Press release

Top 30 Indonesian Automotive Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)Astra International (ASII)

Astra Otoparts (AUTO)

Indomobil Sukses Internasional (IMAS)

Mitra Pinasthika Mustika (MPMX)

Goodyear Indonesia (GDYR)

Gajah Tunggal (GJTL)

Selamat Sempurna (SMSM)

Dharma Polimetal (DRMA)

Indo Kordsa (BRAM)

Indospring (INDS)

Multi Prima Sejahtera (LPIN)

Multistrada Arah Sarana (MASA)

Nipress (NIPS)

Prima Alloy Steel Universal (PRAS)

Garuda Metalindo (BOLT)

Autopedia Sukses Lestari (ASLC)

Bintang Oto Global (BOGA)

VKTR Teknologi Mobilitas (VKTR)

Isra Presisi Indonesia (ISAP)

Jantra Grupo Indonesia (KAQY)

Lupromax Pelumas Indonesia (LMAX)

Cipta Perdana Lancar (PART)

Anugerah Spareparts Sejahtera (AEGS)

CARS (Bintraco Dharma)

Tunas Ridean (TURI)

Kobexindo Tractors (KOBX)

Intraco Penta (INTA)

Astra Graphia (ASGR) automotive services/related ecosystem

Goodyear Tire Indonesia

Branta Mulia / Indo Kordsa

2) Revenue results of major public companies in Indonesia

1. Astra International Tbk (ASII)

Net profit (9M 2025): IDR 24.47 trillion ≈ USD 1.47 billion. Down 5% YoY due mainly to weaker coal-related income and slower car sales; still supported by financial and commodity segments.

2. Astra Otoparts Tbk (AUTO)

Revenue (9M 2025): IDR 14.8 trillion ≈ USD 0.89 billion. Net profit: IDR 1.6 trillion ≈ USD 96 million, up 2.6% YoY, with stronger margin performance adjusting for one-off items. Supported by solid OEM demand and expanding EV-component portfolio.

3. Indomobil Sukses Internasional Tbk (IMAS)

Revenue (9M 2025): IDR 22.72 trillion (≈ USD 1.36 billion), up 4.6% YoY. Net profit: IDR 360.75 billion (≈ USD 22 million), up 87.3% YoY. Growth driven by operational efficiency and expanded automotive distribution.

4. Goodyear Indonesia Tbk (GDYR)

Revenue (9M 2025): USD 120.17 million, down 7.6% YoY. Net profit: USD 3.34 million, down 37.5% YoY. Decline from weaker tire demand and higher costs.

5. Gajah Tunggal Tbk (GJTL)

Noted among leading tire producers; sector revenues were under pressure paralleling weaker vehicle sales, and the company recorded revenue declines during the period.

6. Selamat Sempurna Tbk (SMSM)

Saw continued growth in FY 2024 profit margin (~19.8%), positioning it as a stable components player.

Q3 2025 results indicated steady revenue, though detailed numbers are not publicly disclosed.

7. Dharma Polimetal Tbk (DRMA)

Revenue growth remained in single digits as of Sept 2025 alongside other component producers.

8. Mitra Pinasthika Mustika Tbk (MPMX)

Operates auto retail and distribution business; historical results show stable multi-billion-rupiah profits.

9. Indospring Tbk (INDS)

Recognized for spring manufacturing for commercial vehicles; part of the main automotive component listing set.

10. Garuda Metalindo Tbk (BOLT)

Was the only auto component issuer with double-digit revenue growth Jan-Sept 2025.

3) Key trends & insights from Q3 2025

1. Weakening local vehicle demand

National car sales dropped about 11% YoY in the first nine months of 2025. This pressured distributors, dealers, and OEM-linked component suppliers.

2. Components-sector resilience

Companies such as Astra Otoparts managed positive profit and revenue growth due to OEM demand and exports despite sluggish vehicle sales.

3. Diverging business performance

Large conglomerates like Astra saw mild profit declines (-5%), while some mid-caps such as Indomobil posted strong profit surges (≥+80% YoY).

4. Electrification and digitalization

Companies integrated EV-component production, charging infrastructure build-out, and digital retail services as new growth pillars.

4) Outlook for Q4 2025 and beyond

Sector leaders expect full-year-2025 performance to remain broadly in line with current trends, reflecting moderate growth potential but persistent market challenges.

Companies are optimistic about maintaining profitability thanks to diversification, cost controls, and EV-ecosystem participation.

Longer-term growth will depend on: consumer recovery, EV adoption and export competitiveness within ASEAN.

5) Conclusion

The top Indonesian public companies in the automotive sector delivered mixed Q3 2025 results:

Market leaders such as Astra maintained strong absolute profits above USD 1 billion but slowed slightly due to weaker macro factors.

Component manufacturers and distributors performed more robustly, with some mid-caps posting strong growth.

The sector appears to be entering a transformation cycle from purely production-volume growth to a more innovation-driven, electrified ecosystem.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Automotive Public Companies Q3 2025 Revenue & Performance here

News-ID: 4333684 • Views: …

More Releases from QY Research

Lightweight Protection, Heavyweight Growth: Inside the UV Resistant Low Weight E …

The global UV resistant low weight exterior paint industry represents a specialized segment of the broader exterior coatings and architectural paint sector, engineered to provide enhanced protection against ultraviolet (UV) radiation while reducing overall weight. This segment is increasingly significant in applications where weight reduction is critical, such as high-utilization fleets, specialized architectural structures, and environmentally demanding climates. The industry is driven by rising construction activity, sustainable building practices, and…

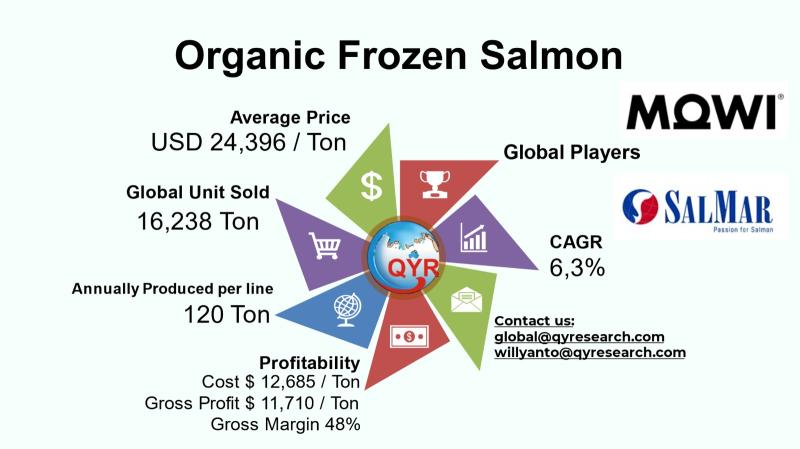

High Price, High Potential: Global Organic Frozen Salmon Market Analysis

The global organic frozen salmon market represents a specialized segment within the broader seafood and organic food industries, characterized by a growing consumer preference for sustainably sourced, minimally processed seafood products. While conventional salmon has long been a staple in many global diets, the organic frozen sub-segment appeals particularly to health-conscious, environmentally aware consumers who prioritize chemical-free aquaculture and traceable supply chains. This shift is driven by rising incomes, greater…

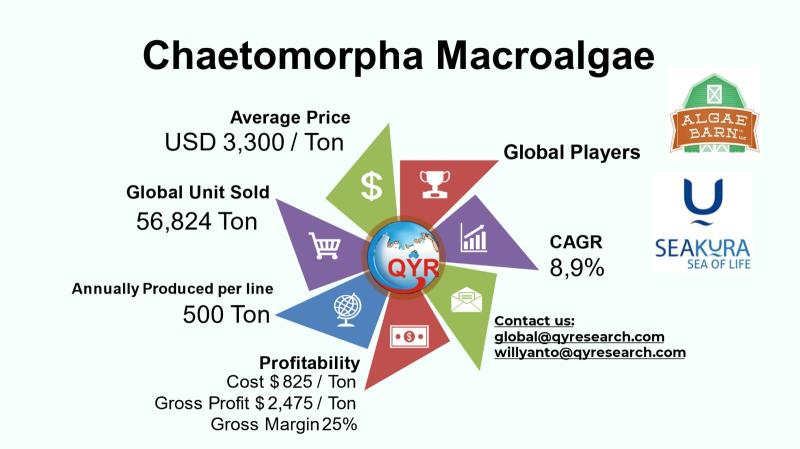

Green Gold: How Chaetomorpha Macroalgae Is Transforming Aquaculture and Eco-Indu …

The global market for Chaetomorpha Macroalgae has evolved from a niche ecological product into a diverse industrial raw material serving aquaculture, aquarium maintenance, water treatment, nutraceuticals, and emerging bioindustrial applications. Chaetomorphas fast growth, high nutrient uptake, and environmental remediation properties have elevated its status beyond hobbyist usage into large‐scale commercial supply chains, especially where water quality management and natural filtration are priorities. Globally, Chaetomorpha Macroalgae is expanding rapidly as part…

Global and U.S. AI Video Management Software Market Report, Published by QY Rese …

QY Research has released a comprehensive new market report on AI Video Management Software, refers to intelligent software platforms that use artificial intelligence to manage, analyze, and interpret video streams from cameras in real time. These systems go beyond traditional video recording by integrating AI-powered analytics, enabling automatic detection, classification, and alerting for events, behaviors, or anomalies.

https://www.qyresearch.com/reports/5546948/ai-video-management-software

Core Market Data

Global market size: USD 11.9 billion

CAGR (2024-2030): 18.1%

Average price: USD 11,000 per…

More Releases for Indo

Indocia Unveils $2,000 Monthly Bonus Top 50 $INDO Holders

The new initiative rewards long-term commitment by distributing $2,000 monthly among the top 50 token holders, boosting investor confidence and ecosystem stability.

An exclusive monthly incentive program has been launched by Indocia, a rising star in the decentralized arena, which directly benefits its most devoted and devoted fans. Starting this month, the top 50 INDO token holders will split a $2000 monthly pool of staking prizes, supporting the community's primary goal…

Indocia Officially Launches Presale Website for the INDO Token

Indocia proudly announces the launch of its presale website for the INDO token, a transformative move in the decentralized finance realm. Indocia.org ushers in a new age of crypto investment, characterized by substantial community involvement and the empowerment of its members.

The newly launched website offers detailed insights into the INDO token, emphasizing its role in advancing decentralized finance and promoting a more inclusive financial ecosystem. It simplifies the user journey…

Ashish Jain Announces New Indo-Fusion Restaurant in London

Dubai - 29 October, 2024 - Ashish Jain, a globally renowned finance innovator and one of the Top 25 Fund Managers in the World (2023), is taking his expertise to new heights. Jain has announced the launch of the Alieus Hedge Fund, a groundbreaking venture focused on high-growth sectors and alternative assets. In a surprising twist, Jain also revealed his latest business venture outside the finance industry-a new Indo-Fusion restaurant…

ZKSciences exhibiting at Indo Expo 2020 in Denver

ZKSciences is excited to be exhibiting at Indo Expo on January 25th and 26th in Denver, CO. ZKSciences representatives will be at booth #513, and eager to discuss with Indo Expo attendees the yield and growth enhancement capabilities offered by zeolites. Stop by to learn about the ZK GrowFactor(TM) family of zeolite soil amendments and how these bring additional yield increases over existing zeolite amendments. Professional growers are invited to…

Indo–UAE Business & Social Forum 2018–19

Press Release

Contact: Anam Kumar, Chief Editor, AsiaOne Magazine

Phone: 011-40236308; 9718885718

Email: anam@asiaone.co.in

india@asiaone.co.in

Date: 2nd May 2019

Venue: J W Marriott Hotel, Dubai

11th Edition of Asian Business & Social Forum,

Indo–UAE Business & Social Forum 2018–19

&

5th Edition – World’s Greatest Brands & Leaders 2018–19

In addition to the coveted

Knight of Honour Awards,

AsiaOne Person of the Year Awards,

Guest of Honour Awards,

AsiaOne 40 Under 40 Most Influential Leaders 2018–19 Asia & GCC,

World’s Greatest CXOs Awards 2018–19,

India’s Fastest…

Indo–UAE Business & Social Forum 2018–19

11th Edition of Asian Business & Social Forum,

Indo–UAE Business & Social Forum 2018–19

&

5th Edition – World’s Greatest Brands & Leaders 2018–19

In addition to the coveted

Knight of Honour Awards,

AsiaOne Person of the Year Awards,

Guest of Honour Awards,

AsiaOne 40 Under 40 Most Influential Leaders 2018–19 Asia & GCC,

World’s Greatest CXOs Awards 2018–19,

World’s Greatest CSR Awards,

India’s Fastest Growing Brands & Leaders Awards,

Bangladesh’s Fastest Growing Brands & Leaders Awards,

Eminent Jury Awards,

AsiaOne Eminent Guest…