Press release

Carbon Credit Market Expected to Expand Rapidly at 12.3% CAGR Through 2033 Says Persistence Market Research

The global carbon credit (carbon offset) market is undergoing unprecedented expansion as businesses and governments accelerate efforts to combat climate change. Carbon credits, representing one ton of CO2 emissions either avoided or removed from the atmosphere, have become critical tools for organizations aiming to meet emissions reduction targets. The market includes compliance-driven carbon trading systems, such as the European Union Emissions Trading System (EU ETS) and the Carbon Border Adjustment Mechanism (CBAM), as well as voluntary offsets purchased by corporations seeking to achieve net-zero targets beyond regulatory obligations.Download Your Free Sample & Explore Key Insights: https://www.persistencemarketresearch.com/samples/33769

In 2026, the global carbon credit market is projected to reach US$ 1,260.3 billion, with forecasts estimating it could surge to US$ 2,838.8 billion by 2033, growing at a CAGR of 12.3%. This growth is underpinned by both regulatory compliance and voluntary corporate initiatives. Europe currently leads the market with nearly 80% share, driven by well-established compliance infrastructure, stringent climate regulations, declining emissions caps, and high carbon prices that incentivize active participation. North America is the fastest-growing region, expanding at 16.5% CAGR through 2033, supported by state-level compliance schemes like the Regional Greenhouse Gas Initiative and increasing corporate sustainability commitments.

The compliance segment dominates the market with 99% share, reflecting mandatory obligations under established frameworks. Meanwhile, the carbon removal and sequestration segment is the fastest-growing, benefiting from declining costs, improved renewable energy integration, and emerging commercial opportunities for captured CO2 in synthetic fuels and industrial chemicals.

Key Highlights from the Report

• The global carbon credit market is projected to reach US$ 2,838.8 billion by 2033.

• Europe holds the largest market share, accounting for nearly 80% in 2026.

• North America is the fastest-growing regional market with a 16.5% CAGR through 2033.

• The compliance carbon market maintains dominance with a 99% share.

• Carbon removal/sequestration projects are the fastest-growing segment at 19.2% CAGR.

• Article 6 of the Paris Agreement offers significant international trading opportunities.

Market Segmentation

The carbon credit market is segmented primarily by business model, project type, and end-user industry. By business model, the compliance market dominates, accounting for almost the entire market value due to legal requirements under emission trading schemes, cap-and-trade systems, and regional carbon pricing mechanisms. Conversely, the voluntary carbon market is expanding rapidly, driven by corporate net-zero pledges, ESG mandates, and supply chain decarbonization initiatives. Verified carbon credits in the voluntary market allow companies to offset emissions exceeding regulatory obligations, often at premium prices reflecting project quality and additionality.

Project type segmentation differentiates avoidance/reduction projects from removal/sequestration projects. Avoidance projects, such as renewable energy deployment, methane capture, and energy efficiency improvements, account for roughly 70% of current carbon credit transactions. Removal and sequestration projects-including afforestation, reforestation, soil carbon storage, biochar, and direct air capture-are gaining momentum as businesses shift focus toward permanent CO2 removal. These projects not only meet regulatory compliance but also support corporate credibility in long-term net-zero strategies.

End-user segmentation highlights the power sector as the dominant category, representing nearly 30% of demand in 2026 due to its significant greenhouse gas emissions. Other high-demand sectors include oil and gas, aviation, industrial manufacturing, and transportation. The aviation sector, in particular, is increasingly reliant on carbon credits under the CORSIA scheme to offset international flight emissions, creating niche demand for high-quality removal projects.

Get Custom Insights Designed for Your Business: https://www.persistencemarketresearch.com/request-customization/33769

Regional Insights

Europe maintains its position as the global leader in carbon credits, driven by mature compliance markets like the EU ETS, strict emissions caps, and carbon border adjustment mechanisms. Voluntary market growth is also strong, fueled by corporate ESG commitments and investor scrutiny. The region is increasingly shifting toward high-integrity removal credits, including engineered solutions and nature-based offsets.

North America is the fastest-growing region, propelled by established compliance schemes such as California's cap-and-trade program and the Regional Greenhouse Gas Initiative (RGGI). Robust corporate net-zero commitments and technological infrastructure further accelerate market expansion, particularly for voluntary offsets.

Asia Pacific is the primary supply hub for carbon credits. By 2024, the region accounted for 56% of global issuance, with China generating 48% and India 23% of the total. Emerging markets, including Indonesia, Vietnam, and Thailand, are actively expanding project pipelines and preparing for compliance and voluntary schemes. Article 6 implementation enables cross-border trading, increasing the international role of Asian carbon credits.

Market Drivers

Corporate net-zero pledges and ESG mandates are key drivers reshaping the carbon credit market. Companies are increasingly seeking carbon credits to neutralize residual emissions that cannot be eliminated internally. Investor pressure, evolving credit-rating frameworks, and consumer expectations for transparency intensify demand. Regulatory compliance mechanisms, including the EU ETS, CBAM, and CORSIA, also create inelastic demand for carbon credits, compelling regulated entities to purchase credits regardless of economic cycles. International agreements such as the Paris Agreement further strengthen structural demand by translating global climate commitments into enforceable domestic policies.

Market Restraints

Despite robust growth, the market faces significant challenges. High verification and certification costs limit participation for small-scale and community-based projects, particularly in emerging economies. Technical expertise is required for monitoring, reporting, and verification under standards like Verra and Gold Standard, creating entry barriers. Fixed costs for certification and compliance restrict smaller initiatives, reducing diversity in carbon supply sources. These structural hurdles limit the scalability of low-cost, high-impact projects such as tropical reforestation and sustainable land management, despite their climate mitigation potential.

Market Opportunities

The carbon credit market is moving toward high-integrity carbon removal and long-term sequestration projects. Corporate net-zero strategies increasingly demand durable removal credits, creating premium pricing opportunities. Technologies and methodologies such as direct air capture, afforestation, biochar, and soil carbon storage are emerging as key growth areas. The Article 6 framework under the Paris Agreement enables cross-border trading, allowing Asian project developers to participate in international markets. Advances in monitoring and verification reduce integrity risks, improving investor confidence and supporting sustainable market growth.

Checkout Now & Download Complete Market Report: https://www.persistencemarketresearch.com/checkout/33769

Company Insights

The global carbon credit market features both established climate solution providers and emerging project developers. Key players include:

• EKI Energy Services Ltd.

• 3Degrees

• Finite Carbon

• Climeco LLC

• CarbonBetter

• Tasman Environmental Markets

• ClimatePartner GmbH

• Terrapass

• Carbon Credit Capital LLC

• South Pole Group

• Puro.earth

• Xpansiv

• Carbon Trade Exchange

• AirCarbon Exchange

• Deloitte

Market Segmentation

By Business Model

Voluntary Market

Compliance Market

By Project Type

Avoidance/Reduction Projects

Removal/Sequestration Projects

By End-User

Power

Energy

Aviation

Transportation

Buildings

Industrial

Others

By Region

North America

Europe

East Asia

South Asia & Oceania

Latin America

Middle East & Africa

Recent Developments:

In October 2025, EKI Energy Services registered a floating solar installation certified under Verra's Verified Carbon Standard, pioneering renewable energy-based carbon credits.

In December 2025, a tech-backed carbon removal coalition invested $44.2 million in high-integrity carbon removal credits from NULIFE GreenTech, signaling growing investment in durable removal solutions.

Conclusion

The carbon credit (carbon offset) market is entering a phase of unprecedented growth driven by regulatory compliance, corporate net-zero commitments, and the rise of high-integrity carbon removal projects. Europe continues to dominate with well-established compliance infrastructure, while North America demonstrates rapid growth fueled by voluntary and compliance schemes. Asia Pacific, particularly China and India, serves as a critical supply hub, leveraging renewable energy and reforestation initiatives to meet international demand.

While challenges such as high certification costs and technical barriers limit smaller project participation, opportunities in carbon removal, Article 6 trading frameworks, and technology-driven verification systems are creating long-term growth potential. The transition from avoidance-based offsets to permanent carbon removal is reshaping the market landscape, offering premium pricing, investor confidence, and global scalability. With continued innovation, policy support, and corporate engagement, the carbon credit market is poised to play a pivotal role in achieving global net-zero and climate-resilient futures.

Contact Us:

Persistence Market Research

Second Floor, 150 Fleet Street, London, EC4A 2DQ, United Kingdom

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Carbon Credit Market Expected to Expand Rapidly at 12.3% CAGR Through 2033 Says Persistence Market Research here

News-ID: 4337188 • Views: …

More Releases from Persistence Market Research

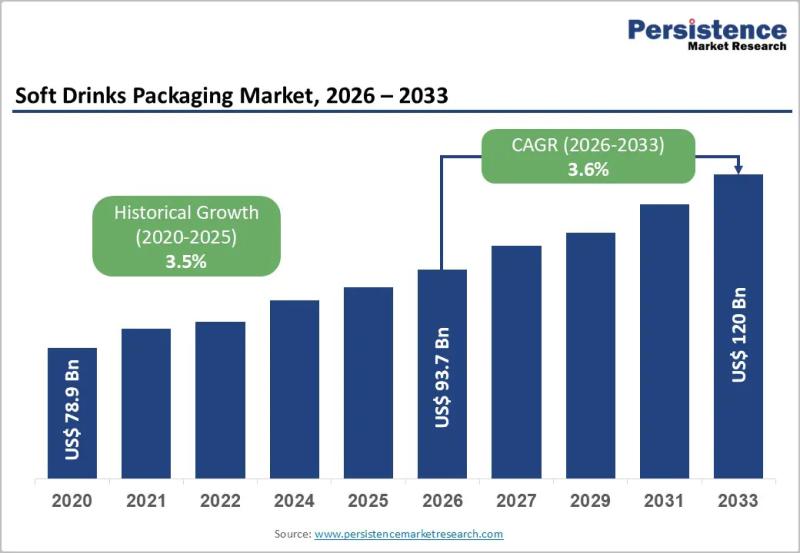

Soft Drinks Packaging Market to Reach US$120.0 Billion by 2033 - Persistence Mar …

The soft drinks packaging market plays a central role in the global beverage industry, serving carbonated drinks, juices, flavored water, energy drinks, and ready to drink teas and coffees. Packaging is no longer limited to containment and transportation; it has evolved into a critical component of branding, sustainability strategy, consumer convenience, and supply chain efficiency. Manufacturers are increasingly focusing on lightweight materials, recyclable packaging formats, and innovative designs that improve…

Christmas Tree Valves Market Size to Reach US$8.1 Billion by 2033 - Persistence …

The Christmas Tree Valves Market plays a critical role in the upstream oil and gas industry, serving as a central component in wellhead equipment systems. Christmas tree valves are installed on oil and gas wells to control pressure, regulate flow, and ensure safe extraction of hydrocarbons. These assemblies, commonly referred to as "Christmas trees," consist of multiple valves, spools, and fittings arranged in a structure that resembles a decorated tree.…

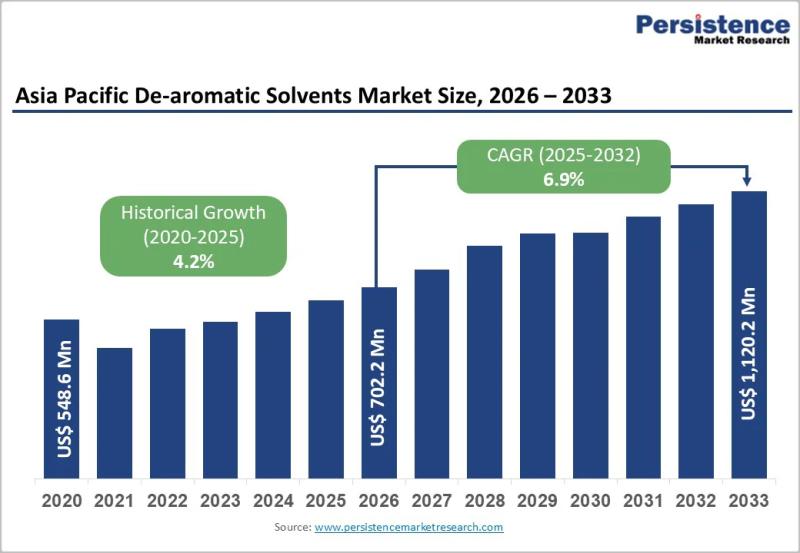

Asia Pacific De-aromatic Solvents Market to Reach US$1,120.2 Million by 2033 - P …

The Asia Pacific De-aromatic Solvents Market is gaining steady momentum as industries across the region increasingly shift toward low aromatic, high purity solvent formulations. De-aromatic solvents are hydrocarbon solvents that have significantly reduced aromatic content, making them suitable for applications requiring low odor, lower toxicity, and improved environmental performance. These solvents are widely used in paints and coatings, adhesives, inks, metalworking fluids, agrochemicals, and cleaning formulations. As regulatory scrutiny around…

Off-Highway Radiators Market to Reach US$ 7.2 Bn by 2033 as Leading Players Like …

The off-highway radiators market plays a vital role in ensuring efficient thermal management in heavy-duty equipment used across construction, agriculture, mining, and forestry sectors. These radiators regulate engine temperatures, prevent overheating, and support consistent equipment performance under extreme operating conditions. Growing mechanization and the expansion of infrastructure projects worldwide are increasing reliance on durable cooling systems. Equipment manufacturers are prioritizing high-performance radiators that offer reliability, longer service life, and resistance…

More Releases for Carbon

Carbon-Carbon Composite Market to Reach $3.31 Billion by 2031 | SGL Carbon, Toyo …

NEW YORK, (UNITED STATES) - QY Research latest 'Carbon-Carbon Composite Market 2025 Report' offers an unparalleled, in-depth analysis of the industry, delivering critical market insights that empower businesses to enhance their knowledge and refine their decision-making processes. This meticulously crafted report serves as a catalyst for growth, unlocking immense opportunities for companies to boost their return rates and solidify their competitive edge in an ever-evolving market. What sets this report…

Carbon Black Market Next Big Thing | Cabot, Tokai Carbon, Jiangxi Black Carbon, …

Market Research Forecast published a new research publication on "Global U.S. U.S. Carbon Black Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the U.S. U.S. Carbon Black Market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive…

Carbon-Carbon Composite Material Market Size, Share 2024, Impressive Industry Gr …

Report Description: -

QY Research's latest report 'Carbon-Carbon Composite Material Market 2024 Report' provides a comprehensive analysis of the industry with market insights will definitely facilitate to increase the knowledge and decision-making skills of the business, thus providing an immense opportunity for growth. Finally, this will increase the return rate and strengthen the competitive advantage within. Since it's a personalised market report, the services are catered to the particular difficulty. The…

Carbon Black Market Scenario & Industry Applications 2020-2025 | Phillips Carbon …

The global carbon black market size is projected to surpass USD 18 billion by 2025. Carbon black act as a reinforcement material for tires and rubber, and possess electrical conductive properties. Carbon black provide pigmentation, conductivity, and UV protection for a number of coating applications along with toners and printing inks for specific color requirements. Its multiple application across various end product along with rising economic outlook has significantly enhanced…

Global Carbon-Carbon Composite Market 2020-2026 SGL Carbon, Toyo Tanso, Tokai Ca …

Global Carbon-Carbon Composite Market 2020-2026 analysis Report offers a comprehensive analysis of the market. It will therefore via depth Qualitative insights, Historical standing and verifiable projections regarding market size. The projections featured inside the report square measure derived victimisation verified analysis methodologies and assumptions. Report provides a progressive summary of the Carbon-Carbon Composite business 2020 together with definitions, classifications, Carbon-Carbon Composite market research, a decent vary of applications and Carbon-Carbon…

Global Carbon Black Market to 2026| Cabot, Orion Engineered Carbons, Birla Carbo …

Albany, NY, 10th January : Recent research and the current scenario as well as future market potential of "Carbon Black Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2018 - 2026" globally.

Carbon Black Market - Overview

Carbon black (CB) is manufactured through partial combustion of heavy hydrocarbons under controlled temperature and pressure to obtain fine particles and aggregates having a wide range of structure and surface properties. This…