Press release

India Gold Loan Market Set to Surge to USD 170.49 Billion by 2032 | Market Size, CAGR & Strategic Outlook

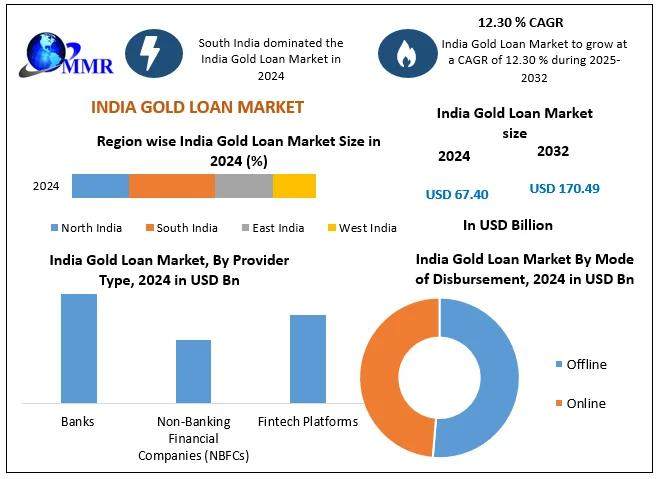

Market Size and GrowthThe India Gold Loan Market is witnessing strong expansion, supported by increasing household borrowing needs and the growing role of organized lenders. The market was valued at over USD 67.40 billion in 2024 and is projected to reach around USD 170.49 billion by 2032, registering a CAGR of approximately 12.30 % during the forecast period. This growth reflects the rising acceptance of gold loans as a fast, secure, and flexible financing option for both personal and business requirements. Expansion of banking networks, improved loan processing systems, and growing digital penetration are further accelerating market adoption across urban as well as semi-urban regions.

Unlock Insights: Request a Free Sample of Our Latest Report Now @ https://www.maximizemarketresearch.com/request-sample/213911/

Market Overview

Gold loans are secured loans where borrowers pledge gold ornaments or jewelry as collateral in exchange for short- to medium-term credit. In India, gold has long been considered a trusted store of value, making it a natural choice for collateral-based lending. Gold loans are widely used for business expansion, agricultural needs, medical emergencies, education expenses, and household consumption. Compared to unsecured loans, gold loans offer lower interest rates, faster approval, and minimal documentation, making them highly attractive for a broad customer base. The market includes banks, non-banking financial companies (NBFCs), cooperative institutions, and emerging digital lending platforms, all competing to expand their gold loan portfolios through improved customer experience and faster disbursal mechanisms.

India Gold Loan Market Segmentation

by Provider Type

Banks

Non-Banking Financial Companies (NBFCs)

Fintech Platforms

by Mode of Disbursement

Offline

Online

by End User

Banking

Agricultural Households

Small Business Owners & Traders

Others

Access Premium Market Insights - Limited-Time 30% Off https://www.maximizemarketresearch.com/market-report/india-gold-loan-market/213911/

India Gold Loan Market Key Growth Drivers

High Household Gold Ownership

India holds one of the largest stocks of privately owned gold globally. This massive gold reserve provides a strong foundation for secured lending and continues to support long-term market growth.

Rising Demand for Short-Term Credit

Small businesses, traders, farmers, and salaried individuals increasingly rely on gold loans to meet urgent funding needs, working capital requirements, and seasonal expenses.

Expansion of Organized Lending Channels

Banks and regulated NBFCs are strengthening branch networks and adopting standardized valuation practices, improving trust and transparency in gold loan services.

Digital Transformation in Lending

Online gold loan applications, doorstep gold collection, instant valuation, and digital repayments are enhancing customer convenience and expanding reach, especially among younger borrowers.

Financial Inclusion Initiatives

Government and regulatory support for priority sector lending and rural banking is helping extend gold loan access to underserved populations.

Market Challenges

Gold Price Volatility

Fluctuating gold prices affect loan-to-value ratios, collateral valuation, and borrower eligibility, creating operational and risk management challenges for lenders.

Intense Market Competition

Aggressive pricing, promotional offers, and rapid branch expansion are increasing competition among banks, NBFCs, and fintech lenders, putting pressure on profit margins.

Operational Risks and Asset Security

Safe storage, transportation, and handling of pledged gold require strict security infrastructure, which adds to operational costs.

Regulatory Compliance Requirements

Changes in lending norms, auction procedures, and capital provisioning guidelines can impact business strategies and growth planning.

Recent Developments

Banks have increased their focus on secured retail lending, leading to faster growth in gold loan portfolios compared to other loan categories.

NBFCs are investing in technology platforms to streamline valuation, documentation, and customer onboarding processes.

Several lenders have introduced flexible repayment options, including bullet repayments and interest-only payment schemes.

Digital gold loan services with doorstep collection and instant credit transfer are gaining popularity in metropolitan and tier-2 cities.

Risk analytics and AI-based valuation tools are being adopted to improve credit assessment and fraud detection.

Need More Information? Inquire About additional details here @ https://www.maximizemarketresearch.com/request-sample/213911/

Emerging Opportunities

Untapped Household Gold Reserves

Only a small portion of household gold is currently monetized, leaving significant potential for market expansion through awareness campaigns and trust-building initiatives.

Growth in Rural and Agricultural Lending

Seasonal farming expenses and crop cycles create strong demand for short-tenure loans, positioning gold loans as a reliable credit source in rural economies.

Product Customization

Lenders are developing tailored products for MSMEs, traders, and women entrepreneurs, expanding gold loan usage beyond traditional purposes.

Partnerships with Fintech Platforms

Collaborations between traditional lenders and fintech firms are enabling faster processing, broader reach, and improved customer engagement.

Cross-Selling Financial Products

Gold loan customers present opportunities for selling insurance, savings products, and digital payment services, enhancing overall customer lifetime value.

India Gold Loan Market Key Players:

1. Axis Bank of India

2. Central Bank of India

3. Federal Bank Limited

4. HDFC Bank Limited

5. ICICI Limited

6. Kotak Mahindra Bank Limited

7. Manappuram Finance Limited

8. Muthoot Finance Limited

9. State Bank of India

10. Union Bank of India

11. India Infoline Finance Limited

12. Canara Bank

13. Bank of Baroda

14. Punjab National Bank

15. Nitstone Finserv

Frequently Asked Questions (FAQs)

1. What is a gold loan and how does it work?

A gold loan is a secured loan where borrowers pledge gold jewelry or ornaments as collateral to receive funds, which are repaid with interest over a fixed tenure.

2. What is the market size of the India Gold Loan Market by 2032?

The market size of the Linear Lighting by 2032 is expected to reach USD 170.49 Billion.

3. Why is the India gold loan market growing rapidly?

Growth is driven by high gold ownership, increasing credit needs, fast loan processing, lower interest rates compared to unsecured loans, and expanding digital services.

4. Who are the major providers of gold loans in India?

The India Gold Loan Market includes public and private sector banks, NBFCs, cooperative societies, and fintech-enabled lending platforms.

5. Is a gold loan safer than other types of loans?

From a lender's perspective, gold loans are considered relatively safer due to collateral backing. For borrowers, they offer quicker access to funds with fewer documentation requirements.

6. What factors influence the loan amount in a gold loan?

Loan value depends on the purity, weight, and market price of gold, as well as regulatory loan-to-value limits set by financial authorities.

7. Can gold loans support small business growth?

Yes, many small traders and MSMEs use gold loans for inventory purchase, cash flow management, and business expansion due to easy availability and short approval times.

Related Reports:

Surety Market https://www.maximizemarketresearch.com/market-report/surety-market/185094/

Premium Finance Market https://www.maximizemarketresearch.com/market-report/premium-finance-market/213507/

Luxury Fashion Market https://www.maximizemarketresearch.com/market-report/luxury-fashion-market/126250/

Most performing reports:

Sustainable Fashion Market https://www.maximizemarketresearch.com/market-report/sustainable-fashion-market/213432/

Global Silk Market https://www.maximizemarketresearch.com/market-report/global-silk-market/26259/

Cosmetics Market https://www.maximizemarketresearch.com/market-report/global-cosmetics-market/72541/

Vinyl Records Market https://www.maximizemarketresearch.com/market-report/global-vinyl-records-market/108517/

Drone Light Shows Market https://www.maximizemarketresearch.com/market-report/drone-light-shows-market/148130/

Connect With Us:

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Gold Loan Market Set to Surge to USD 170.49 Billion by 2032 | Market Size, CAGR & Strategic Outlook here

News-ID: 4340244 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

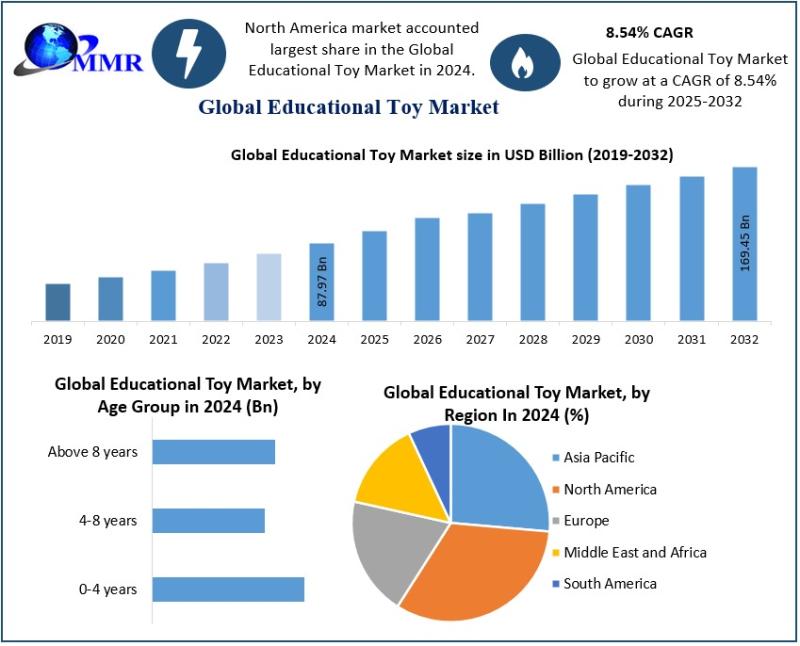

Educational Toy Market Outlook Strengthens as Learning-Driven Play Gains Global …

The Educational Toy Market size was valued at USD 87.97 Billion in 2024 and the total Educational Toy revenue is expected to grow at a CAGR of 8.54% from 2025 to 2032, reaching nearly USD 169.45 Billion.

The Educational Toy Market is witnessing a significant transformation as parents, educators, and institutions increasingly prioritize toys that combine entertainment with cognitive development. Educational toys are specifically designed to enhance problem-solving abilities, creativity, emotional…

Pink Himalayan Salt Market Growth Driven by Clean-Label Food and Wellness Applic …

The Pink Himalayan Salt Market size was valued at USD 12.42 Billion in 2024 and the total Pink Himalayan Salt revenue is expected to grow at a CAGR of 4.2% from 2025 to 2032, reaching nearly USD 17.27 Billion.

The Pink Himalayan Salt Market is witnessing notable momentum as consumers across the globe increasingly prioritize natural, mineral-rich, and minimally processed food ingredients. Sourced primarily from ancient salt deposits in the Himalayan…

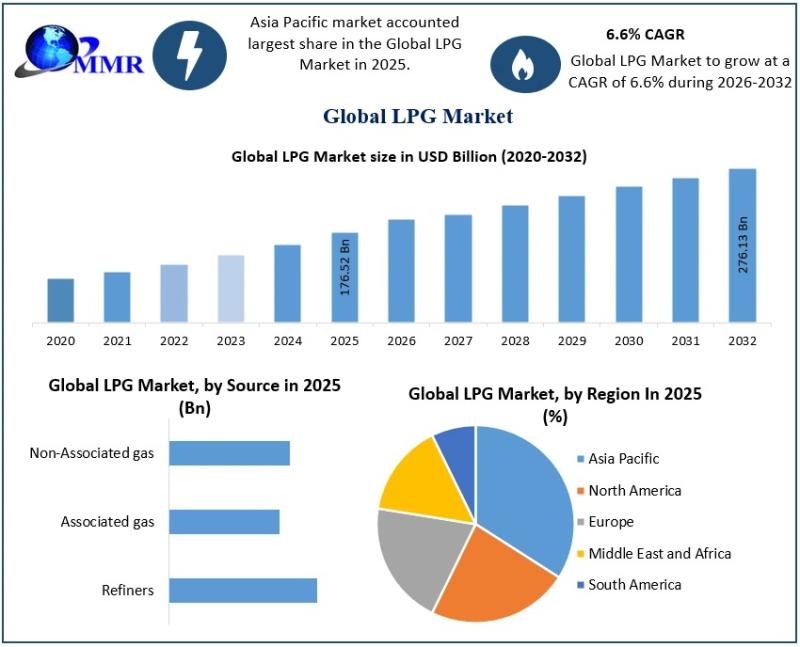

LPG Market Outlook Highlights Sustainable Energy Transition Across Global Econom …

The LPG Market size was valued at USD 176.52 Billion in 2025 and the total LPG revenue is expected to grow at a CAGR of 6.6% from 2025 to 2032, reaching nearly USD 276.13 Billion by 2032.

The LPG Market continues to gain strategic importance as governments, industries, and households shift toward cleaner and more efficient fuel alternatives. Liquefied Petroleum Gas, widely used for cooking, heating, transportation, and industrial applications, offers…

Commercial Roofing Market Poised for Strategic Transformation as Sustainable Con …

Commercial Roofing Market was valued nearly US$ 12.63 Bn in 2024. Commercial Roofing Market size is estimated to grow at a CAGR of 6.2 % & is expected to reach at USD 20.44 Bn. by 2032.

The Commercial Roofing Market is undergoing a significant shift as commercial construction priorities evolve toward durability, energy performance, and long term asset protection. Growing awareness around lifecycle cost efficiency and climate resilience is reshaping material…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2018 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…