Press release

Co-Processed Excipients Market to Reach US$ 3.10 Billion by 2031, Driven by Direct Compression Adoption, Patient-Centric Dosage Forms, and Functional Formulation Demand | QY Research

Market Summary -The global market for Co-Processed Excipients was estimated to be worth US$ 2,282 million in 2024 and is forecast to reach a readjusted size of US$ 3,096 million by 2031, expanding at a steady CAGR of 4.6% during the forecast period 2025-2031.

According to QY Research, the newly released report titled "Co-Processed Excipients Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031" provides a comprehensive, data-driven assessment of the global co-processed excipients industry. The study delivers detailed insights into market size evolution, pricing trends, production capacity, competitive structure, regional demand patterns, and future growth opportunities for pharmaceutical excipient manufacturers, formulation scientists, and investors.

Get Full PDF Sample Copy of the Report (Including Full TOC, Tables & Charts):

https://www.qyresearch.in/request-sample/chemical-material-co-processed-excipients-market-share-and-ranking-overall-sales-and-demand-forecast-2025-2031

Trade Policy Impact and Supply Chain Assessment -

The potential shifts in the 2025 U.S. tariff framework introduce notable volatility risks to the global Co-Processed Excipients market. This report offers a comprehensive evaluation of recent tariff adjustments and international strategic countermeasures affecting cross-border excipient production, raw-material sourcing, and pharmaceutical supply chains.

The analysis examines impacts on manufacturing footprints, capital investment strategies, regional trade dependencies, and supply chain restructuring. Given the globalized sourcing of excipient raw materials and increasing regulatory scrutiny, this assessment enables stakeholders to anticipate policy risks, optimize procurement strategies, and strengthen supply chain resilience in a complex global trade environment.

Product Definition and Functional Overview -

Co-processed excipients are physical combinations of two or more pharmacopeia-listed excipients, engineered without chemical modification to deliver enhanced functional performance. Their advantages arise from optimized physical properties rather than chemical bonding, allowing formulators to achieve superior flowability, compressibility, disintegration, and dissolution behavior.

Key characteristics of co-processed excipients include:

► Physical (not chemical) modification

► Enhanced compressibility and flow performance

► Reduced formulation complexity

► Improved tablet robustness and content uniformity

► Cost efficiency through simplified manufacturing

These excipients are particularly valuable in direct compression (DC) processes and modern tablet manufacturing, where consistent performance and process efficiency are critical.

Market Drivers and Demand Fundamentals -

One of the most significant drivers shaping the co-processed excipients market is the pharmaceutical industry's transition from traditional excipients to functionality-based excipient systems. As modern APIs become more potent, moisture-sensitive, and poorly compressible, formulators increasingly rely on co-processed excipients to enhance manufacturability without introducing complex granulation steps.

The rapid expansion of direct compression technology is another major growth driver. Direct compression reduces production time, energy consumption, and operational costs, but requires excipients with exceptional flow and compaction characteristics. Co-processed excipients-such as MCC-lactose and MCC-mannitol blends-are specifically designed to meet these requirements, accelerating adoption across generic and branded drug manufacturing.

Additionally, growing demand for patient-centric dosage forms, including orally disintegrating tablets (ODTs), chewables, and dispersible formulations, is boosting market growth. Co-processed excipients containing mannitol or other sugar alcohols offer rapid disintegration, pleasant mouthfeel, and mechanical strength, making them ideal for pediatric, geriatric, and self-administration applications.

Industry Trends and Regulatory Landscape -

Regulatory acceptance is steadily advancing in the co-processed excipients industry. Although these excipients consist of established materials, their combined physical structure requires detailed characterization for regulatory submissions. Regulatory bodies such as the U.S. FDA and EMA have increasingly recognized co-processed excipients, provided safety, performance, and stability are well documented.

The inclusion of co-processed excipients in major compendia such as the USP and European Pharmacopoeia reflects growing regulatory clarity, reducing barriers to market entry and encouraging innovation. This regulatory progress supports wider adoption across pharmaceuticals and nutraceuticals.

Market Structure and Key Insights -

► Global market value reached US$ 2.28 billion in 2024

► Market projected to exceed US$ 3.09 billion by 2031

► Global production reached approximately 336.4 K MT in 2024

► Average global market price around US$ 6,782 per MT

► Gross profit margins typically range from 25% to 35%

► Market concentration remains low, with top five companies holding less than 30% share

The fragmented market structure encourages innovation and customization, allowing both multinational and regional players to compete effectively.

Regional Market Outlook -

► North America - driven by advanced pharmaceutical manufacturing and regulatory compliance

► Europe - strong demand supported by high-quality formulation standards and generics production

► Asia Pacific - fastest growth region, led by expanding generic drug manufacturing in China and India

► South America & Middle East & Africa - emerging markets with gradual adoption linked to pharmaceutical capacity expansion

Competitive Landscape -

The global Co-Processed Excipients market is characterized by moderate entry barriers, strong formulation expertise requirements, and application-specific customization.

Key companies profiled in the report include:

► Meggle

► Roquette

► BASF

► JRS Pharma

► ABF Ingredients

► Colorcon

► Daicel Corporation

► Shin-Etsu

► IFF (DuPont)

► Fuji

► Topchain

The report analyzes company market share, product portfolios, production technologies, and competitive strategies in detail.

Market Segmentation Highlights -

By Type

► Granulation

► Spray Drying

► Hot Melt Extrusion

► Solvent Evaporation

► Others

By Application

► Pharmaceuticals

► Nutraceuticals

Each segment is evaluated based on sales volume, revenue contribution, growth trends, and future potential.

Reasons to Procure This Report -

► Access accurate global and regional market forecasts (2020-2031)

► Understand company market share, ranking, and competitive dynamics

► Evaluate technology trends and regulatory developments

► Identify high-growth formulation technologies and applications

► Support investment planning, capacity expansion, and product development strategies

Key Questions Answered in the Report -

► What is the current and future size of the global Co-Processed Excipients market?

► Which formulation technologies are driving demand growth?

► How fragmented is the competitive landscape, and who are the key suppliers?

► How are direct compression and patient-centric dosage forms influencing excipient demand?

► What regulatory and technology trends will shape the market through 2031?

Request for Pre-Order / Enquiry:

https://www.qyresearch.in/pre-order-inquiry/chemical-material-co-processed-excipients-market-share-and-ranking-overall-sales-and-demand-forecast-2025-2031

Table of Content:

1 Market Overview

1.1 Co-Processed Excipients Product Introduction

1.2 Global Co-Processed Excipients Market Size Forecast

1.2.1 Global Co-Processed Excipients Sales Value (2020-2031)

1.2.2 Global Co-Processed Excipients Sales Volume (2020-2031)

1.2.3 Global Co-Processed Excipients Sales Price (2020-2031)

1.3 Co-Processed Excipients Market Trends & Drivers

1.3.1 Co-Processed Excipients Industry Trends

1.3.2 Co-Processed Excipients Market Drivers & Opportunity

1.3.3 Co-Processed Excipients Market Challenges

1.3.4 Co-Processed Excipients Market Restraints

1.4 Assumptions and Limitations

1.5 Study Objectives

1.6 Years Considered

2 Competitive Analysis by Company

2.1 Global Co-Processed Excipients Players Revenue Ranking (2024)

2.2 Global Co-Processed Excipients Revenue by Company (2020-2025)

2.3 Global Co-Processed Excipients Players Sales Volume Ranking (2024)

2.4 Global Co-Processed Excipients Sales Volume by Company Players (2020-2025)

2.5 Global Co-Processed Excipients Average Price by Company (2020-2025)

2.6 Key Manufacturers Co-Processed Excipients Manufacturing Base and Headquarters

2.7 Key Manufacturers Co-Processed Excipients Product Offered

2.8 Key Manufacturers Time to Begin Mass Production of Co-Processed Excipients

2.9 Co-Processed Excipients Market Competitive Analysis

2.9.1 Co-Processed Excipients Market Concentration Rate (2020-2025)

2.9.2 Global 5 and 10 Largest Manufacturers by Co-Processed Excipients Revenue in 2024

2.9.3 Global Top Manufacturers by Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Revenue in Co-Processed Excipients as of 2024)

2.10 Mergers & Acquisitions, Expansion

3 Segmentation by Type

3.1 Introduction by Type

3.1.1 Granulation

3.1.2 Spray Drying

3.1.3 Hot Melt Extrusion

3.1.4 Solvent Evaporation

3.1.5 Others

3.2 Global Co-Processed Excipients Sales Value by Type

3.2.1 Global Co-Processed Excipients Sales Value by Type (2020 VS 2024 VS 2031)

3.2.2 Global Co-Processed Excipients Sales Value, by Type (2020-2031)

3.2.3 Global Co-Processed Excipients Sales Value, by Type (%) (2020-2031)

3.3 Global Co-Processed Excipients Sales Volume by Type

3.3.1 Global Co-Processed Excipients Sales Volume by Type (2020 VS 2024 VS 2031)

3.3.2 Global Co-Processed Excipients Sales Volume, by Type (2020-2031)

3.3.3 Global Co-Processed Excipients Sales Volume, by Type (%) (2020-2031)

3.4 Global Co-Processed Excipients Average Price by Type (2020-2031)

4 Segmentation by Dosage Form

4.1 Introduction by Dosage Form

4.1.1 Direct Compression Tablets

4.1.2 Orally Disintegrating Tablets (ODTs)

4.1.3 Effervescent Tablets or Powders

4.1.4 Capsule Fillers and Pellets

4.1.5 Others

4.2 Global Co-Processed Excipients Sales Value by Dosage Form

4.2.1 Global Co-Processed Excipients Sales Value by Dosage Form (2020 VS 2024 VS 2031)

4.2.2 Global Co-Processed Excipients Sales Value, by Dosage Form (2020-2031)

4.2.3 Global Co-Processed Excipients Sales Value, by Dosage Form (%) (2020-2031)

4.3 Global Co-Processed Excipients Sales Volume by Dosage Form

4.3.1 Global Co-Processed Excipients Sales Volume by Dosage Form (2020 VS 2024 VS 2031)

4.3.2 Global Co-Processed Excipients Sales Volume, by Dosage Form (2020-2031)

4.3.3 Global Co-Processed Excipients Sales Volume, by Dosage Form (%) (2020-2031)

4.4 Global Co-Processed Excipients Average Price by Dosage Form (2020-2031)

5 Segmentation by Composition

5.1 Introduction by Composition

5.1.1 Cellulose-Based Systems

5.1.2 Sugar-Based Systems

5.1.3 Inorganic-Organic Blends

5.1.4 Polyol-Based Systems

5.1.5 Others

5.2 Global Co-Processed Excipients Sales Value by Composition

5.2.1 Global Co-Processed Excipients Sales Value by Composition (2020 VS 2024 VS 2031)

5.2.2 Global Co-Processed Excipients Sales Value, by Composition (2020-2031)

5.2.3 Global Co-Processed Excipients Sales Value, by Composition (%) (2020-2031)

5.3 Global Co-Processed Excipients Sales Volume by Composition

5.3.1 Global Co-Processed Excipients Sales Volume by Composition (2020 VS 2024 VS 2031)

5.3.2 Global Co-Processed Excipients Sales Volume, by Composition (2020-2031)

5.3.3 Global Co-Processed Excipients Sales Volume, by Composition (%) (2020-2031)

5.4 Global Co-Processed Excipients Average Price by Composition (2020-2031)

6 Segmentation by Physical Form

6.1 Introduction by Physical Form

6.1.1 Fine Powder Form

6.1.2 Granular Form

6.1.3 Spherical or Spray-Dried Particles

6.1.4 High-Density or Low-Density Grades

6.1.5 Others

6.2 Global Co-Processed Excipients Sales Value by Physical Form

6.2.1 Global Co-Processed Excipients Sales Value by Physical Form (2020 VS 2024 VS 2031)

6.2.2 Global Co-Processed Excipients Sales Value, by Physical Form (2020-2031)

6.2.3 Global Co-Processed Excipients Sales Value, by Physical Form (%) (2020-2031)

6.3 Global Co-Processed Excipients Sales Volume by Physical Form

6.3.1 Global Co-Processed Excipients Sales Volume by Physical Form (2020 VS 2024 VS 2031)

6.3.2 Global Co-Processed Excipients Sales Volume, by Physical Form (2020-2031)

6.3.3 Global Co-Processed Excipients Sales Volume, by Physical Form (%) (2020-2031)

6.4 Global Co-Processed Excipients Average Price by Physical Form (2020-2031)

7 Segmentation by Application

7.1 Introduction by Application

7.1.1 Pharmaceuticals

7.1.2 Nutraceuticals

7.2 Global Co-Processed Excipients Sales Value by Application

7.2.1 Global Co-Processed Excipients Sales Value by Application (2020 VS 2024 VS 2031)

7.2.2 Global Co-Processed Excipients Sales Value, by Application (2020-2031)

7.2.3 Global Co-Processed Excipients Sales Value, by Application (%) (2020-2031)

7.3 Global Co-Processed Excipients Sales Volume by Application

7.3.1 Global Co-Processed Excipients Sales Volume by Application (2020 VS 2024 VS 2031)

7.3.2 Global Co-Processed Excipients Sales Volume, by Application (2020-2031)

7.3.3 Global Co-Processed Excipients Sales Volume, by Application (%) (2020-2031)

7.4 Global Co-Processed Excipients Average Price by Application (2020-2031)

8 Segmentation by Region

8.1 Global Co-Processed Excipients Sales Value by Region

8.1.1 Global Co-Processed Excipients Sales Value by Region: 2020 VS 2024 VS 2031

8.1.2 Global Co-Processed Excipients Sales Value by Region (2020-2025)

8.1.3 Global Co-Processed Excipients Sales Value by Region (2026-2031)

8.1.4 Global Co-Processed Excipients Sales Value by Region (%), (2020-2031)

8.2 Global Co-Processed Excipients Sales Volume by Region

8.2.1 Global Co-Processed Excipients Sales Volume by Region: 2020 VS 2024 VS 2031

8.2.2 Global Co-Processed Excipients Sales Volume by Region (2020-2025)

8.2.3 Global Co-Processed Excipients Sales Volume by Region (2026-2031)

8.2.4 Global Co-Processed Excipients Sales Volume by Region (%), (2020-2031)

8.3 Global Co-Processed Excipients Average Price by Region (2020-2031)

8.4 North America

8.4.1 North America Co-Processed Excipients Sales Value, 2020-2031

8.4.2 North America Co-Processed Excipients Sales Value by Country (%), 2024 VS 2031

8.5 Europe

8.5.1 Europe Co-Processed Excipients Sales Value, 2020-2031

8.5.2 Europe Co-Processed Excipients Sales Value by Country (%), 2024 VS 2031

8.6 Asia Pacific

8.6.1 Asia Pacific Co-Processed Excipients Sales Value, 2020-2031

8.6.2 Asia Pacific Co-Processed Excipients Sales Value by Region (%), 2024 VS 2031

8.7 South America

8.7.1 South America Co-Processed Excipients Sales Value, 2020-2031

8.7.2 South America Co-Processed Excipients Sales Value by Country (%), 2024 VS 2031

8.8 Middle East & Africa

8.8.1 Middle East & Africa Co-Processed Excipients Sales Value, 2020-2031

8.8.2 Middle East & Africa Co-Processed Excipients Sales Value by Country (%), 2024 VS 2031

9 Segmentation by Key Countries/Regions

9.1 Key Countries/Regions Co-Processed Excipients Sales Value Growth Trends, 2020 VS 2024 VS 2031

9.2 Key Countries/Regions Co-Processed Excipients Sales Value and Sales Volume

9.2.1 Key Countries/Regions Co-Processed Excipients Sales Value, 2020-2031

9.2.2 Key Countries/Regions Co-Processed Excipients Sales Volume, 2020-2031

9.3 United States

9.3.1 United States Co-Processed Excipients Sales Value, 2020-2031

9.3.2 United States Co-Processed Excipients Sales Value by Type (%), 2024 VS 2031

9.3.3 United States Co-Processed Excipients Sales Value by Application, 2024 VS 2031

9.4 Europe

9.4.1 Europe Co-Processed Excipients Sales Value, 2020-2031

9.4.2 Europe Co-Processed Excipients Sales Value by Type (%), 2024 VS 2031

9.4.3 Europe Co-Processed Excipients Sales Value by Application, 2024 VS 2031

9.5 China

9.5.1 China Co-Processed Excipients Sales Value, 2020-2031

9.5.2 China Co-Processed Excipients Sales Value by Type (%), 2024 VS 2031

9.5.3 China Co-Processed Excipients Sales Value by Application, 2024 VS 2031

9.6 Japan

9.6.1 Japan Co-Processed Excipients Sales Value, 2020-2031

9.6.2 Japan Co-Processed Excipients Sales Value by Type (%), 2024 VS 2031

9.6.3 Japan Co-Processed Excipients Sales Value by Application, 2024 VS 2031

9.7 South Korea

9.7.1 South Korea Co-Processed Excipients Sales Value, 2020-2031

9.7.2 South Korea Co-Processed Excipients Sales Value by Type (%), 2024 VS 2031

9.7.3 South Korea Co-Processed Excipients Sales Value by Application, 2024 VS 2031

9.8 Southeast Asia

9.8.1 Southeast Asia Co-Processed Excipients Sales Value, 2020-2031

9.8.2 Southeast Asia Co-Processed Excipients Sales Value by Type (%), 2024 VS 2031

9.8.3 Southeast Asia Co-Processed Excipients Sales Value by Application, 2024 VS 2031

9.9 India

9.9.1 India Co-Processed Excipients Sales Value, 2020-2031

9.9.2 India Co-Processed Excipients Sales Value by Type (%), 2024 VS 2031

9.9.3 India Co-Processed Excipients Sales Value by Application, 2024 VS 2031

10 Company Profiles

10.1 Meggle

10.1.1 Meggle Company Information

10.1.2 Meggle Introduction and Business Overview

10.1.3 Meggle Co-Processed Excipients Sales, Revenue, Price and Gross Margin (2020-2025)

10.1.4 Meggle Co-Processed Excipients Product Offerings

10.1.5 Meggle Recent Development

10.2 Roquette

10.2.1 Roquette Company Information

10.2.2 Roquette Introduction and Business Overview

10.2.3 Roquette Co-Processed Excipients Sales, Revenue, Price and Gross Margin (2020-2025)

10.2.4 Roquette Co-Processed Excipients Product Offerings

10.2.5 Roquette Recent Development

10.3 BASF

10.3.1 BASF Company Information

10.3.2 BASF Introduction and Business Overview

10.3.3 BASF Co-Processed Excipients Sales, Revenue, Price and Gross Margin (2020-2025)

10.3.4 BASF Co-Processed Excipients Product Offerings

10.3.5 BASF Recent Development

10.4 JRS Pharma

10.4.1 JRS Pharma Company Information

10.4.2 JRS Pharma Introduction and Business Overview

10.4.3 JRS Pharma Co-Processed Excipients Sales, Revenue, Price and Gross Margin (2020-2025)

10.4.4 JRS Pharma Co-Processed Excipients Product Offerings

10.4.5 JRS Pharma Recent Development

10.5 ABF Ingredients

10.5.1 ABF Ingredients Company Information

10.5.2 ABF Ingredients Introduction and Business Overview

10.5.3 ABF Ingredients Co-Processed Excipients Sales, Revenue, Price and Gross Margin (2020-2025)

10.5.4 ABF Ingredients Co-Processed Excipients Product Offerings

10.5.5 ABF Ingredients Recent Development

10.6 Colorcon

10.6.1 Colorcon Company Information

10.6.2 Colorcon Introduction and Business Overview

10.6.3 Colorcon Co-Processed Excipients Sales, Revenue, Price and Gross Margin (2020-2025)

10.6.4 Colorcon Co-Processed Excipients Product Offerings

10.6.5 Colorcon Recent Development

10.7 Daicel Corporation

10.7.1 Daicel Corporation Company Information

10.7.2 Daicel Corporation Introduction and Business Overview

10.7.3 Daicel Corporation Co-Processed Excipients Sales, Revenue, Price and Gross Margin (2020-2025)

10.7.4 Daicel Corporation Co-Processed Excipients Product Offerings

10.7.5 Daicel Corporation Recent Development

10.8 Shin-Etsu

10.8.1 Shin-Etsu Company Information

10.8.2 Shin-Etsu Introduction and Business Overview

10.8.3 Shin-Etsu Co-Processed Excipients Sales, Revenue, Price and Gross Margin (2020-2025)

10.8.4 Shin-Etsu Co-Processed Excipients Product Offerings

10.8.5 Shin-Etsu Recent Development

10.9 IFF (DuPont)

10.9.1 IFF (DuPont) Company Information

10.9.2 IFF (DuPont) Introduction and Business Overview

10.9.3 IFF (DuPont) Co-Processed Excipients Sales, Revenue, Price and Gross Margin (2020-2025)

10.9.4 IFF (DuPont) Co-Processed Excipients Product Offerings

10.9.5 IFF (DuPont) Recent Development

10.10 Fuji

10.10.1 Fuji Company Information

10.10.2 Fuji Introduction and Business Overview

10.10.3 Fuji Co-Processed Excipients Sales, Revenue, Price and Gross Margin (2020-2025)

10.10.4 Fuji Co-Processed Excipients Product Offerings

10.10.5 Fuji Recent Development

10.11 Topchain

10.11.1 Topchain Company Information

10.11.2 Topchain Introduction and Business Overview

10.11.3 Topchain Co-Processed Excipients Sales, Revenue, Price and Gross Margin (2020-2025)

10.11.4 Topchain Co-Processed Excipients Product Offerings

10.11.5 Topchain Recent Development

11 Industry Chain Analysis

11.1 Co-Processed Excipients Industrial Chain

11.2 Co-Processed Excipients Upstream Analysis

11.2.1 Key Raw Materials

11.2.2 Raw Materials Key Suppliers

11.2.3 Manufacturing Cost Structure

11.3 Midstream Analysis

11.4 Downstream Analysis (Customers Analysis)

11.5 Sales Model and Sales Channels

11.5.1 Co-Processed Excipients Sales Model

11.5.2 Sales Channel

11.5.3 Co-Processed Excipients Distributors

12 Research Findings and Conclusion

13 Appendix

13.1 Research Methodology

13.1.1 Methodology/Research Approach

13.1.1.1 Research Programs/Design

13.1.1.2 Market Size Estimation

13.1.1.3 Market Breakdown and Data Triangulation

13.1.2 Data Source

13.1.2.1 Secondary Sources

13.1.2.2 Primary Sources

13.2 Author Details

13.3 Disclaimer

QY Research PVT. LTD.

315 Work Avenue,

Raheja Woods,

6th Floor, Kalyani Nagar,

Yervada, Pune - 411060,

Maharashtra, India

India: (O) +91 866 998 6909

USA: (O) +1 626 295 2442

Email: hitesh@qyresearch.com

Web: www.qyresearch.in

About Us -

QY Research, established in 2007, is a globally recognized market research and consulting firm delivering syndicated and customized research solutions across pharmaceuticals, excipients, chemicals, advanced materials, healthcare, and industrial manufacturing sectors. With more than 50,000 clients across over 80 countries, QY Research combines rigorous research methodologies, deep domain expertise, and actionable insights to support data-driven decision-making and long-term business growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Co-Processed Excipients Market to Reach US$ 3.10 Billion by 2031, Driven by Direct Compression Adoption, Patient-Centric Dosage Forms, and Functional Formulation Demand | QY Research here

News-ID: 4339517 • Views: …

More Releases from QY Research, Inc.

Global Semiconductor Silicon Wafer Market to Reach US$ 29.08 Billion by 2032, Dr …

Market Summary -

The global Semiconductor Silicon Wafer market was valued at US$ 17,020 million in 2025 and is projected to reach US$ 29,080 million by 2032, growing at a CAGR of 8.1% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Semiconductor Silicon Wafer Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" delivers a comprehensive, data-driven assessment of the global silicon wafer…

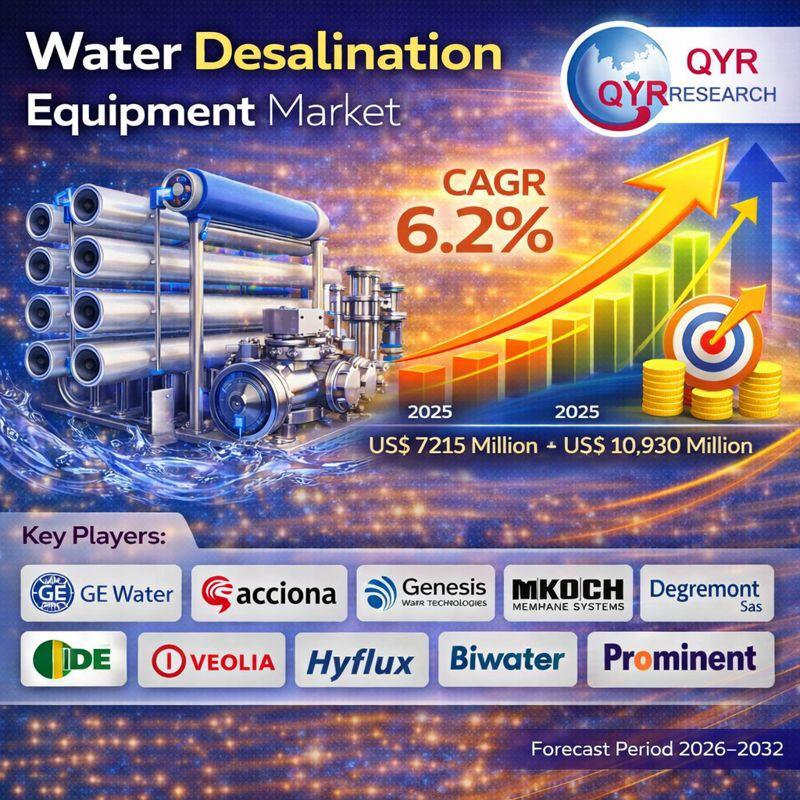

Global Water Desalination Equipment Market to Reach US$ 10.93 Billion by 2032, D …

Market Summary -

The global Water Desalination Equipment market was valued at US$ 7,215 million in 2025 and is projected to reach US$ 10,930 million by 2032, growing at a CAGR of 6.2% during the forecast period 2026-2032.

According to QY Research, the newly published report titled "Global Water Desalination Equipment Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven evaluation of the global desalination equipment…

Global Syndiotactic Polystyrene Market to Reach US$ 162 Million by 2032, Driven …

Market Summary -

The global Syndiotactic Polystyrene (SPS) market was valued at US$ 111 million in 2025 and is projected to reach US$ 162 million by 2032, expanding at a CAGR of 5.6% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Syndiotactic Polystyrene Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven assessment of the global SPS market. The…

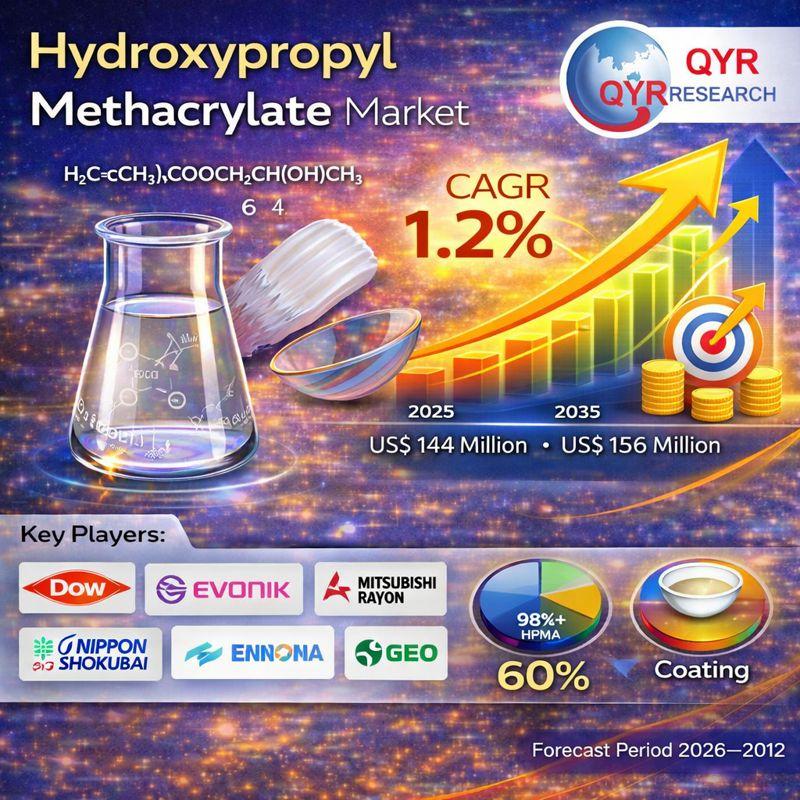

Global Hydroxypropyl Methacrylate Market to Reach US$ 156 Million by 2032, Suppo …

Market Summary -

The global Hydroxypropyl Methacrylate (HPMA) market was valued at US$ 144 million in 2025 and is projected to reach US$ 156 million by 2032, expanding at a CAGR of 1.2% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Hydroxypropyl Methacrylate Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven evaluation of the global HPMA market.…

More Releases for Excipients

Emerging Trends to Reshape the Organic Pharmaceutical Excipients Market: Label-F …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

Organic Pharmaceutical Excipients Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

In the past few years, there has been significant growth in the market size of organic pharmaceutical excipients. It is predicted that the market will expand from its $11.25 billion valuation in 2024 to…

How big is Pharmaceutical Excipients Market?

Pharmaceutical Excipients Market is forecasted to reach at a CAGR of 5.5 % during the forecast period (2024-2031).

The objectives outlined in the report are multifaceted and aimed at offering a comprehensive understanding of the Pharmaceutical Excipients market dynamics. These objectives encompass a meticulous analysis and forecast of the market's dimensions, encompassing both its value and volume aspects. Additionally, the report seeks to discern and delineate the market shares held by…

Global Pharmaceutical Excipients Market to Witness Growth Through 2021, Due to I …

The global Pharmaceutical Excipients market focuses on encompassing major statistical evidence for the Pharmaceutical Excipients industry as it offers our readers a value addition on guiding them in encountering the obstacles surrounding the market. A comprehensive addition of several factors such as global distribution, manufacturers, market size, and market factors that affect the global contributions are reported in the study. In addition, the Pharmaceutical Excipients study also shifts its attention…

Biopharmaceuticals Excipients Market 2020-2030

Triglycerides, Esters, Mannitol, Sorbitol, Sucrose, Dextrose, Starch, Specialty Biopharmaceutical Excipients & Others

Purchase the full report or download free sample pages: https://www.visiongain.com/report/biopharmaceuticals-excipients-market-2020-2030/

The biopharmaceuticals excipients market is expected to grow at a CAGR of 12.2%.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new 162-page report you will receive 85 charts- all unavailable elsewhere.

The 162-page report provides…

Global Pharmaceutical Excipients Market Research Report

This report studies the global Pharmaceutical Excipients market status and forecast, categorizes the global Pharmaceutical Excipients market size (value & volume) by manufacturers, type, application, and region. This report focuses on the top manufacturers in North America, Europe, Japan, China, and other regions (India, Southeast Asia). The major manufacturers covered in this report Ashland BASF DOW Roquette FMC Evonik Lubrizol Associated British Foods Croda International Archer Daniels Midland Geographically, this…

Excipients Market Report 2018: Segmentation by Type (Organic Excipients, Inorgan …

Global Excipients market research report provides company profile for Evonik, Lubrizol, Associated British Foods, Croda International, Archer Daniels Midland, Ashland, BASF, DOW, Roquette, FMC and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The…