Press release

Cathodic Electrocoating Market to Reach US$ 5.87 Billion by 2031, Driven by Automotive Demand, Low-VOC Regulations, and Energy-Efficient Coating Technologies | QY Research

Market Summary -The global market for Cathodic Electrocoating was estimated to be worth US$ 4,244 million in 2024 and is forecast to reach a readjusted size of US$ 5,866 million by 2031, expanding at a CAGR of 5.0% during the forecast period 2025-2031.

According to QY Research, the newly released report titled "Cathodic Electrocoating Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031" provides a comprehensive, data-driven assessment of the global cathodic electrocoating market. The study delivers detailed insights into market size evolution, pricing trends, production capacity, company market share and ranking, regional demand patterns, and long-term growth opportunities across automotive and industrial applications.

Get Full PDF Sample Copy of the Report (Including Full TOC, Tables & Charts):

https://www.qyresearch.in/request-sample/service-software-cathodic-electrocoating-market-share-and-ranking-overall-sales-and-demand-forecast-2025-2031

Industry Scale and Capacity Overview -

Global cathodic electrocoating demand reached approximately 1,280.5 kilotons in 2024, with an average selling price of around US$ 3,314 per ton. Total global production capacity stood at roughly 1,423 kilotons, while the industry maintained a healthy gross profit margin of about 33.1%, reflecting strong technical barriers and stable downstream demand.

Product Definition and Technology Evolution -

Cathodic electrocoating is an advanced surface-coating process in which the metal workpiece acts as the cathode, attracting positively charged paint particles from an aqueous coating bath. Compared with anodic electrocoating, the cathodic process significantly reduces metal ion dissolution into the coating film, resulting in superior corrosion resistance, durability, and film performance.

As the limitations of conventional spray coating-such as low transfer efficiency, solvent emissions, and uneven coverage-have become more apparent, electrophoretic coating has gained widespread adoption. The technology has evolved from anodic to cathodic systems, from single-component to two-component formulations, and continues to expand into new industrial applications. The process involves four fundamental mechanisms: electrolysis, electrophoresis, electrodeposition, and electroosmosis, ensuring uniform film thickness and excellent edge coverage.

Because cathodic electrocoating relies on water-based or water-dispersible ionic polymers, it releases minimal volatile organic compounds (VOCs), making it one of the most environmentally friendly coating technologies available today.

Raw Materials and Cost Structure -

Key raw materials include resins, pigments, fillers, additives, and solvents, with the chemical industry serving as the primary upstream sector. Product costs are closely linked to crude oil price fluctuations, which affect resin and additive pricing. While overall market supply is sufficient, raw-material price volatility continues to influence coating prices across regions.

Downstream Applications and Demand Dynamics -

Cathodic electrocoating is widely used in the automotive industry, particularly for vehicle bodies and structural components, as well as in non-automotive sectors such as construction machinery, motorcycles, hardware, and home appliances. Demand from these industries is closely correlated with macroeconomic cycles.

In automotive OEM coatings-especially passenger car applications-international coating leaders maintain a dominant position, benefiting from long-term supply agreements, stringent qualification standards, and deep technical expertise.

Sustainability, Regulations, and Technology Trends -

Global emphasis on low-VOC, low-toxicity, and environmentally sustainable coatings continues to accelerate the adoption of cathodic electrocoating. Regulatory standards for VOC emissions, hazardous substances, and paint-shop operations are becoming increasingly stringent worldwide, particularly in China, Europe, and North America.

To meet compliance and cost pressures, manufacturers are advancing:

► High-solids and ultra-low-VOC formulations

► Low-temperature curing technologies (targeting 140-150°C or lower) to reduce energy consumption

► Advanced wastewater and sludge treatment solutions, including membrane separation and electrocoagulation

► Closed-loop resource utilization and low-carbon operational models

The industry is transitioning from simple emission reduction toward full-process environmental optimization and resource efficiency.

Competitive Strategy and Product Upgrading -

Coatings suppliers are increasingly shifting from a product-centric to a customer-centric approach, focusing on delivering lower total coating costs while maintaining or improving performance. Key R&D priorities include:

► Improved throwability and uniform coverage

► Enhanced edge and corrosion protection

► Better appearance and surface finish

► Reduced coating usage and baking energy requirements

These innovations are central to maintaining competitiveness in a market where customers demand higher efficiency, lower costs, and regulatory compliance.

Market Structure and Key Insights -

► The cathodic electrocoating market is highly concentrated, particularly in automotive OEM applications

► Automotive body and parts remain the largest demand segments

► Asia-Pacific is the fastest-growing region, driven by vehicle production and industrial expansion

► Sustainability and energy efficiency are the primary long-term growth drivers

Regional Market Outlook -

The report provides detailed regional and country-level analysis covering:

► Asia-Pacific (China, Japan, South Korea, Southeast Asia, India) - largest and fastest-growing market

► Europe (Germany, France, UK, Italy, etc.) - strong regulatory-driven adoption of low-VOC coatings

► North America (U.S., Canada, Mexico) - stable demand from automotive and industrial manufacturing

► South America and Middle East & Africa - emerging markets with gradual penetration

Competitive Landscape -

The global cathodic electrocoating market is dominated by international coating leaders with strong positions in automotive OEM supply.

Key companies profiled in the report include:

PPG Industries, BASF, Axalta, Nippon Paint, Kansai Paint, Sherwin-Williams, KCC Corporation, along with regional and specialty suppliers.

The report analyzes company market share, technology positioning, regional presence, and competitive strategies in detail.

Market Segmentation Highlights -

By Type

► Epoxy

► Acrylic

► Others

By Application

► Auto Body

► Auto Parts

► Two- and Three-Wheelers

► Hardware

► Home Appliances

► Construction Machinery

► Others

Each segment is evaluated in terms of revenue contribution, growth trends, and future demand potential.

Reasons to Procure This Report -

► Access accurate global and regional cathodic electrocoating market forecasts (2020-2031)

► Understand company market share, ranking, and competitive structure

► Evaluate sustainability regulations and technology transition impacts

► Identify high-growth applications and regional opportunities

► Support strategic planning, capacity expansion, and investment decisions

Key Questions Answered in the Report -

► What is the current and future size of the global cathodic electrocoating market?

► Which regions and applications are driving demand growth?

► How concentrated is the competitive landscape, and who are the leading suppliers?

► How are environmental regulations reshaping coating formulations and processes?

► What technological trends will define market evolution through 2031?

Request for Pre-Order / Enquiry -

https://www.qyresearch.in/pre-order-inquiry/service-software-cathodic-electrocoating-market-share-and-ranking-overall-sales-and-demand-forecast-2025-2031

Table of Content:

1 Market Overview

1.1 Cathodic Electrocoating Product Introduction

1.2 Global Cathodic Electrocoating Market Size Forecast (2020-2031)

1.3 Cathodic Electrocoating Market Trends & Drivers

1.3.1 Cathodic Electrocoating Industry Trends

1.3.2 Cathodic Electrocoating Market Drivers & Opportunity

1.3.3 Cathodic Electrocoating Market Challenges

1.3.4 Cathodic Electrocoating Market Restraints

1.4 Assumptions and Limitations

1.5 Study Objectives

1.6 Years Considered

2 Competitive Analysis by Company

2.1 Global Cathodic Electrocoating Players Revenue Ranking (2024)

2.2 Global Cathodic Electrocoating Revenue by Company (2020-2025)

2.3 Key Companies Cathodic Electrocoating Manufacturing Base Distribution and Headquarters

2.4 Key Companies Cathodic Electrocoating Product Offered

2.5 Key Companies Time to Begin Mass Production of Cathodic Electrocoating

2.6 Cathodic Electrocoating Market Competitive Analysis

2.6.1 Cathodic Electrocoating Market Concentration Rate (2020-2025)

2.6.2 Global 5 and 10 Largest Companies by Cathodic Electrocoating Revenue in 2024

2.6.3 Global Top Companies by Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Revenue in Cathodic Electrocoating as of 2024)

2.7 Mergers & Acquisitions, Expansion

3 Segmentation by Type

3.1 Introduction by Type

3.1.1 Epoxy

3.1.2 Acrylic

3.1.3 Others

3.2 Global Cathodic Electrocoating Sales Value by Type

3.2.1 Global Cathodic Electrocoating Sales Value by Type (2020 VS 2024 VS 2031)

3.2.2 Global Cathodic Electrocoating Sales Value, by Type (2020-2031)

3.2.3 Global Cathodic Electrocoating Sales Value, by Type (%) (2020-2031)

4 Segmentation by Component

4.1 Introduction by Component

4.1.1 Double-component

4.1.2 Single-component

4.2 Global Cathodic Electrocoating Sales Value by Component

4.2.1 Global Cathodic Electrocoating Sales Value by Component (2020 VS 2024 VS 2031)

4.2.2 Global Cathodic Electrocoating Sales Value, by Component (2020-2031)

4.2.3 Global Cathodic Electrocoating Sales Value, by Component (%) (2020-2031)

5 Segmentation by Channel

5.1 Introduction by Channel

5.1.1 Direct Sales

5.1.2 Distribution

5.2 Global Cathodic Electrocoating Sales Value by Channel

5.2.1 Global Cathodic Electrocoating Sales Value by Channel (2020 VS 2024 VS 2031)

5.2.2 Global Cathodic Electrocoating Sales Value, by Channel (2020-2031)

5.2.3 Global Cathodic Electrocoating Sales Value, by Channel (%) (2020-2031)

6 Segmentation by Application

6.1 Introduction by Application

6.1.1 Auto Body

6.1.2 Auto Parts

6.1.3 Two- and Three-wheels

6.1.4 Hardware

6.1.5 Home Appliances

6.1.6 Construction Machinery

6.1.7 Others

6.2 Global Cathodic Electrocoating Sales Value by Application

6.2.1 Global Cathodic Electrocoating Sales Value by Application (2020 VS 2024 VS 2031)

6.2.2 Global Cathodic Electrocoating Sales Value, by Application (2020-2031)

6.2.3 Global Cathodic Electrocoating Sales Value, by Application (%) (2020-2031)

7 Segmentation by Region

7.1 Global Cathodic Electrocoating Sales Value by Region

7.1.1 Global Cathodic Electrocoating Sales Value by Region: 2020 VS 2024 VS 2031

7.1.2 Global Cathodic Electrocoating Sales Value by Region (2020-2025)

7.1.3 Global Cathodic Electrocoating Sales Value by Region (2026-2031)

7.1.4 Global Cathodic Electrocoating Sales Value by Region (%), (2020-2031)

7.2 North America

7.2.1 North America Cathodic Electrocoating Sales Value, 2020-2031

7.2.2 North America Cathodic Electrocoating Sales Value by Country (%), 2024 VS 2031

7.3 Europe

7.3.1 Europe Cathodic Electrocoating Sales Value, 2020-2031

7.3.2 Europe Cathodic Electrocoating Sales Value by Country (%), 2024 VS 2031

7.4 Asia Pacific

7.4.1 Asia Pacific Cathodic Electrocoating Sales Value, 2020-2031

7.4.2 Asia Pacific Cathodic Electrocoating Sales Value by Region (%), 2024 VS 2031

7.5 South America

7.5.1 South America Cathodic Electrocoating Sales Value, 2020-2031

7.5.2 South America Cathodic Electrocoating Sales Value by Country (%), 2024 VS 2031

7.6 Middle East & Africa

7.6.1 Middle East & Africa Cathodic Electrocoating Sales Value, 2020-2031

7.6.2 Middle East & Africa Cathodic Electrocoating Sales Value by Country (%), 2024 VS 2031

8 Segmentation by Key Countries/Regions

8.1 Key Countries/Regions Cathodic Electrocoating Sales Value Growth Trends, 2020 VS 2024 VS 2031

8.2 Key Countries/Regions Cathodic Electrocoating Sales Value, 2020-2031

8.3 United States

8.3.1 United States Cathodic Electrocoating Sales Value, 2020-2031

8.3.2 United States Cathodic Electrocoating Sales Value by Type (%), 2024 VS 2031

8.3.3 United States Cathodic Electrocoating Sales Value by Application, 2024 VS 2031

8.4 Europe

8.4.1 Europe Cathodic Electrocoating Sales Value, 2020-2031

8.4.2 Europe Cathodic Electrocoating Sales Value by Type (%), 2024 VS 2031

8.4.3 Europe Cathodic Electrocoating Sales Value by Application, 2024 VS 2031

8.5 China

8.5.1 China Cathodic Electrocoating Sales Value, 2020-2031

8.5.2 China Cathodic Electrocoating Sales Value by Type (%), 2024 VS 2031

8.5.3 China Cathodic Electrocoating Sales Value by Application, 2024 VS 2031

8.6 Japan

8.6.1 Japan Cathodic Electrocoating Sales Value, 2020-2031

8.6.2 Japan Cathodic Electrocoating Sales Value by Type (%), 2024 VS 2031

8.6.3 Japan Cathodic Electrocoating Sales Value by Application, 2024 VS 2031

8.7 South Korea

8.7.1 South Korea Cathodic Electrocoating Sales Value, 2020-2031

8.7.2 South Korea Cathodic Electrocoating Sales Value by Type (%), 2024 VS 2031

8.7.3 South Korea Cathodic Electrocoating Sales Value by Application, 2024 VS 2031

8.8 Southeast Asia

8.8.1 Southeast Asia Cathodic Electrocoating Sales Value, 2020-2031

8.8.2 Southeast Asia Cathodic Electrocoating Sales Value by Type (%), 2024 VS 2031

8.8.3 Southeast Asia Cathodic Electrocoating Sales Value by Application, 2024 VS 2031

8.9 India

8.9.1 India Cathodic Electrocoating Sales Value, 2020-2031

8.9.2 India Cathodic Electrocoating Sales Value by Type (%), 2024 VS 2031

8.9.3 India Cathodic Electrocoating Sales Value by Application, 2024 VS 2031

9 Company Profiles

9.1 PPG Industries

9.1.1 PPG Industries Profile

9.1.2 PPG Industries Main Business

9.1.3 PPG Industries Cathodic Electrocoating Products, Services and Solutions

9.1.4 PPG Industries Cathodic Electrocoating Revenue (US$ Million) & (2020-2025)

9.1.5 PPG Industries Recent Developments

9.2 BASF

9.2.1 BASF Profile

9.2.2 BASF Main Business

9.2.3 BASF Cathodic Electrocoating Products, Services and Solutions

9.2.4 BASF Cathodic Electrocoating Revenue (US$ Million) & (2020-2025)

9.2.5 BASF Recent Developments

9.3 Axalta

9.3.1 Axalta Profile

9.3.2 Axalta Main Business

9.3.3 Axalta Cathodic Electrocoating Products, Services and Solutions

9.3.4 Axalta Cathodic Electrocoating Revenue (US$ Million) & (2020-2025)

9.3.5 Axalta Recent Developments

9.4 Nippon Paint

9.4.1 Nippon Paint Profile

9.4.2 Nippon Paint Main Business

9.4.3 Nippon Paint Cathodic Electrocoating Products, Services and Solutions

9.4.4 Nippon Paint Cathodic Electrocoating Revenue (US$ Million) & (2020-2025)

9.4.5 Nippon Paint Recent Developments

9.5 Kansai Paint

9.5.1 Kansai Paint Profile

9.5.2 Kansai Paint Main Business

9.5.3 Kansai Paint Cathodic Electrocoating Products, Services and Solutions

9.5.4 Kansai Paint Cathodic Electrocoating Revenue (US$ Million) & (2020-2025)

9.5.5 Kansai Paint Recent Developments

9.6 Xiangjiang Kansai

9.6.1 Xiangjiang Kansai Profile

9.6.2 Xiangjiang Kansai Main Business

9.6.3 Xiangjiang Kansai Cathodic Electrocoating Products, Services and Solutions

9.6.4 Xiangjiang Kansai Cathodic Electrocoating Revenue (US$ Million) & (2020-2025)

9.6.5 Xiangjiang Kansai Recent Developments

9.7 Sherwin-Williams

9.7.1 Sherwin-Williams Profile

9.7.2 Sherwin-Williams Main Business

9.7.3 Sherwin-Williams Cathodic Electrocoating Products, Services and Solutions

9.7.4 Sherwin-Williams Cathodic Electrocoating Revenue (US$ Million) & (2020-2025)

9.7.5 Sherwin-Williams Recent Developments

9.8 Haolisen

9.8.1 Haolisen Profile

9.8.2 Haolisen Main Business

9.8.3 Haolisen Cathodic Electrocoating Products, Services and Solutions

9.8.4 Haolisen Cathodic Electrocoating Revenue (US$ Million) & (2020-2025)

9.8.5 Haolisen Recent Developments

9.9 KCC Corporation

9.9.1 KCC Corporation Profile

9.9.2 KCC Corporation Main Business

9.9.3 KCC Corporation Cathodic Electrocoating Products, Services and Solutions

9.9.4 KCC Corporation Cathodic Electrocoating Revenue (US$ Million) & (2020-2025)

9.9.5 KCC Corporation Recent Developments

9.10 Kinlita

9.10.1 Kinlita Profile

9.10.2 Kinlita Main Business

9.10.3 Kinlita Cathodic Electrocoating Products, Services and Solutions

9.10.4 Kinlita Cathodic Electrocoating Revenue (US$ Million) & (2020-2025)

9.10.5 Kinlita Recent Developments

9.11 Kodest

9.11.1 Kodest Profile

9.11.2 Kodest Main Business

9.11.3 Kodest Cathodic Electrocoating Products, Services and Solutions

9.11.4 Kodest Cathodic Electrocoating Revenue (US$ Million) & (2020-2025)

9.11.5 Kodest Recent Developments

9.12 Modine

9.12.1 Modine Profile

9.12.2 Modine Main Business

9.12.3 Modine Cathodic Electrocoating Products, Services and Solutions

9.12.4 Modine Cathodic Electrocoating Revenue (US$ Million) & (2020-2025)

9.12.5 Modine Recent Developments

9.13 Shimizu

9.13.1 Shimizu Profile

9.13.2 Shimizu Main Business

9.13.3 Shimizu Cathodic Electrocoating Products, Services and Solutions

9.13.4 Shimizu Cathodic Electrocoating Revenue (US$ Million) & (2020-2025)

9.13.5 Shimizu Recent Developments

9.14 Daoqum

9.14.1 Daoqum Profile

9.14.2 Daoqum Main Business

9.14.3 Daoqum Cathodic Electrocoating Products, Services and Solutions

9.14.4 Daoqum Cathodic Electrocoating Revenue (US$ Million) & (2020-2025)

9.14.5 Daoqum Recent Developments

9.15 Tatung Fine Chemicals

9.15.1 Tatung Fine Chemicals Profile

9.15.2 Tatung Fine Chemicals Main Business

9.15.3 Tatung Fine Chemicals Cathodic Electrocoating Products, Services and Solutions

9.15.4 Tatung Fine Chemicals Cathodic Electrocoating Revenue (US$ Million) & (2020-2025)

9.15.5 Tatung Fine Chemicals Recent Developments

10 Industry Chain Analysis

10.1 Cathodic Electrocoating Industrial Chain

10.2 Cathodic Electrocoating Upstream Analysis

10.2.1 Key Raw Materials

10.2.2 Raw Materials Key Suppliers

10.2.3 Manufacturing Cost Structure

10.3 Midstream Analysis

10.4 Downstream Analysis (Customers Analysis)

10.5 Sales Model and Sales Channels

10.5.1 Cathodic Electrocoating Sales Model

10.5.2 Sales Channel

10.5.3 Cathodic Electrocoating Distributors

11 Research Findings and Conclusion

12 Appendix

12.1 Research Methodology

12.1.1 Methodology/Research Approach

12.1.1.1 Research Programs/Design

12.1.1.2 Market Size Estimation

12.1.1.3 Market Breakdown and Data Triangulation

12.1.2 Data Source

12.1.2.1 Secondary Sources

12.1.2.2 Primary Sources

12.2 Author Details

12.3 Disclaimer

QY Research PVT. LTD.

315 Work Avenue,

Raheja Woods,

6th Floor, Kalyani Nagar,

Yervada, Pune - 411060,

Maharashtra, India

India: (O) +91 866 998 6909

USA: (O) +1 626 295 2442

Email: hitesh@qyresearch.com

Web: www.qyresearch.in

About Us -

QY Research, established in 2007, is a globally recognized market research and consulting firm delivering syndicated and customized research solutions across coatings, chemicals, automotive materials, industrial manufacturing, and advanced materials sectors. With more than 50,000 clients across over 80 countries, QY Research combines rigorous research methodologies, deep industry expertise, and actionable insights to support data-driven decision-making and long-term business growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cathodic Electrocoating Market to Reach US$ 5.87 Billion by 2031, Driven by Automotive Demand, Low-VOC Regulations, and Energy-Efficient Coating Technologies | QY Research here

News-ID: 4340776 • Views: …

More Releases from QY Research, Inc.

Global Semiconductor Silicon Wafer Market to Reach US$ 29.08 Billion by 2032, Dr …

Market Summary -

The global Semiconductor Silicon Wafer market was valued at US$ 17,020 million in 2025 and is projected to reach US$ 29,080 million by 2032, growing at a CAGR of 8.1% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Semiconductor Silicon Wafer Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" delivers a comprehensive, data-driven assessment of the global silicon wafer…

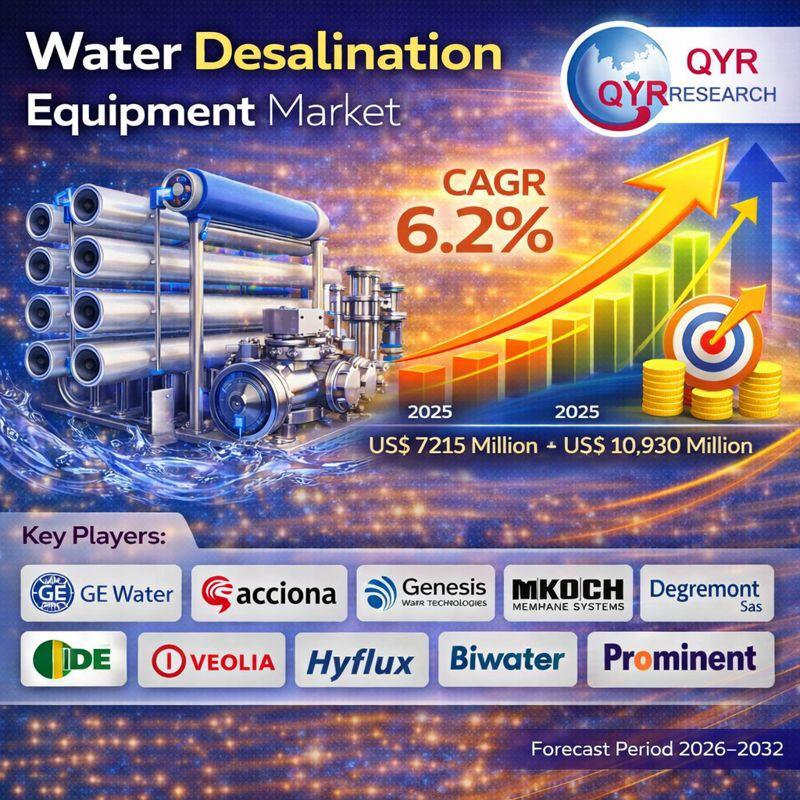

Global Water Desalination Equipment Market to Reach US$ 10.93 Billion by 2032, D …

Market Summary -

The global Water Desalination Equipment market was valued at US$ 7,215 million in 2025 and is projected to reach US$ 10,930 million by 2032, growing at a CAGR of 6.2% during the forecast period 2026-2032.

According to QY Research, the newly published report titled "Global Water Desalination Equipment Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven evaluation of the global desalination equipment…

Global Syndiotactic Polystyrene Market to Reach US$ 162 Million by 2032, Driven …

Market Summary -

The global Syndiotactic Polystyrene (SPS) market was valued at US$ 111 million in 2025 and is projected to reach US$ 162 million by 2032, expanding at a CAGR of 5.6% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Syndiotactic Polystyrene Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven assessment of the global SPS market. The…

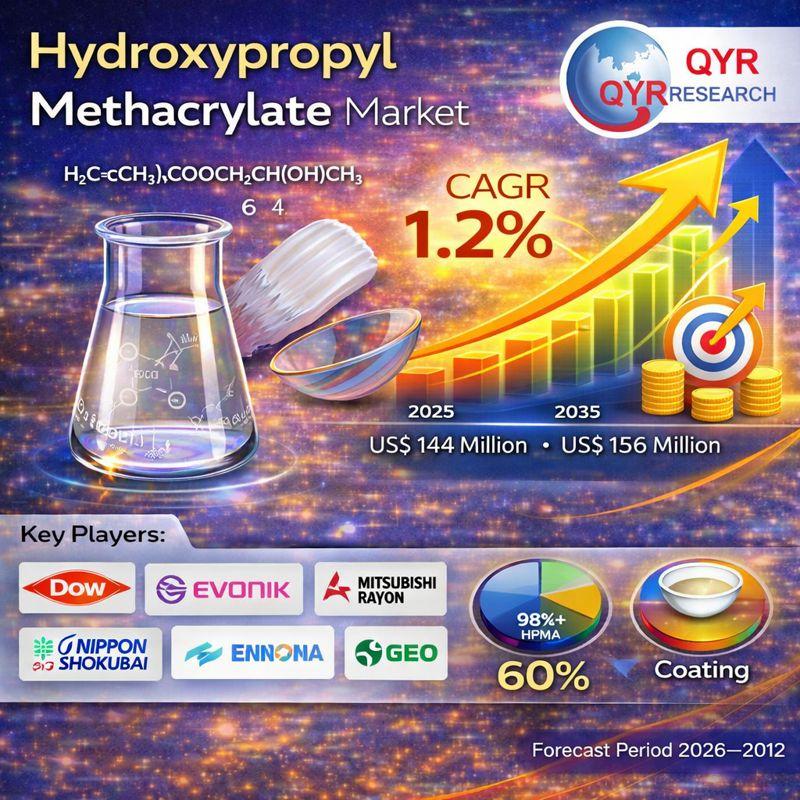

Global Hydroxypropyl Methacrylate Market to Reach US$ 156 Million by 2032, Suppo …

Market Summary -

The global Hydroxypropyl Methacrylate (HPMA) market was valued at US$ 144 million in 2025 and is projected to reach US$ 156 million by 2032, expanding at a CAGR of 1.2% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Hydroxypropyl Methacrylate Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven evaluation of the global HPMA market.…

More Releases for Cathodic

Cathodic Protection Market Size, Trends & Forecast 2025-2032

Overview of the Cathodic Protection Market

As per MRFR analysis, the Cathodic Protection Market Size was estimated at 9.89 (USD Billion) in 2024. The Cathodic Protection Market Industry is expected to grow from 10.23 (USD Billion) in 2025 to 13.81 (USD Billion) till 2034, at a CAGR (growth rate) is expected to be around 3.39% during the forecast period (2025 - 2034)

The cathodic protection (CP) market has emerged as a critical…

Cathodic Protection Market Set to Achieve US$ 7.64 Bn by 2031

Introduction:

Cathodic protection (CP) is a critical technology used to control corrosion in metal structures, especially those exposed to harsh environments, such as pipelines, storage tanks, and offshore platforms. It is widely used in industries such as oil and gas, marine, transportation, and infrastructure. As industries increasingly prioritize the maintenance and longevity of metal structures, the global cathodic protection market is witnessing significant growth.

This report delves into the current state and…

Cathodic Protection Solution Market is Booming Worldwide | ESC, MATCOR, Stork, C …

The latest research study titled Cathodic Protection Solution - Global and China Top Players Market Growth 2022-2029 provides readers with details on strategic planning and tactical business decisions that influence and stabilize growth prognosis in Cathodic Protection Solution - Top Players Market. A few disruptive trends, however, will have opposing and strong influences on the development of Cathodic Protection Solution - Top Players market and the distribution across players. To…

Exponential Growth Expected for Cathodic Protection Solutions Market With Comple …

The latest competent report published by SMI with the title "Cathodic Protection Solutions Market 2023: Demand and Opportunities" provides comprehensive information on the market. It also includes in-depth information about market drivers, opportunities, industry restraints and growth with challenges, and cumulative growth analysis. Moreover, the report also provides an in-depth analysis of research and information collected from various sources that have the ability to help decision-makers in the global market.…

Cathodic Protection Market Trends, Growth, Industry Analysis and Forecast - 2025

Cathodic Protection market is expected to record a steady CAGR of nearly 6% through 2025, to exceed revenues worth US$ 7,000 Mn.

Cathodic protection with impressive currents is still preferred by end users. Revenues from impressive current-based cathodic protection accounted for a large share of the market in 2018. With the increasing demand for corrosion protection on underground and subsea pipelines in suburban and rural areas, the demand for impressive current…

Global Cathodic Protection Cable Market Huge Growth Opportunity between 2020-202 …

LP INFORMATION recently released a research report on the Cathodic Protection Cable market analysis, which studies the Cathodic Protection Cable's industry coverage, current market competitive status, and market outlook and forecast by 2025.

Global "Cathodic Protection Cable Market 2020-2025" Research Report categorizes the global Cathodic Protection Cable market by key players, product type, applications and regions,etc. The report also covers the latest industry data, key players…