Press release

The Global O-RAN (Open Radio Access Network) Market is projected to reach a market size of $20.41 billion by the end of 2030.

The O-RAN (Open Radio Access Network) Market was valued at $4.51 billion and is projected to reach a market size of $20.41 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 35.2%.Request Sample @ https://virtuemarketresearch.com/report/o-ran-market/request-sample

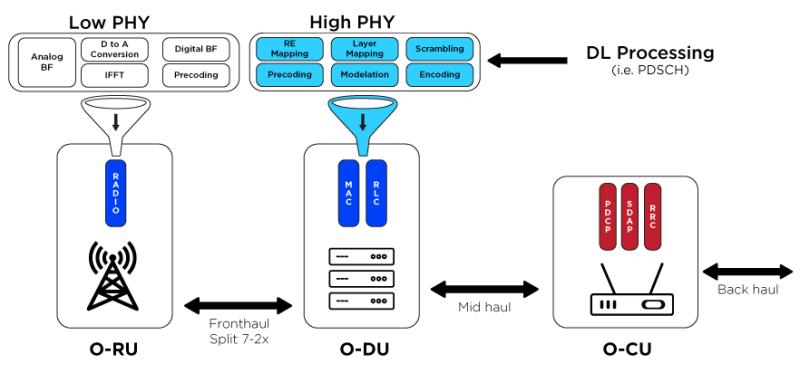

The O-RAN (Open Radio Access Network) market is reshaping the way wireless communication systems are built and operated. It focuses on creating open and interoperable interfaces within the radio access network, allowing multiple vendors to work together seamlessly. This approach is gaining attention as telecom operators aim to move away from proprietary and closed systems. One of the major long-term drivers behind this growth is the continuous global expansion of 5G networks. As the number of connected devices increases, the demand for flexible, cost-efficient, and scalable network solutions rises sharply. O-RAN offers an innovative answer by enabling network components from different manufacturers to communicate through standardized interfaces, which lowers costs and promotes innovation. Over the years, this open framework has turned into a critical foundation for next-generation connectivity.

The COVID-19 pandemic initially brought unexpected challenges to the O-RAN market, slowing hardware production and delaying the rollout of new infrastructure due to disrupted supply chains. However, the situation quickly evolved into an accelerator for the technology. The sudden surge in remote working, online education, and digital services increased the demand for reliable network coverage and low-latency communication. Telecom providers started adopting O-RAN-based solutions faster, aiming to improve network agility and reduce operational costs. The pandemic also highlighted the need for more resilient and flexible network architectures that can be scaled easily to manage unpredictable traffic loads. In many ways, COVID-19 served as a turning point, pushing telecom industries toward open and software-defined network infrastructures that could respond rapidly to changing conditions.

In the short term, one of the key market drivers for O-RAN is the increasing collaboration between network operators, software developers, and cloud service providers. These partnerships are creating a unified ecosystem where open interfaces and virtualized components make it easier to test, deploy, and manage network services. The shift toward disaggregated hardware and software is giving operators more control over network customization and optimization. As more pilot programs and live deployments occur, the benefits of reduced capital expenditure and faster innovation cycles are becoming evident. This short-term push is crucial for maintaining the momentum of O-RAN adoption, especially as telecom companies seek to maximize performance without increasing overall spending.

An emerging opportunity within the O-RAN market lies in its ability to integrate artificial intelligence and machine learning into network management. These technologies can analyze network traffic in real-time, predict congestion points, and automate corrective measures to maintain quality of service. Such integration is opening new pathways for energy-efficient and self-optimizing networks. Start-ups and established technology companies alike are investing in developing intelligent RAN controllers that use AI algorithms to make autonomous decisions. This opportunity is not limited to high-income regions; developing markets are also showing interest in using AI-driven O-RAN systems to expand rural connectivity at lower costs. As this synergy between AI and open network architecture grows, the value proposition of O-RAN continues to strengthen globally.

A noticeable trend emerging in the O-RAN industry is the growing adoption of cloud-native architectures and edge computing integration. The combination of O-RAN with cloud infrastructure is allowing operators to deploy virtualized network functions closer to end-users, significantly reducing latency. This trend is reshaping how mobile networks are designed, emphasizing flexibility and scalability. Companies are exploring how to host radio functions in virtual machines and containers that can be updated or modified without affecting overall performance. This move toward cloudification of radio networks is expected to play a major role in enabling future technologies such as autonomous vehicles, smart factories, and immersive extended reality applications.

Altogether, the O-RAN market represents a decisive shift in the global telecom landscape. What once depended on proprietary solutions is now transitioning toward openness, collaboration, and software-defined control. The long-term drive from 5G deployment, the accelerated digital transformation due to the pandemic, the short-term boost from multi-industry partnerships, the vast opportunity offered by AI integration, and the trend toward cloud-native systems are shaping this market's evolution. These forces together are constructing a digital foundation where efficiency, adaptability, and inclusiveness define the future of wireless connectivity worldwide.

Segmentation Analysis:

By Component: Hardware, Software, Services

The O-RAN (Open Radio Access Network) Market by component showcases a transformative shift in how network layers interact and evolve. The largest segment in this category is hardware, driven by the rising need for advanced, interoperable radio units, distributed units, and centralized units that support open interfaces and scalable performance. Telecom providers are heavily investing in modular and energy-efficient radio components to enhance flexibility while reducing vendor dependency. Meanwhile, the fastest-growing segment during the forecast period is software, fueled by the increasing adoption of virtualization, automation, and artificial intelligence-based network management tools. The software layer enables dynamic resource allocation, predictive maintenance, and cloud-based orchestration, leading to more agile and programmable networks. Service providers are gradually moving from fixed-function hardware to intelligent software ecosystems that can be customized to user demands. Managed and integration services continue to play a vital supporting role, ensuring seamless interoperability among diverse vendors. This component-based approach is making O-RAN systems adaptable, cost-effective, and more competitive across various network environments, thereby fostering innovation and accelerating the shift toward fully open and flexible radio access architectures worldwide.

By Connectivity Technology: 2G and 3 G, 4G/LTE, 5G

In the O-RAN (Open Radio Access Network) Market by connectivity technology, modernization, and compatibility define the transition across generations. The largest segment is 4G/LTE, as it continues to represent a substantial share of global mobile infrastructure, particularly in developing and mid-tier markets where LTE networks remain the dominant communication standard. The O-RAN framework in this segment allows operators to enhance coverage, lower operational costs, and integrate software-defined functionalities without major overhauls. However, the fastest-growing segment during the forecast period is 5G, as telecom operators globally are investing heavily in O-RAN-enabled architectures to achieve ultra-low latency and high-speed connectivity. The 5G-driven O-RAN ecosystem supports massive MIMO, beamforming, and network slicing, allowing real-time adaptability and efficient spectrum usage. In contrast, the 2G and 3 G segment continues to decline but remain relevant for backward compatibility in rural or underdeveloped regions. The combination of 4G's maturity and 5G's innovation is reshaping how networks are built, moving from static, proprietary systems to open, software-centric environments that promote scalability and competitive vendor collaboration across the radio access domain.

By Deployment Type: Public Networks, Private Networks

The O-RAN (Open Radio Access Network) Market by deployment type is diversifying as operators explore new approaches to meet enterprise and public connectivity demands. The largest segment in this category is public networks, driven by the increasing adoption of open architecture by national telecom operators seeking to reduce infrastructure costs and avoid vendor lock-in. These deployments are particularly prevalent in large-scale urban rollouts, where performance and interoperability across multiple equipment providers are crucial. Public networks benefit from the standardized nature of O-RAN, allowing seamless integration with legacy infrastructure while improving network efficiency. On the other hand, the fastest-growing segment during the forecast period is private networks, as industries like manufacturing, logistics, healthcare, and smart campuses increasingly adopt O-RAN-based solutions for localized, secure, and ultra-reliable connectivity. The flexibility of O-RAN allows enterprises to customize their private network environments, integrating edge computing and automation to support specialized industrial applications. This growth reflects how O-RAN's open model is empowering organizations to take control of their network design, driving new business models and enabling digital transformation at the enterprise level across multiple verticals worldwide.

Enquire Before Buying @ https://virtuemarketresearch.com/report/o-ran-market/enquire

By Frequency Band: Sub-6 GHz, Millimeter Wave (mm-Wave)

In the O-RAN (Open Radio Access Network) Market by frequency band, performance optimization and coverage efficiency are key areas of development. The largest segment in this category is Sub-6 GHz, favored for its extensive coverage, lower latency, and reliability across broad geographic regions. Sub-6 GHz frequencies are especially critical for rural and suburban deployments, where cost-effective, wide-area connectivity is prioritized over ultra-high-speed throughput. Telecom providers are increasingly leveraging open hardware and interoperable radio components in this band to ensure smooth network operation and scalability. Conversely, the fastest-growing segment during the forecast period is the millimeter wave (mm-Wave), driven by the need for enhanced bandwidth capacity and faster data transmission rates in densely populated urban centers. The mm-Wave spectrum supports next-generation use cases like high-definition streaming, AR/VR experiences, and industrial IoT applications. Though it faces challenges with shorter range and signal penetration, ongoing innovation in beamforming and small-cell technology is improving mm-Wave deployment efficiency. The coexistence of both bands enables balanced network architecture, with Sub-6 GHz ensuring reach and mm-Wave delivering performance, making O-RAN's open approach ideal for integrating diverse frequency layers into a cohesive system.

By Deployment Phase: Greenfield Deployments, Brownfield Integrations

The O-RAN (Open Radio Access Network) Market by deployment phase is evolving as operators strategize between building new networks and transforming existing ones. The largest segment in this category is brownfield integrations, reflecting the widespread efforts by telecom operators to upgrade existing RAN infrastructures with open and virtualized solutions. Brownfield projects allow providers to transition gradually, integrating O-RAN components alongside legacy systems without disrupting service continuity. These integrations reduce the total cost of ownership while maintaining operational consistency, making them highly attractive for large-scale operators. Meanwhile, the fastest-growing segment during the forecast period is greenfield deployments, as new entrants and regional providers are establishing O-RAN-based networks from the ground up, free from legacy constraints. These deployments take advantage of full network virtualization, cloud-native design, and multi-vendor interoperability from the outset. Greenfield projects are particularly common in emerging markets and private industrial networks, where flexibility, scalability, and future readiness are top priorities. The dual momentum of brownfield modernization and greenfield innovation highlights the adaptability of O-RAN, enabling both traditional and new players to shape next-generation connectivity frameworks globally.

Regional Analysis:

The O-RAN (Open Radio Access Network) Market by region presents a dynamic landscape shaped by investment levels, regulatory support, and technological readiness. The largest regional market is Asia-Pacific, fueled by strong 5G rollouts in countries such as China, Japan, and South Korea, along with government initiatives promoting network openness and vendor diversification. Telecom operators in this region are at the forefront of deploying O-RAN solutions to enhance capacity, efficiency, and cost optimization. On the other hand, the fastest-growing region during the forecast period is North America, driven by increasing collaboration between telecom operators, cloud service providers, and open network alliances. Major initiatives promoting open standards and software-defined infrastructure are accelerating adoption. Europe continues to witness stable growth, supported by strategic alliances and pilot projects. Meanwhile, South America and the Middle East & Africa are gradually expanding their O-RAN deployments as part of long-term digital transformation plans. Regional innovation hubs, diverse vendor ecosystems, and supportive policy frameworks are making O-RAN adoption a key enabler of resilient and inclusive global communication networks.

Latest Industry Developments:

• Partnership and ecosystem orchestration is accelerating as a market-wide trend: Telecom operators, cloud providers, system integrators, and infrastructure vendors are forming multi-party alliances to build end-to-end O-RAN stacks and managed services that reduce integration risk and speed deployments. These collaborations bundle connectivity, edge compute, security, and vertical-specific solutions so operators can offer turnkey private and public network options. The rise of joint pilots, lab co-development, and operator-led testbeds is lowering technical barriers while creating repeatable deployment playbooks for scale. This cooperative model helps share costs, aligns roadmaps across software and hardware providers, and supports faster commercialization of O-RAN offerings.

• AI-driven automation and cloud-native orchestration are becoming a primary technology trend: The deployment of RAN Intelligent Controllers (RIC), xApps/rApps, and cloud-native RAN functions is enabling real-time analytics, predictive maintenance, and automated traffic steering at scale. Network teams increasingly prefer microservices-based RICs that run on public or private clouds so policy, energy savings, and throughput optimizations can be delivered as software features rather than forklift upgrades. This shift allows continuous feature velocity, simpler multi-vendor integration, and faster troubleshooting through telemetry and closed-loop control, materially improving O-RAN value for both public macro and enterprise private networks.

• Pragmatic, staged rollouts and rigorous interoperability validation are converging into an industry adoption trend: Operators are avoiding all-in, single-phase conversions and instead favor brownfield integrations, staged greenfield pilots, and neutral-host trials to manage multi-vendor complexity. That pragmatism pairs with growing investment in conformance labs, open testbeds, and shared certification frameworks to validate uplink/downlink performance, timing, and interface stability before scale-out. The result is longer pilot cycles but higher production reliability, a preference for managed integration services, and clearer vendor accountability-factors that lower commercial risk and accelerate broader O-RAN acceptance across regions and verticals.

Buy Now @ https://virtuemarketresearch.com/checkout/o-ran-market

About Us:

"Virtue Market Research stands at the forefront of strategic analysis, empowering businesses to navigate complex market landscapes with precision and confidence. Specializing in both syndicated and bespoke consulting services, we offer in-depth insights into the ever-evolving interplay between global demand and supply dynamics. Leveraging our expertise, businesses can identify emerging opportunities, discern critical trends, and make decisions that pave the way for future success."

103 Kumar Plaza,SRPF Road,

Ramtekadi,Pune,

Maharashtra - 411013

Virtue Market Research stands at the forefront of strategic analysis, empowering businesses to navigate complex market landscapes with precision and confidence. Specializing in both syndicated and bespoke consulting services, we offer in-depth insights into the ever-evolving interplay between global demand and supply dynamics. Leveraging our expertise, businesses can identify emerging opportunities, discern critical trends, and make decisions that pave the way for future success."

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The Global O-RAN (Open Radio Access Network) Market is projected to reach a market size of $20.41 billion by the end of 2030. here

News-ID: 4340436 • Views: …

More Releases from Virtue Market Research

The Global Vodka Seltzer Market is projected to reach a market size of USD 16.22 …

The Vodka Seltzer Market was valued at USD 9.4 billion in 2024 and is projected to reach a market size of USD 16.21 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.1%.

Request Sample @ https://virtuemarketresearch.com/report/vodka-seltzer-market/request-sample

The vodka seltzer market has grown from a niche beverage choice into a mainstream favorite, supported by shifting consumer lifestyles and evolving…

The Global Telehealth Services Market and is projected to reach a market size of …

The Global Telehealth Services Market was valued at USD 126.1 billion and is projected to reach a market size of USD 302.49 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 15.7%.

Request Sample @ https://virtuemarketresearch.com/report/telehealth-services-market/request-sample

The perennial shift towards patient-centric healthcare has been a pivotal long-term market driver for telehealth services. Over the years, the industry has witnessed…

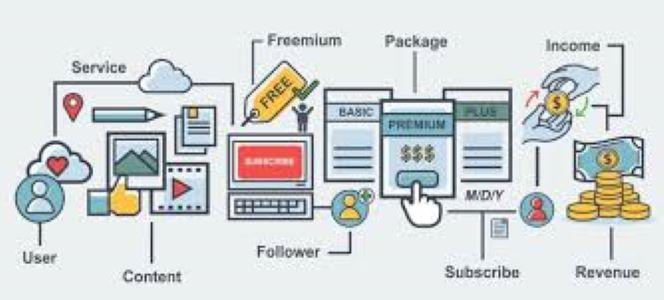

The Subscription Box/Subscription E-Commerce Market is projected to reach a mark …

The Subscription Box/Subscription E-Commerce Market is valued at USD 47.19 billion in 2024 and is projected to reach a market size of USD 97.73 billion by the end of 2030. Over the outlook period of 2025-2030, the market is anticipated to grow at a CAGR of 12.9%.

Request Sample @ https://virtuemarketresearch.com/report/subscription-e-commerce-market/request-sample

The subscription e-commerce market has grown into one of the most dynamic parts of the digital economy. It began as a…

The Global Aramid Fibre Reinforced Polymer Composites Market is projected to rea …

According to the report published by Virtue Market Research in Aramid Fibre Reinforced Polymer Composites Market was valued at USD 5.55 billion and is projected to reach a market size of USD 8.57 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.5%.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/aramid-fibre-reinforced-polymer-composites-market/request-sample

The Aramid Fibre Reinforced Polymer Composites…

More Releases for Network

Managed Network Services Market 2031: Optimizing Network Management

Managed Network Services Market Scope:

Managed Network Services Market size was valued at USD 267.4 billion in 2022 and is poised to grow from USD 304.03 billion in 2023 to USD 849.19 billion by 2031, growing at a CAGR of 13.7% in the forecast period (2024-2031).

Access the full 2024 Managed Network Services Market report for a comprehensive understanding @https://www.skyquestt.com/report/managed-network-services-market

The study of the global Managed Network Services Market is presented in the…

Global Oilfield Communications Market Derived by Communication Network - VSAT Co …

“The increasing investments and enhancing network infrastructure, rising technological advancements for communication across oilfields, and increasing demand from oil and gas operators to scale the production of mature oilfields, are expected to act as growth drivers for the oilfield communications market.”

The global oilfield communications market size grew from USD 3.4 billion in 2020 to USD 4.5 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 5.5% during the…

Gaming Network Market to See Huge Growth by 202 | Game Loot Network, ZAM Network …

A new business intelligence report released by HTF MI with title "Global Gaming Network Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread)" is designed covering micro level of analysis by manufacturers and key business segments. The Global Gaming Network Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research…

Insight into Gaming Network Market to 2025 - Xiled Gaming Network, Game Loot Net …

The updated research report on "Gaming Network Market" presents crucial information like market share, size, and growth rate. It offers insights on the driving factors, hampering aspects, challenges, opportunities, and trends including details on market segments and sub-segments.

Based on the Gaming Network industrial chain, this report mainly elaborates the definition, types, applications and major players of Gaming Network market in details. Deep analysis about market status (2015-2020), enterprise competition pattern,…

Numerous Applications in Gaming Network Market Growth and Forecast with Top Key …

Gaming Network is one of the world's leading games media businesses. With a strong focus on editorial quality and community, our network of award-winning websites, video and social channels reaches over 50 million gamers every month. Our market-leading events attract over 100,000 visitors each year.

This report on Gaming Network market delivers detailed analysis on the main challenges and growth prospects in the market. This research study is anticipated to…

Water Network Management, Water Network Management trends, Water Network Managem …

MarketStudyReport.com adds a new 2018-2023 Global Water Network Management Market Report focuses on the major drivers and restraints for the global key players providing analysis of the market share, segmentation, revenue forecasts and geographic regions of the market.

This report presents a comprehensive overview, market shares, and growth opportunities of by Water Network Management product type, application, key manufacturers and key regions. Over the next five years, Water Network Management will…