Press release

Dysautonomia Treatment Drugs Market to Reach US$ 1.49 Billion by 2031, Driven by Rising POTS Awareness, Post-COVID Autonomic Disorders, and Specialty Neurology Care | QY Research

Market Summary -The global market for Dysautonomia Treatment Drugs was estimated to be worth US$ 1,026 million in 2024 and is forecast to reach a readjusted size of US$ 1,492 million by 2031, expanding at a steady CAGR of 5.7% during the forecast period 2025-2031.

According to QY Research, the newly released report titled "Dysautonomia Treatment Drugs Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031" delivers a comprehensive, data-driven assessment of this emerging therapeutic segment. The study provides in-depth insights into market size evolution, competitive positioning, treatment patterns, regional demand dynamics, and long-term growth opportunities for pharmaceutical companies, clinical researchers, healthcare providers, and investors.

Get Full PDF Sample Copy of the Report (Including Full TOC, Tables & Charts):

https://www.qyresearch.in/request-sample/pharma-healthcare-dysautonomia-treatment-drugs-market-share-and-ranking-overall-sales-and-demand-forecast-2025-2031

Product Definition and Therapeutic Overview -

Dysautonomia Treatment Drugs refer to pharmacologic agents and related biologics used to manage symptoms caused by dysfunction of the autonomic nervous system. These therapies target conditions such as postural orthostatic tachycardia syndrome (POTS), neurogenic orthostatic hypotension (nOH), orthostatic intolerance, neurocardiogenic syncope, and other autonomic neuropathies.

Treatment mechanisms include modulation of intravascular volume, vascular tone, heart rate control, neurohormonal signaling, and immune-mediated pathways. Current therapeutic approaches rely on both approved and off-label drugs, including volume expanders, vasoconstrictors, heart-rate modulators, and immunomodulatory agents, reflecting the heterogeneous nature of dysautonomia and its underlying causes.

Market Dynamics and Industry Landscape -

The global dysautonomia treatment drugs market is in an emerging yet steadily developing stage, supported by increasing recognition of autonomic nervous system disorders among clinicians and patients. Rising diagnosis rates of POTS and nOH, growing post-viral and post-COVID autonomic dysfunction cases, and the expansion of specialized neurology and cardiology care networks are driving demand for effective pharmacologic interventions.

Historically, market growth has been moderate due to limited FDA-approved therapies and widespread dependence on off-label prescribing. However, newer drug developments-including norepinephrine prodrugs, heart-rate modulators, and immune-targeted therapies-are introducing fresh commercial potential. The market remains moderately fragmented, with relatively few pharmaceutical companies directly focused on dysautonomia, while an increasing number of clinical-stage biotech firms are entering the space to address significant unmet medical needs.

In 2024, the global market achieved an average gross profit margin of approximately 60%, reflecting the specialty nature of therapies, chronic treatment requirements, and premium pricing of branded and biologic products.

Clinical Pipeline and R&D Activity -

Unlike traditional pharmaceutical markets driven by large manufacturing capacity expansions, dysautonomia drug development is primarily shaped by clinical trial platforms and R&D initiatives. Notable ongoing and planned programs include the RECOVER-AUTONOMIC platform, evaluating IVIG and ivabradine in post-acute COVID autonomic dysfunction, multiple randomized and crossover trials assessing ivabradine for POTS, and continued droxidopa (Northera) programs for neurogenic orthostatic hypotension.

Additional investigator-initiated studies and IND-stage biotech programs are exploring immunotherapies and small-molecule repurposing strategies aimed at autoimmune and neurogenic dysautonomia, signaling a gradually strengthening development pipeline.

Supply Chain Structure: Upstream to Downstream -

Upstream, the market begins with API manufacturers, excipient suppliers, CROs, and academic translational research centers supporting small-molecule and biologic development. Midstream activities include formulation development, finished-dose manufacturing, regulatory affairs, branded pharmaceutical marketing, and specialty distribution.

Downstream, therapies reach patients through wholesalers, specialty and retail pharmacies, hospital purchasing groups, neurologists, cardiologists, and multidisciplinary care teams, with reimbursement frameworks, PBMs, and specialty pharmacy networks playing a critical role in access and pricing dynamics.

Regional Market Outlook -

North America represents the largest regional market, supported by high disease awareness, strong reimbursement systems, and access to specialized autonomic disorder centers. The United States leads global consumption and research activity. Europe follows, with Germany, the UK, and France demonstrating active clinical research and patient registry development.

The Asia-Pacific region, led by Japan, South Korea, and Australia, shows strong long-term growth potential as diagnostic capabilities improve and healthcare infrastructure expands. Latin America and the Middle East & Africa remain at earlier stages of adoption, constrained by diagnostic and access challenges, but are expected to benefit from broader global supply chain expansion over time.

Market Trends and Key Growth Drivers -

Key trends shaping the dysautonomia treatment drugs market include the shift toward combination therapies, personalized treatment strategies based on specific autonomic dysfunction subtypes, and increasing use of digital health platforms for symptom monitoring and remote care.

Advances in artificial intelligence and data analytics are expected to improve diagnostic accuracy and drug response modeling. Commercially, generic drugs such as midodrine and fludrocortisone dominate the cost-sensitive segment, while branded therapies like droxidopa and emerging biologics target niche, higher-value patient populations.

Competitive Landscape -

The competitive landscape is moderately fragmented, with both large pharmaceutical companies and smaller specialty players participating across different treatment classes. The report provides detailed analysis of company market share, product portfolios, strategic positioning, and pipeline activity.

Key companies profiled include Aspen, Ferring Pharmaceuticals, Lundbeck, Bausch Health Companies, Amgen, Boehringer Ingelheim, Takeda, Teva, Pfizer, Eli Lilly, AA Pharma, and Kenvue.

Market Segmentation Highlights -

By Type:

► Chronic Orthostatic Intolerance Treatment Drugs

► Dysautonomia Symptoms and Comorbidities Treatment Drugs

By Application:

► Pediatric

► Teen / Adult

► Ages 50+

Each segment is evaluated in terms of revenue contribution, clinical relevance, growth trends, and future market potential.

Reasons to Procure This Report -

► Access reliable global and regional revenue forecasts (2020-2031)

► Understand company market share, ranking, and competitive dynamics

► Analyze clinical pipeline activity and emerging therapeutic approaches

► Identify high-growth patient segments and regional opportunities

► Support strategic planning, R&D prioritization, and market entry decisions

Key Questions Answered in the Report -

► What is the current and future size of the global dysautonomia treatment drugs market?

► Which regions and patient groups are driving demand growth?

► How fragmented is the competitive landscape, and who are the leading players?

► How are post-COVID autonomic disorders influencing market expansion?

► What treatment innovations will shape the market through 2031?

Request for Pre-Order / Enquiry:

https://www.qyresearch.in/pre-order-inquiry/pharma-healthcare-dysautonomia-treatment-drugs-market-share-and-ranking-overall-sales-and-demand-forecast-2025-2031

Table of Content:

1 Market Overview

1.1 Dysautonomia Treatment Drugs Product Introduction

1.2 Global Dysautonomia Treatment Drugs Market Size Forecast (2020-2031)

1.3 Dysautonomia Treatment Drugs Market Trends & Drivers

1.3.1 Dysautonomia Treatment Drugs Industry Trends

1.3.2 Dysautonomia Treatment Drugs Market Drivers & Opportunity

1.3.3 Dysautonomia Treatment Drugs Market Challenges

1.3.4 Dysautonomia Treatment Drugs Market Restraints

1.4 Assumptions and Limitations

1.5 Study Objectives

1.6 Years Considered

2 Competitive Analysis by Company

2.1 Global Dysautonomia Treatment Drugs Players Revenue Ranking (2024)

2.2 Global Dysautonomia Treatment Drugs Revenue by Company (2020-2025)

2.3 Key Companies Dysautonomia Treatment Drugs Manufacturing Base Distribution and Headquarters

2.4 Key Companies Dysautonomia Treatment Drugs Product Offered

2.5 Key Companies Time to Begin Mass Production of Dysautonomia Treatment Drugs

2.6 Dysautonomia Treatment Drugs Market Competitive Analysis

2.6.1 Dysautonomia Treatment Drugs Market Concentration Rate (2020-2025)

2.6.2 Global 5 and 10 Largest Companies by Dysautonomia Treatment Drugs Revenue in 2024

2.6.3 Global Top Companies by Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Revenue in Dysautonomia Treatment Drugs as of 2024)

2.7 Mergers & Acquisitions, Expansion

3 Segmentation by Type

3.1 Introduction by Type

3.1.1 Chronic Orthostatic Intolerance Treatment Drugs

3.1.2 Dysautonomia Symptoms and CoMorbidities Treatment Drugs

3.2 Global Dysautonomia Treatment Drugs Sales Value by Type

3.2.1 Global Dysautonomia Treatment Drugs Sales Value by Type (2020 VS 2024 VS 2031)

3.2.2 Global Dysautonomia Treatment Drugs Sales Value, by Type (2020-2031)

3.2.3 Global Dysautonomia Treatment Drugs Sales Value, by Type (%) (2020-2031)

4 Segmentation by Therapeutic Mechanism

4.1 Introduction by Therapeutic Mechanism

4.1.1 Mineralocorticoids

4.1.2 Alpha-Adrenergic Agonists

4.1.3 Norepinephrine Prodrugs

4.1.4 Heart-Rate Modulators

4.1.5 Others

4.2 Global Dysautonomia Treatment Drugs Sales Value by Therapeutic Mechanism

4.2.1 Global Dysautonomia Treatment Drugs Sales Value by Therapeutic Mechanism (2020 VS 2024 VS 2031)

4.2.2 Global Dysautonomia Treatment Drugs Sales Value, by Therapeutic Mechanism (2020-2031)

4.2.3 Global Dysautonomia Treatment Drugs Sales Value, by Therapeutic Mechanism (%) (2020-2031)

5 Segmentation by Indication

5.1 Introduction by Indication

5.1.1 POTS

5.1.2 Neurogenic Orthostatic Hypotension

5.1.3 Neurocardiogenic Syncope

5.1.4 Diabetic Autonomic Neuropathy

5.1.5 Others

5.2 Global Dysautonomia Treatment Drugs Sales Value by Indication

5.2.1 Global Dysautonomia Treatment Drugs Sales Value by Indication (2020 VS 2024 VS 2031)

5.2.2 Global Dysautonomia Treatment Drugs Sales Value, by Indication (2020-2031)

5.2.3 Global Dysautonomia Treatment Drugs Sales Value, by Indication (%) (2020-2031)

6 Segmentation by Route

6.1 Introduction by Route

6.1.1 Oral

6.1.2 Parenteral

6.2 Global Dysautonomia Treatment Drugs Sales Value by Route

6.2.1 Global Dysautonomia Treatment Drugs Sales Value by Route (2020 VS 2024 VS 2031)

6.2.2 Global Dysautonomia Treatment Drugs Sales Value, by Route (2020-2031)

6.2.3 Global Dysautonomia Treatment Drugs Sales Value, by Route (%) (2020-2031)

7 Segmentation by Application

7.1 Introduction by Application

7.1.1 Pediatric

7.1.2 Teen/Adult

7.1.3 Ages 50+

7.2 Global Dysautonomia Treatment Drugs Sales Value by Application

7.2.1 Global Dysautonomia Treatment Drugs Sales Value by Application (2020 VS 2024 VS 2031)

7.2.2 Global Dysautonomia Treatment Drugs Sales Value, by Application (2020-2031)

7.2.3 Global Dysautonomia Treatment Drugs Sales Value, by Application (%) (2020-2031)

8 Segmentation by Region

8.1 Global Dysautonomia Treatment Drugs Sales Value by Region

8.1.1 Global Dysautonomia Treatment Drugs Sales Value by Region: 2020 VS 2024 VS 2031

8.1.2 Global Dysautonomia Treatment Drugs Sales Value by Region (2020-2025)

8.1.3 Global Dysautonomia Treatment Drugs Sales Value by Region (2026-2031)

8.1.4 Global Dysautonomia Treatment Drugs Sales Value by Region (%), (2020-2031)

8.2 North America

8.2.1 North America Dysautonomia Treatment Drugs Sales Value, 2020-2031

8.2.2 North America Dysautonomia Treatment Drugs Sales Value by Country (%), 2024 VS 2031

8.3 Europe

8.3.1 Europe Dysautonomia Treatment Drugs Sales Value, 2020-2031

8.3.2 Europe Dysautonomia Treatment Drugs Sales Value by Country (%), 2024 VS 2031

8.4 Asia Pacific

8.4.1 Asia Pacific Dysautonomia Treatment Drugs Sales Value, 2020-2031

8.4.2 Asia Pacific Dysautonomia Treatment Drugs Sales Value by Region (%), 2024 VS 2031

8.5 South America

8.5.1 South America Dysautonomia Treatment Drugs Sales Value, 2020-2031

8.5.2 South America Dysautonomia Treatment Drugs Sales Value by Country (%), 2024 VS 2031

8.6 Middle East & Africa

8.6.1 Middle East & Africa Dysautonomia Treatment Drugs Sales Value, 2020-2031

8.6.2 Middle East & Africa Dysautonomia Treatment Drugs Sales Value by Country (%), 2024 VS 2031

9 Segmentation by Key Countries/Regions

9.1 Key Countries/Regions Dysautonomia Treatment Drugs Sales Value Growth Trends, 2020 VS 2024 VS 2031

9.2 Key Countries/Regions Dysautonomia Treatment Drugs Sales Value, 2020-2031

9.3 United States

9.3.1 United States Dysautonomia Treatment Drugs Sales Value, 2020-2031

9.3.2 United States Dysautonomia Treatment Drugs Sales Value by Type (%), 2024 VS 2031

9.3.3 United States Dysautonomia Treatment Drugs Sales Value by Application, 2024 VS 2031

9.4 Europe

9.4.1 Europe Dysautonomia Treatment Drugs Sales Value, 2020-2031

9.4.2 Europe Dysautonomia Treatment Drugs Sales Value by Type (%), 2024 VS 2031

9.4.3 Europe Dysautonomia Treatment Drugs Sales Value by Application, 2024 VS 2031

9.5 China

9.5.1 China Dysautonomia Treatment Drugs Sales Value, 2020-2031

9.5.2 China Dysautonomia Treatment Drugs Sales Value by Type (%), 2024 VS 2031

9.5.3 China Dysautonomia Treatment Drugs Sales Value by Application, 2024 VS 2031

9.6 Japan

9.6.1 Japan Dysautonomia Treatment Drugs Sales Value, 2020-2031

9.6.2 Japan Dysautonomia Treatment Drugs Sales Value by Type (%), 2024 VS 2031

9.6.3 Japan Dysautonomia Treatment Drugs Sales Value by Application, 2024 VS 2031

9.7 South Korea

9.7.1 South Korea Dysautonomia Treatment Drugs Sales Value, 2020-2031

9.7.2 South Korea Dysautonomia Treatment Drugs Sales Value by Type (%), 2024 VS 2031

9.7.3 South Korea Dysautonomia Treatment Drugs Sales Value by Application, 2024 VS 2031

9.8 Southeast Asia

9.8.1 Southeast Asia Dysautonomia Treatment Drugs Sales Value, 2020-2031

9.8.2 Southeast Asia Dysautonomia Treatment Drugs Sales Value by Type (%), 2024 VS 2031

9.8.3 Southeast Asia Dysautonomia Treatment Drugs Sales Value by Application, 2024 VS 2031

9.9 India

9.9.1 India Dysautonomia Treatment Drugs Sales Value, 2020-2031

9.9.2 India Dysautonomia Treatment Drugs Sales Value by Type (%), 2024 VS 2031

9.9.3 India Dysautonomia Treatment Drugs Sales Value by Application, 2024 VS 2031

10 Company Profiles

10.1 Aspen

10.1.1 Aspen Profile

10.1.2 Aspen Main Business

10.1.3 Aspen Dysautonomia Treatment Drugs Products, Services and Solutions

10.1.4 Aspen Dysautonomia Treatment Drugs Revenue (US$ Million) & (2020-2025)

10.1.5 Aspen Recent Developments

10.2 Ferring Pharmaceuticals

10.2.1 Ferring Pharmaceuticals Profile

10.2.2 Ferring Pharmaceuticals Main Business

10.2.3 Ferring Pharmaceuticals Dysautonomia Treatment Drugs Products, Services and Solutions

10.2.4 Ferring Pharmaceuticals Dysautonomia Treatment Drugs Revenue (US$ Million) & (2020-2025)

10.2.5 Ferring Pharmaceuticals Recent Developments

10.3 Lundbeck

10.3.1 Lundbeck Profile

10.3.2 Lundbeck Main Business

10.3.3 Lundbeck Dysautonomia Treatment Drugs Products, Services and Solutions

10.3.4 Lundbeck Dysautonomia Treatment Drugs Revenue (US$ Million) & (2020-2025)

10.3.5 Lundbeck Recent Developments

10.4 Bausch Health Companies

10.4.1 Bausch Health Companies Profile

10.4.2 Bausch Health Companies Main Business

10.4.3 Bausch Health Companies Dysautonomia Treatment Drugs Products, Services and Solutions

10.4.4 Bausch Health Companies Dysautonomia Treatment Drugs Revenue (US$ Million) & (2020-2025)

10.4.5 Bausch Health Companies Recent Developments

10.5 Amgen

10.5.1 Amgen Profile

10.5.2 Amgen Main Business

10.5.3 Amgen Dysautonomia Treatment Drugs Products, Services and Solutions

10.5.4 Amgen Dysautonomia Treatment Drugs Revenue (US$ Million) & (2020-2025)

10.5.5 Amgen Recent Developments

10.6 Boehringer Ingelheim

10.6.1 Boehringer Ingelheim Profile

10.6.2 Boehringer Ingelheim Main Business

10.6.3 Boehringer Ingelheim Dysautonomia Treatment Drugs Products, Services and Solutions

10.6.4 Boehringer Ingelheim Dysautonomia Treatment Drugs Revenue (US$ Million) & (2020-2025)

10.6.5 Boehringer Ingelheim Recent Developments

10.7 Takeda

10.7.1 Takeda Profile

10.7.2 Takeda Main Business

10.7.3 Takeda Dysautonomia Treatment Drugs Products, Services and Solutions

10.7.4 Takeda Dysautonomia Treatment Drugs Revenue (US$ Million) & (2020-2025)

10.7.5 Takeda Recent Developments

10.8 Teva

10.8.1 Teva Profile

10.8.2 Teva Main Business

10.8.3 Teva Dysautonomia Treatment Drugs Products, Services and Solutions

10.8.4 Teva Dysautonomia Treatment Drugs Revenue (US$ Million) & (2020-2025)

10.8.5 Teva Recent Developments

10.9 Pfizer

10.9.1 Pfizer Profile

10.9.2 Pfizer Main Business

10.9.3 Pfizer Dysautonomia Treatment Drugs Products, Services and Solutions

10.9.4 Pfizer Dysautonomia Treatment Drugs Revenue (US$ Million) & (2020-2025)

10.9.5 Pfizer Recent Developments

10.10 Eli Lilly

10.10.1 Eli Lilly Profile

10.10.2 Eli Lilly Main Business

10.10.3 Eli Lilly Dysautonomia Treatment Drugs Products, Services and Solutions

10.10.4 Eli Lilly Dysautonomia Treatment Drugs Revenue (US$ Million) & (2020-2025)

10.10.5 Eli Lilly Recent Developments

10.11 AA Pharma

10.11.1 AA Pharma Profile

10.11.2 AA Pharma Main Business

10.11.3 AA Pharma Dysautonomia Treatment Drugs Products, Services and Solutions

10.11.4 AA Pharma Dysautonomia Treatment Drugs Revenue (US$ Million) & (2020-2025)

10.11.5 AA Pharma Recent Developments

10.12 Kenvue

10.12.1 Kenvue Profile

10.12.2 Kenvue Main Business

10.12.3 Kenvue Dysautonomia Treatment Drugs Products, Services and Solutions

10.12.4 Kenvue Dysautonomia Treatment Drugs Revenue (US$ Million) & (2020-2025)

10.12.5 Kenvue Recent Developments

11 Industry Chain Analysis

11.1 Dysautonomia Treatment Drugs Industrial Chain

11.2 Dysautonomia Treatment Drugs Upstream Analysis

11.2.1 Key Raw Materials

11.2.2 Raw Materials Key Suppliers

11.2.3 Manufacturing Cost Structure

11.3 Midstream Analysis

11.4 Downstream Analysis (Customers Analysis)

11.5 Sales Model and Sales Channels

11.5.1 Dysautonomia Treatment Drugs Sales Model

11.5.2 Sales Channel

11.5.3 Dysautonomia Treatment Drugs Distributors

12 Research Findings and Conclusion

13 Appendix

13.1 Research Methodology

13.1.1 Methodology/Research Approach

13.1.1.1 Research Programs/Design

13.1.1.2 Market Size Estimation

13.1.1.3 Market Breakdown and Data Triangulation

13.1.2 Data Source

13.1.2.1 Secondary Sources

13.1.2.2 Primary Sources

13.2 Author Details

13.3 Disclaimer

QY Research PVT. LTD.

315 Work Avenue,

Raheja Woods,

6th Floor, Kalyani Nagar,

Yervada, Pune - 411060,

Maharashtra, India

India: (O) +91 866 998 6909

USA: (O) +1 626 295 2442

Email: hitesh@qyresearch.com

Web: www.qyresearch.in

About Us -

QY Research, established in 2007, is a globally recognized market research and consulting firm delivering syndicated and customized research solutions across pharmaceuticals, biotechnology, medical devices, chemicals, advanced materials, and healthcare services. With more than 50,000 clients across over 80 countries, QY Research combines rigorous research methodologies, deep domain expertise, and actionable insights to support data-driven decision-making and sustainable business growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Dysautonomia Treatment Drugs Market to Reach US$ 1.49 Billion by 2031, Driven by Rising POTS Awareness, Post-COVID Autonomic Disorders, and Specialty Neurology Care | QY Research here

News-ID: 4340808 • Views: …

More Releases from QY Research, Inc.

General Purpose Microcontroller Market to Reach US$ 32.9 Billion by 2031, Driven …

Market Summary -

The global market for General Purpose Microcontrollers was estimated to be worth US$ 23,266 million in 2024 and is forecast to reach a readjusted size of US$ 32,934 million by 2031, expanding at a steady CAGR of 5.1% during the forecast period 2025-2031.

According to QY Research, the newly released report titled "General Purpose Microcontroller Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031" delivers a comprehensive, data-driven…

Industrial Microcontrollers Market to Reach US$ 7.58 Billion by 2031, Driven by …

Market Overview

According to QY Research, the global Industrial Microcontrollers Market was valued at US$ 5,274 million in 2024 and is projected to reach US$ 7,576 million by 2031, growing at a CAGR of 5.3% during the forecast period 2025-2031.

The newly released report titled "Industrial Microcontrollers Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031" provides an in-depth, data-driven analysis of the global industrial MCU landscape. The study evaluates historical…

Through Glass Via (TGV) Interposers Market to Reach US$ 319 Million by 2031, Acc …

Market Summary -

The global market for Through Glass Via (TGV) Interposers was estimated to be worth US$ 101 million in 2024 and is forecast to reach a readjusted size of US$ 319 million by 2031, expanding at a robust CAGR of 18.0% during the forecast period 2025-2031.

According to QY Research, the newly released report titled "Through Glass Via (TGV) Interposers Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031"…

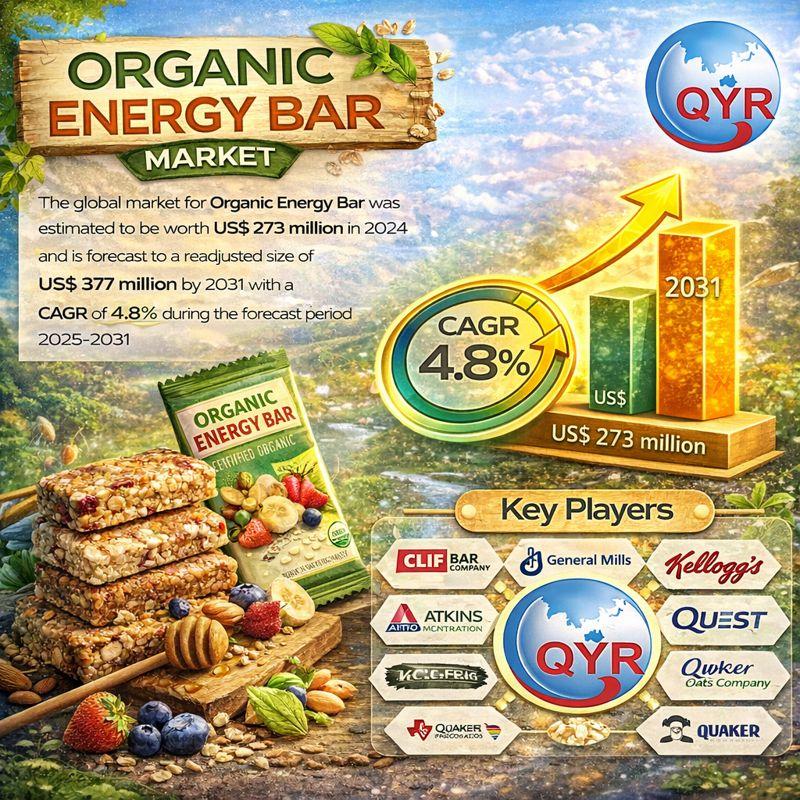

Organic Energy Bar Market to Reach US$ 377 Million by 2031, Driven by Clean-Labe …

Market Summary -

The global market for Organic Energy Bars was estimated to be worth US$ 273 million in 2024 and is forecast to reach a readjusted size of US$ 377 million by 2031, expanding at a CAGR of 4.8% during the forecast period 2025-2031.

According to QY Research, the newly released report titled "Organic Energy Bar Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031" delivers a comprehensive, data-driven assessment…

More Releases for Treatment

Trigeminal Neuralgia Treatment Market Size, Trigeminal Neuralgia Treatment Marke …

Trigeminal Neuralgia Treatment Market Dynamics are clarified by an in-depth review of facts on current and emerging trends. To understand a resource, the paper uses Porter's five forces to examine the importance of numerous qualities such as understanding of suppliers and customers, dangers provided by various agents, competitive strength, and promising new businesses. precious. Furthermore, the study covers numerous firms' Trigeminal Neuralgia Treatment research data, benefit, gross margin, worldwide market…

Medical Tourism Market Report by Treatment Type (Dental Treatment, Cosmetic Trea …

The global medical tourism market accounted for $104.68 billion in 2019, and is projected to reach $273.72 billion by 2027, registering a CAGR of 12.8% from 2019 to 2027 in terms of value.

View Full Report: https://reports.valuates.com/market-reports/ALLI-Auto-0P310/medical-tourism

In terms of volume, the global medical tourism market accounted for 23,042.90 thousand patients in 2019, and is projected to reach 70,358.61 thousand patients by 2027, registering a CAGR of 15.0% from 2019 to…

Stretch Marks Treatment Market by Treatment & Forecast - 2025

Global Stretch Marks Treatment Market: Snapshot

In order to expand their outreach and add to their product portfolio, keen players in the global stretch marks treatment market are taking the inorganic route of acquisitions. They are also pouring money into development of new and better products.

Rising instances of obesity causing stretch marks is serving to catalyze growth in the market. In addition, growing aesthetic consciousness among people, especially among pregnant women,…

Stretch Marks Treatment Market by Treatment & Forecast - 2025

Global Stretch Marks Treatment Market: Snapshot

In order to expand their outreach and add to their product portfolio, keen players in the global stretch marks treatment market are taking the inorganic route of acquisitions. They are also pouring money into development of new and better products.

Rising instances of obesity causing stretch marks is serving to catalyze growth in the market. In addition, growing aesthetic consciousness among people, especially among pregnant women,…

Medical Tourism Market by Treatment Type (Dental Treatment, Cosmetic Treatment, …

Medical Tourism Market Overview:

The global medical tourism market was valued at $53,768 million in 2017, and is estimated to reach at $143,461 million by 2025, registering a CAGR of 12.9% from 2018 to 2025.

Organized travel across international borders to avail medical treatment of some form, which may or may not be available in the travelers home country is defined as medical tourism. Medical tourists travel abroad for the maintenance, enhancement,…

Substance Use Disorder Treatment Market By Type (Alcohol abuse treatment, Nicoti …

According to World Health Organization (WHO), the leading cause of disability around the world is not a physical disease, but a serious mood disorder known as depression. Around 350 million people suffer from depression worldwide, and that only about 50% of these individuals will ever receive treatment. According to Anxiety and Depression Association of America, in the U.S., over 15 million adults experience an episode of clinical depression in any…