Press release

Top 30 Indonesian Metal Public Companies - Q3 2025 Revenue & Performance

1) Overall companies' performance (Q3 2025 snapshot)PT Aneka Tambang Tbk (ANTM) - Q3 profit ~Rp 5.97 T / ≈ USD 357 m

Bayan Resources Tbk (BYAN) - Q3 profit ~Rp 8.71 T / ≈ USD 523 m

Adaro Energy Tbk / Alamtri Resources (ADRO) - Q3 profit ~Rp 5.03 T / ≈ USD 301 m

Indo Tambangraya Megah Tbk (ITMG)

PT Bukit Asam Tbk (PTBA) - Q3 profit ~Rp 1.39 T / ≈ USD 83 m

Vale Indonesia Tbk (INCO) - Q3 profit ~USD 27.2 m (reported) / revenue ~USD 278.6 m

PT Timah Tbk (TINS) Q3 profit data noted (smaller net)

Harum Energy Tbk (HRUM) Q3 profit reported

Merdeka Copper Gold Tbk (MDKA) 9M revenue ~USD 1.3 bn

Amman Mineral Internasional Tbk (AMMN) reported significant quarterly loss

Golden Energy & Resources / GEMS major coal & miner with published Q3 profit

Bumi Resources Tbk (BUMI) mining group with reported profit

PT Merdeka Gold Resources / EMAS recently listed precious metals miner

Borneo Olah Sarana Sukses (BOSS) mining/metal services entity

Baramulti Suksessarana (BSSR) coal/miner name in sector lists

Indika Energy Tbk (INDY) diversified energy & coal/mining support

Mitrabara Adiperdana Tbk (MBAP) mining & logistics group

Sumber Mineral Global smaller listed miner mention

J Resources / PSAB gold miner & IDX-listed entity

Wilton (SQMI) nickel / metal producer

Bumi Resources Minerals (BRMS) - minerals segment of Bumi - reported profit sample

Transcoal Pacific Tbk - coal & related mining

Petrosea Tbk - mining & infrastructure services

Elnusa Tbk - oil & mining services

TBS Energi Utama Tbk - energy & mining exposure

Trimegah Bangun Persada (nickel interests via Harita Group) nickel miner referenced

Merdeka Battery Materials (MBMA) battery & metals material unit

PT Timah Smelting or related TINS subsidiaries

IDX Mining Index Small Caps various smaller metals & mining tickers routinely included in sector lists

Other junior metal miners & resources stocks additional emerging names on the IDX metals/mining screener

2) Revenue results of major public companies in Indonesia summarized (per company)

1. PT Aneka Tambang Tbk (ANTM)

Q3 2025 Net Profit: ~Rp 5.97 trillion ≈ USD $357.7m. Antam reported strong profitability driven by gains in gold and nickel product segments and higher downstream margins, delivering solid volume increases versus prior quarters.

2. Bayan Resources (BYAN)

Q3 2025 Profit: ~Rp 8.71 trillion ≈ USD $521.8m. One of the largest mining profits in Indonesia in Q3, helped by volume consistency and contract pricing.

3. Adaro Energy (ADRO)

Q3 2025 Profit: ~Rp 5.03 trillion ≈ USD $301.3m. Continued cash-generating performance despite pricing pressure on coal benchmarks.

4. Indo Tambangraya Megah (ITMG)

Q3 2025 Net Profit: ~Rp 2.18 trillion ≈ USD $130.6m. Mid-cap performance reflected dampened coal prices but stable operational execution.

5. PT Bukit Asam Tbk (PTBA)

Q3 2025 Profit: ~Rp 1.39 trillion ≈ USD $83.3m. Volume growth offset by weaker realized pricing yields.

6. Vale Indonesia (INCO)

Q3 2025 Profit: ~Rp 874.8 billion ≈ USD $52.4m. Nickel concentrate operations delivered modest profit growth due to efficiencies and stable product cycles.

7. PT Timah (TINS)

Q3 2025 Profit: ~Rp 602.4 billion ≈ USD $36.1m. Tin price and product mix effects weighed on margins; still profitable.

8. Harum Energy (HRUM)

Q3 2025 Profit: ~Rp 622.3 billion ≈ USD $37.3m. Operating cash flows remained positive amid tighter margins.

9. Merdeka Copper Gold (MDKA)

FY9M/Revenue: USD $1,298m. Merdeka's metal portfolio drove scale, though revenue was down ~22% YoY due to weaker nickel.

10. Amman Mineral Internasional (AMMN)|

Q3 2025 Net Loss: ~Rp -2.98 trillion ≈ USD -$178.5m. Large quarterly loss largely tied to smelter export constraints and operational blockages.

3) Key trends & insights from Q3 2025

Commodity Pricing & Margins:

Across Indonesian metal producers, Q3 earnings outcomes underscored the impact of slower pricing for key metals like nickel and tin, with relatively modest profit for concentrate-focused firms. Some companies saw strong earnings due to diversification into higher-value segments like gold (e.g., ANTM), while others struggled due to smelter operational issues (e.g., AMMN).

Downstream & Processing Focus:

Downstream processing gains such as refined nickel and gold products contributed to better margins at mid-tier producers. The sectors shift toward value-added metal products rather than primary ore exports was a notable theme.

Smelter & Export Permits:

Operational bottlenecks, such as export permit complications and smelter shutdowns, particularly affected AMMNs earnings for Q3 2025, reversing previous profitability.

Market Valuation:

The Indonesian metals & mining index showed elevated Earnings multiples relative to recent history, reflecting investor confidence in longer-term commodity demand and earnings growth prospects.

4) Outlook for Q4 2025 and beyond

Demand Prospects:

Global metal demand particularly for nickel, copper, and gold will shape the outlook. Continued growth in EV batteries and renewables could support sustained demand for nickel and copper, though shifts in technology (e.g., LFP batteries reducing nickel dependency) could moderate long-term copper and nickel pricing upside.

Policy Influence:

Indonesia's export policies and local processing requirements remain key variables. Potential production adjustments (e.g., reduced nickel output to stabilize prices) could tighten supply and ultimately improve realized prices for Indonesian miners.

Operational Expansion:

Major producers like Merdeka and Antam are expected to continue investing in downstream processing and HPAL-type facilities, which could yield improved earnings in the medium term.

5) Conclusion

Indonesia's metal and mining sector during Q3 2025 delivered mixed financial outcomes, with several top miners and metal producers reporting solid profits (e.g., Antam, Bayan) while others faced operational challenges or modest earnings (e.g., Timah, Amman). The overall industry continued to show growth in market valuation and investor confidence, even amid softening pricing for base metals.

Looking ahead, policy shifts, commodity demand trends, and downstream processing expansion will be pivotal for shaping industry performance in Q4 2025 and into 2026. While the near-term earnings environment remains cyclical, fundamentals suggest that Indonesia's position as a key global metals supplier particularly for nickel, copper, and gold will support long-term value creation.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Metal Public Companies - Q3 2025 Revenue & Performance here

News-ID: 4339473 • Views: …

More Releases from QY Research

Top 30 Indonesian Battery Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Aneka Tambang Tbk (ANTM) diversified metals (nickel & battery feedstock)

Bayan Resources Tbk (BYAN) large mining & metal revenue

AlamTri Resources / Adaro Energy Tbk (ADRO) diversified mining & metals

Indo Tambangraya Megah Tbk (ITMG) mining including metals exposure

PT Bukit Asam Tbk (PTBA) minerals/coal & metals linkage

Vale Indonesia Tbk (INCO) nickel & concentrates

PT Timah…

The Future of Contactless Experiences: RFID Wristband Systems Market Forecast, C …

The RFID (Radio-Frequency Identification) Wristband System industry has emerged as a critical segment within the broader RFID ecosystem, enabling automated identification, access control, contactless payments, and data analytics across event management, healthcare, transportation, and entertainment sectors. RFID wristbands consist of embedded electronic tags that communicate with readers to transmit unique IDs and other encoded information, eliminating manual scanning and streamlining user interactions across environments such as theme parks, festivals, hospitals,…

From Food to Pharma: The Expanding Role of Multi Piston Viscous Filling Systems

The global Multi Piston Viscous Filler Machine market plays a critical role in modern automated packaging lines, particularly for products that require high filling accuracy, consistency, and repeatability when handling viscous, semi-viscous, and high-density liquids. These machines have become a core asset across food, beverage, pharmaceutical, cosmetic, chemical, and specialty industrial manufacturing, where production efficiency and hygiene standards are increasingly non-negotiable. As manufacturers worldwide continue shifting toward higher throughput and…

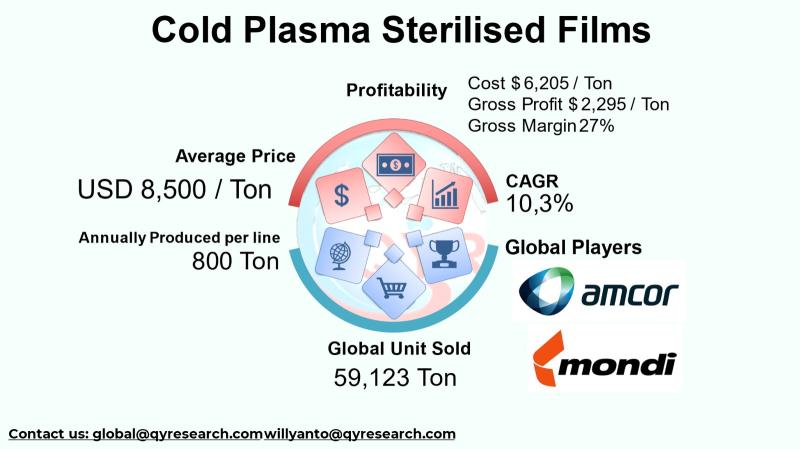

Sterile by Design: The Global Rise of Cold Plasma Sterilised Films and Asia-Paci …

The global Cold Plasma Sterilised Films industry is an emergent segment of advanced packaging and sterilisation technologies, integrating cold plasma treatment with polymer film substrates to achieve microbial-free surfaces without thermal or chemical degradation. These films are essential in sectors requiring rigorous sterility especially medical and pharmaceutical packaging as well as aseptic food packaging due to their ability to maintain integrity under sterilised conditions and provide enhanced shelf life and…

More Releases for Tbk

Indonesia Textile Industry Market Valuation Expected to Hit USD 28.57 billion by …

USA, New Jersey: According to Verified Market Research analysis, the global Indonesia Textile Industry Market size was valued at USD 21.7 Billion in 2023 and is projected to reach USD 28.57 Billion by 2031, growing at a CAGR of 3.50% from 2024 to 2031

How AI and Machine Learning Are Redefining the future of Indonesia Textile Industry Market?

AI-powered production planning systems optimize yarn selection, fabric blends, and loom utilization, improving output…

Infrastructure Market 2021 Strategic Assessments - PT. Acset Indonusa Tbk.., Pt. …

The Infrastructure Market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The Infrastructure sector in Indonesia is…

Indonesia Telecom Tower Market Demand, Size, Share, Scope & Forecast To 2025 |To …

The Indonesia telecom tower market accounted to US$ 557.9 Mn in 2017 and is expected to grow at a CAGR of 27.1% during the forecast period 2018 – 2025, to account to US$ 3,695.5 Mn by 2025.

Get Sample Copy of this Indonesia Telecom Tower Market research report at - https://www.businessmarketinsights.com/sample/TIPRE00004113

The Business Market Insights provides you regional research analysis on “Indonesia Telecom Tower Market” and forecast to 2025. The research report…

Coal Mining in Indonesia Market 2022| PT Bumi Resources Tbk, PT Adaro Energy Tbk …

Researchmoz added Most up-to-date research on "Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption" to its huge collection of research reports.

Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption

Summary

GlobalData's "Coal Mining in Indonesia to 2022", provides a comprehensive coverage on Indonesias coal industry. It provides historical and forecast data on coal production by grade, reserves, consumption and exports by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes

Summary

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by type; exports, exports by type and exports by country. Detailed analysis of the…