Press release

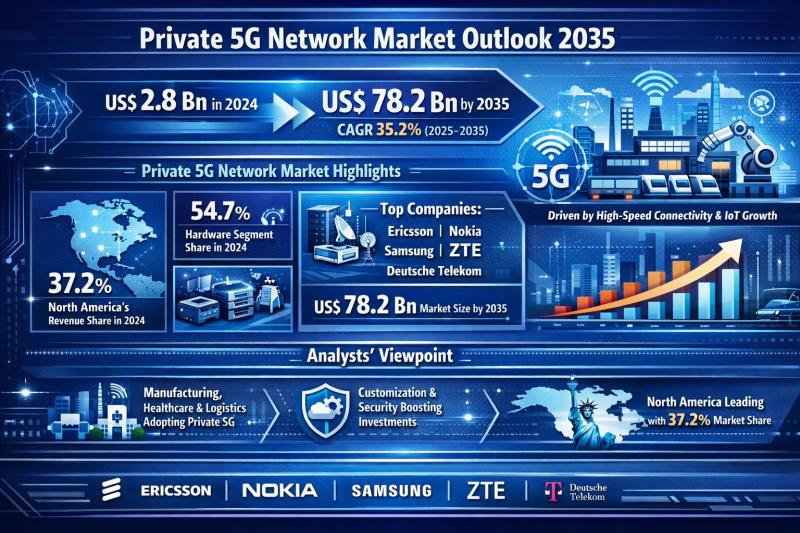

Global Private 5G Network Market Outlook 2035: Revenue Expected to Cross US$ 78.2 Billion at 35.2% CAGR

The global private 5G network market was valued at US$ 2.8 billion in 2024 and is projected to expand dramatically to US$ 78.2 billion by 2035, registering an exceptional compound annual growth rate (CAGR) of 35.2% during 2025-2035. This exponential growth trajectory reflects the accelerating shift of enterprises toward dedicated, high-performance wireless networks that offer greater control, ultra-low latency, and enhanced security compared to public networks.The scale of this growth highlights how private 5G networks are moving from pilot deployments into full-scale commercial rollouts across industries such as manufacturing, healthcare, logistics, energy, and defense. By 2035, private 5G is expected to become a foundational layer of enterprise digital infrastructure worldwide.

→Discover Market Opportunities - Request Your Sample Copy Now: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=85394

→Market Overview

Private 5G networks are dedicated cellular networks designed for exclusive enterprise use. Unlike public 5G networks that are shared among multiple users, private 5G networks provide organizations with full ownership or control over network performance, data traffic, and security policies. Leveraging core 5G capabilities-such as ultra-reliable low-latency communication, massive device connectivity, and high data throughput-these networks are uniquely suited for mission-critical and automation-heavy environments.

The market's rapid expansion is closely linked to the adoption of Industry 4.0, smart manufacturing, autonomous logistics, remote healthcare, and AI-driven operations. Enterprises increasingly view private 5G not merely as a connectivity solution but as a strategic enabler for digital transformation, operational efficiency, and competitive differentiation.

→Analysts' Viewpoint

From an analytical standpoint, the private 5G network market is experiencing sustained momentum due to enterprises seeking greater control, security, and predictable performance. Manufacturing plants, hospitals, ports, warehouses, and campuses are deploying private 5G to overcome the limitations of Wi-Fi and public cellular networks.

The convergence of IoT, AI, automation, and edge computing is accelerating demand. Private 5G is emerging as the only viable wireless technology capable of supporting these advanced applications at scale. Regulatory support, easing of spectrum allocation, and declining infrastructure costs further reinforce the investment case for private 5G deployments.

→Key Market Growth Drivers

1.Increased Demand for High-Speed Connectivity

One of the strongest growth drivers is the escalating need for high-speed, low-latency connectivity. Traditional wireless networks often fail to support bandwidth-intensive and latency-sensitive applications. Private 5G enables real-time data exchange between machines, sensors, robots, and personnel, which is essential for smart factories, automated warehouses, and digital hospitals.

2.Growth of IoT and Automation Technologies

The rapid proliferation of IoT devices and automation technologies is fundamentally reshaping enterprise operations. Private 5G networks support massive device connectivity without compromising performance, making them ideal for environments with thousands of connected endpoints operating simultaneously.

3.Customization and Flexibility for Enterprises

Customization is a critical differentiator. Enterprises can tailor private 5G networks to prioritize specific applications, ensure data sovereignty, and scale capacity as operational requirements evolve. This flexibility significantly enhances productivity and future-proofs enterprise networks.

Explore Strategies & Trends - Request Full Report Access - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=85394

→Component and Technology Outlook

By component, hardware dominated the market in 2024, accounting for 54.7% of total revenue. Demand is driven by investments in base stations, antennas, routers, and edge computing devices required to build resilient private 5G infrastructures. Advanced technologies such as Massive MIMO and virtualization are improving network efficiency, coverage, and energy performance.

Software and services-including network orchestration, analytics, and managed services-are expected to witness rapid growth over the forecast period as enterprises seek simplified deployment and lifecycle management.

→Regional Outlook and Market Segmentation

North America led the global private 5G network market in 2024 with a revenue share of 37.2%. The region benefits from advanced digital infrastructure, favorable regulatory frameworks, and strong investments in industrial automation and smart healthcare. Enterprises in the U.S. and Canada are early adopters of private 5G, particularly across manufacturing, logistics, and defense sectors.

Europe follows closely, driven by Industry 4.0 initiatives and strong government support for private spectrum usage. Asia Pacific is projected to witness the fastest growth through 2035, fueled by rapid industrialization, smart city projects, and large-scale deployments in countries such as China, Japan, South Korea, and India. Latin America and the Middle East & Africa are emerging markets, offering long-term growth opportunities as digital infrastructure investments accelerate.

→Analysis of Key Players and Competitive Landscape

The private 5G network market is moderately consolidated, with global telecom equipment vendors, network operators, and technology providers competing on innovation, partnerships, and end-to-end solutions.

Key players include Telefonaktiebolaget LM Ericsson, Nokia Corporation, Samsung Electronics Co., Ltd., ZTE Corporation, and Deutsche Telekom Group, along with AT&T, Juniper Networks, Verizon Communications, Huawei Technologies, Cisco Systems, Vodafone Group, and BT Group.

These companies are profiled based on financial performance, product portfolios, strategic initiatives, and recent developments, highlighting their role in shaping the global private 5G ecosystem.

→Key Player Strategies

Leading players are focusing on strategic partnerships, cloud-native architectures, open RAN solutions, and AI-driven network automation. Many are collaborating with hyperscalers and industrial technology providers to deliver turnkey private 5G solutions tailored to specific verticals. Investments in virtualization, edge computing, and security-enhanced platforms are central to maintaining competitive advantage.

→Recent Developments

In May 2025, Telefónica Germany GmbH & Co. partnered with Ciena Corporation to advance network cloudification and autonomous network transformation using cloud-native automation for dynamic 5G network slicing.

In March 2025, STC partnered with Juniper Networks to enhance 5G-ready network security using AI-native automation, improving latency, power efficiency, and large-scale security.

In March 2025, NEC Corporation launched its commercial virtualized RAN software, targeting over 50,000 vRAN base stations by FY2026, supporting energy-efficient and cloud-native 5G networks.

→Market Challenges and Opportunities

High initial deployment costs, spectrum availability constraints, and integration complexity remain key challenges. However, these are increasingly offset by long-term operational savings, productivity gains, and enhanced security.

Opportunities lie in expanding use cases across smart factories, autonomous transportation, remote healthcare, and campus networks. As spectrum policies become more enterprise-friendly, adoption barriers are expected to decline further.

→Investment Landscape and ROI Outlook

Private 5G networks offer a compelling return on investment (ROI) by reducing downtime, improving operational efficiency, and enabling advanced automation. Enterprises investing early are likely to gain significant competitive advantages, particularly in high-value industrial and mission-critical applications.

→Why Buy This Report?

This report provides in-depth insights into market size, growth drivers, competitive strategies, regional trends, and investment opportunities. It enables stakeholders to identify high-growth segments, benchmark competitors, and make informed strategic decisions in a rapidly evolving market.

→FAQs

Q.How big was the global private 5G network market in 2024?

A.The market was valued at US$ 2.8 billion in 2024.

Q.What is the projected market size by 2035?

A.It is expected to reach US$ 78.2 billion by 2035.

Q.What factors are driving market growth?

A.Key drivers include increased demand for high-speed connectivity and the rapid growth of IoT and automation technologies.

Q.What is the expected CAGR during 2025-2035?

A.The market is anticipated to grow at a CAGR of 35.2%.

Q.Which region is expected to dominate the market?

A.North America is expected to maintain the largest market share throughout the forecast period.

Buy Full Report Now: https://www.transparencymarketresearch.com/checkout.php?rep_id=85394<ype=S

→Explore Latest Research Reports by Transparency Market Research:

Edge Computing Market: https://www.transparencymarketresearch.com/edge-computing-market.html

Data Center Networking Market: https://www.transparencymarketresearch.com/data-center-networking-market.html

Software as a Service (SaaS) Market: https://www.transparencymarketresearch.com/software-as-a-service-market.html

Contact Us:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Private 5G Network Market Outlook 2035: Revenue Expected to Cross US$ 78.2 Billion at 35.2% CAGR here

News-ID: 4340626 • Views: …

More Releases from Transparency Market Research

Electric Wheelchair Market Expanding at 9.2% CAGR Through 2036 - By Control Type …

The global electric wheelchair market continues to demonstrate strong and sustained growth, fueled by demographic transitions, technological innovation, and expanding healthcare access worldwide. Valued at US$ 5.8 billion in 2025, the market is projected to reach US$ 15.3 billion by 2036, expanding at a compound annual growth rate (CAGR) of 9.2% from 2026 to 2036.

Discover essential conclusions and data from our Report in this sample -

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=4198

This robust trajectory reflects rising…

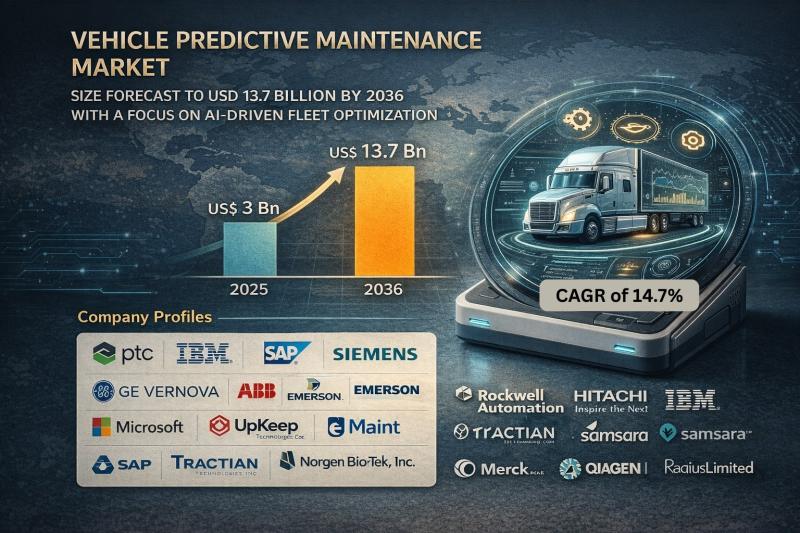

Vehicle Predictive Maintenance Market Size Forecast to USD 13.7 Billion by 2036 …

Vehicle Predictive Maintenance Market Outlook 2036

The global vehicle predictive maintenance market was valued at USD 3 Billion in 2025 and is projected to reach USD 13.7 Billion by 2036, expanding at a robust CAGR of 14.7% from 2026 to 2036. Market growth is driven by increasing adoption of connected vehicles, rising fleet digitalization, advancements in AI-driven analytics, and growing emphasis on minimizing vehicle downtime and maintenance costs.

👉 Get your sample…

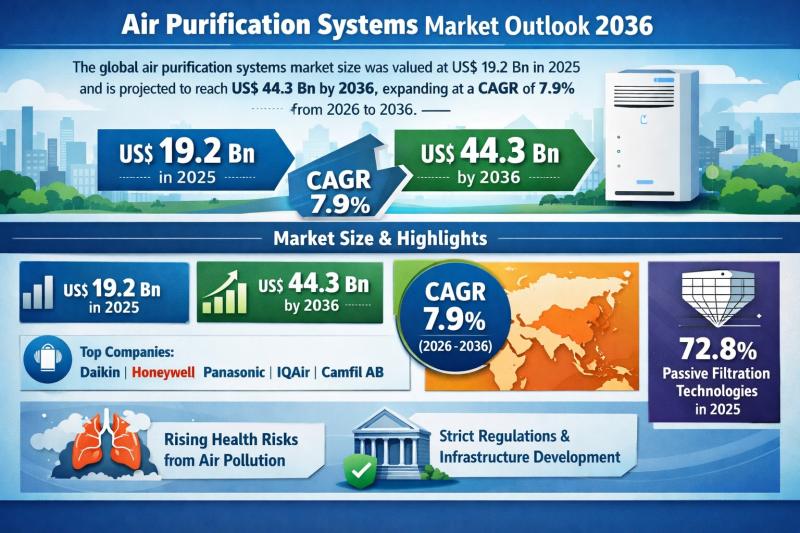

Global Air Purification Systems Market to Reach USD 44.3 Billion by 2036 at 7.9% …

The global Air Purification Systems Market was valued at US$ 19.2 Bn in 2025 and is projected to expand to US$ 44.3 Bn by 2036, registering a compound annual growth rate (CAGR) of 7.9% from 2026 to 2036. The market's upward trajectory reflects the structural shift in indoor air quality (IAQ) management, moving from discretionary consumer spending to mission-critical infrastructure investment.

With historical data available from 2021 to 2024, the industry…

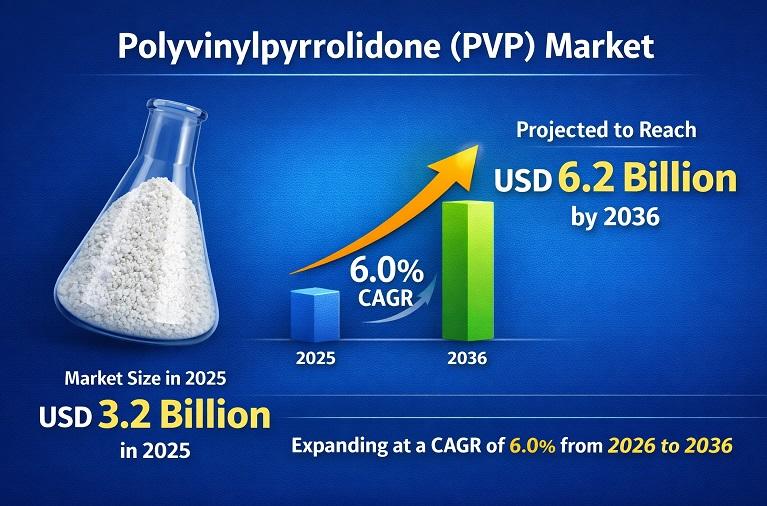

Polyvinylpyrrolidone (PVP) Market to Reach USD 6.2 Billion by 2036 Driven by Pha …

The Polyvinylpyrrolidone (PVP) Market was valued at around US$ 3.2 billion in 2025 and is projected to reach approximately US$ 6.2 billion by 2036, expanding at a steady CAGR of about 6.0% during the forecast period. This growth is primarily driven by rising demand from the pharmaceutical industry, where PVP is widely used as a tablet binder, solubilizer, and stabilizer, along with increasing consumption in cosmetics and personal care products…

More Releases for Private

real estate private equity firms,private equity manager,private equity financing …

Real estate private equity is the practice of investing in real estate properties or real estate-related assets using private capital. Private equity firms, high net worth individuals, and institutional investors are among the primary players in this market. These investors provide the capital for real estate transactions, such as the purchase of properties, and in return, they receive a share of the profits generated by the properties.

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The…

private asset management,private wealth management firms,middle market private e …

Private asset management is the management of assets on behalf of private individuals, families, or institutions. It involves the creation of a customized investment strategy to achieve specific financial goals, such as wealth preservation, growth, income generation, or a combination of these objectives. The assets managed can include cash and cash equivalents, stocks, bonds, real estate, private equity, and alternative investments.

https://tendawholesale.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private asset management is typically provided by…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

private investment,private equity,private equity firms,private equity fund,capit …

Private investment refers to the purchase or financing of a private company or a portion of it, typically by a private equity firm, venture capital firm, or angel investor. Private investments can take various forms, including equity investments, debt investments, or a combination of both.

http://pandacuads.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private equity firms typically invest in mature companies that have a proven track record of revenue and earnings, but that may be underperforming…

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

China Private Equity Financing Consulting, China Private Equity Investment Corpo …

Pandacu China is a venture capital firm that focuses on early-stage investments in technology companies based in China. The firm was founded in 2015 by a group of experienced venture capitalists and entrepreneurs who have a deep understanding of the Chinese market and a strong network of contacts in the tech industry.

http://pandacuads.com/

China Private Equity Financing Consulting

Email:nolan@pandacuads.com

Pandacu China's mission is to help innovative and ambitious entrepreneurs turn their ideas into successful…