Press release

How Enterprise Payments Platforms Are Transforming Global Business Payments

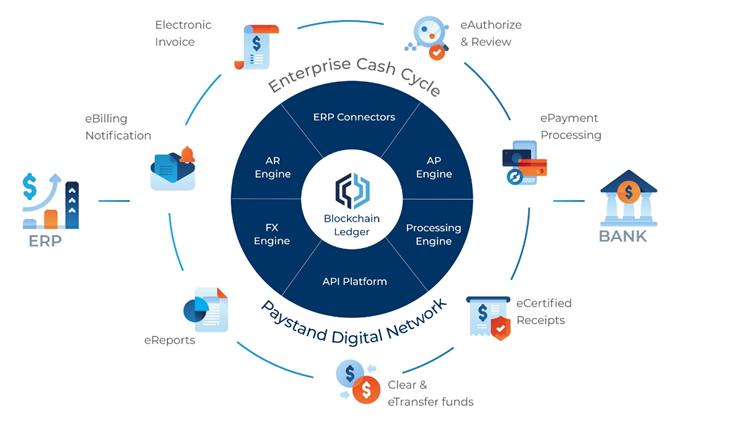

The enterprise payments platform market has emerged as a foundational pillar of modern digital commerce, enabling organizations to manage, process, and optimize complex payment workflows across multiple channels and geographies. These platforms unify card payments, ACH transfers, real-time payments, cross-border transactions, and alternative payment methods within a single, scalable infrastructure. As enterprises increasingly move away from fragmented legacy systems, enterprise payments platforms are becoming essential for operational efficiency, regulatory compliance, and customer experience enhancement.In terms of market size, the global enterprise payments platform market is likely to be valued at US$ 16.5 billion in 2026 and is expected to reach US$ 32.1 billion by 2033, expanding at a CAGR of 10.0% from 2026 to 2033. This steady growth trajectory is driven by enterprise-wide digital transformation initiatives, rising adoption of cloud-native architectures, and the need for real-time, API-driven, multi-rail payment capabilities. Organizations across BFSI, retail, e-commerce, and large corporates are prioritizing modern payment orchestration to stay competitive in an increasingly digital economy.

Elevate your business strategy with comprehensive market data. Request a sample report now: https://www.persistencemarketresearch.com/samples/32069

Market Dynamics: Key Growth Drivers and Leading Segments

One of the primary growth drivers behind the enterprise payments platform market is the rapid modernization of legacy payment systems. Enterprises are under pressure to support instant payments, open banking integrations, and embedded finance use cases, all of which require flexible, API-first platforms. Regulatory initiatives supporting instant payments and open banking, particularly in developed economies, have further accelerated enterprise adoption by reducing barriers to innovation and encouraging interoperability across financial ecosystems.

From a segmentation perspective, solutions dominate the market, accounting for approximately 65% of the revenue share in 2026, as enterprises prioritize core payment functionalities such as real-time gateways, fraud detection, reconciliation, and compliance management. Cloud-based deployments lead the market with over 55% share, driven by scalability, cost efficiency, and support for distributed enterprise operations. BFSI remains the leading end-user segment, representing over 40% of total revenue, due to high transaction volumes, stringent regulatory requirements, and advanced fraud management needs.

Enterprise Payments Platform Market Statistics and Competitive Landscape

The enterprise payments platform market is characterized by strong competition among established financial technology providers, global payment processors, and emerging SaaS-based vendors. Market growth is supported by rising transaction volumes across digital channels, increasing cross-border trade, and the proliferation of embedded finance models. Enterprises are no longer viewing payment platforms as back-office utilities but as strategic assets that directly influence customer experience and revenue growth.

North America leads the global market, accounting for nearly 35% of market share in 2026, supported by a mature digital payments ecosystem, strong innovation culture, and favorable regulatory frameworks. Meanwhile, Asia Pacific is expected to be the fastest-growing region during the forecast period, driven by rapid digitalization, high smartphone penetration, and government-led initiatives promoting cashless economies. This combination of mature and emerging markets creates a balanced global growth outlook for enterprise payments platforms.

Key Highlights from the Report

The global enterprise payments platform market is projected to grow at a CAGR of 10.0% from 2026 to 2033.

Market size is expected to increase from US$ 16.5 billion in 2026 to US$ 32.1 billion by 2033.

North America is the largest regional market, accounting for around 35% share in 2026.

Asia Pacific is anticipated to be the fastest-growing regional market during the forecast period.

Solutions dominate the component segment, representing approximately 65% of total revenue.

BFSI remains the leading end-user segment due to high transaction volumes and compliance needs.

Market Segmentation Analysis

The enterprise payments platform market is segmented based on component type, deployment mode, end-user, and payment type. By component, the market is broadly divided into solutions and services. Solutions form the backbone of enterprise payments platforms, offering functionalities such as payment processing, transaction routing, fraud detection, compliance management, and analytics. Services, including implementation, integration, and support, play a critical role in ensuring seamless deployment across complex enterprise environments.

Based on deployment mode, the market is segmented into cloud-based and on-premise platforms. Cloud-based enterprise payments platforms are gaining rapid traction due to their scalability, lower upfront costs, and ability to support real-time updates and integrations. On-premise solutions continue to find adoption among highly regulated enterprises that require greater control over data and infrastructure, though their market share is gradually declining as cloud security and compliance standards improve.

End-User and Industry Vertical Insights

From an end-user perspective, the enterprise payments platform market serves BFSI, retail and e-commerce, IT and telecom, healthcare, manufacturing, and other large enterprises. BFSI leads adoption due to its need for high-volume, multi-rail transaction processing and stringent regulatory compliance. Retail and e-commerce enterprises are rapidly adopting advanced payment platforms to support omni-channel payments, digital wallets, and cross-border transactions.

Large corporates across manufacturing and logistics are also emerging as key adopters, leveraging enterprise payments platforms to streamline supplier payments, improve cash flow visibility, and reduce operational inefficiencies. As embedded finance models gain traction, non-financial enterprises are increasingly integrating payment capabilities directly into their platforms, further expanding the addressable market.

Regional Insights: North America and Europe

North America remains the dominant region in the enterprise payments platform market, supported by early adoption of digital payment technologies and a strong presence of leading fintech and payment solution providers. The region benefits from robust infrastructure, high enterprise IT spending, and regulatory initiatives that encourage innovation in instant payments and open banking. Enterprises in the U.S. and Canada are actively investing in modern payment orchestration to enhance customer experience and operational agility.

Europe represents a mature yet evolving market, driven by regulatory frameworks such as PSD2 and open banking mandates. These regulations have accelerated API adoption and interoperability across financial institutions, creating strong demand for enterprise payments platforms. European enterprises are focusing on cross-border payment efficiency and compliance, making the region a key contributor to global market revenue.

Secure Your Full Report - Proceed to Checkout: https://www.persistencemarketresearch.com/checkout/32069

Regional Insights: Asia Pacific and Rest of the World

Asia Pacific is expected to register the fastest growth in the enterprise payments platform market during the forecast period. Rapid urbanization, expanding e-commerce ecosystems, and widespread smartphone adoption are driving digital payment volumes across countries such as China, India, and Southeast Asian nations. Government initiatives promoting cashless economies and real-time payment infrastructure further strengthen regional growth prospects.

The rest of the world, including Latin America, the Middle East, and Africa, is witnessing gradual adoption of enterprise payments platforms. Increasing financial inclusion, growth of digital banking, and rising cross-border trade are creating new opportunities for platform providers, particularly those offering scalable and localized solutions.

Market Drivers

The primary driver of the enterprise payments platform market is the increasing need for real-time, omni-channel payment processing. Enterprises are under pressure to deliver seamless payment experiences across digital and physical channels while ensuring speed, security, and transparency. The shift toward API-driven architectures and microservices has further accelerated adoption, enabling enterprises to integrate new payment methods quickly.

Another key driver is the rise of embedded finance and open banking ecosystems. Enterprises are embedding payment capabilities directly into their platforms to create new revenue streams and enhance customer engagement. Regulatory support for open banking and instant payments has lowered entry barriers and encouraged innovation across the payments value chain.

Market Restraints

Despite strong growth prospects, the enterprise payments platform market faces challenges related to data security and regulatory compliance. Enterprises handling large volumes of sensitive financial data must adhere to complex and evolving regulatory requirements, which can increase implementation costs and complexity. Concerns around cybersecurity and data breaches remain a significant restraint, particularly for cloud-based deployments.

Integration complexity is another notable restraint, especially for large enterprises with deeply entrenched legacy systems. Migrating to modern enterprise payments platforms requires careful planning, skilled resources, and substantial investment, which can slow adoption among cost-sensitive organizations.

Market Opportunities

The growing adoption of real-time payments presents significant opportunities for enterprise payments platform providers. As more countries roll out instant payment infrastructures, enterprises will require platforms capable of supporting high-speed, low-latency transactions across multiple rails. This creates opportunities for vendors offering flexible, scalable, and interoperable solutions.

Cross-border payments and global treasury management also represent high-growth opportunities. Enterprises operating across multiple regions are seeking unified platforms that provide real-time visibility, currency conversion, and compliance management. Vendors that can address these needs through advanced analytics and AI-driven capabilities are well-positioned to capture future market share.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/32069

Reasons to Buy the Report

✔ Gain a comprehensive understanding of the enterprise payments platform market size, trends, and growth outlook through 2033.

✔ Identify key growth drivers, restraints, and opportunities shaping enterprise payment modernization strategies.

✔ Analyze detailed market segmentation by component, deployment mode, end-user, and region.

✔ Understand competitive dynamics and strategic positioning of leading market players.

✔ Support data-driven investment and business decisions with reliable market forecasts and insights.

Frequently Asked Questions (FAQs)

How Big is the Enterprise Payments Platform Market and how fast is it growing globally?

Who are the Key Players in the Global Market for Enterprise Payments Platform solutions?

What is the Projected Growth Rate of the Enterprise Payments Platform Market during the forecast period?

What is the Market Forecast for the Enterprise Payments Platform Market for 2032 and beyond?

Which Region is Estimated to Dominate the Industry through the Forecast Period?

Company Insights

FIS

Fiserv

ACI Worldwide

Visa

Mastercard

PayPal

Stripe

Adyen

Worldline

Global Payments

Recent developments in the enterprise payments platform market include strategic partnerships between fintech providers and banks to accelerate real-time payment adoption, as well as increased investment in cloud-native, API-driven payment orchestration platforms to support embedded finance use cases. Leading players are also enhancing their platforms with AI-driven fraud detection and advanced analytics to deliver greater value to enterprise customers.

Conclusion: The Future of Enterprise Payments Platforms

The enterprise payments platform market is entering a phase of sustained growth, driven by digital transformation, regulatory support, and evolving enterprise payment needs. As organizations seek to modernize legacy systems and embrace real-time, omni-channel payment experiences, enterprise payments platforms will play an increasingly strategic role in business operations.

With strong growth prospects across both mature and emerging markets, the industry presents significant opportunities for technology providers, financial institutions, and enterprises alike. Vendors that focus on scalability, security, and interoperability will be best positioned to succeed in this dynamic and rapidly evolving market landscape.

Related Reports:

Intelligent Vending Machine Market https://www.persistencemarketresearch.com/market-research/intelligent-vending-machines-market.asp

Area Sensor Market https://www.persistencemarketresearch.com/market-research/area-sensors-market.asp

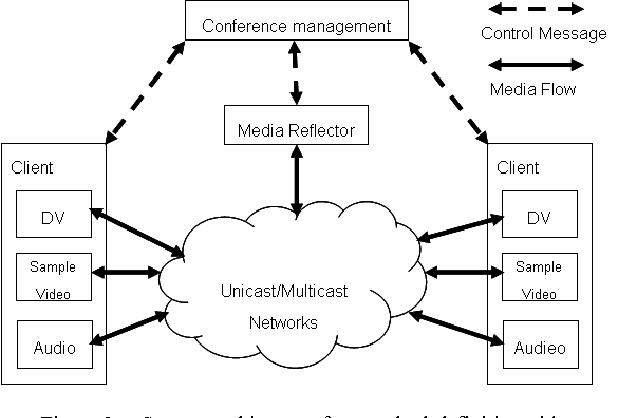

Video Conferencing Endpoints and Infrastructure Market https://www.persistencemarketresearch.com/market-research/video-conferencing-endpoints-and-infrastructure-market.asp

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

Contact Us:

Persistence Market Research

Second Floor, 150 Fleet Street,

London, EC4A 2DQ, United Kingdom

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How Enterprise Payments Platforms Are Transforming Global Business Payments here

News-ID: 4336849 • Views: …

More Releases from Persistence Market Research

How Video Conferencing Endpoints and Infrastructure Are Powering the Hybrid Work …

The video conferencing endpoints and infrastructure market has evolved from a supplementary enterprise tool into a core component of modern digital collaboration strategies. Organizations across industries now rely on high-quality video communication to support hybrid workforces, global teams, and customer-facing interactions. Endpoints such as room systems, desktops, mobiles, and immersive devices, combined with robust infrastructure including cloud platforms, servers, and network solutions, form the backbone of this rapidly expanding market.

In…

U.S. Energy Drinks Market US$49.0Bn by 2033 Driven by Youth Demand and Innovatio …

The U.S. energy drinks market is witnessing a period of sustained expansion, underpinned by evolving consumer lifestyles, increasing health awareness, and continuous product innovation by leading beverage manufacturers. In 2026, the market size is likely to be valued at approximately US$ 28.0 billion, reflecting the strong penetration of energy drinks across diverse demographic segments, including young adults, working professionals, fitness enthusiasts, and gamers. Over the forecast period from 2026 to…

How Intelligent Vending Machines Are Reshaping Automated Commerce

The intelligent vending machine market is undergoing a significant transformation as automation, digital payments, and data-driven retail converge. Valued at US$ 10.4 billion in 2025, the global intelligent vending machine market is projected to reach US$ 23.4 billion by 2032, expanding at a robust CAGR of 12.3% during the forecast period. This growth reflects a structural shift from traditional coin-operated vending to smart, connected, and analytics-enabled machines that deliver superior…

How Mobile Marketing Is Redefining Customer Engagement in a Smartphone-First Wor …

The mobile marketing market has emerged as one of the most dynamic segments of the global digital advertising ecosystem, driven by the rapid shift toward mobile-first consumer behavior. As smartphones increasingly dominate internet access worldwide, businesses are reallocating marketing budgets to channels that deliver real-time, personalized engagement. Mobile marketing leverages formats such as SMS campaigns, push notifications, in-app advertising, location-based promotions, and mobile video ads to connect brands directly with…

More Releases for Enterprise

Why SMBs Deserve Enterprise-Level IT - Without the Enterprise Price Tag

Small and mid-sized businesses (SMBs) often operate under the misconception that enterprise-level IT solutions are reserved only for large corporations with unlimited budgets. Yet in today's digital-first economy, SMBs face many of the same risks and operational demands as their larger counterparts: cybersecurity threats, regulatory compliance, and the need for efficient, reliable technology to support growth. A managed IT services provider, Cortavo [https://cortavo.com/what-is-cortavo], has demonstrated that enterprise-level IT does not…

OpenPayd's Ozan Ozerk Named Enterprise Entrepreneur at 2025 Enterprise Awards

London, 19 June 2025 - Dr. Ozan Ozerk, founder of OpenPayd, has been named "Enterprise Entrepreneur" at this year's Enterprise Awards, an event that celebrates the UK's most impactful technology founders. The ceremony took place at Drapers' Hall on the evening of 18 June, bringing together leaders from across the innovation and investment landscape.

The recognition comes after a period of substantial growth for OpenPayd. In the past 12 months, the…

Redefining Enterprise Connectivity: Enterprise VSAT Market Poised for Remarkable …

Enterprise VSAT's market was estimated to be worth US$ 4,324.5 Mn in 2022, and by the end of 2033, it is anticipated to have increased to US$ 8,110.5 Mn. In 2023, the market for corporate VSAT is anticipated to be worth $4,514.8 Mn USD. From 2023 to 2033, the enterprise VSAT market is anticipated to expand at a 6.0% CAGR.

Businesses in industries like retail and consumer goods, healthcare, BFSI, media…

Enterprise WLAN Market Awareness Overview 2025 | , Hewlett-Packard Enterprise, H …

Global Enterprise WLAN Market: Snapshot

The global enterprise WLAN is registering a significant rise in its valuation, thanks to the increasing penetration of Internet across the world. The rapidly rising market for enterprise WLAN technology is anticipated to boost the cloud technology and the Internet of Things (IoT) industries as well, inducing intense competitiveness. Moreover, the continual technological advancements are projected to increase WLAN applications in a number of industry sectors…

Enterprise Mobility Market - Generating an Increasing Demand for Enterprise Mobi …

Geographically-spread enterprises are constantly faced with scenarios that require the convergence of a large number of communication channels and inclusion of foreign computing devices in the central network.

With a vast rise in mobile devices that need to be integrated with enterprise networks, mostly owing to the increasing trend of policies such as bring-your-own-device and choose-your-own-device, and diversely located workplaces and employees, the need for adopting enterprise mobility solution has…

Enterprise Mobility Market - Generating an Increasing Demand for Enterprise Mobi …

Geographically-spread enterprises are constantly faced with scenarios that require the convergence of a large number of communication channels and inclusion of foreign computing devices in the central network. With a vast rise in mobile devices that need to be integrated with enterprise networks, mostly owing to the increasing trend of policies such as bring-your-own-device and choose-your-own-device, and diversely located workplaces and employees, the need for adopting enterprise mobility solution has…