Press release

Crypto Asset Management Market Outlook, Technology Evolution, and Growth Opportunities | Top Companies are Gemini Trust Company, LLC, Crypto Finance Group, BitGo.

The global crypto asset management market reached around US$ 1.74 billion in 2023, increased to approximately US$ 1.89 billion in 2024, and is projected to hit about US$ 15.87 billion by 2033, reflecting a strong CAGR of nearly 26.7% during 2025-2033. This robust trajectory is underpinned by accelerating institutional participation, stronger regulatory frameworks, and rapid innovation across custody, trading, and analytics platforms.Crypto Asset Management refers to the professional management of digital assets such as cryptocurrencies, tokens, and blockchain-based investments on behalf of individuals, institutions, or funds. It involves portfolio allocation, trading, custody, risk management, and performance monitoring using specialized platforms and tools. Crypto asset managers apply investment strategies to optimize returns while managing volatility and market risks. The service often integrates secure custody solutions, compliance controls, and analytics. Crypto asset management is increasingly adopted by institutional investors as digital assets gain mainstream acceptance.

Request Exclusive Sample: https://www.datamintelligence.com/download-sample/crypto-asset-management-market?rk

Recent Developments:

United States: Recent Industry Developments - Crypto Asset Management

✅ In July 2025, U.S.-based asset managers expanded crypto portfolio offerings for institutional investors, focusing on diversified exposure across Bitcoin, Ethereum, and tokenized assets. The move reflects growing demand for professionally managed digital asset strategies amid evolving regulatory clarity.

✅ In June 2025, a leading U.S. crypto asset management firm enhanced its custody and risk management framework to align with institutional compliance standards. The update emphasizes secure storage, real-time portfolio monitoring, and improved governance controls.

✅ In May 2025, several U.S. financial institutions integrated crypto asset management platforms with traditional wealth management systems. The integration enables unified reporting, compliance tracking, and performance analytics across digital and traditional assets.

Japan: Recent Industry Developments - Crypto Asset Management

✅ In July 2025, Japanese financial institutions increased adoption of regulated crypto asset management services to meet rising institutional and high-net-worth investor interest. The focus is on compliant custody solutions and structured digital asset products.

✅ In June 2025, a consortium of Japanese crypto exchanges and asset managers collaborated to enhance investor protection mechanisms. The initiative includes improved asset segregation, transparency standards, and risk disclosure frameworks.

✅ In May 2025, Japan's Financial Services Agency (FSA) supported the expansion of licensed crypto asset management services. The regulatory stance aims to balance innovation with market stability and investor protection.

Market Overview and Segmentation:

Crypto asset management solutions span a wide spectrum of products and services designed to manage diverse digital assets, including cryptocurrencies, security tokens, stablecoins, NFTs, and DeFi positions. They combine blockchain connectivity with risk management, analytics, and governance tools to support the full lifecycle of digital investments, from onboarding and KYC to execution, monitoring, and reporting.

The market is typically segmented by:

Product / Solution Type:

Custodial solutions (cold/hot storage, key management, insurance-backed vaults)

Portfolio and risk management platforms

Trading and execution management systems

Compliance, reporting, and tax solutions

Custodian solutions currently account for the dominant share due to their critical role in safeguarding private keys, ensuring regulatory compliance, and providing institutional‐grade security and insurance.

Deployment Model:

Cloud-based platforms, which lead adoption by offering scalability, rapid deployment, and easier integration with exchanges and on‐chain data feeds.

On‐premises solutions, favored by highly regulated entities and large institutions with strict data sovereignty and security requirements.

Application / Access:

Web-based interfaces that enable advanced analytics, multi‐venue connectivity, and institutional workflows.

Mobile-based applications, which are growing rapidly as investors demand real‐time visibility, trading, and portfolio control on the move.

End User:

Institutional investors (banks, asset managers, hedge funds, family offices)

Crypto funds and fintech platforms

High‐net‐worth and retail investors seeking secure, consolidated management of digital assets.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/crypto-asset-management-market?rk

Market Drivers and Opportunities:

Several structural trends are propelling the expansion of the crypto asset management market:

Institutionalization of crypto:

Banks, hedge funds, and asset managers are increasingly allocating to Bitcoin, Ethereum, and diversified digital asset strategies, demanding professional‐grade custody, execution, and risk tools. Their entry is elevating standards for governance, reporting, and security, catalyzing demand for regulated platforms and trusted custodians.

Evolving regulation and compliance:

Clearer regulatory guidance in major markets is enabling compliant product launches such as spot Bitcoin ETFs and structured crypto funds, supporting greater participation from conservative investors. Heightened focus on AML, KYC, and auditability is driving adoption of platforms that integrate surveillance, transaction monitoring, and robust reporting capabilities.

Security, custody, and risk management:

High‐profile hacks and fraud incidents have underscored the need for institutional‐grade security architectures, including multi‐signature wallets, hardware security modules, and insurance‐backed custody. Providers that combine strong security with user‐friendly interfaces and integrated risk analytics are well‐positioned to capture growing demand from both institutions and sophisticated retail users.

Key opportunities include:

Expansion of integrated platforms offering custody, trading, staking, DeFi access, and reporting within a unified environment.

Adoption of AI‐driven analytics, algorithmic strategies, and predictive risk models to optimize portfolio performance and automate decision‐making.

Growth in tokenization of real‐world assets (RWAs), enabling crypto asset managers to create diversified portfolios spanning both native digital assets and tokenized traditional instruments.

Regional Market Dynamics:

Regional performance is uneven but collectively supportive of strong global growth, with clear leadership and catch‐up dynamics:

North America:

North America currently represents the largest share of the crypto asset management market, driven by regulatory progress, high institutional inflows, and the presence of leading custodians and exchanges. The approval of spot Bitcoin ETFs in the U.S., alongside earlier crypto ETPs in Canada, has reinforced the region's status as a hub for regulated digital asset investment products.

Asia Pacific:

Asia Pacific is emerging as the fastest‐growing region, supported by rapid digitization, a large tech‐savvy population, and expanding fintech and blockchain ecosystems. Markets such as India, China, Singapore, and Japan are driving momentum through supportive innovation policies, growing retail participation, and increasing institutional experimentation with digital assets.

Europe:

Europe benefits from an increasingly harmonized regulatory landscape and strong focus on investor protection, which is encouraging the development of compliant custody, exchange, and asset management offerings. Fintech hubs and established financial centers are partnering with crypto specialists to launch regulated products and cross‐border distribution platforms.

Rest of the World:

Regions in the Middle East, Latin America, and Africa are at earlier stages but are seeing rising activity around digital asset hubs, payment innovation, and tokenization projects. As regulatory frameworks evolve and infrastructure improves, these markets present long‐term opportunities for specialized crypto asset managers and technology providers.

Buy now: https://www.datamintelligence.com/buy-now-page?report=crypto-asset-management-market?rk

Competitive Landscape and Strategic Focus:

Gemini Trust Company, LLC, Crypto Finance Group, BitGo, Coinbase, FMR LLC, Bakkt, Paxos Trust Company, LLC, Sygnum, Ledger SAS., Anchorage Digital.

Typical solution portfolios include:

Secure custodial platforms combining cold storage, insurance, and compliance frameworks.

Integrated trading and portfolio management systems with connectivity to multiple exchanges and liquidity venues.

Governance, compliance, and reporting modules that support regulatory audits and investor transparency.

Strategic priorities across the competitive landscape focus on:

Building end‐to‐end, cloud‐native platforms that seamlessly connect custody, trading, staking, DeFi, and reporting.

Strengthening interoperability with traditional financial systems, including order management, risk engines, and back‐office infrastructure.

Leveraging AI and advanced analytics to enhance surveillance, risk scoring, and portfolio optimization, thereby improving performance and resilience.

Future Outlook:

The crypto asset management market is poised to remain on a high‐growth trajectory through 2033 as digital assets solidify their role within diversified portfolios and financial infrastructure. Continued institutionalization, maturing regulation, and technological innovation are expected to expand the addressable market and deepen integration with mainstream capital markets.

Future developments are likely to feature:

Wider adoption of AI‐enabled, automated investment strategies that can operate across centralized and decentralized venues.

Broader tokenization of real‐world assets, creating new product segments and revenue streams for asset managers.

Enhanced emphasis on sustainability, governance, and transparency, aligning crypto asset management practices with global ESG expectations.

As a result, crypto asset management is set to evolve into a foundational pillar of modern finance, offering compelling growth opportunities for platforms, custodians, service providers, and investors that can navigate security, compliance, and innovation at scale.

For comprehensive insights, forecasts, and competitive intelligence on this market, visit DataM Intelligence's dedicated crypto asset management report page.

Have a look at our Subscription Dashboard:

https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Crypto Asset Management Market Outlook, Technology Evolution, and Growth Opportunities | Top Companies are Gemini Trust Company, LLC, Crypto Finance Group, BitGo. here

News-ID: 4340842 • Views: …

More Releases from DataM Intelligence 4market Research LLP

North America Surgical LED Lights Market Growth Outlook 2024-2031 | Top Companie …

The North America Surgical Led Lights market was reached at a high CAGR from 2024 to 2031.

Surgical LED Lights are specialized lighting devices used in operating rooms and surgical settings to provide bright, focused illumination during surgical procedures. These lights utilize Light Emitting Diode (LED) technology, which offers several advantages over traditional lighting sources, including improved energy efficiency, reduced heat generation, and longer lifespans. Surgical LED lights can be adjusted…

Respiratory Monitoring Devices Market to Reach US$38.14 Billion by 2033 at 8.2% …

The global respiratory monitoring devices market size was US$ 18.80 Billion in 2024 and is expected to reach US$ 38.14 Billion by 2033, growing at a CAGR of 8.2% from 2025 to 2033. as healthcare providers increase adoption of advanced monitoring solutions to improve diagnosis, management, and care of respiratory conditions.

Growth is supported by rising demand across key product types such as wearable sensors, capnography systems, spirometers, and…

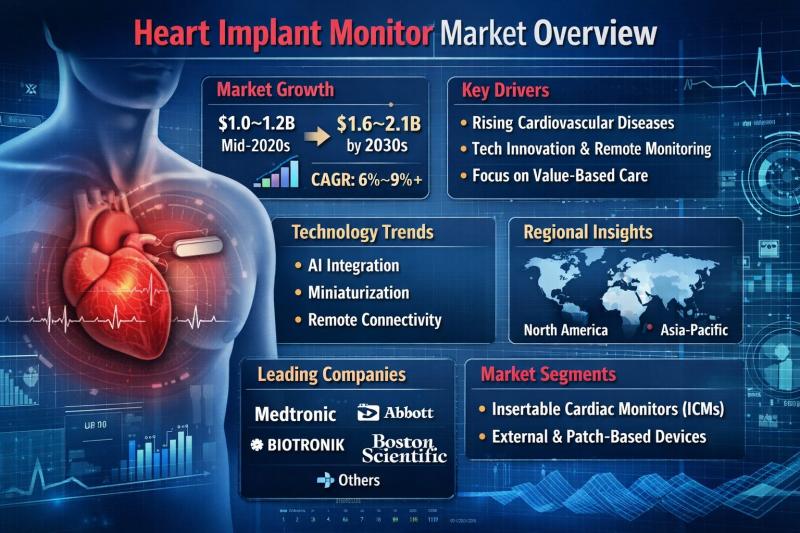

Heart Implant Monitor Market: Comprehensive Industry Analysis, Trends, and Futur …

The global Heart Implant Monitor Market, also known as the implantable cardiac monitor (ICM) or insertable cardiac monitor market, represents a rapidly evolving segment within the broader cardiac diagnostics industry. These devices are small, minimally invasive monitors implanted under the skin to continuously track heart rhythm abnormalities over extended periods. They play a critical role in detecting arrhythmias, unexplained syncope, atrial fibrillation (AF), and cryptogenic stroke.

With cardiovascular diseases (CVDs) remaining…

Cardiac Catheters and Guidewires Market to Reach US$64.09 Billion by 2033 at 7.7 …

The cardiac catheters and guidewires was valued at US$ 14.53 Billion. The global Cardiac Catheters and Guidewires market size reached US$ 15.54 Billion in 2024 and is expected to reach US$ 64.09 Billion by 2033, growing at a CAGR of 7.7% from 2025-2033. as the global burden of cardiovascular diseases rises and minimally invasive interventional procedures become more widely adopted.

Growth is supported by increasing demand across key product types such…

More Releases for Crypto

Next 100x Crypto Analysis: ZKP Crypto & Mutuum Finance Compete for Best Presale …

The crypto market stands at a turning point. Bitcoin's 21 Week EMA has moved below its 50 Week EMA, a rare bearish signal last seen in April 2022 before a long bear market phase. Bitcoin is trading near $78,800. Additional strain came from inflation data released this morning, which shifted expectations away from a pause in rate policy and toward possible hikes.

Ethereum continues to lag around $2,300 and remains…

Top 10 Crypto Watchlist: Apeing's Upcoming Crypto Presale

Crypto Watchlist: 10 Altcoins Gain Momentum as Apeing's Upcoming Crypto Presale Climbs Search Rankings

The market never announces its turning points. One week feels unstoppable, the next feels empty. Charts still exist, indicators still flash, and opinions still flood timelines. Yet when fear creeps in, action disappears. People wait. They hesitate. They promise themselves clarity will arrive tomorrow.

That pause is where most losses begin. Crypto does not reward comfort. It rewards…

Top 10 Crypto Watchlist: Apeing's Upcoming Crypto Presale

Crypto Watchlist: 10 Altcoins Gain Momentum as Apeing's Upcoming Crypto Presale Climbs Search Rankings

The market never announces its turning points. One week feels unstoppable, the next feels empty. Charts still exist, indicators still flash, and opinions still flood timelines. Yet when fear creeps in, action disappears. People wait. They hesitate. They promise themselves clarity will arrive tomorrow.

That pause is where most losses begin. Crypto does not reward comfort.…

7 Breakthrough Crypto Stars: $APEING Dominates 1000x Crypto

Time is running out for anyone serious about catching the next 1000x crypto rocket. Apeing ($APEING) https://www.apeing.com/ is making waves for early movers, offering whitelist access that could define who wins big and who watches from the sidelines. This isn't a drill. Phase 1 entry is still open, and history has proven that hesitation is the kryptonite of crypto gains. Savvy investors and meme-lovers alike are already strategizing their moves,…

Crypto Asset Management Service Market Next Big Thing | Barracuda, Crypto Financ …

Latest Study on Industrial Growth of Crypto Asset Management Service Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Crypto Asset Management Service market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the…

Crypto Consulting Services Market Key Players: Crypto Greeks, Crypto Consulting …

The crypto consulting services market refers to the industry that provides advice, guidance, and support to individuals and organizations that are involved in the cryptocurrency and blockchain space. This market has emerged in response to the increasing demand for expertise in this area, as more and more people are becoming interested in cryptocurrencies and blockchain technology.

Download a FREE Sample Report at https://www.reportsnreports.com/contacts/requestsample.aspx?name=6994775

The below companies that are profiled have been…