Press release

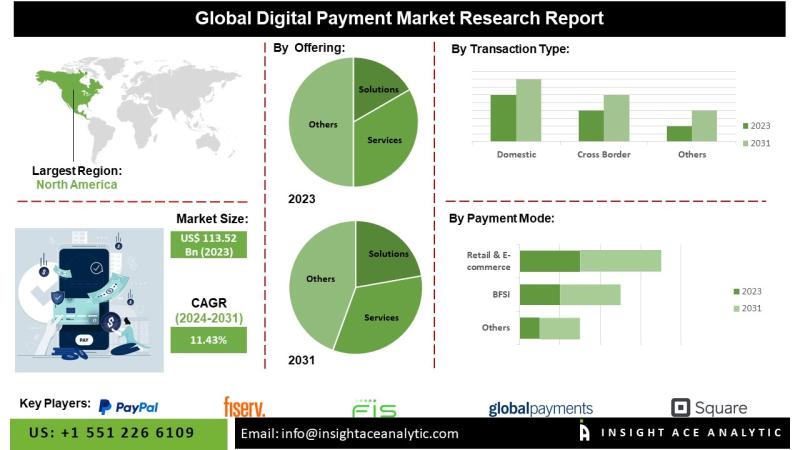

Digital Payment Market Size and Forecast Fueled by Secure Payment Infrastructure and User Convenience

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Digital Payment Market- (By Offering (Solutions (Payment Gateway, Payment Processors, Payment Wallet, Point of Sale, and Other Solutions), Services (professional services (Consulting, Implementation, Support & Maintenance), Managed Services), By Transaction Type (Domestic and Cross Border), Payment Mode (Cards, Digital Wallet, ACH Transfer), By Vertical (BFSI, Retail & E-commerce, Healthcare, Travel & Hospitality, IT & ITeS, Telecom, Transportation & Logistics, Media & Entertainment, Other Verticals)), Trends, Industry Competition Analysis, Revenue and Forecast To 2034."Global Digital Payment Market Size is valued at USD 124.8 Billion in 2024 and is predicted to reach USD 357.7 Billion by the year 2034 at a 11.2% CAGR during the forecast period for 2025-2034.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/2168

Digital payments involve the electronic exchange of monetary value between individuals, enterprises, or institutions through digital channels. These transactions include online payments, mobile-based payment solutions, contactless methods, and the use of digital wallets. Supported by improvements in internet accessibility, mobile device penetration, and secure payment infrastructures, digital payment systems provide a convenient, efficient, and dependable alternative to traditional cash-based and paper-based transactions. In recent years, the digital payments landscape has undergone rapid expansion and technological advancement, significantly transforming how financial transactions are executed by consumers and businesses alike.

The market is characterized by intense competition, encompassing established banking institutions, global technology corporations, and innovative fintech companies. Market growth is largely driven by the proliferation of e-commerce and the widespread adoption of technology-enabled financial services. Leading providers such as Google Pay, Apple Pay, Samsung Pay, and Alipay have established strong market positions through sustained investments in advanced technologies and continuous platform development. Notably, Alipay, developed by Alibaba Group, has enhanced transaction efficiency between consumers and merchants, contributing to improved operational processes and a more seamless payment experience.

List of Prominent Players in the Digital Payment Market:

• PayPal (US)

• Fiserv (US)

• FIS (US)

• Global Payments (US)

• Square (US)

• Stripe (US)

• VISA (US)

• Mastercard (US)

• Worldline (France)

• Adyen (Netherlands)

• ACI Worldwide (US)

• Temenos (Switzerland)

• PayU (Netherlands)

• Apple (US)

• JPMorgan Chase (US)

• WEX (US)

• FLEETCOR (US)

• Aurus (US)

• PayTrace (US)

• Stax by FattMerchant (US)

• Verifone(US)

• Spreedly (US)

• Dwolla (US)

• BharatPe (India)

• Payset (UK)

• PaySend (UK)

• MatchMove (Singapore)

• Ripple (US)

• EBANX (Brazil)

• Others

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-02

Market Dynamics

Drivers:

The digital payments market is experiencing robust growth, primarily driven by increasing consumer preference for cashless transactions, which provide greater speed, convenience, and security in fund transfers. The adoption of cost-effective payment technologies, including QR code-based solutions and compact point-of-sale terminals, further supports this transition.

Younger demographics, particularly millennials, are at the forefront of migrating toward mobile and online payment platforms. Moreover, the rising demand for seamless, user-friendly experiences has become a key growth driver. In a highly competitive landscape, providers that deliver superior customer experiences are better positioned to enhance engagement, foster brand loyalty, and achieve long-term market retention.

Challenges:

Despite promising growth, the digital payments sector faces notable challenges. A primary constraint is the lack of standardized frameworks for cross-border transactions. Variations in regulatory requirements across jurisdictions, coupled with limited technical expertise in emerging markets, impede the efficiency of global digital payment systems. The expansion of international trade further accentuates operational complexities stemming from inconsistent government regulations, disparate data governance policies, and incompatible national payment infrastructures. Additionally, many domestic systems are not equipped to support seamless cross-border integration, limiting scalability and the overall effectiveness of international digital payment solutions.

Regional Trends:

The Asia-Pacific (APAC) region is expected to dominate the global digital payments market in terms of revenue, exhibiting a strong compound annual growth rate (CAGR). High adoption of digital wallets and mobile payment platforms in populous markets such as China and India, alongside elevated smartphone penetration, are key drivers of regional expansion. North America remains a significant market contributor, supported by advanced digital infrastructure, widespread internet accessibility, and a technologically adept consumer base, creating favorable conditions for the continued adoption of digital payment solutions across both consumer and enterprise segments.

Recent Developments:

• In Sept 2023, Temenos contributed cutting-edge payment functionalities to IBM Cloud, thereby facilitating the transformation of financial institutions with an emphasis on security and adherence to regulations. Availability was extended to the Temenos Payments Hub on IBM Cloud for Financial Services throughout IBM's hybrid cloud infrastructure, powered by LinuxONE and Red Hat OpenShift with IBM Power.

• In Aug 2023, PayPal Holdings Inc introduced stablecoin, making it the first major financial company. This action has the potential to greatly enhance the sluggish acceptance of digital tokens for transactions.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/2168

Segmentation of Digital Payment Market-

By Offering-

• Solutions

o Payment Gateway Solutions

o Payment Processor Solutions

o Payment Wallet Solutions

o Point of Sale (POS) Solutions

o Others

• Services

o Professional Services

Consulting

Implementation

Support & Maintenance

o Managed Services

By Transaction Type-

• Domestic

• Cross Border

By Payment Mode-

• Cards

• ACH Transfer

• Digital Wallet

• Others

By Vertical-

• BFSI

• Retail & E-Commerce

• IT & ITeS

• Telecom

• Healthcare

• Travel & Hospitality

• Transportation & Logistics

• Media & Entertainment

• Others

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• Southeast Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

Read Overview Report- https://www.insightaceanalytic.com/report/digital-payment-market/2168

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: https://www.insightaceanalytic.com/

Tel : +1 607 400-7072

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Payment Market Size and Forecast Fueled by Secure Payment Infrastructure and User Convenience here

News-ID: 4336998 • Views: …

More Releases from Insightace Analytic Pvt Ltd.

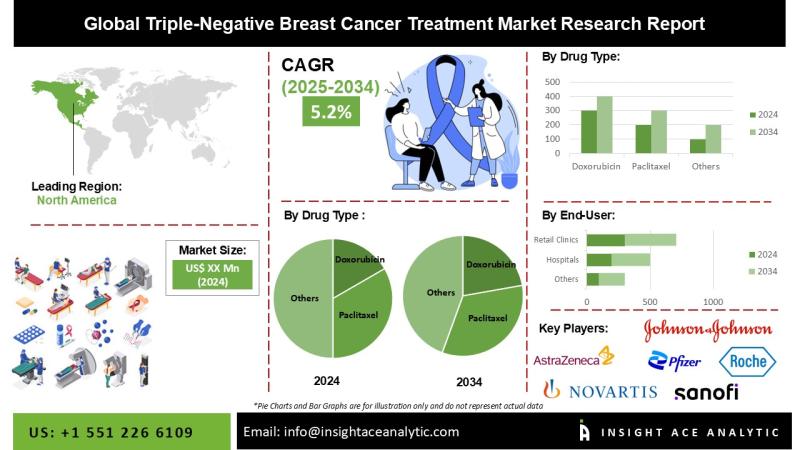

Triple-Negative Breast Cancer Treatment Market Size Benchmarking and Outlook 202 …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Triple-Negative Breast Cancer Treatment Market- by Drug Types (Doxorubicin, Cyclophosphamide, Paclitaxel, Docetaxel, Carboplatin/Cisplatin, and other Drug Type), End-Users (Hospitals, Cancer Research Institutes, and Retail Clinics), Trends, Industry Competition Analysis, Revenue and Forecast To 2034."

According to the latest research by InsightAce Analytic, the global Triple-Negative Breast Cancer Treatment Market Size is estimated to grow at a…

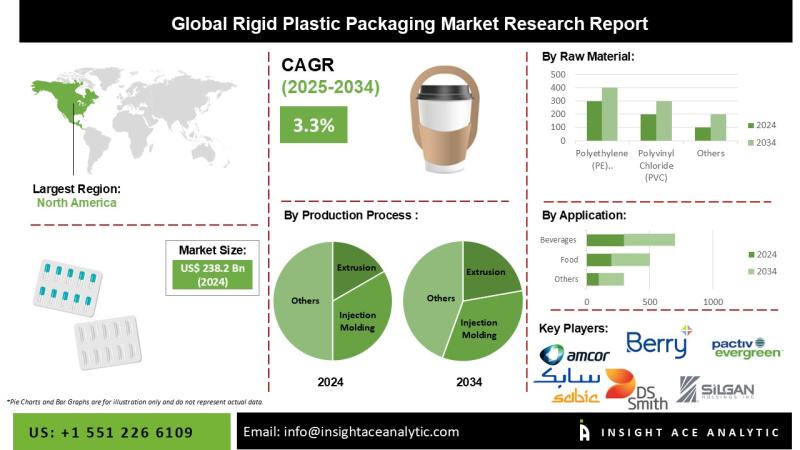

Rigid plastic packaging market Future Growth Hotspots and Forecast 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Rigid Plastic Packaging Market Size, Share & Trends Analysis Report By Application (Food, Beverages, Healthcare, Cosmetics, Industrial), Raw Material (Bioplastics, PE, PET, PS, PP, PVC, EPs, PC, Polyamide), Type (Bottles & Jars, Rigid Bulk Products, Trays, Tubs, Cups, And Pots), Production Process (Extrusion, Injection Molding, Blow Molding And Thermoforming)- Market Outlook And Industry Analysis 2034"…

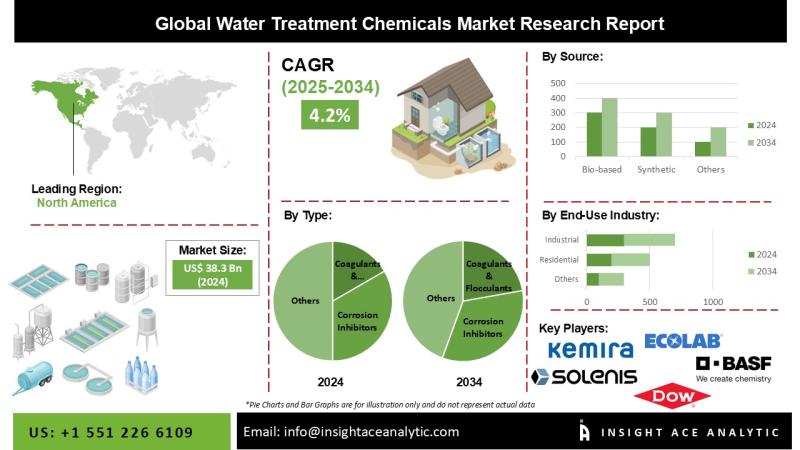

Water Treatment Chemicals Market Advanced Market Intelligence Report 2026 to 203 …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Water Treatment Chemicals Market Size, Share & Trends Analysis Report By Type (Corrosion Inhibitors, Scale Inhibitors, Biocides & Disinfectants, Coagulants & Flocculants, Chelating Agents, Anti-Foaming Agents, PH Adjusters, Stabilizers), Application (Boiler Water Treatment, Cooling Water Treatment, Raw Water Treatment, Water Desalination), End-Use Industry (Residential, Commercial And Industrial), And Source (Synthetic And Bio-Based)- Market Outlook And…

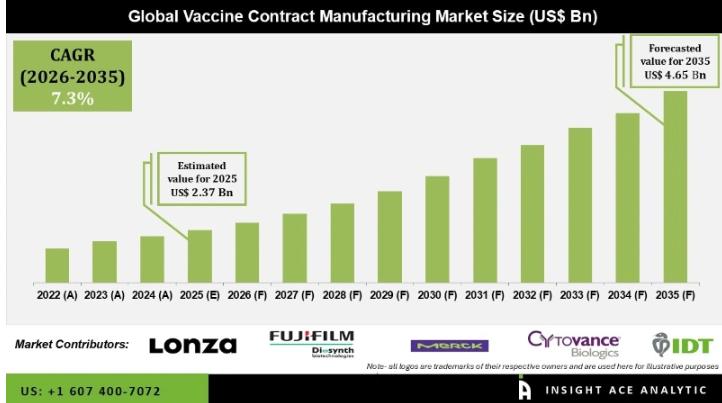

Vaccine Contract Manufacturing Market Value Chain and Forecast Analysis 2026 to …

"Vaccine Contract Manufacturing Market Size is valued at USD 2.37 Bn in 2025 and is predicted to reach USD 4.65 Bn by the year 2035 at a 7.30% CAGR during the forecast period for 2026 to 2035.

Request For Free Sample Pages:

https://www.insightaceanalytic.com/request-sample/2303

Latest Drivers Restraint and Opportunities Market Snapshot:

Key factors influencing the global Vaccine Contract Manufacturing market are: …

More Releases for Pay

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Mobile Wallet (NFC, Digital Wallet) Market to Witness Stunning Growth | Apple Pa …

HTF MI recently introduced Global Mobile Wallet (NFC, Digital Wallet) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Apple Pay, Google Pay, Samsung Pay, PayPal, Alipay, WeChat Pay,…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…