Press release

Renters Insurance Market on Track to Cross $158.1 Billion by 2034

According to a new report published by Allied Market Research, titled, "Renters Insurance Market," The renters insurance market was valued at $74 billion in 2024, and is estimated to reach $158.1 billion by 2034, growing at a CAGR of 7.6% from 2025 to 2034.Get a Sample Copy of this Report

https://www.alliedmarketresearch.com/request-sample/A08186

Renters insurance solutions are gaining popularity among tenants and landlords for protecting personal belongings, streamlining claims processes, and enhancing overall customer satisfaction. Renters coverage serve as essential safeguards against events such as theft, fire, or water damage, providing peace of mind and financial security. In line with key renters insurance market trends, the integration of digital technologies enables real-time policy management and faster claims resolution, reducing reliance on paperwork and manual verification. Modern platforms now offer ai-powered claims processing, dynamic premium adjustments, and mobile-based policy access, allowing consumers to tailor coverage to their property and lifestyle needs. Integration with tools like tenant portals, property management software, and smart home systems also improves the renting experience. With artificial intelligence and data analytics, insurers are detecting fraud, predicting risk, and providing responsive support ensuring seamless protection in the digital-first housing market.

Moreover, the rise in the awareness of the need to protect personal belongings and prepare for unexpected expenses is increasing demand for renters insurance, especially among younger and urban renters. The use of apps, chat services, and online claims tools is improving customer experience and boosting adoption. According to the renters insurance market forecast, these factors play a major role in driving the renters insurance market growth over the coming years, as renters become more aware of the financial risks associated with being uninsured.

Subscription-based renters insurance options with monthly payment plans and extra benefits like emergency housing and liability protection are also gaining traction. These plans help manage costs while offering consistent coverage. However, challenges such as consumer misunderstanding of policy terms and claim management complexities persist. Still, the renters insurance market outlook remains positive, as individuals and property managers increasingly seek dependable coverage, reduced unexpected expenses, and peace of mind in the rental environment.

On the basis of application, the renters insurance industry was dominated by the residential segment in 2024 and is expected to maintain its dominance in the upcoming years. This is attributed to the rising number of tenants across urban areas, increasing awareness of property protection, and the affordability of renters insurance policies. In addition, growing incidences of theft, fire, and natural calamities have driven the demand for residential renters insurance, as tenants seek financial protection against potential property and liability losses.

Request Customization : https://www.alliedmarketresearch.com/request-for-customization/A08186

By region, the renters insurance market was dominated by North America in 2024 and is expected to maintain its dominance in the upcoming years owing to high rental housing demand, stringent landlord insurance requirements, and widespread consumer awareness. The presence of major insurance providers and technological advancements in policy distribution also contribute to market growth. In addition, frequent occurrences of natural disasters in the region encourage tenants to secure affordable protection through renters insurance policies. However, the Asia-Pacific is expected to register the highest CAGR during the forecast period. This is attributed to the rapid urbanization, rising disposable incomes, and increasing awareness of insurance benefits among the growing middle-class population. Moreover, expanding rental housing markets in countries like China and India further support the growth of renters insurance market size.

The report focuses on growth prospects, restraints, and trends of the renters insurance market analysis. The study provides Porter's five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the renters insurance sector.

The renters insurance industry is undergoing rapid transformation, driven by growing concerns over data security, rising digital adoption, and increasing demand for regulatory compliance. As part of key tenant insurance market trends, insurers are leveraging advanced technologies to deliver smarter policy offerings, including ai-powered risk assessment, automated claims processing, and secure digital identity verification to ensure customer data protection. These innovations are helping providers streamline underwriting processes, improve fraud detection, and offer more personalized coverage options. As renters seek greater transparency and convenience, tech-enabled solutions are becoming essential for enhancing trust, safeguarding personal information, and addressing evolving consumer expectations in the digital insurance landscape.

The rise of cloud-based renters insurance platforms and Software-as-a-Service (SaaS) delivery models is transforming the insurance landscape, allowing policyholders to purchase, manage, and update coverage remotely and securely. This flexibility supports both individual renters and large-scale property management operations. In addition, the integration of secure identity verification and role-based access controls is gaining importance, ensuring compliance with data protection laws and reducing fraud through limited-access systems. As digital insurance infrastructure matures and cybersecurity concerns grow, renters insurance providers are adopting smarter, more adaptive technologies to deliver secure, responsive, and personalized protection across a variety of rental environments and customer segments.

Key Findings of The Study

By Coverage Type, the liability coverage segment held the largest share in the renters insurance market for 2024.

By Application, the residential segment held the largest share in the renters insurance market for 2024.

By Distribution Channel, the agents and broker segment held the largest share in the renters insurance market for 2024.

Region-wise, North America held the largest market share in 2024. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

The market players operating in the tax preparation software market are TD Insurance, State Farm Mutual Automobile Insurance Company, Allstate Insurance Company, Liberty Mutual Insurance Company, The Travelers Companies, Inc., Nationwide Mutual Insurance Company, Progressive Casualty Insurance Company, GEICO, Erie Indemnity Co., Farmers Group, Inc., USAA Insurance Group, Root Inc., Hippo Enterprises Inc., Kin Insurance Technology Hub, LLC., Assurant Inc., American Modern Insurance Group, The Hartford Insurance Group, Inc., Chubb Limited, Lemonade, Inc., and Westfield Insurance. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the growth of the renters insurance market share.

Enquire Before Buying : https://www.alliedmarketresearch.com/purchase-enquiry/A08186

Trending Reports:

Remote Deposit Capture Market https://www.alliedmarketresearch.com/remote-deposit-capture-market

Mortgage Brokerage Services Market https://www.alliedmarketresearch.com/mortgage-brokerage-services-market-A06699

RegTech Market https://www.alliedmarketresearch.com/regtech-market

Digital Remittance Market https://www.alliedmarketresearch.com/digital-remittance-market

Banking as a Service Market https://www.alliedmarketresearch.com/banking-as-a-service-market-A14258

Starter Credit Cards Market https://www.alliedmarketresearch.com/starter-credit-cards-market-A315471

Prepaid Card Market https://www.alliedmarketresearch.com/prepaid-card-market

Cryptocurrency Market https://www.alliedmarketresearch.com/crypto-currency-market

Home Banking Market https://www.alliedmarketresearch.com/home-banking-market-A324245

Universal Banking Market https://www.alliedmarketresearch.com/universal-banking-market-A323732

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of the domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Renters Insurance Market on Track to Cross $158.1 Billion by 2034 here

News-ID: 4339002 • Views: …

More Releases from Allied Market Research

Faucet Market Forecast 2035: Reaching USD 118.4 billion by 2035

According to a new report published by Allied Market Research, titled, "Faucet Market," The faucet market size was valued at $48.9 billion in 2023, and is estimated to reach $118.4 billion by 2035, growing at a CAGR of 7.6% from 2023 to 2035.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/2448

Faucet is a plumbing fixture used to control the flow of water in various settings such as kitchens,…

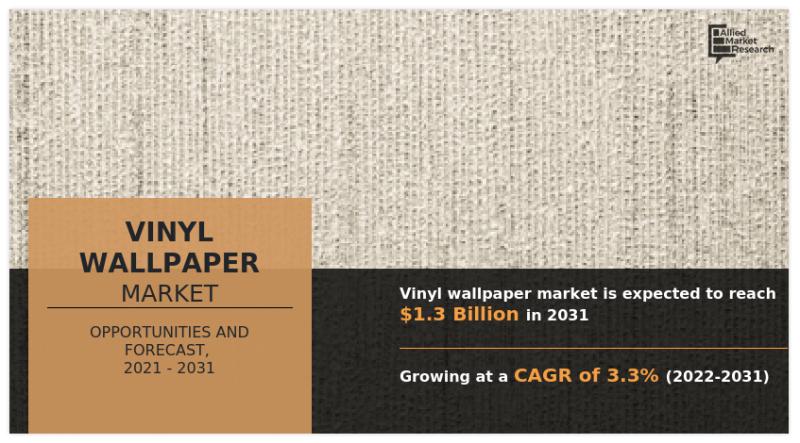

Vinyl Wallpaper Market Size Forecasted to Grow at 3.3% CAGR, Reaching USD 1.3 bi …

The Vinyl Wallpaper Market Size was valued at $943.30 million in 2021, and is estimated to reach $1.3 billion by 2031, growing at a CAGR of 3.3% from 2022 to 2031.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/16970

Vinyl wallpaper consists of a carrier layer (recycled paper or non-woven wallpaper base) and a decorative layer made of polyvinyl chloride. A synthetic foam layer provides three-dimensional structures to…

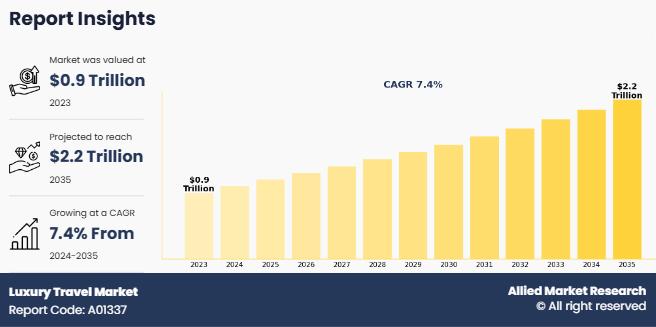

Luxury Travel Market Set to Achieve a Valuation of US$ 2149.7 billion, Riding on …

According to a new report published by Allied Market Research, titled, "Luxury Travel Market," The luxury travel market size was valued at $890.8 billion in 2023, and is estimated to reach $2149.7 billion by 2035, growing at a CAGR of 7.4% from 2024 to 2035.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/1662

Luxury travel refers to travel experiences that offer exceptional comfort, exclusivity, and personalized services, typically catering to…

Men Personal Care Market to Grow at a CAGR of 8.6% and will Reach USD 276.9 bill …

According to a new report published by Allied Market Research, titled, "Men Personal Care Market by Type, Age Group, Price Point, and Distribution Channel: Global Opportunity Analysis and Industry Forecast, 2021-2030," the men personal care market size is expected to reach $276.9 billion by 2030 at a CAGR of 8.6% from 2021 to 2030.

Request The Sample PDF of This Report: @ https://www.alliedmarketresearch.com/request-sample/1701

Men personal care products are non-medicinal…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…