurance market?

Request for Pre-Order / Enquiry Link: https://qyresearch.in/pre-order-inquiry/service-software-global-artificial-intelligence-ai-in-insurance-market-insights-industry-share-sales-projections-and-demand-outlook-2025-2031

Table of Contents - Major Key Points:

1 Artificial Intelligence (AI) in Insurance Market Overview

1.1 Product Definition

1.2 Artificial Intelligence (AI) in Insurance by Type

1.2.1 Global Artificial Intelligence (AI) in Insurance Market Value by Type (2020-2031)

1.2.2 Software

1.2.3 Platform

1.3 Artificial Intelligence (AI) in Insurance by Application

1.3.1 Global Artificial Intelligence (AI) in Insurance Market Value by Application 2020-2031)

1.3.2 Life Insurance

1.3.3 Car Insurance

1.3.4 Property Insurance

1.3.5 Other

1.4 Global Artificial Intelligence (AI) in Insurance Revenue (2020-2031)

1.5 Assumptions and Limitations

1.6 Study Objectives

1.7 Years Considered

2 Key Insights

2.1 Key Emerging Trends

2.2 Key Developments - Mergers Acquisitions, New Product Launches, Collaborations, Partnerships and Joint Ventures

2.3 Latest Technological Advancements

2.4 Insights on Regulatory Scenarios

2.5 Porters Five Forces Analysis

3 Players Competitive Analysis

3.1 Global Artificial Intelligence (AI) in Insurance Revenue by Player (2020-2025)

3.2 Artificial Intelligence (AI) in Insurance Company Evaluation Quadrant

3.3 Industry Rank

3.3.1 Global Key Players of Artificial Intelligence (AI) in Insurance, Industry Ranking, 2023 VS 2024

3.3.2 Global Artificial Intelligence (AI) in Insurance Market Share by Company Type (Tier 1, Tier 2, and Tier 3)

3.3.3 Global Artificial Intelligence (AI) in Insurance Market Concentration Rate

3.3.4 Global 5 and 10 Largest Artificial Intelligence (AI) in Insurance Players Market Share by Revenue

3.4 Artificial Intelligence (AI) in Insurance Market: Overall Company Footprint Analysis

3.4.1 Artificial Intelligence (AI) in Insurance Market: Region Footprint

3.4.2 Artificial Intelligence (AI) in Insurance Market: Company Product Type Footprint

3.4.3 Artificial Intelligence (AI) in Insurance Market: Company Product Application Footprint

3.4.4 Global Key Players of Artificial Intelligence (AI) in Insurance, Date of Enter into This Industry

3.5 Competitive Environment

3.5.1 Historical Structure of the Industry

3.5.2 Barriers of Market Entry

3.5.3 Factors of Competition

4 Players Profiles

4.1 Google

4.1.1 Google Company Details

4.1.2 Google Business Overview

4.1.3 Google Artificial Intelligence (AI) in Insurance Introduction

4.1.4 Google Revenue in Artificial Intelligence (AI) in Insurance Business (2020-2025)

4.1.5 Google Recent Development

4.2 Microsoft Corporation

4.2.1 Microsoft Corporation Company Details

4.2.2 Microsoft Corporation Business Overview

4.2.3 Microsoft Corporation Artificial Intelligence (AI) in Insurance Introduction

4.2.4 Microsoft Corporation Revenue in Artificial Intelligence (AI) in Insurance Business (2020-2025)

4.2.5 Microsoft Corporation Recent Development

4.3 Amazon Web Services Inc

4.3.1 Amazon Web Services Inc Company Details

4.3.2 Amazon Web Services Inc Business Overview

4.3.3 Amazon Web Services Inc Artificial Intelligence (AI) in Insurance Introduction

4.3.4 Amazon Web Services Inc Revenue in Artificial Intelligence (AI) in Insurance Business (2020-2025)

4.3.5 Amazon Web Services Inc Recent Development

4.4 IBM Corporation

4.4.1 IBM Corporation Company Details

4.4.2 IBM Corporation Business Overview

4.4.3 IBM Corporation Artificial Intelligence (AI) in Insurance Introduction

4.4.4 IBM Corporation Revenue in Artificial Intelligence (AI) in Insurance Business (2020-2025)

4.4.5 IBM Corporation Recent Development

4.5 Avaamo Inc

4.5.1 Avaamo Inc Company Details

4.5.2 Avaamo Inc Business Overview

4.5.3 Avaamo Inc Artificial Intelligence (AI) in Insurance Introduction

4.5.4 Avaamo Inc Revenue in Artificial Intelligence (AI) in Insurance Business (2020-2025)

4.5.5 Avaamo Inc Recent Development

4.6 Baidu Inc

4.6.1 Baidu Inc Company Details

4.6.2 Baidu Inc Business Overview

4.6.3 Baidu Inc Artificial Intelligence (AI) in Insurance Introduction

4.6.4 Baidu Inc Revenue in Artificial Intelligence (AI) in Insurance Business (2020-2025)

4.6.5 Baidu Inc Recent Development

4.7 Cape Analytics LLC

4.7.1 Cape Analytics LLC Company Details

4.7.2 Cape Analytics LLC Business Overview

4.7.3 Cape Analytics LLC Artificial Intelligence (AI) in Insurance Introduction

4.7.4 Cape Analytics LLC Revenue in Artificial Intelligence (AI) in Insurance Business (2020-2025)

4.7.5 Cape Analytics LLC Recent Development

4.8 Oracle Corporation

4.8.1 Oracle Corporation Company Details

4.8.2 Oracle Corporation Business Overview

4.8.3 Oracle Corporation Artificial Intelligence (AI) in Insurance Introduction

4.8.4 Oracle Corporation Revenue in Artificial Intelligence (AI) in Insurance Business (2020-2025)

4.8.5 Oracle Corporation Recent Development

5 Analysis by Region

5.1 Global Artificial Intelligence (AI) in Insurance Market Size by Region

5.1.1 Global Artificial Intelligence (AI) in Insurance Revenue by Region: 2020 VS 2024 VS 2031

5.1.2 Global Artificial Intelligence (AI) in Insurance Revenue by Region (2020-2025)

5.1.3 Global Artificial Intelligence (AI) in Insurance Revenue by Region (2026-2031)

5.1.4 Global Artificial Intelligence (AI) in Insurance Revenue Market Share by Region (2020-2031)

5.2 North America Artificial Intelligence (AI) in Insurance Revenue (2020-2031)

5.3 Europe Artificial Intelligence (AI) in Insurance Revenue (2020-2031)

5.4 Asia-Pacific Artificial Intelligence (AI) in Insurance Revenue (2020-2031)

5.5 South America Artificial Intelligence (AI) in Insurance Revenue (2020-2031)

5.6 Middle East & Africa Artificial Intelligence (AI) in Insurance Revenue (2020-2031)

6 Market Scenario by Region & Country

6.1 Global Artificial Intelligence (AI) in Insurance Revenue by Region & Country: 2020 Versus 2024 Versus 2031

6.2 Global Artificial Intelligence (AI) in Insurance Revenue by Region & Country (2020-2031)

6.3 North America Artificial Intelligence (AI) in Insurance Market Facts & Figures by Country

6.3.1 North America Artificial Intelligence (AI) in Insurance Revenue by Country: 2020 VS 2024 VS 2031

6.3.2 North America Artificial Intelligence (AI) in Insurance Revenue by Country (2020-2031)

6.3.3 United States

6.3.4 Canada

6.4 Europe Artificial Intelligence (AI) in Insurance Market Facts & Figures by Country

6.4.1 Europe Artificial Intelligence (AI) in Insurance Revenue by Country: 2020 VS 2024 VS 2031

6.4.2 Europe Artificial Intelligence (AI) in Insurance Revenue by Country (2020-2031)

6.4.3 Germany

6.4.4 France

6.4.5 U.K.

6.4.6 Italy

6.4.7 Russia

6.5 Asia Pacific Artificial Intelligence (AI) in Insurance Market Facts & Figures by Region

6.5.1 Asia Pacific Artificial Intelligence (AI) in Insurance Market Size by Region: 2020 VS 2024 VS 2031

6.5.2 Asia Pacific Artificial Intelligence (AI) in Insurance Revenue by Region (2020-2031)

6.5.3 China

6.5.4 Japan

6.5.5 South Korea

6.5.6 India

6.5.7 Australia

6.5.8 China Taiwan

6.5.9 Indonesia

6.5.10 Thailand

6.5.11 Malaysia

6.6 South America Artificial Intelligence (AI) in Insurance Market Facts & Figures by Country

6.6.1 South America Artificial Intelligence (AI) in Insurance Market Size by Country: 2020 VS 2024 VS 2031

6.6.2 South America Artificial Intelligence (AI) in Insurance Revenue by Country

6.6.3 Mexico

6.6.4 Brazil

6.6.5 Argentina

6.7 Middle East and Africa Artificial Intelligence (AI) in Insurance Market Facts & Figures by Country

6.7.1 Middle East and Africa Artificial Intelligence (AI) in Insurance Market Size by Country: 2020 VS 2024 VS 2031

6.7.2 Middle East and Africa Artificial Intelligence (AI) in Insurance Revenue by Country

6.7.3 Turkey

6.7.4 Saudi Arabia

6.7.5 UAE

7 Segment by Type

7.1 Global Artificial Intelligence (AI) in Insurance Revenue by Type (2020-2025)

7.2 Global Artificial Intelligence (AI) in Insurance Revenue by Type (2026-2031)

7.3 Global Artificial Intelligence (AI) in Insurance Revenue Market Share by Type (2020-2031)

8 Segment by Application

8.1 Global Artificial Intelligence (AI) in Insurance Revenue by Application (2020-2025)

8.2 Global Artificial Intelligence (AI) in Insurance Revenue by Application (2026-2031)

8.3 Global Artificial Intelligence (AI) in Insurance Revenue Market Share by Application (2020-2031)

9 Industry Chain and Sales Channels Analysis

9.1 Artificial Intelligence (AI) in Insurance Industry Chain Analysis

9.2 Artificial Intelligence (AI) in Insurance Key Raw Materials

9.2.1 Key Raw Materials

9.2.2 Raw Materials Key Suppliers

9.3 Artificial Intelligence (AI) in Insurance Production Mode & Process

9.4 Artificial Intelligence (AI) in Insurance Sales and Marketing

9.4.1 Artificial Intelligence (AI) in Insurance Sales Channels

9.4.2 Artificial Intelligence (AI) in Insurance Distributors

9.5 Artificial Intelligence (AI) in Insurance Customers

10 Research Findings and Conclusion

11 Appendix

11.1 Research Methodology

11.1.1 Methodology/Research Approach

11.1.1.1 Research Programs/Design

11.1.1.2 Market Size Estimation

11.1.1.3 Market Breakdown and Data Triangulation

11.1.2 Data Source

11.1.2.1 Secondary Sources

11.1.2.2 Primary Sources

11.2 Author Details

11.3 Disclaimer

About Us:

QYResearch established as a research firm in 2007 and have since grown into a trusted brand amongst many industries. Over the years, we have consistently worked toward delivering high-quality customized solutions for wide range of clients ranging from ICT to healthcare industries. With over 50,000 satisfied clients, spread over 80 countries, we have sincerely strived to deliver the best analytics through exhaustive research methodologies.

Contact Us:

Arshad Shaha | Marketing Executive

QY Research, INC.

315 Work Avenue, Raheja Woods,

Survey No. 222/1, Plot No. 25, 6th Floor,

Kayani Nagar, Yervada, Pune 411006, Maharashtra

Tel: +91-8669986909

Emails - arshad@qyrindia.com

Web - https://www.qyresearch.in

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Artificial Intelligence (AI) in Insurance Market to Grow at a Strong CAGR of 15.3% Through 2031 on Increasing Use of Predictive Analytics here

News-ID: 4341062 • Views: …

More Releases from QYResearch.Inc

Stretch Film Packaging Market Rising Demand from E-commerce and Logistics Fuels …

The global Stretch film packaging market is expected to witness steady growth as industries prioritize cargo security, warehouse productivity, and cost control across increasingly complex supply chains. According to the latest report, Global Stretch Film Packaging Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032, the market was valued at US$ 5,805 million in 2025 and is forecast to reach US$ 7,312 million by 2032, expanding at a…

Hydrogen Peroxide Solvent Market Demand Surge Across Electronics, Healthcare, an …

The global Hydrogen peroxide solvent market is set for consistent expansion, supported by its essential role in pulp bleaching, textile processing, environmental applications, and rapidly advancing electronics manufacturing. According to the latest report, Global Hydrogen Peroxide Solvent Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032, the market stood at US$ 4,795 million in 2025 and is forecast to rise to US$ 6,894 million by 2032, progressing at…

Testing, Inspection and Certification TIC for Apparel Market Gains from Sustaina …

The global Testing, inspection and certification (TIC) market for apparel, footwear, and handbags is gaining strategic importance as brands, retailers, and regulators raise expectations for product safety, sustainability, and traceability. According to the latest industry assessment, Global Testing, Inspection and Certification TIC for Apparel Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032, the sector is positioned for continued growth through the forecast period, driven by complex supply…

Aerial Work Platform (AWP) Market to Reach US$ 15.07 Billion by 2032 | As Electr …

The global Aerial work platform (AWP) market is set for sustained expansion, supported by urbanization, infrastructure renewal, and increasingly strict workplace safety regulations. According to the latest research publication, Global Aerial Work Platform (AWP) Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032, the industry was valued at US$ 11.2 billion in 2025 and is forecast to grow to US$ 15.07 billion by 2032, reflecting a CAGR of…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…